Talk:Wall Street Crash of 1929/Archive 1

| This is an archive of past discussions. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 |

There are interesting other opinions related to the causes of Black Tuesday. One is given on this page. It is written by Dr. D.J.C. Smant, of the monetarian department of the economic faculty of the Erasmus University of Rotterdam, the Netherlands. He points out that the stock market was not severly overpriced at that instant and that the market just followed a logical decline in price level and economical activity. If the Great Depression was not caused by the stock market crash, he argues, it must be caused by the failure of monetarian policy.

Since the official site also makes this remark, I guess we should at least mention that there are other opinions. Dolf 13:19, Oct 18, 2003 (UTC)

I think there's too much emphasis on the number of stocks being sold on this entry -- I mean, exactly as many were bought. Selling, in and of itself, therefore did not cause the crash. Markonen 23:35, 25 Oct 2003 (UTC)

No but the speed at which they were sold did G-Man 00:25, 26 Oct 2003 (UTC)

No, they were bought up exactly as fast, and who ever said that quick buying crashes markets? Mismatch between supply and demand is what crashed the prices, and this isn't clearly reflected in the article. The amount of stocks traded might tell us that it was a busy day, but nothing else. Markonen 10:00, 26 Oct 2003 (UTC)

Yes it does it says that share buying drove the price of shares up to artificially high levels, which were sustained by nothing but the beleif that they would rise further G-Man 18:45, 5 Jan 2004 (UTC)

"This investment drove me to love women"??

Article name

There are about 7000 Google hits for "Black Thursday" as referring to the 1929 Crash. "Wall Street Crash" gets about 19,000 hits. So I'm moving the article. Rd232 21:23, 26 August 2005 (UTC)

Why doesn't the stock market hotlink come straight here? Or does somebody think people interested in the stock market crash might want to read about a bratty Phillies player? Also, some specific numbers would be appreciated. Just what was the DJIA at peak, for instance? --squadfifteen

- Black Thursday refers to just one day (when the decline was worst), though the crash as such took a bit longer to die down, and is sometimes considered to have started on 21 October. I'm renaming this "Stock Market Crash of 1929", as markets across the world were affected. It also gets many more Google hits [1] vs [2]. Oh, and I'll clean up the links... DocendoDiscimus 18:18, 11 October 2005 (UTC)

- Thanks for clarifying a slightly sticky situation. I think I'd stick with "Wall Street Crash 1929" over "Stock Market Crash 1929" though; for one thing, the Google search may be deceptive here as many of the references to "Wall Street Crash" as a name for the event are likely to include the phrase "stock market crash" as a description of the event. If you do want to move the article, maybe it's worth getting more input at Wikipedia:requested moves. Rd232 22:31, 11 October 2005 (UTC)

"millions of investors"

The article states that the events of October 1929 ended up "ruining millions of investors." We know that many investors were ruined and arguably "millions" of people were invested in the stock market. But saying millions were ruined seems to be an overstatement. The millions affected by the Crash of '29 were the workers who lost their jobs when the loss of consumer capital ended numerous businesses. But the percentage of American households investing in stocks in that time was not very high by modern standards.

margin credit as a cause of rising share prices

"Banks lent heavily to fund this share-buying spree." Unless someone can substantiate this claim with some facts (e.g., the fraction of stock-market capitalization funded with debt), then I'll have to remove this claim as arbitrary.

credit pumps often blow out the markets

re: margin credit as a cause of rising share prices

If you examine the boom/bust of the 1990's, there was a prevailing attitude that it was worthwhile to borrow on credit, whether that be margin, mortgage, or even plastic, to buy stocks. Stock prices become artificially high when money is pulled out of thin air (like on credit) to buy them. There is an artificially high demand created by the credit industry, and it is fairly well-documented as a major contributor to boom/bust cycles. In fact, if you go read Bill Fleckenstein's columns on cnbc, he discusses and cites several occasions of the credit market getting over-extended, cutting back, then subsequently drying up the artificial demand. We're actually seeing this right now, as people have become over-extended on credit and the housing ATM, they're going to have to sell their stocks, cash out their 401(k), and eliminate their savings to pay the bills. Most knowledgeable economists see this as a problem in the next 5 years, and there is absolutely the potential for a repeat of 1987. Look for the bond yield curve to invert (short term rates higher than long term rates), then hold on to your hat. It's possible that we may only see this correction in the housing market, since that's where everyone is invested (instead of stocks). Let's hope that's the case.

Total decline

Doesn't anyone think we ought to include the total decline between opening bell Thursday and closing bell Tuesday? Anyone have that figure? Marskell 12:27, 18 March 2006 (UTC)

broker's loans

Galbraith (The Great Crash 1929) indicates two "sources of intelligence on brokers' loans" - the monthly tabulation of the NYSE, and the other the weekly return of the Federal Reserve System. It would seem to be the case, from this book, that the majority of credit for the frenzy of share trading at this period, was supplied by the banks via these brokers' loans.

Page layout

The first section of this page needs to be fixed, the photos make the space way too large for that teeny quote.

Return to pre-crash levels

Stating that stocks didn't return to 1929 levels until 1955 is quite misleading. This excludes dividends, which make up around half of total returns on stocks. Focusing on price alone does not reflect the gains that actual investors experience.

- I wonder whether companies were able to pay dividends during that time. Does anyone have figures and sources for dividends during this period? 64.231.45.185 04:16, 15 September 2006 (UTC)

Timeline

The "timeline" section of this page could really use some cleanup and additional information: it is somewhat uninformative and devoted almost entirely to the anecdote about bankers trying to stop the crash on Black Thursday. I will work on doing this, but if anyone else feels like doing it too, please go ahead. SparhawkWiki 16:11, 10 October 2006 (UTC)

Doesn't compute

The Dow Jones Industrial Average reached a high of 381.17 on September 3, 1929. Three days later, on Black Thursday, October 24, 1929, the stock ...

I didn't know October 24th was three days after September 3rd. Rift in the fabric of space-time?

Need qualified expertise

It seems to me there would be a lot of people, eg. economics students, professors, etc, that could give guidance on this subject. I have a couple old economics books, that I could use as resources, but I'm a layperson on this subject, and there are probably vast resources out there to draw on, but I'm not familiar with them. Can anyone help with this? Richiar 18:07, 24 January 2007 (UTC)

Problem is the policy ruling out truth. Experts on the subject generally admit bafflement or repeat the vague incantations recited here. The assumption that prohibition had nothing to do with the crash, and that the two coincided by sheer coincidence is also too deeply entrenched to be allowed scrutiny under the "stare decisis" policy guideline. IF government action, including prohibition, were a factor, what government-subsidized University is going to publish such a conclusion and thereby make it mentionable here? translator 22:52, 2 March 2007 (UTC)

Needs a graph

This article needs a graph of the crash. 100 years of DOW data can be found here: http://www.analyzeindices.com/dowhistory/djia-100.txt

The file is a too big for my computer, can someone make this into a nice graph please?

(It would be nice to show the graph in relation to the tech boom and bust, anyone got a source with more recent data?) futurebird 19:31, 27 January 2007 (UTC)

Okay, I made this. It looks a bit fuzzy as a thumbnail... is there anyone who can fix that? futurebird 04:49, 28 January 2007 (UTC)

template

I created a new template for notable stock market crashes and I thought I would post it for discussion before adding it to the page. Here it is. Remember 22:42, 27 January 2007 (UTC)

I think it's pretty good. (add it!) Could it have the word "crashes" in bold like "panics" do we need to group by those concepts? Might it be better to group by country or nation? futurebird 22:55, 27 January 2007 (UTC)

the low for the move?

What does "The low for the move occurred on November 13" from the timeline section of the article mean? Feels like something could be clearer here ... Keesiewonder talk 23:21, 28 January 2007 (UTC)

I added this part. It means that the initial leg down in the crash bottomed on November 13 and was then followed by a sizable recovery into April of the following year. I'm a market professional so perhaps it's a little bit of jargon. If you would like to reword it feel free! Robertknyc 02:16, 29 January 2007 (UTC)

Impact

I have removed the "Impact" section as much of it was copy-pasted from another website that I would not immediately call reputable when some of its information is downright wrong. If someone would like to rewrite this section using one of the many reputable sources out there that examine the impact of the crash on the overall economy without making outlandish claims about a national welfare system and what effects it would have had had it been in place. The paragraph as it was was hardly close to the difficult macroeconomic issues that arised from this crash. JHMM13 (T | C) ![]()

![]() 03:23, 1 February 2007 (UTC)

03:23, 1 February 2007 (UTC)

- I have just done a rewrite of the section, focusing on economic theory and some academic debate. In terms of impact on the great depression etc, I will try and locate some references from a few books in the near future. Unlike the previous contributor, I havent written any outlandish claims about a welfare system! LordHarris 23:02, 3 February 2007 (UTC)

- Thanks a lot. It looks very good. I think you're a great writer and I'm sure you know your stuff, but naturally the section would be better with some inline citations. :-D JHMM13 (T | C)

02:15, 4 February 2007 (UTC)

02:15, 4 February 2007 (UTC)

- Thanks a lot. It looks very good. I think you're a great writer and I'm sure you know your stuff, but naturally the section would be better with some inline citations. :-D JHMM13 (T | C)

Good Article Nom

Hey guys. I've just reviewed the article for Good Article status and it looks pretty good. No one can deny the importance of the subject and it should've been nominated a long time ago. However, I did find some issues which should be resolved before I'd confirm it as a good article. Take your time to review and work on them.

- Introduction should be shortened, it contains much more information than a brief description of the article. Certain information on the intro could be placed in a new “Background” or “Prelude” section before the “Timeline” section.

- There are important assertions made in the introduction, such as the importance, the effects, and the legacy of the crash on american economics and history. Although these assertions are widely accepted, they should nonetheless be referenced with outside sources in order to avoid NPOV disputes from other users.

- Quotations should be presented using the proper templates. Browse through them and choose the most appropriate.

The introduction section should not include advanced wording, such as impetus or nadir. Casual readers may not understand them, especially if they aren’t wiki-linked, and may be discouraged from continuing to read the article.

- I removed them, impetus seemed overly wordy, but perhaps nadir should be put in and wiki-linked; though it is a stub and a relatively unused term. Whilding87 00:33, 23 February 2007 (UTC)

Intro reads: The Wall Street Crash of 1929 or The Great Crash… should be changed to The Wall Street Crash of 1929, also known as The Great Crash, the Crash of ’29 , or Black Thursday,…done. Diez2 16:22, 15 February 2007 (UTC)

- The day of the crash and subsequent events are often called Black Thursday and Black Tuesday. Each day has an importance in the crash, and distinctions between the two should be made in the intro, duly identified in bold.

Dow Jones Industrial Average (DJIA) is wiki-linked several times. This should only be done in the intro, and maybe (although not widely accepted) the first time the name appears in the article’s body.

- The use of commas throughout the article should be checked. Many are missing or misplaced. Additionally, references should follow punctuations,[1] not the other way around.

- References - If an assertion is made, they should be referenced directly with footnotes. If the information was obtained from another article, then the references from the other article should also be included in the 1929 crash article. Even if assertions are widely accepted, they should nonetheless be referenced with outside sources in order to avoid NPOV disputes from other users. For example, the following statements are very important to the article, but they aren’t directly referenced:

- The crash marked the beginning of widespread and long-lasting consequences for the United States. (Note: one could also argue that its effects are not limited to the U.S.)

- The roaring twenties were a time of prosperity and excess in the city, (excess? NPOV?) and, despite warnings of speculation,(who?) many believed that the market could sustain high price levels.

- …(the crash) is usually seen as having the greatest impact on the events that followed. Therefore (comma required) the (1929 required) Wall Street Crash is widely regarded as signaling the downward economic slide that initiated the Great Depression.

- The meeting included Thomas W. Lamont, acting head of Morgan Bank; Albert Wiggin, head of the Chase National Bank; and Charles E. Mitchell, president of the National City Bank. They chose Richard Whitney, vice president of the Exchange, to act on their behalf. With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U.S. Steel at a price well above the current market. As amazed traders watched, Whitney then placed similar bids on other "blue chip" stocks.

- According to economists such as Joseph Schumpeter and Nikolai Kondratieff (comma required) the Crash was merely an historical event in the continuing process known as Economic cycles.

- According to the economist Milton Friedman, he believes this was a mistake as it turned the recession into a depression.

- http://www.zeitgeistmovie.com/ - Has theories of its own. Are they verifiable?

- Missing sections: “External links” and “Further reading” sections should be added; there’s bound to be other websites and books on the 1929 crash than the ones included in the footnotes section. We can start with this: [3]

TIP: For quote templates, check out: Category:Quotation templates

TIP: For referencing and citing sources, see: WP:REF

When these issues are fixed, I’d be glad to confirm it to good article status. Please bear in mind that my judgment is in no way perfect. If you disagree about any of the above suggestions, let's talk about it. That's what this page is for! - Mtmelendez (TALK|UB|HOME) 19:53, 14 February 2007 (UTC)

- P.S. There's a HUGE backlog of Good Article candidates just waiting for review. When your finished with this article, take some time to review some others. Your help is greatly appreciated. And remember, BE BOLD! - Mtmelendez (TALK|UB|HOME) 19:53, 14 February 2007 (UTC)

Good Article Failed

I'm sorry guys, I.ve given this GA Nom process a whole 13 days, but I'm not satisfied with a few citation and NPOV issues as per my original suggestions above. However, I do think the article is close to good and with a few more edits, could pass the GA criteria. Here's a summary of my conclusions:

- It is reasonably well written.

- a (prose):

b (MoS):

b (MoS):

- a (prose):

- It is factually accurate and verifiable.

- a (references):

b (citations to reliable sources):

b (citations to reliable sources):  c (OR):

c (OR):

- a (references):

- It is broad in its coverage.

- a (major aspects):

b (focused):

b (focused):

- a (major aspects):

- It follows the neutral point of view policy.

- a (fair representation):

b (all significant views):

b (all significant views):

- a (fair representation):

- It is stable.

- It contains images, where possible, to illustrate the topic.

- a (tagged and captioned):

b lack of images (does not in itself exclude GA):

b lack of images (does not in itself exclude GA):  c (non-free images have fair use rationales):

c (non-free images have fair use rationales):

- a (tagged and captioned):

- Overall:

- a Pass/Fail:

- a Pass/Fail:

If someone does manage to improve these issues, nominate it again and post a message in my talkpage. I'd be glad to re-review it and pass it as a good article. - Mtmelendez (TALK|UB|HOME) 18:19, 27 February 2007 (UTC)

Black Thursday, Friday, Monday, Tuesday

The high levels of 'IP-vandalism' over the last month seem to occur due to some uncertainty as to whether this phenomenon is best known as Black Thursday or Black Tuesday. (Black Friday via a dab-page also leads here, btw.) Does the IP have a point, should this be discussed? The anon user is welcome to present reasons for their reversions here. --DorisHノート 11:50, 23 March 2007 (UTC)

October 29 was a Tuesday. Why do so many people vandalize and say that it is Thursday? --Robertknyc 02:59, 30 March 2007 (UTC)

- It's not vandalism. People are getting confused over whether the article is referring to the initial crash of Black Thursday or the subsequent generalized panic that occurred five days later, on Black Tuesday. Better differentiation in the opening paragraph is necessary to stop the changearounds... --Hiddekel 22:57, 2 April 2007 (UTC)

64.209.74.229 23:14, 26 July 2007 (UTC) [rgs]

Just a question on the TimeLine section:

The 1st paragraph has the following:

"The decline then accelerated into the so-called "Black Thursday", October 24, 1929. A record number of 12.9 million shares were traded on that day."

The 3rd paragraph has the following:

"The next day, "Black Tuesday", October 29, 1929, 12.4 million shares were traded, a number that broke the record set five days earlier and that was not exceeded until 1969."

So am I not reading something correctly? How does "12.4 million shares" break the record of "12.9 million shares"? Hopefully, it is a typo, cause it doesn't make sense to me. I hope this helps.

64.209.74.229 23:14, 26 July 2007 (UTC) [rgs]

I agree this was wrong and just fixed this problem. A bogus edit was done prior changing 16.4 million to 12.9 and also altering a date. Keep an eye out for other such nonsense. RoundSparrow 04:58, 11 August 2007 (UTC)

Reference to Black Monday, 1987

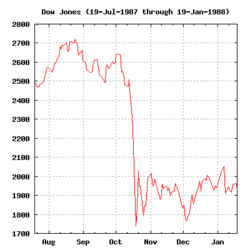

Section 2.1, "Official Investigation of the Crash" contains the following statement regarding the stock market crash of 1987: "On so-called Black Monday of 1987, the Dow Jones Industrial Average fell a full 22.6% (the markets quickly recovered, posting the largest one-day increase since 1932 only two days later)." Does anyone else think that this statement regarding the recovery is misleading, as it suggests that the markets made a full recovery within two days? While it is true that there was a large rally two days after the crash, the DJIA didn't recover to pre-crash levels until the early 1990s (see graph). Rosscadogan 09:05, 31 May 2007 (UTC)

Contradiction

The decline then accelerated into the so-called "Black Thursday", October 24, 1929. A record number of 12.9 million shares were traded on that day.

"Black Tuesday", October 29, 1929, 12.4 million shares were traded, a number that broke the record set five days earlier and that was not exceeded until 1969.

12.4 million is obviously less than 12.9 million so the record would not have been broken. Are the figures mixed up, should it be 13.4million or is it just a mistake? [[Guest9999 18:45, 29 July 2007 (UTC)]]

Someone messed it up a while back, I just corrected it now. 16.4 is the proper number, nytimes headline from following day. Anyone able to add a cite link to that? RoundSparrow 05:01, 11 August 2007 (UTC)

DATE

I think it needs to be made clear, especially for non-Americans and for youngsters, the exact date that is considered to be The Day The Stock Market Crashed. Now, we all know that's October 29 -- but nowhere in this article is that clarified or stated. I think it should be stated clearly and early on, and without mentioning day of the week. Then later on in the article (or additionally), the timeline and buildup and blow-by-blow can also be detailed. But for someone coming to Wikipedia looking to find out The Day The Stock Market Crashed, this article strikes out. Anyway, thanks in advance to those who can remedy this situation. Softlavender 11:59, 31 August 2007 (UTC)

| This is an archive of past discussions. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 |