Talk:Modern monetary theory/Archive 1

| This is an archive of past discussions about Modern monetary theory. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 |

Wikiproject:Chartalism proposal

Contributors to the article on Chartalism might be interested to know that a proposal has been put forward for a Wikiproject on Chartalism, in case they want to support it or participate in the project.-The Gnome (talk) 11:00, 22 March 2011 (UTC)

Confusion about status of Chartalism

There seems to be a great deal of confusion on Wikipedia as a whole as to whether chartalism represents the dominant monetary theory, with circuitism as an alternative, or whether there is some third theory (referred to on various pages as "mainstream" or "classical" monetary theory) which is the dominant view. It seems that if chartalism is the dominant view, this would be a good place to say so. If it isn't, some mention should be made of what the dominant view is. RaulGroom (talk) 03:41, 7 October 2009 (UTC)

- After doing some reading, I now believe that what is referred to here as the "mainstream" view is "metalism." Since there is no "metalism" page, I guess I will create one. I'll try to keep it strictly NPOV since I am actually a chartalist. RaulGroom (talk) 01:35, 9 October 2009 (UTC)

- It looks like you never got around to doing this. Any update on this?--greenrd (talk) 11:52, 3 October 2010 (UTC)

- Indeed, you're right, I dropped the ball on this somewhat. I decided I didn't have enough background to write a quality article so I have been spending the last several months reading the relevant scholarly materials. Perhaps I will pick this back up; it appears there's still no metalism page. RaulGroom (talk) 17:13, 17 January 2011 (UTC)

- Monetarism, with some variations, is the "mainstream" monetary theory, at least in the West (see the bottom of Monetarism#Practice where both American Federal Reserve and European Central Bank are cited as following monetarism). In a paper (at page 6, numbered 38), published by the History of Economic Thought Society of Australia, I found this explanation:

.Warren and Pearson acquired a far greater renown during the Great Depression through their remedies for economic distress. […] Because gold is the key variable in this theory of prices we will call it "metalism". Metallism[sic!] has the implication that by increasing the money price of gold government could increase the money price of commodities. Metalism was an unorthodox theory of prices in 1933: to Keynes mind it was "rubbish". (Brooks, 1969, p. 112). Metalism is also antagonistic to the non-Keynesian view which emphasises the quantity of money, or monetarism, which sees money prices as determined by the demand and supply of money.

— William Coleman, The New Deal's New Gold Policy: A Case Study in the Power of (old) Ideas, History of Economics Review, Volume 17, Winter 1992 - So monetarism and metalism are distinct and antagonist monetary theories.--MaD70 (talk) 23:30, 16 July 2011 (UTC)

- Monetarism, with some variations, is the "mainstream" monetary theory, at least in the West (see the bottom of Monetarism#Practice where both American Federal Reserve and European Central Bank are cited as following monetarism). In a paper (at page 6, numbered 38), published by the History of Economic Thought Society of Australia, I found this explanation:

Disputing "Job Guarantee" Section

Chartalists don't guarantee a job. They merely argue that the role of government in cases of underutilization is to provide the necessary demand to resolve that situation, since otherwise you have unused capacity and net economic loss. It's quite a jump to take that and conclude the government hires everyone who isn't employed; in fact, it often means the government becomes the customer of a lot of businesses. If you are in a state of underutilization that represents an economic loss, and it's due to a demand problem, it means you must have some net fiscal expansion from some source in order to drive utilization. If the private sector is attempting to build assets (run a surplus) and you have an external deficit, the only mathematical means of accomplishing this is public deficit, that is, the government is either hiring people or buying from the private sector. So the section I've marked for expert review needs to recognize that Chartalists prescribe that government deals with unemployment not by guaranteeing a job, but by hiring more and/or spending i.e. buying more from the private sector. Things could easily, and likely would, weigh more towards the second option.ThVa (talk) 21:28, 27 June 2011 (UTC) (posting on behalf of one Filburt)

- Your comment underlines the need to seperate MMT from Chartalism, not because they are completely different, but because MMT is just the modern theory that is (in part) built on the foundations of Chartalism, and includes many other ideas outside of chartalism. A Job Guarantee IS prescriptive to MMT, but not necessarily to Chartalism.Charles Jurcich (talk) 13:12, 31 August 2011 (UTC)

Chartalism and Modern Monetary Theory

It looks like this has become an article on 'Modern Monetary Theory'. Perhaps Modern Monetary Theory should be a separate article? - Crosbie 18:18, 26 July 2011 (UTC)

- Are there any scholarly articles on 'Modern Monetary Theory' and, to perpetuate the pathetic fallacy, has this article been hijacked by a fringe theory?

- As an MMTer myself, I agree that MMT needs to be seperated from Chartalism - I'm sure Chartalism as a wider school of thought has an extensive history beyond modern interpretations like MMT. But their needs to be strong references between the two, given that MMT is the only Chartalist theory systematically redeveloped in recent times (as far as I know). Also MMT contains many ideas that are outside of chartalism.Charles Jurcich (talk) 13:12, 31 August 2011 (UTC)

Expansion + Re-write

I'm going to have a go at expanding this article into what will hopefully be an easy-to-read introduction for non-economic types. I've tried to incorporate many of the points people have noted above. However, there is surprisingly little criticism on the actual descriptive part of the theory - it seems to check out in its description of reserve accounting and deficit spending. However, if anyone has any relevant scholarly criticism, please feel free to add.Andyk 33 (talk) 13:18, 3 March 2011 (UTC)

I was caught by these two sentences: "MMT does, however, insert one caveat: that long-term government bonds can affect the term structure of interest rates. For example, in times of uncertainty, long-term debt may not be desired by the market, leading to high interest rates for that particular type of debt, and therefore affecting the yield curve. MMT proponents therefore tend to argue that government should limit itself to short-term bonds." MMT (I thought) is not a policy advocation, but simply a description of how monetary and fiscal policy is interwoven.

What I would add is a section regarding how government bonds differ from private sector debt. Starting with private sector debt is continually maintained (interest and principle are paid back over time) where as sovereign government bonds are accrual type (interest and principle are paid at the time of bond maturity). Second, private sector debt is a claim on an asset that has a limited life span whereas sovereign bonds can be issued in maturities that exceed the life span of any private sector asset. Third, I would describe how banks and other large bond holders manage their duration and default risk by mixing sovereign debt with private sector debt. Fourth, a description of how government bond auctions are handled would be helpful - the sovereign decides the maturity spectrum of the debt it is trying to sell, while the private sector determines the amount of interest it wants for purchasing that debt.

On the last point realize that a sovereign can in fact sell debt at any interest rate - real or nominal. Imagine for instance if the bond auction process was reversed. The sovereign determines the interest rate on the debt it wants to sell, and the private sector submits bids for the maturity. Obviously, the sovereign would try to delay the payment of interest for as long as possible and so would accept bids of the longest maturity. Meanwhile, the purchaser of the bond is taking on more risk with the longer duration, but that is the point - for any term structure out to infinity there is a price for risk.

Finally, I would nod to the risks associated with sovereign debt - inflation, currency debasement (if you are a nonlocal holder of the debt), political upheaval, invasion, and armageddon.67.165.88.175 (talk) —Preceding undated comment added 01:59, 2 September 2011 (UTC).

Modern Monetary Theory and Capitalism

Why does this keep getting deleted?

I, for one, believe that this section should certainly be deleted. Although I think the point it is making, could, in some way, be incorporated into the artice, as it currently stands it is an original piece of work which cites no source. It is also very odd sitting by itself at the end of the article. Andyk 33 (talk) 12:42, 31 August 2011 (UTC)

The point is multifaceted - but let me try to explain. A sovereign government does not go bankrupt for the following reasons: 1. A sovereign government has the ability to tax the populace and use the taxes to pay the interest on the debt 2. The bonds that it sells are accrual type bonds (as opposed to coupon type) meaning that the interest payments in cash are only made at the date the bond matures 3. A sovereign government has an infinite financing horizon meaning that it can roll over its debt again and again and again infinitum. More to the point it can sell debt of any maturity of its choosing (1 year, 30 year, 50 year, 100 year, whatever). 4. Put two and three together, and you arrive at an entity that can defer the cash payment of interest as long as it likes 5. Since a sovereign government can defer cash payment as long as it likes it can pay any interest rate that it likes by decree. 6. The monetary authority generally sets interest rates on short term debt lower than interest rates on long term debt. Meaning that there will always be buyers for long term debt as long as it is profitable to borrow short term and lend long term. Notice this is a more general description of the "printing money" hypothesis. Money (cash) is simply a zero term liability of the monetary authority that can be used to purchase long term liabilities.

How does this relate to capitalism? Capitalism itself is built upon the sale of liabilities to finance the difference between what an entity takes in revenue, and what an entity spends. It is an economic impossibility for all sectors ( sovereign government, businesses, individuals ) to run surpluses even under MMT, and so one sector must defer consumption / production, ie they must buy the liabilities of a second sector for that second sector to run a deficit. In the corporate sector there are two types of liabilities - equities and bonds. The difference between the two is that bonds represent senior claims on future income while equities are junior claims. The difference between the two comes into focus when a company tumbles into bankruptcy. When it becomes clear that a company cannot meet its obligations often times the equity holders are wiped out or suffer a dilution as bond holders are forced to convert their holdings to equity (debt to equity bankruptcy restructuring).

What is missing from most of the MMT theories that I have read are equity like claims sold by a sovereign government. Remember that in the corporate arena, equities are junior claims on a corporations revenue stream. A sovereign government can sell non-guaranteed claims on its future tax revenue as easily as a corporation can. In fact by doing so, an economy can escape the 0% lower bound for the cost of debt service in the private sector.4.49.117.146 (talk)

A little bit more on #4 will make things clear. Sovereign governments hold bond auctions where the federal government decides what duration of debt it wants to sell and the buyers determine what interest rate they will accept for that debt. What if the two are reversed? What if the federal government decides the interest rate and the buyer determines the duration? For instance, suppose the U. S. Treasury decided it wanted to sell 10% bonds. It would then start accepting bids with the longest duration bid being accepted (50 years, 100 years, whatever). Obviously, the purchaser of the bond is taking on more risk with the longer duration, but that is the point - for any term structure out to infinity there is a price for risk. Whether the markets can properly gauge that risk is a separate issue.

As a visual example imagine stretching a sovereign debt yield curve out to infinity. What is the interest rate at infinity? What you will discover is that the interest rate is infinity as well. The mathematical reason is that the derivitative with respect to time of a yield curve does not have a zero except at infinity. The reason the derivative with respect to time does not have a zero is because of the monetary authority always keeping short term rates below long term rates (with rare exceptions). 4.49.117.146 (talk)

MMT does not just apply to federal governments. You should consider replacing the term "federal government" with either "government" or "govenment sector" or "sovereign government" (meaning a government that has sovereignty over its monetary system (so excluding Eurozone countries)). You should also formally cite MMT's major proponents and it's published documents in this section. You need also to expand on the mechanism by which a government can set "any" yield at which it issues government debt, and under what institutional arrangements.Charles Jurcich (talk) 13:12, 31 August 2011 (UTC)

The institutional arrangement would be a reversal of the bond auction process. The Treasury department announces that it is going to sell debt with a yield of such and such percent. Bidders then submit bids on the duration (5 years, 10 years, 30 years, 50 years) that they are willing to absorb to purchase the debt. — Preceding unsigned comment added by 67.165.88.175 (talk) 03:28, 28 September 2011 (UTC)

Vertical transactions

Andyk, In the second paragraph of this section you have the sentence

- "In order for the government to spend, it sells government bonds on the open market."

I would remove this sentence for two reasons

- it adds nothing to the very correct point being made here

- MMT disputes this, saying that a corresponding government bond issuance is solely for the purpose of maintaining a positive rate (above the support rate), and has nothing to do with 'financing' deficit spending.

Simply removing it is fine, but then deal seperately with the issue of deficit spending without corresponding debt issuance. Do not quote me directly - i'm not an economist - but find the description of this on Prof. Bill Mitchell's blogs.Charles Jurcich (talk) 13:36, 31 August 2011 (UTC)

Further to the point above, Mitchell deals in detail with the specific issue of running a government deficit without corresponding debt issuance in this Questions and Answers blog under 'Question 1' - http://bilbo.economicoutlook.net/blog/?p=15747 you can then try to find more citable references later perhaps. Charles Jurcich (talk) 14:47, 31 August 2011 (UTC)

- Thankyou Charles - I think the point you make is a good one. I wrote this article a while ago, and upon re-reading it there are multiple sections of the document that could be reworded, made more concise or clearer. I will attempt to do that one of these days! 122.107.183.158 (talk) 16:39, 2 September 2011 (UTC)

- Yeah, I just tripped over that sentence; I'll remove it shortly. So, while it applies to Greece (which must sell bonds before it can spend, it does not apply to the US, which can simply print money. That's why Greece is in crisis, and the US isn't. linas (talk) 21:26, 20 October 2011 (UTC)

Chronology of MMT

Georg Friedrich Knapp described the theory in "The State Theory of Money". This book was published in 1905. Alfred Mitchell-Innes articles on money and credit appeared in 1913. So why does the article say the theory was developed by GFK in the 1920s? GFK would have been in his 80s! It looks like 1900s would be more accurate! 86.214.202.188 (talk) 23:24, 14 November 2011 (UTC)

- It seems this issue has been fixed in the current iteration of the article. K♪monkey@('_')@ Talk⇉✌ 00:04, 22 November 2011 (UTC)

This article does not present Modern Money theory impartially

The article fails to mention Wynn Godley, Marc Lavoie and gives only passing mention of L. Randall Wray and can't even give a web link to Wray of which google says there are almost 900,000. Sigh.

Godley was only the major architect of the theory and has the best description of it in one place.

Reading the first three chapters of his book Monetary Economics: An Integrated Approach to Credit, Money, Income, Production and Wealth would be sufficient to understand Modern Money theory. This article gives short shift to all of his major explanations.

There is talk in the comments above about metalism- meaning I guess a money system that is 'backed' up by precious metal. Since no such money system is now in existence on the planet, what is the point?

Quoting Paul Krugman "has stated that the MMT view that deficits never matter as long as you have your own currency" is just plain silly. The guy has it all wrong and MMT never says that anywhere. Instead it says that policy makers must use great discretion in creating government debt. L. Randall Wray has responded to Krugman's gross simplification and blew it away. So I see no point in making up a straw man - was that just to fill up the page?

How sophomoric

How cliché

There's a much better description of Modern Money Theory here

http://pragcap.com/resources/understanding-modern-monetary-system

Thaddeus0720 (talk) 01:54, 18 November 2011 (UTC)

- In general, the impartiality of a wikipedia article is met due to the tenets espoused by the wiki community WP:BRIEF including writing content using a neutral point of view WP:NPOV. However, the articles found here may have biased editing from new wiki contributors who have not yet appreciated the desirability of writing in the neutral voice. If you find that this is the case for this specific article and while your comments here in the article discussion page have merit and may move other wiki users to edit the article in accord to your insights, your efforts may be better directed towards editing the content of the article that you find objectionable that do not adhere to the tenets of wikipedia like neutral point of view WP:NPOV. With respect to the subject of "metalism" that you mentioned (which I do not claim to know and defer to other editors), it is not necessary that there be a prerequisite of utility for an area of knowledge to be included in an encyclopedia. Afterall, wikipedia is sought out as a repository for the introduction to areas of knowledge and not usually as an authoritative guardian of information. Afterall, people still look up articles such as Dinosaur and Dodo, extinct animal subjects which can be said may have no "practical" value or old historical events which likewise may have no relevance to the "modern era." But, as the adage goes, history has a tendancy to repeat itself. K♪monkey@('_')@ Talk⇉✌ 01:04, 22 November 2011 (UTC)

Removed edit to 'Background' section

There was a big-ish change to the Background section, which looked to have some good info but which just isn't formatted well enough to suit the article. If the original submitter or someone else, would reformat it to suit the article better here in Talk first (to see what people think) and then put it back, that would be good (I may not get around to rechecking this page, just pulling it and leaving it here to be sorted out).

I've pasted it below, verbatim. Arfed (talk) 09:46, 25 November 2012 (UTC)

Evidence for MMT/Chartalism:

I just go by empirical scientific evidence which is why MMT or www.MonetaryRealism.com wins over rational people --the most important is that ALL spending is income for someone else --and that all gov spending is income for the private sector (that's just regular accounting --someone's debit is someone else's credit)... & that the vast majority of the money supply is made up of money creation(aka as loans/credit by fractional reserve lending) by private banks & when they reduce loans/credit/money creation, recessions happen...and then it's up to gov to counteract the money supply contraction with gov money creation (aka 'deficit spending)--which shows why taxes should be cut & gov money creation(aka 'deficit spending') increased during stagnant economies(recessions are caused by contractions in money supply) so as to fund hiring & spending/demand:

there's tons of empirical evidence/data charts from official sources like Federal Reserve Charts of evidence/facts here- Oil/energy prices cause inflation, NOT federal deficits -evidence/facts here: 1. http://rodgermmitchell.wordpress.com/2010/04/06/more-thoughts-on-inflation/

2. Economics Verifiable EVIDENCE by CEO/MBA economist at http://rodgermmitchell.wordpress.com/2009/09/07/introduction/ & http://rodgermmitchell.wordpress.com/2011/07/09/why-bank-lending-leads-to-recessions-a-counter-intuitive-finding ..more at www.RodgerMitchell.com

3. http://pragcap.com/debunking-ron-pauls-talking-points

4. http://pragcap.com/the-most-destructive-monetary-myth-in-the-usa

5. 7. Seven Deadly Frauds of Economic Policy http://moslereconomics.com/wp-content/powerpoints/7DIF.pdf by Bank CEO/economist Warren Mosler from http://MoslerEconomics.com/ -Daily Insightful & Most Accurate Verifiable Economics Analysis

6. http://mikenormaneconomics.blogspot.com/search?q=fdr+social+security -Proof showing how FDR & his a cabinet admitted that Social Security/payroll taxes are UNNECESSARY in a fiat currency gov but they agreed to them as a "useful fiction" by conservative politicians so that politicians in the future wouldn't cut it since people "paid into it" & video testimony & writings by several Federal Reserve chairmen from Greenspan, Bernanke & Eccles that Social Security can not go bankrupt since it's all fiat

The biggest objection is "what about inflation or devaluing US dollar?"

The US dollar has value because it actually is still the LARGEST country exporter of food & manufacturer of goods (from Intel chips, Microsoft Windows/Office, to Hollywood movies/music) that the world wants

--China depends on the US for imports of wheat, soybean, rice, corn. See charts below --btw, Russia & China stopped using the US dollar for trade between them.. the US dollar didn't lose/drop in value nor collapse nor hyperinflate

http://seekingalpha.com/article/165958-u-s-still-the-world-s-largest-manufacturer

why US fiat dollar (and even EURO) has value, backed by world's greatest production/export of food:

http://in.reuters.com/article/2008/04/18/trade-wto-food-idINL1835607720080418

The US doens't need nor needed Braetton Woods' Accord to be 'world reserve' currency... that happened after the fact because the US for years prior was the world's greatest exporter & producer of goods (and still the leading nation as biggest exporter of FOOD) after WW2 (making the US dollar most valuable), & then world's biggest importer (by 'exporting' fiat US dollars as nations exoprted to the US to accumulate US dollars because they wanted US dollars to buy US goods/services) which is how it became 'world reserve' currency.

P.S. Weimar Germany's hyperinflation was caused by shortages caused by 90% drop in it's production when almost all their industrial/manufacturing workers went on strike for 8+ months to protest French/Belgian invasion of Germany to confiscate German industrial goods (coal, steel, manufactured goods,etc) for war reparations & from economics professor Bill Mitchell: http://bilbo.economicoutlook.net/blog/?p=3773

Zimbabwe's hyperinflation was caused by shortages caused by drops of 30%-57% of it's production sectors(food, textiles, manufacturing,etc) due to Mugwabe after years of civil war won & expelled all the white landowners(who made up most of the educated, skilled, professional, managerial class & employed most of the population) & gave their land/assets/factories to his revolutionaries who were mostly armed peasants who had no idea how to run a farm, agribusiness, nor factory & unemployment then skyrocketed to 80%+

- UPDATE: Some of the sources in the above, are very useful in MMT debates (particularly the evidence links), so some of the above is definitely worth properly formatting into the main article, if anyone is interested in doing that properly (I don't have a good enough overview, to do this myself right now). Arfed (talk) 21:05, 3 January 2013 (UTC)

Economists who utilize MMT & MCT Predicted the Financial Crisis when All Others Failed

Both Michael Hudson & Steve Keen predicted in detail the Housing Collapse & resulting economic crisis while mainstream economists were completely clueless (and remain so) Vilhelmo (talk) 04:16, 17 January 2013 (UTC)

Unbalanced Criticism Section

Is it normal to have the majority of the criticism section made up of statements from supporters of a scientific theory? 212.56.120.79 (talk) 17:44, 31 March 2013 (UTC)

Decoupling Chartalism and MMT

Modern Monetary Theory has certainly received enough coverage from media outlets and comments from high-profile economists to justify a separate article under WP:GNG. There are a fair number of theoretical claims and policy proposals associated with MMT (including some referred in this article) that aren't simply logical consequences of Knapp's Chartalism and don't really warrant detailed discussion on a Chartalist page (the post-Keynesian theory of endogenous money, and Warren Mosler view of imports, and many of the criticisms of MMT being the most obvious examples). Removing this could be balanced by adding more general discussion of critical reception of Knapp's book, links with Keynes' general theory, fiat vs commodity money debates, historical precursors etc. that aren't part of the MMT core. I've created a proto-MMT page on my user-space.

here which will start off by absorbing much of the content here and hopefully develop into something more coherent and comprehensive. I'll try to add new content here and to get consensus for the replacement of the redirect with a new Modern Monetary Theory article before removing all the MMT stuff from this page, but it could use a trim now...

Any help with developing either page would be much appreciated. — Preceding unsigned comment added by Dtellett (talk • contribs) 16:15, 15 April 2012 (UTC)

- MMT is the modern configuration of chartalism. Hence the name neo-Chartalism. Sure, it starts with Knapp, but his theory was improved upon by several others after him - those improvements come to correct flaws in the theory, some expand logically from the fact money is a creature of the state (for example, Tax Driven Money approach). Can Knapp's Chartalism exist without the posterior contributions that were made? Yes, but in an incomplete form. 95.92.77.117 (talk) 20:59, 25 April 2012 (UTC)

- I agree that MMT warrants its own article at this point. Treating the subject more fully here would imbalance this article. Professor marginalia (talk) 22:34, 13 April 2013 (UTC)

Proposal: renaming the article as "Modern Monetary Theory". What do you think?

Ok, it is just a suggestion. However it is a bit odd to find an article where in almost every single line it is written "MMT is", "MMT has" and then you notice that the name of the article is "Chartalism". --NUMB3RN7NE (talk) 13:06, 23 July 2013 (UTC)

- You should start this discussion by substituting the {{Requested move}} template. – Allen4names (contributions) 04:43, 24 July 2013 (UTC)

Austrian School criticism

I found a sentence in the main article that was incorrect in claim and I explain why it should be either removed, altered, or substantiated with a secondary source.

The sentence that is problematic is this: "As such, a critique of MMT that employs an example of a society without a monetary system exhibiting those qualities cannot be a critique of MMT."

Wikipedia has an article on critique and I base my objection to the inclusion of the aforementioned because it does not agree with the definition of critique as stated in the wiki article. According to the wiki article, if the critique employs deductive logic then it is considered strong. If the Austrian position is simply that an economy can produce savings absent a "monetary system, that employs a fiat currency and floating exchange rate" then it respresents a valid critique of MMT's theory of "savings". While the Austrian school is currently considered heterodox and while the Austrian critique can be generalized to all economic theories that presume "a monetary system that employs a fiat currency and floating exchange rate", nevertheless to make the statement that the Austrian critique using Robinson Crusoe worldview cannot be a critique specific to MMT is a bit too bold and inconsistent with the current wiki article on critique. If the sentence was stated as a defense by a reknown MMT proponent, it should directly cite that person and include the appropriate verifiable citation. Otherwise, the sentence appears to be synthesis WP:NOR. K♪monkey@('_')@ Talk⇉✌ 02:08, 22 November 2011 (UTC)

Kjmonkey said:

" If the Austrian position is simply that an economy can produce savings absent a "monetary system, that employs a fiat currency and floating exchange rate" then it respresents a valid critique of MMT's theory of "savings"

It is not a valid critique of MMT.

MMT refers to savings of financial assets NOT real assets.

MMT agrees that an economy can produce savings of REAL assets absent a monetary system.

Vilhelmo (talk) 18:02, 28 November 2013 (UTC)

Criticism

Any criticism available?

- I'd like to see it on an even more basic level than the first commenter, since I'm not an economist. This sounds to me like an economics version of a perpetual motion machine. It's counterintuitive to the rank amateur that money creates money in some kind of infinite loop. That doesn't mean it couldn't be right. Only that some of us need it explained and/or critiqued more clearly. In my limited view, money has value because it buys things, not because some government printed it so that I could pay taxes. If a government just prints money (late Tsarist Russia, current Zimbabwe) without regard to underlying goods, it becomes worthless no matter how many taxes people pay. I don't get it. —Preceding unsigned comment added by Quixote9 (talk • contribs) 20:27, 6 June 2010 (UTC)

- A chartalist would argue that (fiat) money can only buy things because a merchant is willing to accept it, i.e. he has a demand for it; and it is the demand of governments that taxes be paid in fiat money that creates that demand, as opposed to the merchant demanding that you exchange goods of equal value for his goods (a barter system).

- Historically speaking the chartalist view is an accurate description both of how money came into existence in the first place (in ancient Egypt and Mesopotamia, it's pretty clear that money was the result of state accounting and tax practices) and how the use of money entered "primitive" economies in the colonial era; the french/british/australians etc would show up and demand that the inhabitants of a region pay an annual tax in francs/pounds (usually on pain of corvee, goods seizure or death if they didn't pay up). The inhabitants discovered that the only way they could get the money to pay the tax was by working in the colonial plantations/mines/other industries. They usually "earned" an excess over their tax requirements and would seek to exchange this excess for goods they wanted; hence a commercial economy would spring up. Money is basically "company scrip" where the "company" is the state.

- "Printing money" is about the ratio between gold and paper currency in a gold-standard economy. It doesn't really apply as a concept to a modern fiat currency economy.

- This doesn't mean that crediting accounts in excess of the real amounts of goods and services in the economy won't cause inflation. HOWEVER, it will only cause inflation after currently un- or under-used resources have all been brought into circulation by the increase in demand. Since people are a resource, this basically means that you won't get significant inflation until you reach the point of full employment. We are all a very long way from that point right now.

- James Haughton (talk) 05:34, 2 July 2010 (UTC)

- Haughton wrote "... description of how money came into existence in the first place (in ancient Egypt and Mesopotamia)..." I don't know about Egypt, but in Mesopotamia the Sumerians used barley as money. Each day the farmers paid each farm worker a standard-size bowl of barley. If a worker did not eat all of his/her daily wages, he/she could save the surplus barley until they had enough to pay a shoemarker for shoes, a fruit grower for fruit, etc. The government acted like a bank and loaned barley to contractors who hired laborers to dig canals, etc. I don't know if this barley money resembles any feature of chartalism. Greensburger (talk) 22:43, 3 March 2011 (UTC)

Good to see that the criticism section has been updated - but I still feel it is rather poor at the moment. The criticism sections on other economics pages go into specific detail, whereas the criticism cited on this page seems to be along the lines of "this theory is wrong because it's wrong". I will have a look in more detail at the links to see if I can pull out some more information. Andyk 33 (talk) 01:31, 31 July 2011 (UTC)

- In this section you show the following criticism and response

- - "Murphy also criticises MMT on the basis that savings in the form of government bonds are not net assets for the private sector as a whole, since the bond will only be redeemed after the government "raises the necessary funds from the same group of Taxpayers in the future".[18] In response to this, MMT authors point out that the repayment of bonds does not necessarily have to occur from taxes; a central bank attempting to hold an interest rate target must necessarily purchase government bonds. These purchases occur through the creation of currency, rather than taxation."

- A more accurate response would be along the lines of

- - "in response to this, MMT authors claim this is a misunderstanding of MMT tenents. MMT authors do not say that when government runs a deficit, it is the government bond sales that adds net financial assets to the private sector as Murphy implies, in fact they say it is the budget deficit that adds the net financial assets. The bond sale itself has simply swapped one net financial asset (reserves) for another (government bonds), altering the composition of net financial assets, not the amount. Further, the funds to repay government bonds never come from taxation. Interest payments are payed "from nowhere" through government spending in the normal way consistent with Chartalism. Whilst the principal is repaid by further bond sales, which have no effect on the amount of net financial assets."

- Question 2 in the following blog from Mitchell deals with this point - http://bilbo.economicoutlook.net/blog/?p=15747

Hope this helps. Charles Jurcich (talk) 17:30, 31 August 2011 (UTC)

- This is from the Amazon forum on politics:

- Modern Monetary Theory (MMT) is covered by a long article in Wikipedia.

- I have recommended this addition to its coverage:

- "Criticism that budgetary issues, like deficits in revenue from taxes, may reduce voter support for MMT, is not often broadcast. Yet MMT would attract voters whose income has lagged behind other incomes for no reason based on fairness. Why so little support for MMT on election day? Because help for lower income families is made out to require higher taxes. MMT actually argues that such help will protect everyone from inadequate aggregate demand. MMT is against taxing the voters whose constituency is the largest. Yet this unreported criticism is at the heart of the matter addressed by MMT."

- This view is perhaps the most important one in this experiment.

- Experiment referred to is on Amazon dot com slash forum slash politics. — Preceding unsigned comment added by 99.30.177.158 (talk) 16:47, 5 December 2013 (UTC)

- Wikipedia has removed my plan to limit taxation to those taxes that are not counter-productive (i.e. to taxes to prevent hyper-inflation). Taxing labor or necessary inputs or outputs to the production of necessities is always counter-productive.

- I sent Wikipedia $10. They have more entries than ants to my house. But none of their entries gives them $10 just because they are worth $10 trillion. They are a blessing -- but they confuse all readers when it comes to justifying American money and taxes. — Preceding unsigned comment added by 99.30.177.158 (talk) 16:43, 5 December 2013 (UTC)

Chartalism standalone

Chartalism warrants its own article. The previous chartalism article became almost completely about MMT, so the MMT standalone fixed that. But there should be a stub for chartalism, if there isn't interest yet for developing the standalone, rather than a redirect. Chartalism isn't necessarily "modern". MMT economics is quite a bit more than chartalism (neo-Keynesian, pulling in the Minsky financial sector component, the job guarantee etc). The conflation of the two (chartalism and MMT) as we're doing now with the redirect, as if they're synonyms, misleads readers. I recommend that Chartalism be stubbed -- that neochartalism redirect here and reference to chartalism here in the MMT article text be wikilinked to the stub--hopefully sparking interest in developing it. Professor marginalia (talk) 05:48, 7 April 2014 (UTC)

- Go for it. --Surturz (talk) 06:06, 7 April 2014 (UTC)

incomhrehensible

I have never understood a word written about MMT is this me or am i the rule ? if I am the rule, why is this state of affairs ? it is sort of like marxism - one has the constant feeling of trying to punch through tacky jello — Preceding unsigned comment added by 2601:6:3880:CC8:E1E9:A589:57D7:BE1B (talk) 01:40, 12 January 2015 (UTC)

- It takes a lot of time reading about it, to fully 'grok' it - a lot of their narrative is confusing and, frankly, badly written (sometimes self-contradictory) and highly academia or 'home-crowd' oriented (so they have a very long way to go with improving their narrative - but they are getting better). It is well worth taking the time to explore though, as the more you do learn it, the more it 'clicks', and seems incredibly intuitive compared the much of everything else (I will say though, starting at a level of zero economic understanding, it took me a good 2-3 years to fully grok; this was only time spent gradually learning as a dilettante). Arfed (talk) 00:19, 19 February 2015 (UTC)

Criticism of exports

This bit was added by an anonymous user, criticizing Mosler's view on exports/imports, but it doesn't fit the formatting of the article and isn't cited, so moving here:

- [The previous ignores the realities that utility decreases. As no one needs more than three smart-phones, excess production is costly inventory that ends up scrapped as garbage unless it is sold. It is a negative asset. But sellers create more than they themselves need, because the value of money received is much larger than they value their inventory. Company A makes 1B smart phones, not 100M, because exporting the remaining 900M is valuable and useful. The domestic country could not have consumed the excess 900M units. Thus there is in fact no economic cost lost by selling what amounts to excess scrap, and exports in real life certainly add net value/wealth to the exporting country. No country would export if this were not the case.]

Arguably, this isn't suitable for the article at all - I don't know what Wikipedia guidelines it would fall-foul to though (WP:NOR?) Arfed (talk) 21:01, 12 November 2015 (UTC)

Palley criticism

The criticism from Thomas Palley was expanded recently, and it is just a big block of text in the criticism section now. Could this be cleaned up a bit? Also, Post-Keynesian (and, as far as I know, MMT'er) Phil Pilkington did a good analysis of Palleys criticism there, and has shown it it is in part, more neo-Keynesian/neoclassical-synthesis than Post-Keynesian (e.g. relying on IS/LM, when this seems to be rejected by most Post-Keynesian's?); maybe this warrants inclusion as a 'counter-criticism': https://fixingtheeconomists.wordpress.com/2014/02/18/palleys-critique-of-mmt-post-keynesian-or-neo-keynesian/ Arfed (talk) 00:22, 19 February 2015 (UTC)

- Agree that the Palley section is a bit long, and I wrote some of it!! That said, it's not the weakest part of the article by any stretch of the imagination, and he's about the only person to provide a thorough academic critique of MMT so the weight is due. Pilkington's analysis doesn't belong there: Wikipedia doesn't generally do "counter criticisms" in criticism sections, particularly not counter criticisms which boil down to "I'm surprised he's using orthodox economic models" Dtellett (talk) 22:04, 21 April 2015 (UTC)

- Palleys criticism just reads like a rant. You cannot introduce IS/LM to an article that hasn't mentioned it. MMT does have a complex understanding of inflation. I think all criticisms of economic theories should be reduced to their bare bones as they are mostly he-said she-said type arguments and the details just confuse everyone. --77.100.248.161 (talk) 18:26, 7 March 2016 (UTC)

Wrong claim that governments are completely free to print money

The following quote from the article is: "the government has an unlimited capacity to pay for the things it wishes to purchase" is not true. If it were the governments having poor or corrupt leaders would be able to control world events and for all their citizens to benefit greatly.

There is a serious limit on how much money governments can print and and issue without inflating or super-inflating the currency. Of course they can try, but will then cease to be viable. Surely here we do not wish to consider the way governments can work to fail, but only how money printing can help governments to regain stability and have good control of their country's progress. The MMT idea that current fiat money makes its issue less constrained than with the gold standard, is true to a limited degree. The article should clearly explain the way this is normally constrained.Macrocompassion (talk) 10:24, 11 January 2017 (UTC)

Mainstream economics says an economy can only be sustainable if the amount of spending is kept closed to the amount of tax received. MMT says the the amount of spending is limited to the amount of unemployment. If there is unemployment, then there is scope for additional government spending. If more spending is required when there is full employment, then additional tax is needed to increase unemployment, and so to make more resources available for use by the government. — Preceding unsigned comment added by 194.75.63.98 (talk) 12:17, 23 January 2018 (UTC)

Pathetic fallacy

Is it advisable to include innumerable uses of pathetic fallacy in a Wikipedia article? "A nation wants," for example. "MMT considers," "MMT concludes," "a desire on behalf of the exporting nation" etc.

"Some leading proponents of MMT such as Warren Mosler advocate" is a preferable style.

Mydogtrouble (talk) 12:48, 24 July 2011 (UTC)

- Yes. "Encyclopedic style" does NOT mean: dry and dusty. According to merriam-webster.com, a Pathetic fallacy is not a "fallacy." Cheers!

--2602:306:CFCE:1EE0:5A9:3440:7AEA:4ECC (talk) 17:27, 22 October 2018 (UTC)Doug Bashford

Substantial Redundancy between MMT and Chartalism articles

I suppose this is probably obvious, but the Chartalism page is almost entirely reproduced within the MMT page. I'd like to try to separate the material but I don't have the time at this moment. David A Spitzley (talk) 17:50, 10 January 2019 (UTC)

Revisions needed

>>Based on the national income identity,

Does this mean "national savings identity" or something else? Confused.

>>MMT states that it is [not] possible for the non-government sector to accumulate a surplus [unless //only if] the government runs budget deficits.

Suggested revision for readability. The algebra shown does not support any reasonable interpretation of this claim. Make a case or delete. Define "surplus" exactly.

>>As most private sectors want to accumulate a surplus, How are "wants' relevant ? We need a basis in fact.

>> MMT economists usually advocate for government budget deficits. "usually?" Is there evidence or a poll to support this claim ? 24.165.181.87 (talk) 02:02, 12 February 2019 (UTC)

Money is not a monopoly

There are well over 2,000 competing cryptocurrencies in the world today that either directly or indirectly compete with national fiat systems. The MMT claim that money is a monopoly is seriously whistling past the graveyard and that's being excessively polite. At present there doesn't seem to be anything out there Wikipedia RS worthy that handles this double facepalm worthy observation so I'm just leaving this in comments. We desperately need something that covers exactly how divergent from reality MMT is in its baseline assumption that "the currency" is "a public monopoly" TMLutas (talk) 18:32, 15 March 2019 (UTC)

- The claim is that for each fiat currency the treasury/central bank for that currency is the monopoly issuer of that currency. Naturally there is competetion between currencies; a manufacturer might move its factories from one country to another. Incidentally, Bitcoin is not a fiat currency. — Charles Stewart (talk) 19:00, 15 March 2019 (UTC)

so called "survey"

I reverted an edit which added this:

A 2019 survey of leading economists showed a unanimous rejection of modern monetary theory's assertions that "Countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt" and "Countries that borrow in their own currency can finance as much real government spending as they want by creating money.

The reason is that every economist (MMT economists included) would have answered the same way. In other words, this has nothing to do about MMT and about what MMT says. The MMT is a macroeconomic description of the monetary system characterised by its view of the currency as a tax credit and, therefore, of the currency as a public monopoly. (source: http://www00.unibg.it/dati/corsi/910003/64338-Warren%20Mosler%20Bergamo%20paper%20March%2010.pdf ) --NUMB3RN7NE (talk) 08:47, 15 March 2019 (UTC)

- The cited secondary RS clearly identifies this as part of MMT, as does the IGM survey. Furthermore, your claim of what MMT is in no way consistent with what RS say, and the lede to this article is extremely deficient. Snooganssnoogans (talk) 09:54, 15 March 2019 (UTC)

- I've also started a discussion on the Fringe Noticeboard[1]. Snooganssnoogans (talk) 10:03, 15 March 2019 (UTC)

To add to this discussion, here ( http://rooseveltinstitute.org/deficits-do-matter-not-way-you-think/ ) is an article from Randall Wray (well known founding MMT academic), directly addressing/refuting the claim about MMT (that deficits don't matter) in the above survey. The claim is not a part of MMT, it should not be cited as a reflection of MMT in the article. Arfed (talk) 06:09, 18 March 2019 (UTC)

- Shrug. On Wikipedia, we go by what reliable sources say, not what you wish they had said. Take it up with the reliable sources, then.--Calton | Talk 07:23, 18 March 2019 (UTC)

- Those a RELIABLE source while the Chicago Boot is not! The reason is that Chicago Boot made a survey which has nothing to do with what MMT affirm indeed, the others are the ANSWERS made by MMT economist about this so-called "survey". NUMB3RN7NE (talk) 21:06, 18 March 2019 (UTC)

- Hmm. Well it's not a very good addition to the article if the claims are known to misrepresent MMT. I've adjusted that part of the criticism, to make clear that the survey attributes those claim to MMT - and I've added a response to the survey from a prominent MMT academic who states that MMT does not make both of those claims (from a previously-cited website). Right now I'm concerned about bad faith edits to the article, aimed at smearing MMT - and I'm worried such smears are going to start being backed through use of Wikipedia bureaucracy. Arfed (talk) 05:39, 19 March 2019 (UTC)

- As I read more, there is a lot of public talk among MMT academics that the aurvey is exactly the kind of smear I worry about, above. I'll be keeping an eye, here - I've first hand dealt with stuff like that, before, and it will be given very short shrift... http://bilbo.economicoutlook.net/blog/?p=41823 Arfed (talk) 13:28, 19 March 2019 (UTC)

- Hmm. Well it's not a very good addition to the article if the claims are known to misrepresent MMT. I've adjusted that part of the criticism, to make clear that the survey attributes those claim to MMT - and I've added a response to the survey from a prominent MMT academic who states that MMT does not make both of those claims (from a previously-cited website). Right now I'm concerned about bad faith edits to the article, aimed at smearing MMT - and I'm worried such smears are going to start being backed through use of Wikipedia bureaucracy. Arfed (talk) 05:39, 19 March 2019 (UTC)

Copyright-free material

Hi,

I saw this:

https://wiki.riteme.site/w/index.php?title=Modern_Monetary_Theory&diff=888506920&oldid=888506340

and I ask you how to show that this article:

http://www00.unibg.it/dati/corsi/910003/64338-Warren%20Mosler%20Bergamo%20paper%20March%2010.pdf

is free from copyright. I explain: this article is on the website of University of Bergamo and it is free from copyright.

Thanks. --NUMB3RN7NE (talk) 16:58, 19 March 2019 (UTC)

Hi,

I wrote to the professor who held the course (Stefano Lucarelli) and this is his response (in Italian):

---------- Forwarded message --------- From: Stefano Lucarelli <stefano.lucarelli@unibg.it> Date: mar 19 mar 2019 alle ore 18:37 Subject: Re: Stefano scusa una domanda: ma tu sai se questo paper qui è coperto da copyright? http://www00.unibg.it/dati/corsi/910003/64338-Warren%20Mosler%20Bergamo%20paper%20March%2010.pdf

Non è coperto da copyright, è materiale didattico preparato per il corso a Bergamo di cui ero coordinatore. Puoi farlo circolare.

TRANSLATION (of his answer): "It is not covered by copyright, it is teaching material prepared for the Bergamo course taught by me and of which I was the university coordinator. You can reproduce it."

--NUMB3RN7NE (talk) 17:52, 19 March 2019 (UTC)

- Ok I asked how to overcome this kind of "empasse"... basically it was told me that the professor should place a public declaration on the website of his university where he states that this document is free from copyright. I don't know if this is the right procedure or not, I asked because this is something I have never "experienced" before. --NUMB3RN7NE (talk) 18:36, 19 March 2019 (UTC)

The Table comparing MMT and mainstream

...is kinda POV, kinda of WP:PRIMARY, some of it even WP:OR. It displays the *claims* that MMTers make about mainstream. Most of these are nonsense. For example:

- Mainstream does not say that funding government spending requires taxation or (not "and") issuing bonds. It just says that printing money is not a wise way to fund government spending.

- Ok I guess

- Again, it's not that you can't use fiscal policy to get to full employment, it's just that, according to mainstream, under normal circumstances, monetary policy is a better tool

- Ok I guess

- Currently, the interest rates are not really actively managed but rather follow something like the Taylor Rule. Also, the "MM view" is not controversial or different from the Mainstream view. In fact I can't find it in sources where the MMTers say "Creating money increases supply of deposits/savings, which drives down interest rates to near-zero" (although the claim is non controversial)

- Ok I guess, though the MMT view is kind of wacked. This is probably THE difference between mainstream view and MMT. However, as presented here it's kind of a non-sequitur. The MMT claim, as far as I understand it, is that when you run fiscal deficits you automatically create new money (no)

- Umm, the fact that unemployment insurance etc. increase deficits in the downturn is *exactly* what makes them automatic stabilizers.

I'm going to remove it until 1) we can get rid of the original research and 2) we present this as claims MMTers make about the mainstream, not what the mainstream actually is.Volunteer Marek (talk) 05:04, 23 March 2019 (UTC)

- Why don't you be part of the solution? Leave the parts you are OK with and help me fix the rest. Easier to just revert others work, a special kind of lazy.Farcaster (talk) 05:39, 23 March 2019 (UTC)

- I'm not sure how to fix it. Any kind of comparison is gonna come from either a MMT source or a mainstream source, so either way it would be a POV.Volunteer Marek (talk) 05:48, 23 March 2019 (UTC)

- Reread what you just wrote. Good luck finding any source in the universe other than economic statistical agencies that are unbiased. The point as you well know is neutrality, a blend of sources from all sides in the absence of an arbiter like CBO. I've tried to address your changes; didn't appreciate your removal but your arguments are constructive. Hopefully you can live with more of this and point out where you still have issues.Farcaster (talk) 06:05, 23 March 2019 (UTC)

- It's better. There is kind of a basic issue here of how you confront a "mainstream view" with a "heterodox" or "fringe" view. Mainstream doesn't really pay much attention to the fringe view, or if it does, it's not in scholarly or academic sources. There's no MMT publications or debates with regular economists in journals. MMT is mostly an internet phenomenon. So we either rely on what MMTers, who are fringe, claim or we... I don't know.Volunteer Marek (talk) 07:57, 23 March 2019 (UTC)

- I don't think heterodox means fringe (Robinson?, Minsky?), and some MMT works have found substantial discussion in academic heterodox venues (e.g., Wray's Modern Money). But I think Marek is right that we are unlikely to find a suitable source for this material, and it's a bit too close to OR for my liking. — Charles Stewart (talk) 20:43, 23 March 2019 (UTC)

- It's better. There is kind of a basic issue here of how you confront a "mainstream view" with a "heterodox" or "fringe" view. Mainstream doesn't really pay much attention to the fringe view, or if it does, it's not in scholarly or academic sources. There's no MMT publications or debates with regular economists in journals. MMT is mostly an internet phenomenon. So we either rely on what MMTers, who are fringe, claim or we... I don't know.Volunteer Marek (talk) 07:57, 23 March 2019 (UTC)

- Reread what you just wrote. Good luck finding any source in the universe other than economic statistical agencies that are unbiased. The point as you well know is neutrality, a blend of sources from all sides in the absence of an arbiter like CBO. I've tried to address your changes; didn't appreciate your removal but your arguments are constructive. Hopefully you can live with more of this and point out where you still have issues.Farcaster (talk) 06:05, 23 March 2019 (UTC)

- I'm not sure how to fix it. Any kind of comparison is gonna come from either a MMT source or a mainstream source, so either way it would be a POV.Volunteer Marek (talk) 05:48, 23 March 2019 (UTC)

External links to economists' blogs as relevant expert information

I think we should discuss what's appropriate to link to as further reading on the subject. There are links to economists' blogs in the external links section, which I find to be appropriate as per Wikipedia:External_links#What_should_be_linked section "to be considered", item 4. They are not intended to be citable sources.

There are also non-blog writings published on Warren Mosler's site, for example, that are arguably mandatory readings on the subject. I feel as though those can be considered to have real authority. --Geoffpursell (talk) 23:52, 5 April 2011 (UTC)

Rejoinder: Although the above reference guide says expert blogs are appropriate, citations to personal blogs within the MMT article are unnecessary. The blog citations in the current article are overwhelmingly from Bill Mitchell. Those blogs are quite frankly poorly edited and difficult to read. Every citation in the article to Bill Mitchell can be replaced by a reference to the same point in a formally edited and published work of an MMT economist, even Mitchell himself. Editors should endeavor to replace as many of the Bill Mitchell blog references as possible, with references to formally edited and published works. I have already done so myself. This is easily done by reading the MMT literature. --97.119.0.118 (talk) 00:39, 28 April 2019 (UTC)

Comparison with mainstream table

This table is really quite shoddy. We should remove the back and forth between Kelton and Krugman. Each side of the table should deal with it's side of the theory, and leave criticism to the criticism section. I recommend we just have a simple well-cited sentence or two in each box, letting the citations show who said what. Zyzzek (talk) 14:19, 5 May 2019 (UTC)

Pull this mess

This article is completely wrong in so many ways it should be pulled. It goes wrong right from the get go, calling Modern MONETARY Theory a 'fiscal' policy. Monetary and fiscal policy are fundamentally divergent elements. Anyone who calls one the other is just making stuff up. — Preceding unsigned comment added by 74.15.90.8 (talk)

- One of the key contributions of MMT is to point out that monetary and fiscal policy are actually linked. According to Warren Mosler in Soft Currency Economics:

- Monetary policy sets the price of money, which only indirectly determines the quantity. It will be shown that the overnight interest rate is the primary tool of monetary policy. The Federal Reserve sets the overnight interest rate, the price of money, by adding and draining reserves. Government spending, taxation, and borrowing can also add and drain reserves from the banking system and, therefore, are part of that process.

Point 4 is wrong, according to Kelton

In the video at https://www.cnbc.com/2019/03/26/aocs-economic-theory-has-gotten-one-big-fact-wrong-fitch-says.html at approx. 08:50 she says "I reject the idea that MMT is about using taxes to reduce inflation". Didn't check the authoritative source for the bullet points, but clearly there's some controversy about it.

Removal of money by use of tax / sales of bonds to reduce inflation, is kind of supporting the Quantitive Theory of Money. As far as I am aware, QTM is strongly opposed by MMT academics. Kelton is bang on when she says that tax should not reduce inflation. Tax is to create unemployment (of labour and resources), which will allow the government to purchase, without devaluing the currency. — Preceding unsigned comment added by 188.28.59.47 (talk) 21:35, 6 October 2019 (UTC)

Ketil (talk) 09:01, 28 March 2019 (UTC)

I think its just the interpretation of her statement. From Bloomberg: "The reason the government doesn’t need to sell treasury securities, or levy taxes, to spend money is that the central bank, under the control of the treasury, can pay for everything by conjuring up electronic money. In MMT’s ideal world there would still be taxes, but their main purpose, aside from lessening inequality, would be as “offsets” to keep inflation under control. Taxes would drain just enough money from consumers and businesses so total spending in the economy won’t be excessive." Bloomberg Farcaster (talk) 14:20, 28 March 2019 (UTC)

- According to MMT "framework", the main purpose of taxation is to "enforce" the use of the "currency" issued by the public sector. Otherwise, it would be impossibile for the public sector to function. I mean, otherwise the public sector would not have the capability to source / procure all the workforce, goods, services it needs to function from the private sector. And, in exchange, the public sector can pay the private sector through that specific currency. In other words, according to MMT "framework" taxation is the "instrument" the public sector uses in order to "enforce" the "quality" of "public monopoly" concerning the currency issued by the public sector itself.

- (Source: http://www00.unibg.it/dati/corsi/910003/64338-Warren%20Mosler%20Bergamo%20paper%20March%2010.pdf )

- --NUMB3RN7NE (talk) 17:48, 28 March 2019 (UTC)

I have attempted addressed this as of 27 April 2019 by specifying the bullet point be demand-pull inflation (as per Fullwiler/Grey/Tankus 2019), and citing the Fullwiler/Gray/Tankus column which clarifies and addresses the issue 2600:8804:280:6E:3C9C:D2B2:E41:C0F (talk) 01:39, 28 April 2019 (UTC)

National Accounting Identity

The very first sentence claims Chartalism to be a monetary standard and fiat money a unit of wealth. Let it be explained how we can call it an standard or unit. Free floats are known to be tokens that represent variable quantities of wealth. It neither has any intrinsic value nor any known or definite or definable purchasing power. Market measure wealth using money as the measure of wealth. therefore common medium of exchange must satisfy technical requirement for unit and that require it be precisely defined quantity of what it measures. It must also be noted that measurement is a scientific issue and the opinion that really ought to be considered is the opinion of scientists and technologists. I am of the view that calling Chartalism a monetary standard and fiat money as unit of wealth is foundation of worst fraud against humanity and it must be challenged. — Preceding unsigned comment added by Hrsiddique (talk • contribs) 06:09, 28 January 2011 (UTC) There is a long and dry looking section called 'Deriving the National Accounting Identity from the Expenditure Model of GDP'. A Google search for "National Accounting Identity" chartalism returns one hit, besides Wikipedia. This looks like original research. I will remove it if no sources are provided. - Crosbiesmith (talk) 18:29, 5 October 2009 (UTC)

Not only that, but the deriving of the national accounting equation is completely incorrect. As such I'm going to remove it now. Matthew 18:15 10 october 2009 —Preceding unsigned comment added by 115.70.133.89 (talk) 10:11, 10 October 2009 (UTC)

A simple comment from somebody who knows no economics: The first sentence doesn't seem to really make any sense to me. It still sounds confused even after I added a little punctuation. 31.125.76.2 (talk) 10:33, 28 March 2020 (UTC)

Formatting

The page is going through a lot of edits recently, and the formatting of the content has gotten bad and is not in line with other Wiki pages - the introductory paragraph for instance, should not contain the numbered list of some of MMT's core distinguishing features - it's meant to be an introductory section, which leaves those kinds of more detailed points to later.

I haven't got more to add, nor the time to review everything, but please be mindful of the formatting of the article, keep it in line with other wiki pages, and keep in mind that laymen wholly unfamiliar with MMT, will be coming here to get an introductory/broad idea of what it's about. Edits with new/more-clear information are good, fair play - but emphasis on clarity and fitting in with other wiki articles. Arfed (talk) 23:33, 30 March 2019 (UTC)

- I agree. The page is horrible horrible right now. I'd suggest we take inspiration from the Spanish version of the page here: https://es.wikipedia.org/wiki/Teor%C3%ADa_Monetaria_Moderna

- I also think the page is in need of a rewrite in general. 1) It doesn't provide a good overview of the theory. 2) It confuses policy proposals for the theory. 3) There are constant minor details and one line arguments from supporters and detractors all throughout it, which only serve to confuse the reader.

- I came here to say this. I may take a hacksaw to the lede. Bangabandhu (talk) 13:10, 27 May 2020 (UTC)

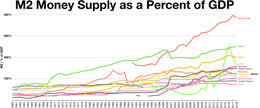

images

I'm moving these files here - they're not referenced in the text and not particularly relevant.

Bangabandhu (talk) 01:57, 1 June 2020 (UTC)

heterodox

recently editors have pointed to [this 2007 article] to state that MMT is heterodox. Source doesn't say MMT is heterodox, but features of it are heterodox. [2019 source] says "But what was once an obscure “heterodox” branch of economics has now become a major topic of debate among Democrats and economists with astonishing speed." Bangabandhu (talk) 12:38, 20 July 2020 (UTC)

- If you want to fix specific point whether MMT is or is not "heterodox" please constrain your edits only that part of the article. But we can agree on that. 82.197.13.58 (talk) 13:04, 20 July 2020 (UTC)

Search on Google and Google scholar for "mmt heterodox", you will find a slew of RS. That you didn't even do this low level of due diligence shows your bias on this issue. I'm adding some more references to the lead. Do not remove the word heterodox, as it is well accepted. LK (talk) 13:59, 27 July 2020 (UTC)

Criticism section starts with an endorsement

The first paragraph of Criticism reads as follows:

- James K. Galbraith supports MMT and wrote the foreword for Mosler's book Seven Deadly Innocent Frauds of Economic Policy in 2010.[74] Steven Hail of the University of Adelaide is another well known MMT economist.[75][76]

Is it normal to start a criticism section with endorsements? It reads strangely and perhaps there is precedent for this sort of thing that I am not familiar with. 68.148.75.147 (talk) 22:25, 9 December 2020 (UTC)

Addendum--the second paragraph also reads like criticisms of criticisms:

- A 2019 survey of leading economists by the University of Chicago Booth's Initiative on Global Markets showed a unanimous rejection of assertions attributed by the survey to Modern Monetary Theory: "Countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt" and "Countries that borrow in their own currency can finance as much real government spending as they want by creating money".[77][78] Directly responding to the survey, MMT economist William K. Black said "MMT scholars do not make or support either claim."[79] Multiple MMT academics regard the attribution of these claims as a smear.[80]

And the final sentence:

- "Prominent MMT economists Scott Fulwiller, Stephanie B. Kelton, and L. Randall Wray have addressed many of the above criticisms[19]."

Seems out of place in a criticism section also, mostly since it lacks further explanation. Apologies for my formatting. 68.148.75.147 (talk) 22:33, 9 December 2020 (UTC)

I added links to Stephanie and L. Randall's names, and corrected the typo in Fullwiler. This sentence still seems a bit out of place.68.148.75.147 (talk) 23:07, 9 December 2020 (UTC)

I decided to be BOLD since no one has responded to my objections here. I deleted the first paragraph of the Criticisms section. 68.148.75.147 (talk) 23:09, 11 December 2020 (UTC)

- Fixed. SPECIFICO talk 00:08, 12 December 2020 (UTC)

- Good enough for me, although a pointed Criticism section seems warranted and precedented. 68.148.75.147 (talk) 00:45, 12 December 2020 (UTC)

What happened to Criticism

After learning a bit more about wiki and the history page, it appears what occurred here was actually a BRD failure. This undo: https://wiki.riteme.site/w/index.php?title=Modern_Monetary_Theory&diff=993007604&oldid=993007490 by User:Liberaldemocrat Should have been discussed prior to undoing the reversion. 68.148.75.147 (talk) 22:01, 23 December 2020 (UTC)

Fundamental Questions

In the United States, the Treasury Department with one hand prints government debt and sells it to investors; with another hand the Treasury Dept prints green dollars and delivers them to the Fed for cost of printing. From time to time the Fed buys government debt and pays with dollars received from the Treasury actually for free. If one disregards the investors, then it becomes clear that the Treasury Dept prints government debt, and also prints free dollars for the Fed to buy the government debt. The government debt constantly rolls over; the new debt is replacing the old debt. In fact, the federal government is already practicing the fundamental aspects of the MMT. Japan, with government debt two and a half times larger than its GDP, is a good example of MMT being practiced for decades, and it works perfectly well. But the good questions are, what is the optimal size of the government debt; what is the optimal level of inflation (both nominal and real); and when the hyperinflation will creep in (Germany in '20s, or Zimbabwe more recently). Government of Japan owns its Central Bank, and they are wise enough to keep interest rates close to zero, regardless of level of inflation. But the Fed, being private and independent, may start increasing interest rates on a whim "to fight inflation" caused by MMT. Irving Fisher explained in his classic Booms and Depressions (1932) how liquidation of debt causes a vicious self--enforcing debt--deflation spiral and economic depression.[1] Lunine (talk) 03:49, 15 February 2021 (UTC)

We should admit that in this debate we have a lot of miscommunication and misunderstanding. When we make statements that government should not worry about budget deficits and government debt, very many reasonable people get nervous, and we should not blame them. Instead, we should start talking about limits, limitations, and common sense. Consider the case of Zimbabwe. The government was printing money to pay salaries of the government employees. The result was hyperinflation. It is clear that there are limits, and governments should indeed worry about those limits. Imagine now that the government of Zimbabwe printed the same amount of money, but ALL that money was paid to create a strong construction materials industry, and to build whatever the country needs -- decent housing, chicken farms, etc. What would have been the result? Zimbabwe would be a rich country by now. Most of the population would live in decent apartments, and there would be "a chicken in every pot." The point here is that creation of money out of thin air not either good or bad. We should frame the MMT in terms of economic development. Consider Argentina. Was bankrupt many times, and bankrupt again. Borrowing money from other countries in their currencies will always bankrupt you. MMT, on the other hand, is a very potent tool for any government to improve the living standards, and to reduce poverty. The main argument of our opponents is an elevated level of inflation. Monetary savings will lose value, but there is a solution. Commercial banks still pay high interest on deposits in saving accounts. The central bank will pay high interest on the reserves the commercial banks keep in the central bank. Holders of cash will be properly compensated. But inflation, as we know, benefits debtors and hurts creditors, and creditors are mostly banks, so the government will have to print money and compensate them. Those who hold debt instruments, government or private, must be compensated. It will take a lot of planning, preparation, and educating all levels of the society how inflation works. But the reward will be tremendous for any country that needs financing to create millions of productive jobs. In countries like India not millions but tens of millions of jobs will be created. Poor countries with underdeveloped financial systems suddenly will be able to finance construction of modern new cities with modern public transportation where most of the people will not even own a car, so the country will save tons of money on import of cars and gasoline. We need to start talking to poor countries, to their governments, bankers, and economists. And the last point. Housing built with government money becomes government property. A better way is for the central bank to print money and to make loans to a government-owned commercial bank which will make loans to private real estate developers which will build whatever the country needs, is that new cities or chicken farms. When construction is completed, the newly built assets will be sold, and the debt will be paid back all the way to the central bank. This way there will be no increase in inflation in the long run. It is explained on this website: http://www.globalpovertysolution.com. The authors refer to it as MODIFIED KEYNESIAN THEORY. Both MMT and MKT have their roots in Keynesian Theory; they are just more promiscuous versions of the same principle - to give the government more active role when the financial system is not capable to do the job. (Lunine (talk) 05:07, 26 February 2021 (UTC))

Modern Monetary Theory in America and Europe

A number of central banks all over the world, most notably in the U.S. and in Europe (European Central Bank) have adopted the MMT as their default monetary policy. In practical terms, it means that those central banks are printing currency and buying government obligations like Treasury bonds, notes, and bills. The result is a direct monetization of government debt if the central bank buys it straight from the Treasury.[2]. In this case the central bank receives currency from the Treasury for the cost of printing, and then pays that currency back to the Treasury for government debt. Usually central banks use indirect monetization of debt. In this case the Treasury prints government obligations and sells them to investors. From time to time the central bank buys government debt from investors and pays with currency received from the Treasury for the cost of printing. Buying the government debt from investors is just an indirect way to monetize the government debt directly. [3]. Many economists do not understand the monetary theory, and they are still in denial about MMT. An important fact to remember is that when the central bank buys government debt from commercial banks, the result is an increase of bank reserves against which the banks make loans. If the banks make what Irving Fisher called "productive loans" [4] (to buy new housing, for example), then such productive loans are good for the economy. If the banks make loans to buy millions of houses or apartments which have not even been built yet, the result is always speculation, fraud, and the Great Recession.[5] Lunine (talk) 19:12, 25 March 2021 (UTC)

Modern Monetary Theory: Short Explanation