Talk:Supply-side economics/Archive 3

| This is an archive of past discussions about Supply-side economics. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | Archive 2 | Archive 3 | Archive 4 |

Laffer curve doesn't illustrate supply-side because it peaks around 70%

The introduction paragraph stating that the Laffer curve illustrates supply-side theories is false, because an economy can be either to the left or right of the Laffer curve's peak, and it says nothing about tax incidence, which is far more highly determinate of outcomes than the total tax rate. EllenCT (talk) 03:08, 28 July 2015 (UTC)

- The sentence in question is not false. It is true, which can be verified by reading the cited source. Of course an economy's tax rate could be either to the left or right of the Laffer curve peak (no one knows for certain where the peak lies or what the shape of the curve is or if there is even a single peak or multiple), the idea is that the peak somewhere between 0% and 100% is the optimum tax rate, and if it is suspected that the tax rate is to the right of this peak, a tax cut (often advocated for by supply-siders) could optimize tax revenue while also boosting output and employment due to the tax cut's economic effect. Laffer theory is a central theory for supply-side economics; no where does it say that this is the only central theory of supply-side economics or that the Laffer curve illustrates all supply-side theories, which seems to be what you are assuming. Abierma3 (talk) 05:24, 28 July 2015 (UTC)

- On the contrary, since you admit that nobody knows exactly where the peak lies, how can you say, "that lowering tax rates has a positive impact on work, output, and employment and generates more government revenue"? That would only be true if the peak were at 0%, which would mean no courts to enforce contracts, for example. Therefore the sentence is false and will be removed. EllenCT (talk) 17:59, 28 July 2015 (UTC)

- It doesn't matter where the peak lies, lowering tax rates will have a positive impact on output and employment. This is known as the economic effect (stimulus) of a tax cut. You cut off an important part of the quote ("...generates more government revenue than would otherwise be expected from the lower tax rate due to the tax cut's economic effect"). For instance, if the tax rate is cut in half, it would be expected mathematically that tax revenue would also be cut in half, but due to the stimulus effect of a tax cut, there will be more government revenue generated than expected (i.e. it will not be cut exactly in half, but will be greater). The sentence is true. Please read the cited source. Abierma3 (talk) 06:52, 29 July 2015 (UTC)

- If the peak is to the right of the current tax rate, cutting taxes does not have a stimulus effect, it has a dampening effect. Do you have a peer reviewed source from the WP:SECONDARY literature, like the Journal of Economic Literature or a literature review published in a high-impact peer reviewed academic journal? We need to follow Wikipedia's reliable source criteria instead of depending on advocacy organizations' websites. EllenCT (talk) 14:00, 29 July 2015 (UTC)

- Cutting taxes has a stimulus effect, no matter where the peak is. See this paper: "Even critics of supply-side economics concede that tax cuts may produce substantial revenue reflows, lowering their net cost." Keep in mind the sentence is not saying that overall tax revenue will be greater, but that tax revenue will be greater than otherwise expected for that lower rate (i.e. "lowering their net cost"). If the peak is to the left of the current tax rate, it is possible that overall tax revenue could increase if the economic effect (stimulus) of the tax cut overpowers the arithmetic effect (but this is another story, it is not what the lead is stating). Also, see this journal article, it says, "The Laffer Curve is the most evident illustration of the key postulations of the supply-side economics." Thus, it is lead worthy and should be explained whether mainstream economists praise it or criticize it because this is the supply-side economics article and it is a key concept of supply-side economics (the viewpoints of critics are also in the same paragraph for NPOV balance). Abierma3 (talk) 15:42, 29 July 2015 (UTC)

- None of those sources is a WP:SECONDARY source, such as a literature review or a meta-analysis. Yet, in this edit summary, you wrote, "Laffer Curve should be emphasized as peer-reviewed secondary source says: 'The Laffer Curve is the most evident illustration of the key postulations of the supply-side economics.'" However, the source cited not only isn't a secondary source, it's not a peer reviewed source. In fact, it's an advocacy organization source just like [1]. Are you aware of the difference between an advocacy organization's publication, a peer reviewed academic journal article or book chapter, and a secondary literature review or meta-analysis? EllenCT (talk) 21:17, 29 July 2015 (UTC)

- BNAS, the source that says, "The Laffer Curve is the most evident illustration of the key postulations of the supply-side economics," is a peer-reviewed source. Laffer Associates is not an advocacy organization, but rather a private company (research and consulting firm) that happened to be founded by Arthur Laffer, and the author (Bruce Bartlett) is credible, so your classification is debatable. I am aware. Abierma3 (talk) 07:17, 30 July 2015 (UTC)

- Journal articles are secondary sources; the primary sources are things like interviews with natives that anthropologists do in the process of preparing the journal articles. However, since supply side theory applies irrespective of where on the Laffer curve one is operating, and indeed also applies to supply curve manipulation even if that manipulation has nothing to do with taxes, I agree that the Laffer curve is not central to supply side theory.Warren Dew (talk) 04:14, 27 December 2016 (UTC)

- None of those sources is a WP:SECONDARY source, such as a literature review or a meta-analysis. Yet, in this edit summary, you wrote, "Laffer Curve should be emphasized as peer-reviewed secondary source says: 'The Laffer Curve is the most evident illustration of the key postulations of the supply-side economics.'" However, the source cited not only isn't a secondary source, it's not a peer reviewed source. In fact, it's an advocacy organization source just like [1]. Are you aware of the difference between an advocacy organization's publication, a peer reviewed academic journal article or book chapter, and a secondary literature review or meta-analysis? EllenCT (talk) 21:17, 29 July 2015 (UTC)

- Cutting taxes has a stimulus effect, no matter where the peak is. See this paper: "Even critics of supply-side economics concede that tax cuts may produce substantial revenue reflows, lowering their net cost." Keep in mind the sentence is not saying that overall tax revenue will be greater, but that tax revenue will be greater than otherwise expected for that lower rate (i.e. "lowering their net cost"). If the peak is to the left of the current tax rate, it is possible that overall tax revenue could increase if the economic effect (stimulus) of the tax cut overpowers the arithmetic effect (but this is another story, it is not what the lead is stating). Also, see this journal article, it says, "The Laffer Curve is the most evident illustration of the key postulations of the supply-side economics." Thus, it is lead worthy and should be explained whether mainstream economists praise it or criticize it because this is the supply-side economics article and it is a key concept of supply-side economics (the viewpoints of critics are also in the same paragraph for NPOV balance). Abierma3 (talk) 15:42, 29 July 2015 (UTC)

- If the peak is to the right of the current tax rate, cutting taxes does not have a stimulus effect, it has a dampening effect. Do you have a peer reviewed source from the WP:SECONDARY literature, like the Journal of Economic Literature or a literature review published in a high-impact peer reviewed academic journal? We need to follow Wikipedia's reliable source criteria instead of depending on advocacy organizations' websites. EllenCT (talk) 14:00, 29 July 2015 (UTC)

- It doesn't matter where the peak lies, lowering tax rates will have a positive impact on output and employment. This is known as the economic effect (stimulus) of a tax cut. You cut off an important part of the quote ("...generates more government revenue than would otherwise be expected from the lower tax rate due to the tax cut's economic effect"). For instance, if the tax rate is cut in half, it would be expected mathematically that tax revenue would also be cut in half, but due to the stimulus effect of a tax cut, there will be more government revenue generated than expected (i.e. it will not be cut exactly in half, but will be greater). The sentence is true. Please read the cited source. Abierma3 (talk) 06:52, 29 July 2015 (UTC)

- On the contrary, since you admit that nobody knows exactly where the peak lies, how can you say, "that lowering tax rates has a positive impact on work, output, and employment and generates more government revenue"? That would only be true if the peak were at 0%, which would mean no courts to enforce contracts, for example. Therefore the sentence is false and will be removed. EllenCT (talk) 17:59, 28 July 2015 (UTC)

Trickle-down economics

LjL apologies if I offended you by my earlier reversion, I did not mean to. https://wiki.riteme.site/w/index.php?title=Supply-side_economics&diff=686511847&oldid=686511549 Volunteer Marek made this edit earlier, saying that as supply-side was not a theory, then we should not make a distinction about the fact that trickle-down is not an actual theory. Once you added citations showing that supply-side economics is a theory, then it makes sense that this earlier point did not stand.

The second source states "Others viewed it (supply-side economics) as traditional Republican "trickle down" economics, meaning that the benefits accruing to wealthier taxpayers would filter throughout the economy" which is a rhetorical term, as Sowell writes here http://www.webcitation.org/6AvD7JHEC, no economist has ever claimed that tax cuts will boost the economy by themselves (what these "others" are viewing it as). Absolutelypuremilk (talk) 21:41, 19 October 2015 (UTC)

- I am not sure I follow completely, but you reverted my edit resulting, among other things, in removal of a source (which smells reliable enough to me) that plainly stated that trickle-down economics was, itself, a theory. How do you justify its removal, as well as the re-addition of a claim that it is not a theory, directly contradicting the source? LjL (talk) 21:46, 19 October 2015 (UTC)

- I read this as another source which criticises supply-side economics but I have now added it back in. Absolutelypuremilk (talk) 21:54, 19 October 2015 (UTC)

- Thanks, but its point - and the quotation from it - is that "Trickle-down economics refers to the economics theory which states [...]", yet in your current revision, the article still insists on stating that trickle-down economics is "a rhetorical term which is not an economic theory.". Can we not contradict the source? LjL (talk) 21:56, 19 October 2015 (UTC)

- My point is that the theory to which it is likened to by critics does not exist (that giving money to the rich through tax cuts will trickle down to the poor - no one has advocated this). However the theory of supply-side economics (also called trickle-down economics by some), that the rich will work harder and invest more if taxes are lower, and that this extra wealth will trickle down to the poor, does exist. However the critics are referring to the former "theory" rather than the latter and so the source you added does not contradict this. I agree it could be clearer, could you suggest an alternative wording? Absolutelypuremilk (talk) 22:05, 19 October 2015 (UTC)

- I found it easier to be bold and change the wording than to explain how I'd change it here. This is the result, tell me what you think. LjL (talk) 22:12, 19 October 2015 (UTC)

- Just for the record, the original "trickle down" theory did claim that giving money to the rich - but through government spending, not tax cuts - would trickle down to the poor; this was the approach taken by Hoover toward the Great Depression. That theory, of course, was entirely a demand side theory and had nothing to do with supply side economics, though.Warren Dew (talk) 04:05, 27 December 2016 (UTC)

- This is an old discussion. Supply side economics are widely seen as the cause of the Great Depression. Supply creates its own demand, unless the over supply creates deflation.... The government becoming the employer of last resort ended the Great Depression under Roosevelt. 18:05, 27 December 2016 (UTC)

Discussion of removal of paragraph on Laffer curve from lede

Lipsquid: you reverted my edit to the lede that removed the final paragraph discussing the Laffer curve, asking what was unsupported. The sentence that the references do not support is "The Laffer curve is a central component of supply-side economics", the topic sentence of the paragraph I removed. The references support the rest of the paragraph explaining the Laffer curve, but do not support that it is central to supply side economics, making it inappropriate for placement in the lede.

For reference, the Laffer curve is actually not central to supply side economics, which is about the supply curve, not about the Laffer curve. In particular, supply side economics is about manipulating the supply curve, in contrast to the demand curve manipulation generally associated with Keynesian economics. This is true whether or not the manipulation results in increased government revenues.

For these reasons, the paragraph on the Laffer curve should be removed from the lede. Warren Dew (talk) 04:00, 27 December 2016 (UTC)

- Per Laffer himself "The Laffer Curve is one of the main theoretical constructs of supply-side economics" <ref>http://www.laffercenter.com/supply-side-economics/laffer-curve/</ref> I added a citation to avoid future confusion. Lipsquid (talk) 04:40, 27 December 2016 (UTC)

- That isn't saying the same thing, though. That's just saying it's a corollary of the theory, not that it's "

central to" the theory. I will edit the sentence to reflect the actual Laffer quote.Warren Dew (talk) 23:02, 27 December 2016 (UTC)

- If you think there is better prose that would be more true to the reference, I encourage you to make improvements. I reverted your edits, but I want to be clear that I am not personally tied to supporting the Laffer Curve, I just want to have the best possible article and to reflect the opinion of the most reliable sources available on the topic. Best Wishes, Lipsquid (talk) 23:28, 27 December 2016 (UTC)

ERROR FOUND

There is an error noticed on the page... it says "in 1999, during the Ronald Reagan Administration." — Preceding unsigned comment added by 205.201.154.104 (talk) 20:29, 5 January 2017 (UTC)

- It means the Nobel Prize was won in 1999, but I have clarified this by rewording. Absolutelypuremilk (talk) 20:34, 5 January 2017 (UTC)

Tax cuts never work

This article promotes the POV that tax cuts have never worked. We get only an unsupported claim that Reaganomics helped improve the economy, followed by authoritative pronouncements that "it is not so." That seems one-sided to me.

We should mention the cuts in tax rates in the 1920s which (according to Thomas Sowell) led to:

- rising output, rising employment to produce that output, rising incomes as a result and rising tax revenues for the government because of the rising incomes, even though the tax rates had been lowered [2]

I believe there was a Democratic president who advised, “... it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.” [JFK?] --Uncle Ed (talk) 16:11, 6 April 2017 (UTC)

Sowell also cites a 2006 quote from the NY Times:

- when tax revenues rose in the wake of the tax rate cuts made during the George W. Bush administration, the New York Times reported: “An unexpectedly steep rise in tax revenues from corporations and the wealthy is driving down the projected budget deficit this year.” [3] --Uncle Ed (talk) 16:15, 6 April 2017 (UTC)

- I would support the addition of this content - thanks for highlighting it. Absolutelypuremilk (talk) 16:39, 6 April 2017 (UTC)

- I added two sections, on the tax cuts of the 1920s and the early 1960s. --Uncle Ed (talk) 16:49, 10 April 2017 (UTC)

What's a tax cut?

Here's an odd phrase:

- However, under Reagan, Congress passed a plan that would slash taxes by $749 billion over five years.

Was Reagan's purpose to cut tax revenue - so that rich people would pay a smaller absolute amount of taxes? Or was Reagan's purpose to cut tax rates, so that rich people would carry out more economy-stimulating activity that would increase tax revenue?

Critics of cutting tax rates tend to describe these as lowering "taxes" by a certain huge amount (like nearly $1 trillion). Advocates of cutting tax rates generally speak in terms of lowering a percent of income that investors have to pay, which (they predict) will result in increasing the amount of "taxes" that the government receives.

The question is whether cutting a tax rate results in less tax being collected. Another question is whether we contributors are smart enough to define the difference; maybe some quotable source out there has already done that job for us, although I daresay there's controversy about it. --Uncle Ed (talk) 21:33, 10 April 2017 (UTC)

- Better refer to experts: http://www.igmchicago.org/surveys/laffer-curve Daniel Vallstrom (talk) 05:10, 11 April 2017 (UTC)

Contradictory Claims/bad sourcing on 1920's data

Differing claims are made in the "Effect on tax revenues" and "U.S. monetary and fiscal experience" sections of the article.

The earlier section shows that revenue did not increase during the 1920's as a result of tax rate cuts, and the citations [23]&[24] support this with real world data published from the primary source, namely the IRS and reports generated from that data.

Under the 1920s subheading in "U.S. monetary and fiscal experience" there is an opposite position taken that tax revenue did increase, as supported by citations [31] & [32]. Examining these sources, they are both secondary, and neither has significant sourcing or data for the claims made therein. Citation [31] in particular does not source any data it presents. Citation [32] conceals its lack of evidentiary reporting by having 4 footnotes, with only the first actually being a source. It also does not make the claim it is being used to support; while it states that higher income tax brackets increased their share of the tax revenue burden, it does not claim that total tax revenue increased, in real or actual terms.

I am new to wiki editing, so I wanted to bring this concern to the talk page first. But it seems to me that the [31]&[21] sources cited due not meet academic rigor and should be removed, or replaced, with the claims they support revised.

WLD000--68.117.200.61 (talk) 07:09, 18 June 2017 (UTC)

- The source [24] comes from a blog, and does not actually give the amount of income tax revenue, merely the tax as a percentage of GDP. The first source does give the amount of revenue though, but it does not say that there was a tax cut in 1920. There also seems to be a misreading of the table, the highest revenue was in 1919, tax levels did return to 1920 levels by the end of the 20s. So I think the first section should be removed, as it does not provide a source for a tax cut in 1920. Absolutelypuremilk (talk) 07:59, 18 June 2017 (UTC)

I need to correct something from what I originally wrote. I mistakenly pointed to citations [23]&[24] when I has intended to note [21]&[22]. I'd recommend those sources be examined prior to deleting what seems to be the more thoroughly researched section.

WLD00068.117.200.61 (talk) 03:37, 21 June 2017 (UTC)

- The sources which are now [21] and [22] are what I examined above. I will remove them now as per WP:OR, the content is trying to draw a conclusion from data, and is also misleading as I have described above. Absolutelypuremilk (talk) 16:34, 22 June 2017 (UTC)

Dr. Paul Craig Roberts

This article is mentioned in the press.

Appended to his latest article, Dr. Paul Craig Roberts makes some critiques and also provides a reprint of his, "Supply-Side Economics, Theory and Results: An Assessment of the Amercian Experience in the 1980s", Paul Craig Roberts, Republished from January 1989, THE INSTITUTE FOR POLITICAL ECONOMY.

SUPPLY-SIDE ECONOMICS, THEORY AND RESULTS 104.174.231.6 (talk) 19:50, 18 July 2017 (UTC)

External links modified

Hello fellow Wikipedians,

I have just modified 6 external links on Supply-side economics. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added archive https://web.archive.org/web/20140502013505/http://www.polyconomics.com/index.php?option=com_content&view=article&id=1806%3Ataxing-capital-gains&catid=52%3A2003&Itemid=31 to http://www.polyconomics.com/index.php?option=com_content&view=article&id=1806%3Ataxing-capital-gains&catid=52%3A2003&Itemid=31

- Added archive https://web.archive.org/web/20050718013109/http://www.asx.com.au/about/pdf/cgt.pdf to http://www.asx.com.au/about/pdf/cgt.pdf

- Added archive https://web.archive.org/web/20090226201115/http://www.house.gov/jec/fiscal/tx-grwth/reagtxct/reagtxct.htm to http://www.house.gov/jec/fiscal/tx-grwth/reagtxct/reagtxct.htm

- Added archive https://web.archive.org/web/20071229124723/http://www.epinet.org/content.cfm/bp168 to http://www.epinet.org/content.cfm/bp168

- Added archive https://web.archive.org/web/20070714004710/http://www.ustreas.gov/press/releases/reports/treasurydynamicanalysisreporjjuly252006.pdf to http://www.ustreas.gov/press/releases/reports/treasurydynamicanalysisreporjjuly252006.pdf

- Added archive https://web.archive.org/web/20070630011354/http://www.yorktownuniversity.com/grad_libraries_supply_side.cfm to http://yorktownuniversity.com/grad_libraries_supply_side.cfm

When you have finished reviewing my changes, you may follow the instructions on the template below to fix any issues with the URLs.

This message was posted before February 2018. After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than regular verification using the archive tool instructions below. Editors have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the RfC before doing mass systematic removals. This message is updated dynamically through the template {{source check}} (last update: 5 June 2024).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.—InternetArchiveBot (Report bug) 23:54, 2 September 2017 (UTC)

External links modified

Hello fellow Wikipedians,

I have just modified one external link on Supply-side economics. Please take a moment to review my edit. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit this simple FaQ for additional information. I made the following changes:

- Added

{{dead link}}tag to http://www.laffercenter.com/supply-side-economics/laffer-curve/ - Added archive https://web.archive.org/web/20080423012207/http://ksghome.harvard.edu/~jfrankel/TNR%20Online%20%20Mankiw%20Out%20of%20Depth.htm to http://ksghome.harvard.edu/~jfrankel/TNR%20Online%20%20Mankiw%20Out%20of%20Depth.htm

When you have finished reviewing my changes, you may follow the instructions on the template below to fix any issues with the URLs.

This message was posted before February 2018. After February 2018, "External links modified" talk page sections are no longer generated or monitored by InternetArchiveBot. No special action is required regarding these talk page notices, other than regular verification using the archive tool instructions below. Editors have permission to delete these "External links modified" talk page sections if they want to de-clutter talk pages, but see the RfC before doing mass systematic removals. This message is updated dynamically through the template {{source check}} (last update: 5 June 2024).

- If you have discovered URLs which were erroneously considered dead by the bot, you can report them with this tool.

- If you found an error with any archives or the URLs themselves, you can fix them with this tool.

Cheers.—InternetArchiveBot (Report bug) 20:44, 6 December 2017 (UTC)

Supply Side Economics doesn't exist as an Economic Ideology or School of Thought.

Supply Side Economics doesn't exist as a foundation of Economic Ideology or a particular School of Thought. Within this Article there is no such citation or source validating Supply-Side Economic as such simply because it doesn't exist. Every single reference to Supply-Side Economics centeres around the Reagan Administration and the Reagan Era because Supply-Side Economics is a Political Ideology born from conservative tenets of Economics at a time when Laffer, Greenspan, and the Chicago School of Thought were the Darlings of Academia at a time when the Market World fully embraced them. Point is, Supply-Side Economics doesn't exist as an Economic Ideology or School of Thought because an Economic Theory must withstand the scrutiny of being able to determine the long & short term results of changes - both endogenous and exogenous - to the economic system. If Economics is to be considered a probabilistic science or quasi-deterministic science, then Supply-Side Economics is antithetical to that goal. shiznaw (talk) 01:10, 20 May 2018 (UTC)

The Clinton years

The article states that: "The Bill Clinton years represent a counter-example to supply side economics as tax increases coincided with record job creation."

I find that somewhat misleading. The average top marginal rate (on which so much of supply-side is based) was lower under Clinton than Reagan. It was still at a historically low level. The Laffer curve doesn't mean you can cut forever and maximize revenues and growth. This section may need some work.Rja13ww33 (talk) 23:16, 12 June 2018 (UTC)

Discussion of Trump tax cuts section

The following text was challenged as OR, although CBO was cited as the source. Let's discuss what sources would be better or if more specific citations or CBO quotes would be helpful.

"President Trump implemented individual and corporate tax cuts which took effect in 2018. CBO estimated in January 2017 that tax revenues would be $3.60 trillion in 2018 assuming the Obama tax policies continued, but actual revenues in 2018 following the Trump tax cuts were $3.33 trillion, a reduction of $270 billion or 7.5%, due primarily to the tax cuts. In other words, revenues would have been considerably higher in the absence of the tax cuts. Total revenues rose less than 1% from 2017 to 2018, although corporate tax revenues fell by $90 billion. Total revenues typically grow more strongly when the economy is performing well."

Further, the debt additions projected by CBO for the 2018-2027 period have increased from the $9.4 trillion that Trump inherited from Obama (January 2017 CBO baseline) to $13.7 trillion (CBO current policy baseline), a $4.3 trillion or 46% increase. Much of this increase is due to the tax cuts, although additional spending is also forecast. CBO forecast in January 2017 that revenues would total $33.0 trillion for the 2018-2025 period, but reduced this forecast by $1.33 trillion to $31.7 trillion (April 2018 current law baseline) after the tax cuts were implemented. The individual tax cuts are assumed to expire under current law after 2025." Farcaster (talk) 01:16, 29 January 2019 (UTC)

- This seems to be a straightforward example of WP:OR as none of the sources cited mention supply side economics from my quick reading. Per WP:PRIMARY "Do not analyze, evaluate, interpret, or synthesize material found in a primary source yourself; instead, refer to reliable secondary sources that do so." we cant cite CBO numbers and infer that they tell us anything about supply-side economics because if we do that would be our own interpretation of the primary material. If you want to add something about the Trump tax cuts, you need a reliable source that discusses it in terms of supply-side economics. Bonewah (talk) 14:03, 29 January 2019 (UTC)

- CBO is stating that the Trump tax cuts significantly decreased revenue, which directly bears on supply side whether they stated so or not. Should we add a sentence at the beginning that says: "One of the central tenets used by the Trump administration to sell the public on their tax cuts was the supply side doctrine that income tax cuts pay for themselves [easy to find lots of sources on that from the current administration]. However, CBO reported that... As an aside, your argument seems like a very legalistic excuse to avoid some punishing facts about the supply side concept.Farcaster (talk) 21:08, 29 January 2019 (UTC)

- I think it is reasonable to treat CBO as a secondary source, as they are analyzing and interpreting data from primary sources like the BEA.Farcaster (talk) 06:30, 30 January 2019 (UTC)

- YOu may not care that the CBO doesnt state what you claim, but the rules explicitly require it. This isnt some edge case where opinions might reasonably differ, you are doing what OR expressly forbids. And no, simply adding something that you think connects the trump tax cuts to Supply side economics doesnt fix everything, it just makes it WP:Synth instead. Look, its very simple, if you want to say something about the Trump tax cuts and supply side, you need a reliable source which does so, you cant draw your own conclusions. It doesnt matter wether the CBO is a primary source or a secondary one, they dont make the connection between supply side and the tax cuts that you are trying to add to this article. This isnt some minor quibble, No OR is one of the pillars of Wikipedia. Bonewah (talk) 14:03, 30 January 2019 (UTC)

- We don't have to find one source that links them. A source that says supply side covers tax cuts paying for themselves, and CBO saying the revenues were a lot lower because of the tax cuts is just fine. We're done here, let's move on.21:40, 30 January 2019 (UTC)

- So is your position that the rules dont apply to you or that you are not breaking them? Because your response is literally what the opening line of wp:synth says not to do: "Do not combine material from multiple sources to reach or imply a conclusion not explicitly stated by any of the sources. Similarly, do not combine different parts of one source to reach or imply a conclusion not explicitly stated by the source. If one reliable source says A, and another reliable source says B, do not join A and B together to imply a conclusion C that is not mentioned by either of the sources. This would be improper editorial synthesis of published material to imply a new conclusion, which is original research" None of the sources you cite explicitly state anything about supply side economics and so it isnt 'just fine' and we are not 'done here' Bonewah (talk) 23:17, 30 January 2019 (UTC)

- I think your interpretation of the rules is wrong and is being used as an excuse to remove sourced material you don't like. Otherwise, you would have pitched in to help rather than reverting. The sources are obviously talking about supply side tax cuts, which is what the Republican/Trump tax cuts are. Whether the words "supply-side" shows up is irrelevant and whether everything is in one source is irrelevant. Mnuchin made the usual claim for supply siders, that the tax cuts will pay for themselves. CBO said, as it always does, that tax cuts cause revenues to fall significantly relative to a baseline without them. You've got a citation from the NYT on one side with the Mnuchin claim and CBO on the other. Do I have to add a third source that says: "The Trump tax cuts are an example of supply side economics?" Do we have to lay this out as an A=B, and B=C, therefore A=C syllogism to get past the wikilawyering? If you've made more than 10,000 edits, volunteer to help instead of impede. Find the bridge if you've got that big a problem with it.Farcaster (talk) 02:45, 31 January 2019 (UTC)

- The Rutgers analysis you added is fine and there is no reason it cant stay in as it speaks to supply side and the Trump tax cuts specifically. The parts where *you* cite the CBO are still *your* analysis and therefor, still OR. The A=B, and B=C, therefore A=C syllogism is exactly the problem as it is exactly what wp:OR and wp:SYNTH forbid. And that isnt 'wikilawyering" that should be 'gotten past', its called following the core tenets of Wikipedia. Im perfectly willing to work with you here but im not going to treat the rules as something to be gotten around or ignored. Bonewah (talk) 13:52, 31 January 2019 (UTC)

- So now that we've established the Trump tax cuts are supply side, why can't we include CBO analysis that says the Trump tax cuts reduced revenues and increased deficits? Would you prefer a CBO quote to that effect?Farcaster (talk) 19:27, 31 January 2019 (UTC)

- Because the CBO analysis doesnt say anything about supply side. Again "Do not combine material from multiple sources to reach or imply a conclusion not explicitly stated by any of the sources." Bonewah (talk) 19:44, 31 January 2019 (UTC)

- Just glancing through this article again, i see this is not the only place this is being done. We need to take a careful look at this whole article and remove all the material that draws its own conclusions from primary sources like the CBO. This is expressly forbidden. Bonewah (talk) 19:59, 31 January 2019 (UTC)

- I disagree with your interpretation. Once we've established that the Trump tax cuts are supply side, content about the effect of the tax cuts is clearly related. CBO doesn't need to use those words; deductive logic dictates that is what they are talking about. And nobody is more credible than them on the budget subject. I think you should revert your last edit.Farcaster (talk) 20:44, 31 January 2019 (UTC)

- Deductive logic; the conclusion flows from the premises with certainty (not probability). There is no leap or interpretation. Premise A: The Trump tax cuts are representative of supply side tax cuts. Premise B: CBO said the Trump Tax cuts caused the deficit to increase and revenues to fall. Conclusion: Therefore, CBO said the supply side tax cuts caused the deficit to increase and revenues to fall.Farcaster (talk) 20:53, 31 January 2019 (UTC)

- So now that we've established the Trump tax cuts are supply side, why can't we include CBO analysis that says the Trump tax cuts reduced revenues and increased deficits? Would you prefer a CBO quote to that effect?Farcaster (talk) 19:27, 31 January 2019 (UTC)

- The Rutgers analysis you added is fine and there is no reason it cant stay in as it speaks to supply side and the Trump tax cuts specifically. The parts where *you* cite the CBO are still *your* analysis and therefor, still OR. The A=B, and B=C, therefore A=C syllogism is exactly the problem as it is exactly what wp:OR and wp:SYNTH forbid. And that isnt 'wikilawyering" that should be 'gotten past', its called following the core tenets of Wikipedia. Im perfectly willing to work with you here but im not going to treat the rules as something to be gotten around or ignored. Bonewah (talk) 13:52, 31 January 2019 (UTC)

- We don't have to find one source that links them. A source that says supply side covers tax cuts paying for themselves, and CBO saying the revenues were a lot lower because of the tax cuts is just fine. We're done here, let's move on.21:40, 30 January 2019 (UTC)

- YOu may not care that the CBO doesnt state what you claim, but the rules explicitly require it. This isnt some edge case where opinions might reasonably differ, you are doing what OR expressly forbids. And no, simply adding something that you think connects the trump tax cuts to Supply side economics doesnt fix everything, it just makes it WP:Synth instead. Look, its very simple, if you want to say something about the Trump tax cuts and supply side, you need a reliable source which does so, you cant draw your own conclusions. It doesnt matter wether the CBO is a primary source or a secondary one, they dont make the connection between supply side and the tax cuts that you are trying to add to this article. This isnt some minor quibble, No OR is one of the pillars of Wikipedia. Bonewah (talk) 14:03, 30 January 2019 (UTC)

- I think it is reasonable to treat CBO as a secondary source, as they are analyzing and interpreting data from primary sources like the BEA.Farcaster (talk) 06:30, 30 January 2019 (UTC)

- CBO is stating that the Trump tax cuts significantly decreased revenue, which directly bears on supply side whether they stated so or not. Should we add a sentence at the beginning that says: "One of the central tenets used by the Trump administration to sell the public on their tax cuts was the supply side doctrine that income tax cuts pay for themselves [easy to find lots of sources on that from the current administration]. However, CBO reported that... As an aside, your argument seems like a very legalistic excuse to avoid some punishing facts about the supply side concept.Farcaster (talk) 21:08, 29 January 2019 (UTC)

<--outdentI reverted the last changes i made just to keep the discussion on track. Establishing that the Trump tax cuts are a supply side thing is fine, but when you use the CBO's numbers to demonstrate any conclusion not expressly stated by the source about supply side is where the problem lie. Again read wp:SYNTH ""A and B, therefore C" is acceptable only if a reliable source has published the same argument in relation to the topic of the article" This is the issue, neither the Rutgers article, nor the CBO have published the argument that the CBO's conclusions have anything to do with supply side theory. You cant do the research and you cant assume that the CBO's analysis proves or disproves anything about supply side. Thats what makes it Original research, its original to Wikipedia and not and an external reliable source. Doesnt matter if you use deductive logic or not, even really really good original research is still original research. Bonewah (talk) 21:07, 31 January 2019 (UTC)

- I admire your tenacity. So how about this: We've got a source saying the Trump tax cuts are supply side. Can we just explain what the CBO says about the Trump tax cuts, leaving the reader to connect (or not connect) the two premises? A: Trump tax cuts are supply side. B: CBO says Trump tax cuts significantly increased the deficit and debt. We don't say anything to the effect that this indicates supply side tax cuts increase deficits, leaving that to the reader.Farcaster (talk) 03:33, 1 February 2019 (UTC)

- Implied OR is still OR. There is basically no reason to be citing the CBO at all in this article. Any analysis that should be here needs to come from a reliable secondary source. WP:PRIMARY says it all "Do not analyze, evaluate, interpret, or synthesize material found in a primary source yourself; instead, refer to reliable secondary sources that do so." Bonewah (talk) 14:46, 1 February 2019 (UTC)

- We can't use CBO in discussions of the effects of supply side tax policies, because CBO doesn't explicitly say this or that tax policy is supply side? I disagree. CBO is the definitive source on the impact of tax policies, whether they use the words supply side or not. I think you're being unreasonable.19:49, 1 February 2019 (UTC)

- We cant use CBO numbers in a discussion of the effects of supply side tax policies because that discussion itself does not come from a reliable secondary source. If some economist were making the same claims about supply side and the trump tax cuts as we are but didnt provide the CBO numbers then you could make a case that doing the calculations here is ok. But as it stands now, the claims being made here exist only here and are therefor OR. Bonewah (talk) 20:16, 1 February 2019 (UTC)

- Here is a source (NYT article) that calls the Trump tax cuts supply side and covers their effects. Are you OK to include a summary of this? [4]Farcaster (talk) 01:03, 12 February 2019 (UTC)

- I would like to tweak the section a bit to bring some balance, but so long as we summarize the sources we have, it wont be OR. I removed the only thing left in that section that i felt was still OR, the chart comparing U.S. federal revenues for two CBO forecasts. Again, this is your work, not the work of a reliable source, so OR. We can talk more about how to accurately reflect what is in our sources, there is lots there to choose from. I made a few changes for balance, feel free to propose changes. So long as we dont introduce our own analysis, we can work out the rest. Bonewah (talk) 03:07, 12 February 2019 (UTC)

- I'm fine with the edits you made. Since I fixed this section, why don't you do the same for the Bush tax cuts and I'll contribute where I can?Farcaster (talk) 01:54, 14 February 2019 (UTC)

- Regarding the line chart I created from CBO tables, if I replace that with the CBO table itself showing the before and after deficits due to the Trump tax cuts, would that be OK to add? In other words, is your concern I created the line chart or that the CBO original content itself is not appropriate to include? The NYT article does mention the $200 billion difference vs. CBO forecast, which is the June 2017 baseline (forecast for 10 years, including 2018) vs. 2018 actual. There are CBO tables showing that difference.Farcaster (talk) 02:07, 14 February 2019 (UTC)

- Let me think about the line chart a bit. Ill get to work on the Bush tax cuts section below. Bonewah (talk) 14:30, 14 February 2019 (UTC)

- Here is a source (NYT article) that calls the Trump tax cuts supply side and covers their effects. Are you OK to include a summary of this? [4]Farcaster (talk) 01:03, 12 February 2019 (UTC)

- We cant use CBO numbers in a discussion of the effects of supply side tax policies because that discussion itself does not come from a reliable secondary source. If some economist were making the same claims about supply side and the trump tax cuts as we are but didnt provide the CBO numbers then you could make a case that doing the calculations here is ok. But as it stands now, the claims being made here exist only here and are therefor OR. Bonewah (talk) 20:16, 1 February 2019 (UTC)

- We can't use CBO in discussions of the effects of supply side tax policies, because CBO doesn't explicitly say this or that tax policy is supply side? I disagree. CBO is the definitive source on the impact of tax policies, whether they use the words supply side or not. I think you're being unreasonable.19:49, 1 February 2019 (UTC)

- Implied OR is still OR. There is basically no reason to be citing the CBO at all in this article. Any analysis that should be here needs to come from a reliable secondary source. WP:PRIMARY says it all "Do not analyze, evaluate, interpret, or synthesize material found in a primary source yourself; instead, refer to reliable secondary sources that do so." Bonewah (talk) 14:46, 1 February 2019 (UTC)

Bush tax cuts

This section could stand some going over, both to make sure there is no OR, but also to tighten it up and keep it focused. A quick read reveals that most of this section covers the budgetary effects of the tax cuts, I.E. do they 'pay for themselves' or cost money. This is related to, but not central to Supply-side economics as i understand it. To me, and we say this in the lede of the article as well, the core concept of supply side is that tax cuts and so forth grow the economy, which sometimes, but not always means that lower taxes bring in more revenue. So, while the budgetary cost of tax cuts should be mentioned, they should not be the focus of this section, or the article itself. Bonewah (talk) 14:38, 14 February 2019 (UTC)

charts and so on

We have BRD'd a chart showing the US deficit and tax revenue. In my opinion this is obvious Original Research in that it is not directly attributable to a reliable source on Supply Side Economics. NOR forbids "..any analysis or synthesis of published material that serves to reach or imply a conclusion not stated by the sources. To demonstrate that you are not adding OR, you must be able to cite reliable, published sources that are directly related to the topic of the article, and directly support the material being presented." This chart is plainly that as 1) the link provided CBO link does not speak to Supply Side Economics at all, and therefore cant be said to be directly related to the topic of the article and 2) is an editor created analysis of the data presented there and so does not directly support the material being presented. Bonewah (talk) 15:31, 3 March 2020 (UTC)

- I think a chart created using CBO data that explains how revenue and expenses changed resulting in Clinton surpluses is relevant to an economics article with a section covering what happened while he was in office. Clinton certainly did NOT follow supply-side orthodoxy, yet the budget balance went from deficit to surplus and Clinton had record job creation and growth. The CBO budget & economic outlook is probably the definitive source for those subjects. It's a great counter-example to the supposed benefits of supply-side approaches. If it's unclear how the chart was prepared, I could add a table of the source data to the detail page behind the chart, to make the referencing precise.Farcaster (talk) 19:01, 3 March 2020 (UTC)

- The chart may be relevant, but if the source doesnt say it, its plainly OR. Correct or relevant isnt what is important here, what is important is "does the source (the CBO) present this information about supply side economics?" It does not. This chart is your work, not the work of a reliable source, thats what makes it OR. Bonewah (talk) 20:45, 3 March 2020 (UTC)

- Take a look at WP:PRIMARY, the CBO is a primary source in this context. The relevant policy "Do not analyze, evaluate, interpret, or synthesize material found in a primary source yourself; instead, refer to reliable secondary sources that do so." Bonewah (talk) 20:57, 3 March 2020 (UTC)

- I'm simply graphing the data that CBO provides. That's done all over Wikipedia. It's easy to compare the two years in the historical tables and create a waterfall chart. It's easy to verify the numbers by looking at the historical tables, but I could add a table to the article if that is your main concern.Farcaster (talk) 21:19, 3 March 2020 (UTC)

- Here is an article that says Clinton put in "demand-side" policies rather than "supply side." This also talks to the Clinton surpluses, economic results, and the tax increases on the wealthy. Would that be sufficient to link to the chart? [1]Farcaster (talk) 21:19, 3 March 2020 (UTC)

- Article for reference: Not from that source, which I believe is a liberal biased source, and as such would of course be against SSE. The whole Clinton section smacks of OR to me, since the salon article doesn't even mention SSE, unless it does in a vague way (I haven't read it, just did a text search.).

- There is no prohibition against "liberal sources" as then we would be forced to remove "conservative sources" which of course support the SSE contrary to mountains of evidence. But as mentioned below, the point here is whether a diagram about the Clinton years from CBO historical tables is OR. If the caption is a problem we can work on that, but a waterfall or any other diagram type shouldn't be controversial. It's sourced to the CBO historical tables within the detail page of the diagram; we can bring that into this article specifically if needed.Farcaster (talk) 00:27, 4 March 2020 (UTC)

- Additionally, the fact that you didn't get this from a source but are now trying to find one, CLEARLY shows that this is OR. I understand trying to explain things to the reader, but if my belief and your belief are different, how do we determine who is correct?...That's why we need Reliable Sources to base the article on, and have a NOR policy. ---Avatar317(talk) 00:02, 4 March 2020 (UTC)

- It's already sourced to the CBO. The initial complaint was that the CBO doesn't talk specifically about supply side economics in their historical tables, but that isn't the point here. The chart is simply a visual description of data in the CBO tables.Farcaster (talk) 00:20, 4 March 2020 (UTC)

- Article for reference: Not from that source, which I believe is a liberal biased source, and as such would of course be against SSE. The whole Clinton section smacks of OR to me, since the salon article doesn't even mention SSE, unless it does in a vague way (I haven't read it, just did a text search.).

I've rewritten the section substantially adding in some stronger source material. If you prefer the table to the graphic, I'm OK with removing one or the other, but not both.Farcaster (talk) 01:50, 4 March 2020 (UTC)

- I want to address a couple of points about the charts and tables. Ill address your other changes separately. 1) you said above "The initial complaint was that the CBO doesn't talk specifically about supply side economics in their historical tables, but that isn't the point here." This is exactly the point. wp:NOR explicitly forbids what you are doing with both the chart and the graph. Neither the CBO nor the other link you offered (which i dont think is an RS, but ill deal with that later) does the analysis you are presenting here. The charts and graphs are your work and therefore Original Research and must go. We can present this data differently if a reliable source does, but not as its sourced now. 2) Im not concerned in this context if the CBO is biased in some way, it just doesnt matter here. You cant perform calculations of their data that they did not themselves offer. The fact that the CBO link you are citing does not speak to Supply Side Economics makes it an inappropriate citation for this article. Bonewah (talk) 15:20, 4 March 2020 (UTC)

- We just disagree fundamentally here and others will have to weigh in. We're talking about the Clinton era, so economic data about that era is relevant whether the source links that concept to supply side economics or does not. Second, taking economic data from sources and graphing it or including it in charts is done all over Wikipedia; see the Economy of the United States for example. The table makes it easier to verify the information. The only OR part if you want to call it that is the basic addition/subtraction row in the table. If you want to leave that to people to do on their own, that's fine with me.Farcaster (talk) 16:17, 4 March 2020 (UTC)

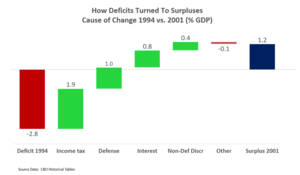

I don't see an issue with a chart (from a RS) illustrating data. However, some of these captions are drawing conclusions. At the head of this section is a good example: Waterfall chart shows cause of change from deficit in 1994 to surplus in 2001, measured as a % GDP. Income tax revenues rose as a % GDP following higher taxes for high income earners, while defense spending and interest fell relative to GDP. That's clearly problematic....another source could be the booming economy of the time. (And so on.) These sorts of things should be trimmed.Rja13ww33 (talk) 18:21, 4 March 2020 (UTC)

It took some hunting, but I found a couple of charts in old CBO and CEA reports that show trends in revenues and outlays during the Clinton era. Since these are verbatim from the government reports, that should address any OR issue.Farcaster (talk) 03:12, 5 March 2020 (UTC)

- Looks like there was a flurry of edits and reverts. Can you provide the relevant links to which you are referring? Bonewah (talk) 14:36, 5 March 2020 (UTC)

- I don't get why the last rev was made. I don't see it as SYNTH or OR. It illustrates data (from a RS) we are trying to communicate to the reader. It is also properly captioned. I think Farcaster's chart should go back in.Rja13ww33 (talk) 15:12, 5 March 2020 (UTC)

- Here's my issues with the graph and table (that I removed, and Farcaster wanted in the article) separately:

- Graph (Individual Income tax revenue): How is this RELEVANT to the Clinton section, or the article in general? The addition Rja13ww33 just made (about economist Alan Reynolds) refers to tax RATES, not total federal government revenue from only the INDIVIDUAL (not including CORPORATE) income taxes...what part of SSE is this supporting/disproving? We need a SOURCE which talks about this.

- Chart: how does the change of National Defense or Social Security outlays say anything about SSE? What does it say? and who is connecting it to SSE? We need a source otherwise this is just random data.

- For this graph and table, I don't see it as biased or implying a conculsion, but I don't see any connection here to the article's subject. I don't see what the reader is supposed to get from this. And for whatever they should understand, we need sources for that claim. ---Avatar317(talk) 23:29, 5 March 2020 (UTC)

- A chart summarizing the Clinton era has nothing to do with the effectiveness of supply side economics? With the chart, the reader can clearly see that individual income taxes going up to record levels as % GDP were consistent with a record economy, supporting the idea of the Clinton era as a counter-example to supply side economics, as explained in the article. The text in the article covers the tax rate increases on the rich. The economy also boomed despite the fiscal austerity of that era, shown in the second panel.Farcaster (talk) 23:55, 5 March 2020 (UTC)

- To me, it illustrates the data given in the article about the increase in tax revenues (in the Clinton era) after a tax increase. This is a key point of debate with this topic: at what rates can revenue be maximized with strong growth? There may be a better way to express it (extraneous data is in there)…...but I would think this would help the reader.Rja13ww33 (talk) 23:59, 5 March 2020 (UTC)

- Farcaster: Ok, I see what you are trying to say:

individual income taxes going up to record levels as % GDP were consistent with a record economy, supporting the idea of the Clinton era as a counter-example to supply side economics, as explained in the article.

but WE NEED THOSE SOURCES verifying your claims attached to that graph (individual income tax). Anything implied or stated on the graph(s) needs clear sources for those claims/implications.

- Farcaster: Ok, I see what you are trying to say:

- For this graph and table, I don't see it as biased or implying a conculsion, but I don't see any connection here to the article's subject. I don't see what the reader is supposed to get from this. And for whatever they should understand, we need sources for that claim. ---Avatar317(talk) 23:29, 5 March 2020 (UTC)

- Additionally:

The economy also boomed despite the fiscal austerity of that era, shown in the second panel.

so this "proves" that demand-side economics doesn't work?...at least at that time in history... You can use the same data (strong economy) to show that both theories (SSE & DSE) are wrong, or right, or work at different times...the reality is that the economy is complicated. THIS IS WHY WE NEED SOURCES!!!

- Additionally:

- For what Rja13ww33 is saying: I think this would be much more helpful/understandable to the reader if we graphed something like EFFECTIVE OVERALL income tax rate on the same graph or next to the individual income tax graph we have, so we'd be able to see how total government revenue (as a % of GDP) varies based on tax rate, over the same years...this would only speak to the Laffer curve, not broader SSE theory. And of course we need sources discussing this.

- As an aside to Farcaster: in my opinion, what is making your edits problematic/Original Research is that it seems that your goal is to show readers something you believe: "supporting the idea of the Clinton era as a counter-example to supply side economics," rather than reading sources and paraphrasing what the sources say, which is the way we are supposed to go about building an encyclopedia. ---Avatar317(talk) 01:52, 6 March 2020 (UTC)

- I've already included a citation in the article stating that Clintonomics was a refutation of supply side theory. If I simply put that citation with the graphic, are we done here and the graphic is now included? We've already gotten past the OR nonsense from before. The graphic is a lot weaker than the initial waterfall/cause of change chart, but I've compromised there. In terms of Supply side economics as practiced by Republicans (e.g., income tax cuts) that is primarily a crank theory, which doesn't really jump out in the article, as there is a lot of "he said, she said" instead of the IGM panel economists nearly unanimously saying tax cuts don't pay for themselves. Further, much of the benefit is on the demand side (e.g., putting more money into the hands of the population) not the so-called investment effects and people suddenly deciding to work because income taxes are lower. Laffer as legend has it drew his concept on a napkin; it is not an empirical finding, yet it's prominently displayed as if it's gospel. The real supply side theory elements I actually added the other day, explaining what measures can be used to expand the aggregate supply curve. This whole thing needs to be rewritten with a basic theme: Real supply side economics is different from the crank Republican theory.Farcaster (talk) 05:47, 6 March 2020 (UTC)

- If you are talking about the chart "Trends in income tax revenue and outlays (spending) as % GDP during the Clinton Administration" above, then no that should not be included. Again, this is your work, not the work of a reliable source. You can not take raw numbers and attempt to draw or imply a conclusion. Full stop. This is what WP:OR means and its unambiguous. The sources you are citing for the graph(s) dont talk about SSE and the citations elsewhere that do talk about SSE dont present that chart. This isnt an edge case, you are doing exactly what the "This page in a nutshell" section of the wp:OR page says not to do. "Articles may not contain any new analysis or synthesis of published material that serves to reach or imply a conclusion not clearly stated by the sources themselves." Bonewah (talk) 16:26, 6 March 2020 (UTC)

- The chart above included in this section on the talk page? The one drawn directly from the CEA and CBO verbatim? It's clearly from reliable sources and presents no OR issue.Farcaster (talk) 16:51, 6 March 2020 (UTC)

- I've already included a citation in the article stating that Clintonomics was a refutation of supply side theory. If I simply put that citation with the graphic, are we done here and the graphic is now included? We've already gotten past the OR nonsense from before. The graphic is a lot weaker than the initial waterfall/cause of change chart, but I've compromised there. In terms of Supply side economics as practiced by Republicans (e.g., income tax cuts) that is primarily a crank theory, which doesn't really jump out in the article, as there is a lot of "he said, she said" instead of the IGM panel economists nearly unanimously saying tax cuts don't pay for themselves. Further, much of the benefit is on the demand side (e.g., putting more money into the hands of the population) not the so-called investment effects and people suddenly deciding to work because income taxes are lower. Laffer as legend has it drew his concept on a napkin; it is not an empirical finding, yet it's prominently displayed as if it's gospel. The real supply side theory elements I actually added the other day, explaining what measures can be used to expand the aggregate supply curve. This whole thing needs to be rewritten with a basic theme: Real supply side economics is different from the crank Republican theory.Farcaster (talk) 05:47, 6 March 2020 (UTC)

- As an aside to Farcaster: in my opinion, what is making your edits problematic/Original Research is that it seems that your goal is to show readers something you believe: "supporting the idea of the Clinton era as a counter-example to supply side economics," rather than reading sources and paraphrasing what the sources say, which is the way we are supposed to go about building an encyclopedia. ---Avatar317(talk) 01:52, 6 March 2020 (UTC)

References

- ^ A Tale of Two Theories: Supply side and Demand Side

- ^ "Economic Report of the President 2001". govinfo.gov. January 2001.

- ^ "The Economic and Budget Outlook: Fiscal years 2000-2009" (PDF). cbo.gov. January 1999.

- Yes the chart above included in this section on the talk page. The one whose sources dont talk about SSE at all. The one that several users have objected to. I have to ask, have you even read WP:NOR? If so, what do you think it means? Because if taking data from a source that doesnt even talk about SSE, performing your own calculations on it not present in the source, then claiming it explains some element of SSE, if that isnt original research, then nothing is. Bonewah (talk) 18:19, 6 March 2020 (UTC)

- The one with the two panels right in the middle of this talk discussion is what I'm talking about, the one you just reverted. NOT THE WATERFALL, which I think is fine but I'm compromising with the two panel chart. There is no OR issue there; we're past that. Now we're talking synthesis, so I added the sources that link supply side to the Clinton economic and budgetary performance. Enough of the Wikilawyering people! It's CEA and CBO charts in a section talking about Clinton's economic performance. Not sure why this is controversial.Farcaster (talk) 19:22, 6 March 2020 (UTC)

Trends in income tax revenue and outlays (spending) as % GDP during the Clinton Administration.[1][2] - The chart that is in there now looks a lot like WP:SYNTH to me, but im going to leave it alone for the moment as i think there are some more important discussions around the 'Clinton Years" section. Bonewah (talk) 18:56, 10 March 2020 (UTC)

- The one with the two panels right in the middle of this talk discussion is what I'm talking about, the one you just reverted. NOT THE WATERFALL, which I think is fine but I'm compromising with the two panel chart. There is no OR issue there; we're past that. Now we're talking synthesis, so I added the sources that link supply side to the Clinton economic and budgetary performance. Enough of the Wikilawyering people! It's CEA and CBO charts in a section talking about Clinton's economic performance. Not sure why this is controversial.Farcaster (talk) 19:22, 6 March 2020 (UTC)

- Yes the chart above included in this section on the talk page. The one whose sources dont talk about SSE at all. The one that several users have objected to. I have to ask, have you even read WP:NOR? If so, what do you think it means? Because if taking data from a source that doesnt even talk about SSE, performing your own calculations on it not present in the source, then claiming it explains some element of SSE, if that isnt original research, then nothing is. Bonewah (talk) 18:19, 6 March 2020 (UTC)

Poorly sourced "taxes went down, but revenue went up" content

Claims that the US was on the wrong side of the Laffer curve need to be sourced to peer-reviewed research, not random Heritage Foundation editorials which state the correlation in Wikipedia's voice. Snooganssnoogans (talk) 21:43, 21 May 2020 (UTC)

- I would agree (i.e. that a additional source is needed for the claim revenue rose in the period in question)....but the section does not make a specific claim on the (so-called) Laffer curve. Furthermore, blanking the whole section was not a good approach as the 1920's/60's were a justification by Supply-Siders in the 80's for the tax cuts which followed. That's important info for the reader. I will see what I can round up as far as a source goes.....but the fact taxes were cut in the period(s) in question is without question.Rja13ww33 (talk) 21:53, 21 May 2020 (UTC)

- I found a source and it appears the revenue number quoted in the Heritage Foundation source (if you click on it) is correct. See: https://www2.census.gov/library/publications/1975/compendia/hist_stats_colonial-1970/hist_stats_colonial-1970p2-chY.pdf?#

- (see p.44 of the pdf itself or p.1110 of the original publication. "Series Y402-411").Rja13ww33 (talk) 23:06, 21 May 2020 (UTC)

- The problem is the implied conclusion that revenue went up because tax rates went down. We can't state that in Wiki voice. Snooganssnoogans (talk) 23:09, 21 May 2020 (UTC)

- We could qualify that by saying something like: according to the Heritage Foundation.... I.e. make it clear that it is their pov that [this because of that]. OR we could say that supply-siders have used this period to justify [whatever]. But we would have to make clear that revenues did rise in this time period. (Regardless of the reason.) In other sections we are clear what happened after tax increases/decreases.Rja13ww33 (talk) 23:16, 21 May 2020 (UTC)

- The problem is the implied conclusion that revenue went up because tax rates went down. We can't state that in Wiki voice. Snooganssnoogans (talk) 23:09, 21 May 2020 (UTC)

"United States monetary and fiscal experience" should be in the "effects on revenue" section

Before I started editing the article, the section "United States monetary and fiscal experience" was constructed as an argument by supply-siders for why their fringe theory is correct. However, this section should be a sub-section within the "Effects on revenue" section, as that's what all the content is about (whether tax reforms increased revenue or not). Snooganssnoogans (talk) 01:50, 14 June 2020 (UTC)

United States monetary and fiscal experience

At the head of the "United States monetary and fiscal experience", this statement has been added:

A 1999 study by University of Chicago economist Austan Goolsbee, which examined major changes in high income tax rates in the United States from the 1920s onwards found no evidence that the United States was on the wrong side of the Laffer curve and that tax revenue increased as a result of the tax cuts.

This appears to be OR. I don't see that specific statement/conclusion drawn. (Although I admit I could have missed it as it is a lengthy article.) It would be better if a direct quote was made or if it was removed. (I have left it in for now.)Rja13ww33 (talk) 01:03, 14 June 2020 (UTC)

- You can skip to the conclusions section, it's got most of it. Volunteer Marek 01:28, 14 June 2020 (UTC)

- I need a specific page number. I didn't see it. At least not stated that way. This is drawing a conclusion and is OR.Rja13ww33 (talk) 01:32, 14 June 2020 (UTC)

- 43-44. Of course it's a paraphrase (to avoid copyright violation) but it's accurate. Same is true for the Thorndike part you're objecting to. Volunteer Marek 01:34, 14 June 2020 (UTC)

- I don't think a short quote from a journal is a copyright issue. In any case, the closest they get to that is: "The notion that governments could raise money by cutting rates is, indeed, a glorious idea. It would permit a Pareto improvement of the most enjoyable kind. Unfortunately for all of us, the data from the historical record suggests that it is unlikely to be true at anything like today's marginal tax rates. it seems that, for now at least, we will just have to keep paying for our tax cuts the old-fashioned way." That's a long way from the statement that was added: "examined major changes in high income tax rates in the United States from the 1920s onwards found no evidence that the United States was on the wrong side of the Laffer curve and that tax revenue increased as a result of the tax cuts"Rja13ww33 (talk) 01:50, 14 June 2020 (UTC)

- 43-44. Of course it's a paraphrase (to avoid copyright violation) but it's accurate. Same is true for the Thorndike part you're objecting to. Volunteer Marek 01:34, 14 June 2020 (UTC)

- I need a specific page number. I didn't see it. At least not stated that way. This is drawing a conclusion and is OR.Rja13ww33 (talk) 01:32, 14 June 2020 (UTC)

Fix looks good snoog.Rja13ww33 (talk) 02:10, 14 June 2020 (UTC)

" ....yet tax revenues declined due to Reagan's tax cuts...."

This has been added. It's true that taxes dropped off initially.....but revenues eventually rose back some years later.

And this seems to be making it all about the tax cuts....when the fact of the matter is: a very deep recession hit at the same time. Saying it was "due to RR's tax cuts"....kind of distorts the issue. (One of the references mentions that recession.)

I think it needs to stated differently.Rja13ww33 (talk) 02:20, 14 June 2020 (UTC)

- The sources comprise analyses that attribute a decline in revenue to the tax cuts. The Reagan administration's own analysis concluded that the tax cuts caused a decline in revenues. Snooganssnoogans (talk) 02:22, 14 June 2020 (UTC)

- No doubt about it....but a reader would think the revenue in 1989 was lower than it was in 1981 looking at that. The quote says that: "...yet tax revenues declined due to Reagan's tax cuts and the deficit ballooned during Reagan's term in office." When I read that (without knowing what I know) I'd think overall revenues were lower.Rja13ww33 (talk) 02:27, 14 June 2020 (UTC)

- How would you word it? It seems pretty clear to me. Snooganssnoogans (talk) 02:29, 14 June 2020 (UTC)

- Probably something like: "the net effect of the 1981 tax cut was a reduction in receipts versus the projected revenue without the tax cut". Something along those lines. (or maybe a direct quote from the article.) It's improper to say revenue fell without clarifying when/how.Rja13ww33 (talk) 02:40, 14 June 2020 (UTC)

- or maybe something like: "The result of [whatever tax cut] was a reduction in revenues relative to a baseline without the cuts [according to whomever/or RS note]"Rja13ww33 (talk) 03:30, 14 June 2020 (UTC)

- That's the right way to say it: A tax cut reduces revenue relative to a baseline without the cuts. That's a standard CBO conclusion. In the case of the Reagan cuts, there is a Treasury study that covers that. I don't know if there is a January 1981 or 1982 CBO baseline like the modern ones.05:03, 14 June 2020 (UTC)

- CBO director Rivlin testified the Reagan tax cuts would reduce revenues in March 1981. See table 3 in this document. I'll create an image file of it. CBO RivlinFarcaster (talk) 05:19, 14 June 2020 (UTC)

- Rivlin also references this study, which shows in Table 4 on page 16 a significant drop in revenue due to the tax cuts for 1981-1986; this is a good comparison vs. baseline. I may use this for the image instead. CBO Study - Analysis of President Reagan's Budget Revisions for Fiscal Year 1982.Farcaster (talk) 05:24, 14 June 2020 (UTC)

- That's the right way to say it: A tax cut reduces revenue relative to a baseline without the cuts. That's a standard CBO conclusion. In the case of the Reagan cuts, there is a Treasury study that covers that. I don't know if there is a January 1981 or 1982 CBO baseline like the modern ones.05:03, 14 June 2020 (UTC)

- How would you word it? It seems pretty clear to me. Snooganssnoogans (talk) 02:29, 14 June 2020 (UTC)

- No doubt about it....but a reader would think the revenue in 1989 was lower than it was in 1981 looking at that. The quote says that: "...yet tax revenues declined due to Reagan's tax cuts and the deficit ballooned during Reagan's term in office." When I read that (without knowing what I know) I'd think overall revenues were lower.Rja13ww33 (talk) 02:27, 14 June 2020 (UTC)

The Thorndike

A editor tried to add this:

However, tax historian Joseph Thorndike argues that it is wrong to assume that overall tax revenue increased due to the tax cuts rather than from the broader economic growth that was taking place at the time.

From the cited article:

Joe Thorndike, a tax historian and director of the Tax History Project at Tax Analysts, said that “tax cuts did seem to increase the amount of taxes collected from wealthy taxpayers, as well as their share of overall revenue. But that’s partly because those same wealthy taxpayers were reaping a large share of the benefits from all that economic growth.”

He said it’s wrong to assume, even with the growth, that the tax cuts paid for themselves: “Did the 1920s tax cuts bolster economic growth? Probably. Did that growth help defray the cost of the tax cuts? Probably. Did that growth cover the full cost of those tax cuts? No.”

As Thorndike put it: “Historically, tax cuts have tended to generate some economic growth that in turn helps cover part of the cost of the cut itself. But to my knowledge, no major tax cut has ever generated enough growth to pay for itself completely.”

It's the part about "...the broader economic growth that was taking place at the time" that is at issue. It is implying that the growth was happening independent of the tax cuts. That's not provable and it's not what Thorndike says. (He actually says the tax cuts "bolter[ed]" growth.

It needs to be paraphrased different.....or we need a direct quote.Rja13ww33 (talk) 01:38, 14 June 2020 (UTC)

- Basic reading comprehension shows that Thorndike is referring to the broader economic growth going on. That's what the "But that’s partly because those same wealthy taxpayers were reaping a large share of the benefits from all that economic growth." and that's also why he explicitly says that the tax cut did not pay for themselves. Snooganssnoogans (talk) 01:47, 14 June 2020 (UTC)

- That's a conclusion you are drawing. You can't walk away from that section saying that. He clearly says that tax cuts do not pay for themselves.....but he also says the tax cuts bolstered that growth. I think to quote him directly would be better.Rja13ww33 (talk) 01:55, 14 June 2020 (UTC)

- There is no dispute among economists that tax cuts bolster economic growth (they were not the sole cause of that economic growth if that's what you're thinking). The section where that particular content is in features arguments that the tax cuts increased tax revenue (which is wrong per Thorndike), so it's unclear to me why you want to emphasize that the tax cuts increased economic growth (except to muddy the waters for less informed readers). Snooganssnoogans (talk) 01:59, 14 June 2020 (UTC)

- No I am no assuming they were "the sole cause of that economic growth" at all. How it is paraphrased is at issue. The "broader economic growth" part is making a judgement call as to the "sole cause" (or not sole cause). If we have to paraphrase....wouldn't something like "Thorndike [says] the tax cuts helped "bolster" growth but did not "cover the full cost of those tax cuts". be better??Rja13ww33 (talk) 02:07, 14 June 2020 (UTC)

- There is no value in talking about economic growth because there is no dispute that tax cuts increase economic growth. The section that this content is in is about tax revenue, so it's unclear to me why we should confuse readers by inserting the blatantly obvious (that tax cuts increase economic growth) rather than focus on the issue that the section is actually about. Snooganssnoogans (talk) 02:25, 14 June 2020 (UTC)

- Again: the problem is the "broader economic growth" part. It's running with the "broader" part being due to something outside of the tax cuts. We cannot know (nor will we ever know) how much (if any at all) the growth of the 1920's was due to any tax cuts. But that statement as is doesn't reflect his comments.Rja13ww33 (talk) 02:31, 14 June 2020 (UTC)

- The line that is in there now "Tax historian Joseph Thorndike argues that the tax cuts helped "bolster" growth but did not "cover the full cost of those tax cuts" seems fine to me. Bonewah (talk) 13:16, 16 June 2020 (UTC)

- Again: the problem is the "broader economic growth" part. It's running with the "broader" part being due to something outside of the tax cuts. We cannot know (nor will we ever know) how much (if any at all) the growth of the 1920's was due to any tax cuts. But that statement as is doesn't reflect his comments.Rja13ww33 (talk) 02:31, 14 June 2020 (UTC)

- There is no value in talking about economic growth because there is no dispute that tax cuts increase economic growth. The section that this content is in is about tax revenue, so it's unclear to me why we should confuse readers by inserting the blatantly obvious (that tax cuts increase economic growth) rather than focus on the issue that the section is actually about. Snooganssnoogans (talk) 02:25, 14 June 2020 (UTC)

- No I am no assuming they were "the sole cause of that economic growth" at all. How it is paraphrased is at issue. The "broader economic growth" part is making a judgement call as to the "sole cause" (or not sole cause). If we have to paraphrase....wouldn't something like "Thorndike [says] the tax cuts helped "bolster" growth but did not "cover the full cost of those tax cuts". be better??Rja13ww33 (talk) 02:07, 14 June 2020 (UTC)

- There is no dispute among economists that tax cuts bolster economic growth (they were not the sole cause of that economic growth if that's what you're thinking). The section where that particular content is in features arguments that the tax cuts increased tax revenue (which is wrong per Thorndike), so it's unclear to me why you want to emphasize that the tax cuts increased economic growth (except to muddy the waters for less informed readers). Snooganssnoogans (talk) 01:59, 14 June 2020 (UTC)

- That's a conclusion you are drawing. You can't walk away from that section saying that. He clearly says that tax cuts do not pay for themselves.....but he also says the tax cuts bolstered that growth. I think to quote him directly would be better.Rja13ww33 (talk) 01:55, 14 June 2020 (UTC)

The Clinton Years