Talk:Land value tax/Archive 2

| This is an archive of past discussions about Land value tax. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | Archive 2 |

Trimming the bottom of the article

It seems to me like we've got a huuuuuge list of references at the bottom, but also a lot of places with [citation needed]. Here's what I'm planning:

- Waiting one week for other concerned editors to act.

- If you know how any particular general reference relates to the article, please change it to an inline citation.

- If there is a general reference that does not support anything in the article, remove it.

- If we need a general reference but it for some reason does not support any particular part of the article, please explain why here.

- After the week has passed, I will mercilessly go at the references section with a pair of hedge clippers. I will also delete all statements with [citation needed].

- Once we're done with this, I think we should shorten the external links section too. To see what I have in mind for when we're finished, see the bottom of the flat tax article. --Explodicle (talk) 17:49, 18 February 2008 (UTC)

- I think that there should be as many citations as possible to research. This is encyclopedic, let people check out sources at their leisure. Why limit information. As to external links, why should the flat tax article be the model, because it is a crack pot idea with just one main source as opposed to a crack pot :) idea with multiple sources? 70.22.67.251 (talk) 22:02, 21 February 2008 (UTC)

- Ok, using today's featured article as an example, I think this article would be most helpful if we relied chiefly on inline citations, but also a few good general references and further reading. For example, all the general references in the Rachel Carson relate to citations, but they're in general references because the citations call out different page numbers. There are a small handful of books specifically about her that are kept for further reading. --Explodicle (talk) 14:29, 22 February 2008 (UTC)

- I think that there should be as many citations as possible to research. This is encyclopedic, let people check out sources at their leisure. Why limit information. As to external links, why should the flat tax article be the model, because it is a crack pot idea with just one main source as opposed to a crack pot :) idea with multiple sources? 70.22.67.251 (talk) 22:02, 21 February 2008 (UTC)

- But there is a difference between a biographical entry and an idea entry. This is an economic concept entry which should as much as possible reflect the historical as well as academic research. And as economics is the dismissal science, there is ambiguity and dispute, so more general citations should be required. There is also the difference between the "theoretical" and "empirical". As taxation is also a political question, there are going to be questions relating to implementation and about how special interest motivators interact with the concept. As this particular concept also involves ethical concerns there are going to be philosophical and theological concepts.

- There probably should be a preference for the more modern citations to work in peer reviewed journals and to work that is published as opposed to stuff that is just on some web site. With respect to non-journal literature, I'd say that there is a place for research and "claims" (so long as they are listed as "claims") by advocacy organizations. But here the preference should be for more established and long lasting groups, such as in the US: the Schalkenbach Foundation, Lincoln Land Institute, Henry George Foundation of America, Center for the Study of Economics. As to the other advocates and groups, they are pretty much pretend organizations - one person outfits with no real operating budgets nor historical contexts, nor work with actual elected officials or use of actual assessment or other verifiable data.

- Perhaps rather than limiting or removing citations we should first categorize them.

- General

- Books

- Peer-Reviewed Journal Articles

- Historical

- Books

- Peer-Reviewed Journal Articles

- Other

- Economic

- Books

- Theoretical

- Empirical

- Peer-Reviewed Journal Articles

- Theoretical

- Empirical

- Other

- Books

- Moral Philosophical and Theological

- Books

- Peer-Reviewed Journal Articles

- Other

- General

- I like that idea. I'm thinking we could split it up into "References" and "Further reading", where the references section is short and relates to citations as I mentioned above, and the further reading section is categorized as you just specified. Instead of deleting anything I can temporarily move it to Talk:Land value tax/Extra references until someone adds it to one of these categories. --Explodicle (talk) 16:37, 22 February 2008 (UTC)

- Less talk. more action. 70.22.67.251 (talk) 22:29, 22 February 2008 (UTC)

- I said I'd give everyone a week, remember? I'll get started today if I get the chance. --Explodicle (talk) 14:52, 25 February 2008 (UTC)

- Less talk. more action. 70.22.67.251 (talk) 22:29, 22 February 2008 (UTC)

- I like that idea. I'm thinking we could split it up into "References" and "Further reading", where the references section is short and relates to citations as I mentioned above, and the further reading section is categorized as you just specified. Instead of deleting anything I can temporarily move it to Talk:Land value tax/Extra references until someone adds it to one of these categories. --Explodicle (talk) 16:37, 22 February 2008 (UTC)

Ok, the references section is shortened. Remember, if anyone misses those sources, you can create a "Further reading" section under the references and put them in there, preferably categorized per 70.22.67.251's suggestion above if you want to keep a lot of them. If possible, please try to stick to books and websites that focus primarily (or at least extensively) on LVT.

Now on to the external links... I think we should keep the top 10 by Alexa ranking or Google hits. Any other ideas? --Explodicle (talk) 19:19, 26 February 2008 (UTC)

Actually, I just removed a few based on completely unrelated criteria. We should probably lose a few more or organize them better, if anyone has any ideas go for it. --Explodicle (talk) 20:36, 6 March 2008 (UTC)

Kiaochow (Jiaozhou Bay)

It's surprising that we have no mention of the German colony of Kiaochow in the current article, since it was the only case so far where the LVT was implemented as the Single Tax (at the rate of 6%) in the manner that Henry George advocated. Even our article on Jiaozhou Bay doesn't make the connection although it was a fundamental fact of the colony's economic organisation and fairly influential on 20th century Chinese economics, particularly Nationalist economics. We really should have something about it. -- Derek Ross | Talk 16:04, 22 February 2008 (UTC)

- Then put it in. Less talk, more action. 70.22.67.251 (talk) 22:16, 22 February 2008 (UTC)

- Ouch! Touche, <grin>! -- Derek Ross | Talk 23:14, 22 February 2008 (UTC)

Lead

Just passing by the article and figured I'd recommend the lead be expanded - it's too short. Should probably be around two-three paragraphs and summarize the article. See WP:LEAD for guidance. Morphh (talk) 12:27, 16 March 2008 (UTC)

- This recommendation seems like mindless rule following. The lead is perfectly fine. The table of contents summarizes the content just fine.69.250.30.31 (talk) 00:36, 17 March 2008 (UTC)

Picture of Marx

I removed picture of Marx in LVT, again. This article is not about Marx it is about LVT. Nor is he intrinsically related to topic as Henry George, is. He made a two bit criticism, so he is mentioned and cited. But to have his picture raises NPOV. Someone just scanning without reading could think he really has something important to do with LVT, which he doesn't. He is too much of a lightening rod, to visually associate, with anything other than himself and his own ideas. 70.22.59.134 (talk) 19:56, 28 March 2008 (UTC)

- Marx's image is in plenty of other articles that are not "about" him, like 19th century, History of sociology and Utilitarianism. Likewise, Alexander Hamilton is famous for far more than just LVT. Marx is by far the most notable person who has made this criticism of LVT, which is directly related to his Communist ideology. If we delete historically relevant information because we are worried about how people will irrationally react to it, we are violating NPOV and censoring Wikipedia. --Explodicle (talk) 22:17, 28 March 2008 (UTC)

- I removed Hamilton's picture, too. Marx and Hamilton are indirectly related to the topic of LVT. St. Ambrose is oft quoted as a religious support for LVT:

"Everyone knows that the Fathers of the Church laid down the duty of the rich toward the poor in no uncertain terms. As St. Ambrose put it: 'You are not making a gift of what is yours to the poor man, but you are giving him back what is his. You have been appropriating things that are meant to be for the common use of everyone. The earth belongs to everyone, not to the rich.'"

Paragraph 23, http://www.vatican.va/holy_father/paul_vi/encyclicals/documents/hf_p-vi_enc_26031967_populorum_en.html

If we add that to the article, shall we also put a picture of the current Pope or of Pope Paul during whose service Populorum Progressio was written? No.

There is first question of relevance but there is also the secondary problem of association which could "suggest" or give appearance of NPOV.70.22.59.134 (talk) 18:31, 29 March 2008 (UTC)

- You are using a strawman argument. If St. Ambrose was the one who had something to say about LVT, then he would be the most appropriate person of whom to include an image, not the Pope. If a famous economist has something significant to say about a tax, I would think it is quite relevant. --Explodicle (talk) 22:35, 29 March 2008 (UTC)

- No strawman. Neither the pope nor Ambrose shoud have picture [An Encyclical is being quoted, St. Ambrose who is cited within the encyclical but without specific reference to source.) because they are not the focus of the article. 70.22.59.134 (talk) 20:43, 2 April 2008 (UTC)

- When you equate including a picture of Marx to including a picture of the pope, you are describing a position that superficially resembles my actual view but is easier to refute. That is a strawman argument. --Explodicle (talk) 16:38, 3 April 2008 (UTC)

- Where are you getting this "focus of the article" idea? Marx is not the "focus" of the Capitalism article, but there is a section devoted to his ideas on the subject, just like in this one - and in the Capitalism article, he has a picture. --Explodicle (talk) 16:38, 3 April 2008 (UTC)

- But the picture is there in Capitalism in a section called "Marxian political economy". 69.250.30.31 (talk) 23:56, 3 April 2008 (UTC)

- What is important isn't the title of the section - it's the content. In both cases, the primary focus is Marx. --Explodicle (talk) 04:26, 4 April 2008 (UTC)

- Pictures of people - no: wiki links - yes.

- The exception here would I think be Henry George, because he is so bound up with concept of Land Value Taxation that he is instrinsic to it.70.22.59.134 (talk) 20:43, 2 April 2008 (UTC)

- Is this statement based on Wikipedia policy or your own opinion? --Explodicle (talk) 16:38, 3 April 2008 (UTC)

- What point of view do you think the image suggests? --Explodicle (talk) 22:35, 29 March 2008 (UTC)

- Why do you think that the image is important to have?69.250.30.31 (talk) 23:56, 3 April 2008 (UTC)

- Per Wikipedia:Images#Pertinence and encyclopedicity: "Images must be relevant to the article they appear in and be significant relative to the article's topic." I think Marx is the most notable critic of LVT, and is thus significant relative to the topic. --Explodicle (talk) 04:41, 4 April 2008 (UTC)

- If you think then you either have an agenda that is pro-Marx or anti-Marx. Marx is not the most notable critic of LVT. His comments seems mostly to be an ad hominem against Henry George. According to some Georgists, the Pope Leo's Rerum Novarem was a critique against LVT and Henry George. In both cases, it seems to me that it is wishful thinking on Georgists' parts,i.e. LVT must be important if both Marx and the Pope hate the idea. (Whether or not it is actually true.

In fact, McGreedy in Catholicism and American Freedom: A History (New York: W.W. Norton, 2003; pbk. 2004) alleges that George claimed that the Pope was against him to curry support (and diminish fears that he was too much associated with Fr. McGlynn as well as his George's catholic wife) and that the NY Bishop alleged even before the copy of Rerum had been released that it was against George (because he was having a petty and bitter dispute with Fr. McGlynn about public support of catholic schools and authority in general.)

This why I think including the pictures could be seen as constituting POV. The absence of the images, does not make the articles any less relevant. But the presence of the images raises a relevance question.70.22.59.134 (talk) 21:27, 4 April 2008 (UTC)

- I think you're right about the ad hominem thing, which would make it more applicable to Georgism as Pm67nz suggests below. --Explodicle (talk) 15:18, 7 April 2008 (UTC)

- Well that would solve the problem. I was always dubious about its inclusion, in the first place.70.22.59.134 (talk) 21:05, 7 April 2008 (UTC)

Milton Friedman

Here is a source you might want to use [1], Milton Friedman said "The property tax is one of the least bad taxes, because it’s levied on something that cannot be produced — that part that is levied on the land". --Doopdoop (talk) 20:19, 14 April 2008 (UTC)

- He used to be mentioned in the article since he was a prominent economist who supported LVT. However the list of supporters was hived off to the Georgism article and then ruthlessly pruned so he no longer appears in this article or in that. -- Derek Ross | Talk 20:52, 14 April 2008 (UTC)

Economic distortion and effects on the economy

I think the point to make here here is not so much that Single Taxers believe that the levying of LVT has a positive effect on the economy. It's more that they believe that the removal of other taxes (whether or not they are replaced by LVT) has the positive effect. -- Derek Ross | Talk 05:47, 16 April 2008 (UTC)

Pickiness and Submission as Good Article

I think the remaining tags are really too picky. They should be removed and this article should be nominated as good article. Come one perfection is the enemy of the good. If you look at other tax articles, this one is really outstanding. I'm not totally thrilled by External Links, there is a lot of general advocacy group kind of stuff that really doesn't add much to the party. 70.22.67.251 (talk) 23:15, 5 March 2008 (UTC)

- I agree that the article is much better now (in no small part due to your good work), but I still think the tagged areas have problems. For now I'll focus on fixing what's already tagged, and once they're gone I'm all for a Good Article submission. --Explodicle (talk) 15:05, 6 March 2008 (UTC)

- Ok, I fixed all the areas that were tagged. You might like to take a look at the guide for nominating good articles before you put in the request, but at this point I have no complaints. --Explodicle (talk) 14:47, 7 March 2008 (UTC)

- To freaking complicated for me to even figure out how to do it.70.22.67.251 (talk) 21:37, 7 March 2008 (UTC)

- Ok, I think it's looking pretty good, I'll do the nomination. --Explodicle (talk) 20:53, 18 March 2008 (UTC)

- Someone should resubmit. The quick fail was totally unsupported when it came down to "show the basis" challenge.69.250.30.31 (talk) 03:48, 20 April 2008 (UTC)

- What about the external links section? It seems to feature predominantly pro-LVT sites. Even after that, I think we should put in a request for feedback about potential POV problems. --Explodicle (talk) 19:50, 21 April 2008 (UTC)

- Ok, I eliminated the external links, and I've asked for feedback. --Explodicle (talk) 14:10, 7 May 2008 (UTC)

- What about the external links section? It seems to feature predominantly pro-LVT sites. Even after that, I think we should put in a request for feedback about potential POV problems. --Explodicle (talk) 19:50, 21 April 2008 (UTC)

- Someone should resubmit. The quick fail was totally unsupported when it came down to "show the basis" challenge.69.250.30.31 (talk) 03:48, 20 April 2008 (UTC)

- Ok, I think it's looking pretty good, I'll do the nomination. --Explodicle (talk) 20:53, 18 March 2008 (UTC)

- To freaking complicated for me to even figure out how to do it.70.22.67.251 (talk) 21:37, 7 March 2008 (UTC)

- Ok, I fixed all the areas that were tagged. You might like to take a look at the guide for nominating good articles before you put in the request, but at this point I have no complaints. --Explodicle (talk) 14:47, 7 March 2008 (UTC)

GA Review

This article was "quick failed". The problem is the obvious pro-Georgist bias that clearly violates WP:NPOV. --Doopdoop (talk) 22:43, 3 April 2008 (UTC)

- obvious pro-georgist bias? Aren't there as many criticisms against as claims in support? The article seems mostly historical. And quite a bit of work was put into avoiding POV during the edits over the last few months.

- That which is opinion has clearly been labelled as such by phrases like "claims", e.g.

- It seems to me that you need to provide some specificity for your claim that the article violates NPOV.

- Would you please tag the places that are POV? We'd be happy to fix any problems, but where they are is not quite so obvious to us. --Explodicle (talk) 04:52, 4 April 2008 (UTC)

- While I myself personally support taxes that have low deadweight loss, I do recognize that this article has extensive NPOV problems. For a start, please look at [2]. --Doopdoop (talk) 21:35, 4 April 2008 (UTC)

- Well to be fair that template is intended for articles which only have an "arguments against" section hiving off negative criticism from the main body of the article, whereas this article has both an "arguments against" and a balancing "arguments in favour" section. And that approach is not unique to the LVT article. Other taxation articles use it too. Flat tax has such sections (albeit with slightly different titles). Both the VAT and the Income tax articles only have an "arguments against" section and so could definitely be accused of violating NPOV on the grounds of that template. However since the LVT article has two balancing "controversy" sections, one describing the arguments of LVT's proponents and the other those of its opponents, it seems strange that you accuse the article of violating NPOV for that very reason. After all the essence of the NPOV is to describe multiple points of view, where they exist, and Explodicle in particular has worked hard to do just that in this article. That's why we'd prefer to see specific criticism rather than a blanket condemnation of the entire article. There may be other reasons why this is not a Good Article but you haven't yet made a convincing case on the grounds of lack of NPOV. -- Derek Ross | Talk 22:57, 4 April 2008 (UTC)

- The template recommends integrating criticism sections into other sections, so each section would be neutral. --Doopdoop (talk) 19:33, 6 April 2008 (UTC)

- I'm more interested in improving the article than getting it a shiny award anyways. I think it's possible to restructure for less (or none) of the content in the pro/con sections; if this article is an exception to the guideline like Mercantilism then so be it, but we should at least give it a shot before renominating. I'll post a proposed new layout once I've thought about it more. --Explodicle (talk) 21:40, 6 April 2008 (UTC)

- Ok, this is what I have so far. Just go ahead and edit the bullets below if you can think of any improvments. --Explodicle (talk) 15:49, 7 April 2008 (UTC)

- Merge sections 2.1, 2.2, 2.3, 2.5, 3.1, and 3.2 into a new "Economic effects" section.

- Merge 2.4 to section 4.5. Will need a {{topheavy}} tag at first.

- Merge 2.6 and 2.7 to section 4.2

- Merge 3.3 to section 1.

- Well to be fair that template is intended for articles which only have an "arguments against" section hiving off negative criticism from the main body of the article, whereas this article has both an "arguments against" and a balancing "arguments in favour" section. And that approach is not unique to the LVT article. Other taxation articles use it too. Flat tax has such sections (albeit with slightly different titles). Both the VAT and the Income tax articles only have an "arguments against" section and so could definitely be accused of violating NPOV on the grounds of that template. However since the LVT article has two balancing "controversy" sections, one describing the arguments of LVT's proponents and the other those of its opponents, it seems strange that you accuse the article of violating NPOV for that very reason. After all the essence of the NPOV is to describe multiple points of view, where they exist, and Explodicle in particular has worked hard to do just that in this article. That's why we'd prefer to see specific criticism rather than a blanket condemnation of the entire article. There may be other reasons why this is not a Good Article but you haven't yet made a convincing case on the grounds of lack of NPOV. -- Derek Ross | Talk 22:57, 4 April 2008 (UTC)

- What about something like this

- 2 Claims regarding problems, advantages and disadvantages

- Implementation obstacles and advantages

- Combine these

- 3.3 Legal obstacles in some jurisdictions

- 2.4 Simplicity and certainty

- 3.1 Cannot raise sufficient revenue

- 3.2 Loss of asset value

- Economic Effects

- Combine these

- 2.1 Leads to increased economic activity

- 2.2 Produces few if any distortions

- 2.3 Efficient use of land

- 2.5 Less speculation

- Philosophic, Ethical and Religious Concerns

- Combine these

- 2.6 Land Value Taxation is a "value capture tax"

- 2.7 Fairness and justice

- Not fair because it does not respect private property, or something like that? don't quite understand the complaint but have heard it about all taxation of property. —Preceding unsigned comment added by 70.22.59.134 (talk) 21:17, 7 April 2008 (UTC)

- I think we should keep it as simple as possible for now and go from there. Also, rather than calling a section "claims" or "concerns", we should structure the article as fact and point out individual claims as part of the narrative. --Explodicle (talk) 14:05, 9 April 2008 (UTC)

- So instead of a header like claims/concerns we'd just have it these sections? If so I'd agree.

Implementation obstacles and advantages

Combine these 3.3 Legal obstacles in some jurisdictions 2.4 Simplicity and certainty 3.1 Cannot raise sufficient revenue 3.2 Loss of asset value

Economic Effects

Combine these 2.1 Leads to increased economic activity 2.2 Produces few if any distortions 2.3 Efficient use of land 2.5 Less speculation

Philosophic, Ethical and Religious Concerns

Combine these 2.6 Land Value Taxation is a "value capture tax" 2.7 Fairness and justice Not fair because it does not respect private property, or something like that? don't quite understand the complaint but have heard it about all taxation of property.

70.22.59.134 (talk) 15:10, 10 April 2008 (UTC)

On Not Mentioning Marx

Marx should not be listed as a critic as he was in favour of LVT. He was very critical of those who saw it as a panacea, as the text in this article shows (though I don't like "step backwards" - step from where?), but since that criticism is about the theories of Henry George and other advocates rather than the tax itself the section would be more appropriate on the Georgism page. Pm67nz (talk) 21:21, 5 April 2008 (UTC)

- That's a good point - I'll move it. --Explodicle (talk) 15:21, 7 April 2008 (UTC)

- Moving it makes sense because he was primarily critical of George. But to say that he was "in favor of LVT" is simply not completely true. The fairest thing that can be implied was that Marx was FOR taxation and confiscation of anything that was NOT Labor. But even this is complicated because Marx claim that distinction between "the State" and "the Economy", arose because of capitalism's exploitation of labor. Moreover, its not clear that Marx actually directly discusses taxation qua taxation. In Communist Manifesto, Section II. Proletarians and Communists, he is making a predictive judgment or alternatively, an observation, when he writes: "In the most advanced countries the following will be pretty generally applicable: a heavy progressive or graduated income tax." Some have suggested, e.g. on Wikipedia that this is support for a progressive income tax, but it might actually be that he is saying that a progressive income tax happens to preserve the capitalist status quo until such time as the distinction between classes falls away, which after all Marx say as an historical inevitability. The Capitalist hates the land controller as much as Labor hates the land controller. The simplest and fairest thing that can be said of Henry George was that he was FOR the taxation of Land Value and AGAINST the taxation of anything that was not based on the value of Land. But George did not believe that Labor must naturally hate the Capitalist or that the Capitalist exploits the Laborer.

Here's also an interesting take: http://myweb.lmu.edu/jdevine/notes/DUGGER.htm And see http://findarticles.com/p/articles/mi_m0254/is_5_62/ai_112083012/pg_10

Among other things you might note that Marx was also proponent of the notion that valuation is ostensibly problematic. 70.22.59.134 (talk) 15:34, 15 April 2008 (UTC)

POV observations

This article is very obviously pro-Land Tax in its Point of View, and this hasn't been addressed very much. Of the five sections to the article: three are positive, one is neutral and one is part neutral/part negative. The few paragraphs with a negative appraisal of Land Tax are cryptic and difficult to read; while positive points are concisely highlighted in the article. I got the sense that the article was trying to "sell" me something - as you sometimes get with single-POV articles.

- First, the article used to have equal numbers of "claims" and "criticism", but that was objected to as NPOV because an article like this ostensibly isn't supposed separate claims and criticism out like that. The fact is that there aren't really a lot of criticisms primarily because LVT isn't really used that much, because nobody gives a rat's behind enough to actually be critical. It's not like criticisms have been deleted. 70.22.59.134 (talk) 19:52, 16 April 2008 (UTC)

Some examples of LVT opposing topic material, that could be added to the article by someone much more familiar with economics and LVT than me, would be:

- Retires, pensioners or other low-income people can find themselves paying more money than they can afford - not an the basis of their income or spending habits, but on the value of their land. Something which they need to keep to live in, but can increase in value due to market dynamics outside their control. There has been examples of elderly people who can not pay increases in land tax on their home (city growth for example) and have been required to sell it.

- This is version of the land rich,cash poor widow argument. It is also made against the property tax in general. The problem is that there isn't actually empirical data to support the claim. Moveover, most states have so-called homestead credits and/or "circuit breakers" based upon age and/or income to prevent this. Finally, studies of the proposed effects of a two-rate shift show that homeowners and elderly homeowners tend to pay less because they have more value in the structure than in the land. It is hard to put in a critique, if there are no published sources to cite! 70.22.59.134 (talk) 19:52, 16 April 2008 (UTC)

- Market dynamics does influence the valuation of even unimproved land because increased income affluence increases services required/expected in a county, which increases costs, which increases the level of land tax required to break even on government services. LVT doesn't directly solve either the consumption-equity tax problem - because land isn't the service being consumed - or the affordability-fairness tax problem - since land (outside agriculture or mining) can't pay for itself (renting-out doesn't qualify as renters can't use the land to pay for their rent, it simply shifts the tax burden). If you peg a Land Value Tax to a affordability metric like income to resolve the affordability-fairness problem, then it isn't really a land tax anymore.

- Where are the published sources supporting this claim? The problem again is when someone actually studies it we find that land value is more maldistributed than income.70.22.59.134 (talk) 19:52, 16 April 2008 (UTC)

- Land Value Tax, and similar taxes anchored to the land, convert land from something with a purely capital cost - a possession similar to your bed or clothes or toothbrush - to something with an additional on-going outlay - like services have. Which requires a cultural-shift towards acknowledging taxing people's fixed asset base. The distinction of owning and renting land becomes blurred. Land Value Tax suits the anarcho-collectivism paradigm (economically speaking).

- But land isn't like a bed or clothes or toothbrush. They are making more beds, clothes and toothbrushes; they aren't making any more land. And while beds, clothes and toothbrushes wear out, a location doesn't really depreciate - except on the agricultural margin. The paradigm was the taxation of people's fixed asset base -- this is historical the basis for the property tax which fell on all property (whether personal, land or improvement). So in a real sense LVT is a shift AWAY from not TOWARD taxing people's fixed asset base.70.22.59.134 (talk) 19:52, 16 April 2008 (UTC)

- I would also add that land is a productive asset whereas beds, clothes and toothbrushes aren't: you can live off your land if you own enough (or even sell its produce to pay the LVT it is subject to) but it's a bit harder to live off your toothbrush, even if it's an enormous one, let alone use it to pay any taxes it might incur! So it's a bit disingenuous to equate the two kinds of property. Secondly in cost terms most people can afford to buy a toothbrush (or even a bed) without taking out a mortgage. Few people can do that with a plot of land. Hence to say that land, once bought, has no additional on-going outlay is rarely true. Mortgage repayments are very much an on-going outlay for the vast majority of us small-time landowners. -- Derek Ross | Talk 20:36, 16 April 2008 (UTC)

203.9.185.216 (talk) 10:09, 16 April 2008 (UTC)

- Could you provide sources for these criticisms, and throw in a few [neutrality is disputed] tags? The people who actually care about LVT tend to REALLLLLLY care one way or the other, so it's proven hard to keep it balanced. --Explodicle (talk) 15:35, 16 April 2008 (UTC)

External links

After moving Murray Rothbard's criticism from external links into the article, I noticed that all the other external links are pro-LVT. Some of them may even count as extremist. Does anyone know about any useful but less biased sites we can use instead? --Explodicle (talk) 20:10, 18 April 2008 (UTC)

- While Rothbard's criticism should be included in the article, he does make a series of spectacularly weak arguments. For example:

- "The single tax theory is further defective in that it runs up against a grave practical problem. How will the annual tax on land be levied? In many cases, the same person owns both the site and the man-made improvement, and buys and sells both site and improvement together, in a single package. How, then, will the government be able to separate site value from improvement value? No doubt, the single taxers would hire an army of tax assessors. But assessment is purely an arbitrary act and cannot be anything else. And being under the control of politics, it becomes purely a political act as well. Value can only be determined in exchange on the market. It cannot be determined by outside observers."

- This ignores the fact that property tax is levied in every state in the nation. If we can determine the cost of improvements, and the cost of improvements and land together, surely we can determine with some degree of accuracy the cost of the land exclusive of improvements? If someone were to declare that income tax or sales tax was impossible, showing it in use should be sufficient evidence to discredit the statement. Since Harrisburg PA uses a split tax rate, considering both values separately, that is enough to cast doubt on his argument.

- In addition, value is often determined for items that are not for sale. You can insure a home against fire even if you never plan to sell it, and you can insure absolutely unique items -- like art and items of historical interest -- even if they have never been on the auction block. The argument should not be the inability to reach a perfect valuation, but rather if what is reported and paid for yield a more accurate number than taxing sales or income, which can be hidden or under-valued. The difficulty for LVT is the assessment, but the difficulty for income and sales taxes is enforcement, and you have to determine which is an easier problem to solve.

- That's a perfectly valid point, which is why LVT is compared to present-day property tax evaluations right under the Rothbard criticism. Feel free to be bold in any improvements you'll make to the section, just remember that it's the reader's place to judge Rothbard's ideas, not Wikipedia's. --Explodicle (talk) 12:59, 21 April 2008 (UTC)

- I just removed the external links section entirely. We've already got a lot of references tied into the text of the article, and I don't think they constituted a significant improvement. --Explodicle (talk) 01:20, 1 May 2008 (UTC)

Thomas Paine

Does this paragraph added to Advocates in the paragraph on Physiocrats pertain to them? It would better be entered as a new paragraph.

Thomas Paine contended in his Agrarian Justice pamphlet that all citizens should be paid 15 pounds at age 21 "as a compensation in part for the loss of his or her natural inheritance by the introduction of the system of landed property." This proposal was the origin of the citizen's dividend advocated by Geolibertarianism. —Preceding unsigned comment added by 71.229.1.87 (talk) 19:15, 13 August 2008 (UTC)

- It's just there because his pamphet is from the same time period and is philosophically similar. I agree that a section split would be a good idea, but only when we have more than a couple sentences on Paine's views. --Explodicle (T/C) 20:32, 13 August 2008 (UTC)

History section

I think the article might be more neutral and useful if we change from having an "Advocacy" section to a "History" section, which would include the Advocacy section we've got now, the prehistory of LVT before Physiocrats (which is currently only mentioned in the lead). I'd probably split it up into pre-modern era (up to the Physiocrats) and modern era (Henry George and later). Any opinions? --Explodicle (T/C) 17:46, 19 September 2008 (UTC)

- The inclusion of the Americans is nonsensical. Massachusetts adopted a land tax by 1635; New York, or rather the New Netherlands, imitated them in 1655. Hamilton was arguing for the sufficiency of the existing system, not advocating a new one. Septentrionalis PMAnderson 20:30, 17 October 2008 (UTC)

- Hamilton does appear to favour Land Tax in the reference that you have just removed. He is discussing the practicality of having both state and federal taxation, and suggests that there is no problem with having both. "A small land tax will answer the purpose of the States, and will be their most simple and most fit resource." I do not understand why you feel Hamilton was not advocating LT.--wikirpg (talk) 09:05, 19 October 2008 (UTC)

- Because he had no need to advocate it; the land tax was already the principal revenue of the several states, as indeed it still is. He was arguing (in one of the most commercial of the states) that the existing land tax was enough for the states, and they did not need a state tariff as well. We are not interested in isolated quotes, taken out of context. Septentrionalis PMAnderson 22:27, 19 October 2008 (UTC)

- Nor is the distinction between the value of ground-rent and the value of improvements made in the Federalist (or as far as I can see, any where else in Hamilton's works). Septentrionalis PMAnderson 18:28, 20 October 2008 (UTC)

- To advocate something just means you're recommending it - whether or not a system was already in place is irrelevant. The point is that Hamilton clearly states support for the tax. I also think it's safe to assume that when he says "land tax", he means a land tax, not a property tax. --Explodicle (T/C) 14:04, 21 October 2008 (UTC)

- That's an anachronism; in the eighteenth century, a "land tax" was any tax on land. It is our modern use of "property tax" for a tax on real property which is the anomaly. Septentrionalis PMAnderson 15:49, 21 October 2008 (UTC)

- I didn't know that. Do you have a source that verifies this? --Explodicle (T/C) 15:57, 21 October 2008 (UTC)

- The OED defines land-tax as "A tax assessed upon landed property" (if they meant to specify type, or basis of assessment, they would), and quotes Henry Hallam's Constitutional History: "The first land-tax was imposed in 1690, at the rate of three shillings in the pound on the rental." This should not be surprising; the Land Value Tax requires state assessors to evaluate what portion of the total rental is the ground-rent; eighteenth century governments had neither the personnel nor the public trust to do this. Septentrionalis PMAnderson 16:57, 21 October 2008 (UTC)

- Ok, I removed the paragraph. Thanks! --Explodicle (T/C) 13:27, 22 October 2008 (UTC)

- The OED defines land-tax as "A tax assessed upon landed property" (if they meant to specify type, or basis of assessment, they would), and quotes Henry Hallam's Constitutional History: "The first land-tax was imposed in 1690, at the rate of three shillings in the pound on the rental." This should not be surprising; the Land Value Tax requires state assessors to evaluate what portion of the total rental is the ground-rent; eighteenth century governments had neither the personnel nor the public trust to do this. Septentrionalis PMAnderson 16:57, 21 October 2008 (UTC)

- I didn't know that. Do you have a source that verifies this? --Explodicle (T/C) 15:57, 21 October 2008 (UTC)

- That's an anachronism; in the eighteenth century, a "land tax" was any tax on land. It is our modern use of "property tax" for a tax on real property which is the anomaly. Septentrionalis PMAnderson 15:49, 21 October 2008 (UTC)

- To advocate something just means you're recommending it - whether or not a system was already in place is irrelevant. The point is that Hamilton clearly states support for the tax. I also think it's safe to assume that when he says "land tax", he means a land tax, not a property tax. --Explodicle (T/C) 14:04, 21 October 2008 (UTC)

The main idea of the Physiocrats concept of laissez faire was that land was the only legitimate source of public revenue - thus the single tax on land; because a tax on labor (wages) or capital (interest) was to tax private property produced by human effort. The framers of the U.S. Constitution understood and advocated that concept of laissez faire. Hamilton refers to that in Federalist #36 - Accordingly, a land tax was advocated by the Framers of the U.S. Constitution in 1787. Alexander Hamilton, writing in the Federalist Papers #36 [1] gives the consensus of the Constitutional Convention calling it the "most simple and most fit resource" of revenue researved to the States.

Dab295

- I'm a bit confused. Pmanderson argued for the removal of the Federalist Papers #36 source on the grounds that Hamilton's use of "land tax" is an anachronism. Are you saying he is incorrect, and Hamilton is talking about a land value tax? --Explodicle (T/C) 20:43, 5 November 2008 (UTC)

What Pmanderson says is a sophism. Hamilton was expressing the concensus of the Convention delagates, including Franklin, Madison, et al. Madison was in constant correspondence with Jefferson who was in France at the time. Hamilton is subtle in this matter just as it is in the Constitution, looking forward to a time in the future when it would be more acceptable and feasible; at this time he sometimes gave counter arguements as well. What I have written above should be restored to the article.

Dab295

- The only source we've got for the old definition is right here. I don't know how conclusive it is, but it seems to imply "landed property" means the buildings too. I'm not 100% certain, but if you are then I won't stand in your way. --Explodicle (T/C) 22:28, 7 November 2008 (UTC)

- That's the point though, surely. We know that it's a land tax but we don't know whether it's a land value tax, a land area tax, or a property tax. The fact that it's based on Physiocratic theory suggests that it's an LVT but it doesn't prove it, unfortunately. -- Derek Ross | Talk 22:33, 7 November 2008 (UTC)

Hamilton defines his terms in the same FP#36 just a couple of paragraphs above the quote I cited: I am 100% certain of that. I will restore the quote.

Dab295 —Preceding unsigned comment added by 71.229.1.87 (talk) 16:16, 14 November 2008 (UTC)

The quote from Federalist Paper #36 was deleted 18 November 2008 by SmackBot, maybe inadvertantly. It was replaced by a statement not relevant to LVT. The controversy seems to be over Hamilton so let's leave Hamilton out of it; since authorship is not absolutely certain anyway. Hamilton was collaborating with Madison and several of the Papers were written by them jointly. It is possible that Jefferson wrote that quote to Madison for insertion at an appropriate time in one of the Papers. Because Jefferson served as minister to France from 1785 to 1789, he was not able to attend the Philadelphia Convention but he ... was kept informed by his correspondence with James Madison.[2]

DAB (talk) 17:28, 7 January 2009 (UTC) DAB (talk) 18:00, 7 January 2009 (UTC) DAB (talk) 18:06, 7 January 2009 (UTC)

Sources to add

When I get the chance I'll add more from these sources: [3][4][5] --Explodicle (T/C) 16:14, 30 October 2008 (UTC)

This one just got removed for good reason, but if policians who support the LVT ever get mentioned it might be worth putting back in. --Explodicle (T/C) 11:03, 19 December 2008 (UTC)

American politician Ralph Nader supported "the present adjustment of Henry George's celebrated land tax" as part of his 2008 presidential campaign platform.

Fair Tax -- Ralph Nader for President in 2008, retrieved 2008-09-19

Assessment section

Should we merge to Land (economics)? That article seems to deal more with what land value actually is, and so how land value is determined might fit there better. --Explodicle (T/C) 18:22, 22 December 2008 (UTC)

- No I don't think that it should be merged. Assessment is a vital part of any tax. A tax which cannot be assessed, cannot be collected. For instance consider a tax on Beauty. It might be easy to collect but the assessment process would be horrendous. Moreover a tax which is economically harmful to assess but harmless to collect is just as problematical as one which is economically harmless to assess but harmful to collect. So the assessment process is a significant part of any tax and therefore should form part of the discussion. One of the big problems with income tax (and to an even greater degree sales tax) is that its assessment involves the collection and summarisation of a large number of easily hidden transactions over the course of year in order to carry out its assessment. I think that the current additions to the article need a lot more referencing to counter Original Research accusations but that they are, in principle, good. -- Derek Ross | Talk 18:51, 22 December 2008 (UTC)

- In that case, maybe we should merge the "Simplicity and certainty" section into the "Assessment" section. It sounds like they're the same basic concept, and the title of the older section seems a little pro-LVT POV anyways - implying that it is simple and certain. --Explodicle (T/C) 19:45, 22 December 2008 (UTC)

- Yes, that sounds reasonable. -- Derek Ross | Talk 05:54, 23 December 2008 (UTC)

Some further minor changes may help readability. I cover Economic Effects in the notes below.

1.1 could be renamed "Efficiency" to help NPOV. Proponents claim LVT is an efficient tax scheme because: LVT does not inhibit wealth creation activities; LVT encourages use of land. Counter argument could be: Cost of setting up the valuation and additional costs for collecting a new form of tax could outweigh likely revenue, unless LVT is a significant portion of total tax take.

- I've renamed the section per your suggestion. If you can source that counterargument, it too would be a good addition. --Explodicle (T/C) 17:46, 11 January 2009 (UTC)

1.2, 1.3 both relate to economic stability and could merge as "Stability". Speculation is a significant aspect of land pricing and the economic cycle. Main aspects of economic stability are: LVT discourages speculative investment in land, reducing the tendency for the boom-bust cycle; LVT thereby encourages investment in wealth-creation activities. I have just finished reading Harrison's book "Boom Bust 2010" which can provide some citations here.

- If sources aren't added to the new economic cycle section soon I'm just going to delete it. It makes some serious unsourced claims and even recommendations, which are unacceptable per Wikipedia:Verifiability and Wikipedia:Neutral point of view. If the sources are added, I agree that merging the two like you propose would be best. --Explodicle (T/C) 17:46, 11 January 2009 (UTC)

- No one added sources, so I just deleted it. --Explodicle (T/C) 02:55, 19 January 2009 (UTC)

1.4 Loss of Asset Value: This can be a major source of concern on LVT. The fact that asset values are merely shifted from being privatly owned back to being public/community-owned is vital; the assets are not lost but returned to the community. Perhaps renaming this as "Asset Value" would help. As much of the world's assets are based on private land entitlements, this has to be dealt with carefully.

- How about "Shift in asset value"? --Explodicle (T/C) 17:46, 11 January 2009 (UTC)

I could put up a trial amendment of this section if there is agreement.

wikirpg (talk) 12:06, 4 January 2009 (UTC)

- Right now the article is a mess anyways, you should just be bold and change stuff without consulting anyone. If there's significant disagreement we can talk it out here. --Explodicle (T/C) 17:46, 11 January 2009 (UTC)

GA submission

Ok, I think the article is ready for submission as a Good article again. Any objections? --Explodicle (T/C) 22:16, 13 February 2009 (UTC)

- <grin>, You're brave! No. No objections. Let's see what happens. -- Derek Ross | Talk 22:48, 13 February 2009 (UTC)

Removing improvements from Land

Just to be clear. It is certainly possible to remove improvements from land. If a building exists, it can be demolished. If drains exist, they can be blocked. If land has been fertilised, it can be exhausted. In rural Scotland there are many examples of landholdings which were formerly drained, farmed and inhabited but which have reverted to barren moorland as a result of The Clearances of the 19th century and the rural depopulation of the 20th. And in urban settings in many countries, many buildings have been destroyed to avoid the payment of property tax. All these are examples of the removal of improvements to Land.

Having said that I agree with Explodicle's evaluation of Bischoff's assessment method: it would tend to include value provided by improvements and hence would not provide an accurate assessment of unimproved land value. -- Derek Ross | Talk 16:23, 20 February 2009 (UTC)

- Sorry about the confusion - what I should have said is that improvments couldn't be moved to another location without considerable effort, like personal property. --Explodicle (T/C) 16:46, 20 February 2009 (UTC)

Implementation section

The implementation section looks kinda bland. Does anyone have any ideas for stuff we can add that isn't plain old text? --Explodicle (talk) 21:12, 16 June 2008 (UTC)

Rep Moritz, 1935 bill in House

I have removed the verification request. First, there are no links to bills that old. So the citation year and HR No. is sufficient. I have a copy of the bill. It was obtained for me by my Congressman and anybody can go to the Library of Congress and get it themselves. Despite myths to the contrary the whole of human knowledge is not online". There are plenty of citations to which there are no "links".70.22.38.29 (talk) 14:07, 11 August 2008 (UTC)

- Is there any way you could scan your copy, or copy it to Wikisource? I'd like to give it a read. --Explodicle (T/C) 18:28, 11 August 2008 (UTC)

Assessment comment

The comment(s) below were originally left at Talk:Land value tax/Comments, and are posted here for posterity. Following several discussions in past years, these subpages are now deprecated. The comments may be irrelevant or outdated; if so, please feel free to remove this section.

==WP Tax Class==

==WP Tax Priority== Mid priority because global presence, but needs more of that reflected in the content. Could go higher in the priority scale once the global impact is elaborated upon.EECavazos 00:52, 1 November 2007 (UTC)

|

Last edited at 20:38, 29 May 2008 (UTC). Substituted at 20:41, 3 May 2016 (UTC)

Neutrality improvements

Since the neutrality problems are the most fundamental issue with the article (compared to formatting, references, etc) I think we should start with those. A few of Arsenikk's starting points:

- "Why is the tax so little used?"

- "If there is no deadweight loss, why is it not used more?"

- I think we can elaborate on Julie Smith's work for that. LVT is not widespread because landowners are politically powerful. --Explodicle (T/C) 15:31, 9 March 2009 (UTC)

- Nice article. Hadn't seen that one. Yes, it would make a useful reference. -- Derek Ross | Talk 18:26, 9 March 2009 (UTC)

- "I would presume that tax would be evaded by shifting investments into non-land based assets. Is there academic discussion about this?"

- Should we explain the difference between tax avoidance and tax evasion here? --Explodicle (T/C) 15:31, 9 March 2009 (UTC)

- I'm not sure why we need to discuss this in any case. The beauty of the tax is that it can be avoided directly, in the sense that you can avoid being the person paying it to the Government, but that it cannot be avoided indirectly, since if you are not paying tax, you must be paying rent to someone who is paying the tax. So it boils down to a choice between paying tax and paying rent, and thus it becomes unattractive to avoid the direct tax since you end up paying it plus any rental increment that the landowner manages to squeeze out of you. Just moving your wealth to non-land-based assets isn't going to help, since the vast majority of such assets still require at least some land and labour to make them productive. -- Derek Ross | Talk 18:32, 9 March 2009 (UTC)

- "I fail to see much criticism of the tax."

- "Are there arguments that are fundamentally non-economic?"

- "I get the impression the article is biased against libertarianism, and fails to look at it from a political side, especially from from a socialist view."

- There used to be something about Herbert Davenport that had no sources and was obviously biased against him. I bet we can find something from Davenport to beef up the criticism in existing sections. Murray Rothbard made some solid non-economic arguments, and I think we can elaborate those in the Ethics section. Other than Marx calling Georgism "decked out with socialism", I don't know of any socialism-related sources. Any ideas? --Explodicle (T/C) 15:31, 9 March 2009 (UTC)

- The anti-libertarianism claim surprised me. Georgism is sometimes known as left-libertarianism because of its strong view in favour of free enterprise, private ownership and against all personal taxation. The only real difference from right-libertarianism lies in its treatment of property rights over natural resources. So if anything, I would expect the article to be pro-libertarian rather than anti. -- Derek Ross | Talk 18:12, 9 March 2009 (UTC)

- "Are there flaws in the theories?"

- All of the major problems I'm aware of are practical, not theoretical. Maybe when I research Rothbard and Davenport I'll find more. --Explodicle (T/C) 15:31, 9 March 2009 (UTC)

- The neo-classical economists are actually the people to check if you want to discover George's most effective opponents. See [6] for a starter (and the paper it's based on). -- Derek Ross | Talk 18:05, 9 March 2009 (UTC)

- "As for the political discussion, can a modern view be pulled out and given a separate section?"

- I'm not quite sure which timeframe is "modern": most of the sources are 20th century views, which are generally considered modern in the context of economics. LVT isn't exactly the hot thing that everyone is talking about. --Explodicle (T/C) 15:31, 9 March 2009 (UTC)

This book may be very helpful to future edits

Land Value Taxation: Theory, Evidence, and Practice

Author(s): Dye, Richard F. and Richard W. England

Publication Date: May 2009

248 pages; ISBN 978-1-55844-185-9

—Preceding unsigned comment added by 70.22.75.243 (talk) 16:54, 24 March 2009 (UTC)

UK vs US English

I have made contributions and had them severely edited primarily on the grounds of the differences between US and UK English. This is a subject area where so many of the terms are different that we are dealing with dialects on the verge of separating into different languages. I don't know what the answer to this one is, but if it is not addressed the article will be endlessly edited and re-edited by contributors on the two sides of the Atlantic!

- The manual of style says we should pick one and use it consistently within the article. Since LVT has plenty of history both in the UK and USA, I'm OK with either. I guess we should just go with the preference of whoever wants to go through the article fixing grammar/spelling/etc. --Explodicle (T/C) 18:00, 13 May 2009 (UTC)

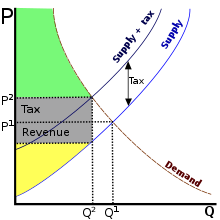

Diagram labels

In Image:Perfectly inelastic supply.svg, why is the yellow rectangle identified as "Tax revenue"? Melchoir (talk) 04:06, 4 August 2009 (UTC)

- (tax revenue) = (market price) X (number of items) X (tax rate). For example, if the average lot is worth $15 per year, and we've got 7 lots taxed at 1/3rd their value, then the tax revenue will be $35 per year. --Explodicle (T/C) 14:37, 4 August 2009 (UTC)

- But that's not the yellow rectangle. The yellow rectangle is (market price - taxation rate) X supply. Melchoir (talk) 03:14, 7 August 2009 (UTC)

- I think I see the point of confusion. I'm thinking of tax rate as a percentage, but you're thinking of a dollar value. Since the diagram just shows it as a flat line on the price axis, that's really my fault. If I modify the image so tax rate is expressed as a range like this diagram, do you think that would be better? --Explodicle (T/C) 13:58, 7 August 2009 (UTC)

- That second diagram also looks a bit problematical to me, Explodicle. I realise that it's trying to show showing the implications of taxing an elastic resource, rather than an inelastic one. However it looks like there are two rectangles, one denoting "tax" and the other denoting "revenue" whereas I take it that this is actually one rectangle labelled "tax revenue". I spent five minutes trying to work out why the lower rectangle was "revenue" before realising that. If someone like me who is quite familiar with these diagrams got confused, I think that it would be a common mistake. -- Derek Ross | Talk 14:18, 7 August 2009 (UTC)

- I'll keep that in mind if I update the diagram. Are you ok with clarifying it as a range, though? --Explodicle (T/C) 14:35, 7 August 2009 (UTC)

- No objection in principle. However it may prove a little difficult to do in practice. The problem being that for a resource in inelastic supply the taxed supply curve will lie directly on the untaxed supply curve since they are both vertical lines which intersect the X-axis at the same point. However if you think you have a solution, that's great. The current diagram is obviously causing some difficulty to a few people, so anything that can be done to make it clearer would be good. -- Derek Ross | Talk 00:04, 8 August 2009 (UTC)

- Actually looking at the current LVT diagram, I wonder if the problem might be solved by switching the tax revenue label and the producer surplus label. The reason I say this is that, intuitively speaking, as the taxation rate rises, the tax revenue increases, whereas on the diagram, as the taxation rate line rises, the area of the tax revenue rectangle falls. Our current diagram therefore suggests that when the taxation rate is 0% the tax revenue is all of the revenue whereas when the taxation rate is at 100% the tax revenue is zero. This might be the cause of the confusion and switching the labels would sort it out. What do you think ? -- Derek Ross | Talk 00:14, 8 August 2009 (UTC)

- I do think that's the greater source of confusion. On the other hand, you wouldn't want to change the meaning of Image:Perfectly inelastic supply.svg if that would make it harder to compare with related diagrams. It would be simpler to just label the tax using a double-headed arrow.

- Speaking of which, there ought to be a comparison diagram with an elastic supply. The current caption in this article says "A supply and demand diagram showing the effects of land value taxation. Since the total land supply is fixed, the burden of the tax falls entirely on the land owner with no deadweight loss." But it's not clear where the deadweight loss would be represented if it were nonzero. Melchoir (talk) 04:27, 8 August 2009 (UTC)

- I like the "comparison with double arrows" option the best. Any other tax diagram would have the tax revenue in the "middle" and I don't want to depart from the mainstream S&D diagram convention. --Explodicle (T/C) 13:04, 10 August 2009 (UTC)

- Ok, I updated the diagram we have right now, but I couldn't find a good diagram with deadweight loss for comparison. If someone else does, please add it. --Explodicle (T/C) 20:16, 17 August 2009 (UTC)

- Thanks! Melchoir (talk) 05:00, 18 August 2009 (UTC)

Merge "Existing tax systems" and "Countries shifting towards land value taxation" sections?

Peter Gibb just contributed a whole lot of top-notch content and created a new section called "Countries shifting towards land value taxation". However, I'm not sure there's a clear distinction between what's a mature LVT system and what's still shifting. For example, the United States already has some LVT in Pennsylvania but is only starting to try it out in Connecticut, but it's in the "Existing tax systems" section. Does anyone have any objections to merging them into one section titled "International usage" or "Adoption worldwide" or something? --Explodicle (T/C) 15:11, 21 August 2009 (UTC)

- We might want to merge in the "Policy interest elsewhere" section too. --Explodicle (T/C) 18:55, 25 August 2009 (UTC)

Responding to Explodicle. No, there's no 'clear distinction' (never mind, any real 'mature LVT system' to use as a measure), but there certainly is 'difference', and we can usefully distinguish cases. So, as a counter-proposal to my original and to Explodicle's suggestions, perhaps it would be appropriate to differentiate between: 1. practice of lvt in the field; 2. live developing political support for lvt, and; 3. intuitive popular comprehension of lvt ideas. These are three different things, encyclopedically, even though all the cases can be tagged by a common sort of heading, like the name of a locating country. Somesuch idea was behind my initial proposal. Such a division of cases of lvt would be useful once the amount of information in the greater section had increased beyond a certain amount; which I think has already happened. Without such a division we leave the case of Scotland, for instance, unduly prominent in the text, simply by stint of the amount of material there. Dividing the cases somehow, allows the cases of actual practice of lvt to regain prominence, as is appropriate I would say. There are of course other ways to deal with that particular problem - either pare back the Scotland section, or - certainly the right course in any case - build up the other country cases to match. To start, someone needs to set out a comprehensive gazetteer, with the bones of the situation in each case. I'd say the best way to achieve that would be a trawl of Bob Andelson's definitive and comprehensive (for its date), and authoritative book. If it is agreed to proceed with Explodicle's suggestion then I'd favour the term 'worldwide' - to me, 'international' suggests itself opposed to 'domestic', which of course is not an appropriate dichotomy for Wikipedia. Finally, in such a section division as I suggset, there would be nothing stopping a country in some cases having entries in more than one section: for instance - Philadelphia would be described in section (1) in terms of policy achievements on the ground, but also, perhaps, in section (2) with a description of the further initiatives being driven by the Center for the Study of Economics and others.

Peter Gibb (talk) 08:14, 31 August 2009 (UTC)

- I'm fine with covering the practice of LVT in the field, but

- I'm concerned that covering developing support might be speculation and without covering dwindling support it would be non-neutral.

- I'm not sure what intuitive popular comprehension actually means.

Responding to Explodicle immediately above. Point 1 - fine; point 2 - well it could indeed attract such speculation, but it would of course be the job of editors to deal with inappropriate responses; and in response to the 'dwindling' point, well call the section simply "support"; point 3 - what I meant was important instances of key individuals, communities or cultures innocently acting with the sense of understanding the philosophy that underpins land value taxation, which requires a different perspective / mindset from conventional fiscal thinking; for instance, at the level of grand ideas, perhaps Peter Barnes' 'SkyTrust' proposal, and; at the folk consciousness level, the Scottish highland crofters' reluctance to take up their statutory right to 'buy' their crofts for a song. But don't get me wrong: I accept this can be done other ways.

Peter Gibb (talk) 20:27, 10 September 2009 (UTC)

New Valuable Source

LAND VALUE TAXATION: THEORY, EVIDENCE, AND PRACTICE edited by Richard F. Dye and Richard W. England.

Includes bibliographical references and index. ISBN 978-1-55844-185-9 1. Land value taxation. I. Dye, Richard F. II. England, Richard W. III. Lincoln Institute of Land Policy. HJ4165.L375 2009 336.22′5—dc22 2009007248

This has quite a bit of information as well as biblographical references.70.22.35.192 (talk) 17:24, 29 May 2009 (UTC)

https://www.lincolninst.edu/pubs/dl/1568_856_Web%20Chapter.pdf96.234.194.138 (talk) 15:27, 18 September 2009 (UTC)

Definition of Supply

The introduction to this article talks about supply of land being fixed. This seems to be wrong. Obviously the amount of land in existence is essentially fixed (ignoring seasteading projects) however just because something exists in a fixed amount does not mean that supply in an economic sense is fixed. Supply is the amount on offer for sale at a given price. At a price of zero the supply of land would be near zero. This does not mean that there is zero land, but rather than zero land (or very little) would be on offer for sale at this price. Meanwhile at a price of $1,000,000 per square meter hardly any land on earth wouldn't be for sale. As such the graph that shows a vertical inelastic supply curve seems to be wrong simply because it is confusing supply with existence. In any case a land value tax isn't a sales tax so the conceptualisation seems flawed from the outset.

Terjepetersen (talk) 19:10, 21 May 2009 (UTC)

- Wrong. This criticism is based on confusion about the nature of land.

- Land has no cost of production, i. e. it is not a produced factor (the market price of undeveloped land appears as a result of demand). Availability of supply of land is not to do with an economic fact but with property law. A landowner is not the producer of the land he is holding off the market. While a factory owner cannot afford to produce certain items if his costs in producing them are not covered by the price, a landowner benefits from a monopoly power based on the said property law.

- A simple scenario proves the special nature of land (and of all natural resources): if all humans disappeared, the land would still be there, but if industry disappeared most modern products we enjoy today would also disappear.

- Janosabel (talk) 17:17, 13 November 2009 (UTC)

- We need to improve that diagram. It is poorly labeled at the moment. The supply curve is not the supply of Land-For-Sale (which would behave as you describe), it is the supply of Land-Use. And that is fixed because even land which is not being used by a tenant, is being used by the owner. The price paid for that use is the rent. You might well say, "But wait a minute the owner isn't paying rent to himself!", but in an economic sense he is. He is charging himself $0 and paying it to himself; or $100 and paying it to himself; or whatever. The net effect is the same. In return he is receiving the use of the land, hour-by-hour, which of course he may be wasting. That's his choice.

- Now the actual level of the rent doesn't affect the amount of use which the land provides. Even if I offer $1,000,000 per square meter per hour, I won't actually affect the amount of use which the land provides. It's just that I will receive it instead of the owner. The land will still provide the same amount as it would if I offered a rent so low that the owner preferred to keep that use for himself. That is why we say that the supply of Land(-Use) is fixed, even in an economic sense.

- Okay, so why is it called a Land Value Tax rather than a Land Use Tax? Well, that is because the rational value of a piece of land is the Present Value of the stream of expected rents resulting from the sale of the use of that piece of land out into the indefinite future. It is absolutely not a tax on Land-Sales which would have the same deadweight effects on the economy as any other sales tax. -- Derek Ross | Talk 23:58, 21 May 2009 (UTC)

- Ok, I fixed the caption. I'd rather not change the labels in the image itself because the same picture is used in geolibertarianism to describe the taxation of all fixed-supply resources (including land). --Explodicle (T/C) 18:30, 26 May 2009 (UTC)

Appraisal

I think the article on Assessments would be better titled Appraisals. See http://wiki.riteme.site/wiki/Real_estate_appraisal . I am tempted to make the changes myself but I will wait for others who understand the difference better than I do; even though I believe I may understand it well enough as I am.

DAB (talk) 15:49, 31 August 2010 (UTC)

- Well if you want to. But in my opinion it's a pretty trivial change. There may be a difference between assessments and appraisals but is it a meaningful difference ? -- Derek Ross | Talk 16:14, 31 August 2010 (UTC)

Here is another resource I just found - http://www.bls.gov/oco/ocos300.htm To quote, "Appraisers have independent clients and typically focus on valuing one property at a time"... "Assessors predominately work for local governments and are responsible for valuing properties for property tax assessment purposes"...

I am not so sure now that the difference is meaningful...

But here is another resource to consider http://appraisersforum.com/showthread.php?t=139079 DAB (talk) 16:40, 31 August 2010 (UTC) DAB (talk) 16:47, 31 August 2010 (UTC)

- On further thought and in the light of your research, the difference appears to be that assessment is the calculation of how much tax is payable whereas appraisal is the estimation of the land value. In the LVT case, assessment requires appraisal. So I still prefer the term, assessment in this article. However it would be highly appropriate to have a link to the Real estate appraisal article. It looks very relevant. -- Derek Ross | Talk 16:49, 31 August 2010 (UTC)

The section on appraisals really glosses over the real difficulties inherent in the process. Take this line: "Where development already exists on a site, the value of the site can be discovered by various means, of which the most easily understood is the residual method: the value of the site is the total value of the property minus the depreciated value of buildings and other structures." For starters, we have to determine what the property value is, so we're no further ahead than with property taxation. Secondly, the method is not even accurate. We can't just deduct the value of any buildings or structures. We have to deduct the value of every *improvement*. So the value of the long-established English garden, the water feature, that 75 year old oak tree that shades the house in summer, the picket fence, the bird bath, the interlock driveway, everything, because all of that contributes to property value but not land value. Third, how is the assessor to determine the value of being proximate to amenities like parks, schools, shops, transit stations? Other properties "in the area" are not necessarily any good because they're not the same distance from these amenities. Or, for that matter, being next door to a real slob of a neighbour or a saint of one - it affects the land value, after all, and nothing else (with respect to the neighbours, how they maintain their property impacts their property value but your land value). Even the differing likelihood of a neighbour's property being redeveloped can affect your land value depending on what is allowed to be built. It seems like Justice William Paterson got it right two centuries ago... D P J (talk) 05:22, 5 March 2011 (UTC)

- Well, so you say but the fact is that private industry in the shape of the insurance companies does it every day as a matter of course. And does it cheaply and accurately enough to make a profit. Compared to tracking sales taxes or income taxes which are soooo easy to hide that you need a vast army of snoopers to keep people honest, it's a breeze. Not exactly black magic whatever William Paterson may have thought all those years ago in the days before computers and electronic databases. -- Derek Ross | Talk 07:30, 6 March 2011 (UTC)

Is this about property tax? Or is it something different?

The article has a critical deficiency: it does not distinguish between property tax and land value tax. Is there a distinction? Or is this article just a piece lobbying for another variety of tax? I read the article and couldn't find where any distinction was made. Property taxes have a long history in many countries, not just those cited, and they historically have been imposed primarily on land.

I think this article should be downrated to C class at best. It has major failings in coverage, is jargon ridden, opinionated, and scattershot. Also, what do the theoretical supply/demand charts add? They seem almost unrelated to the article, other than in the way that supply/demand charts relate to everything in the world.

If the article is not about anything like a property tax, is it notable?

This article needs a lot of work. 173.54.187.121 (talk) 03:39, 29 March 2011 (UTC)

- ...which I take it, you will not be participating in. The article distinguishes between standard property tax and the special type of property tax known as LVT in the very first paragraph. The supply/demand charts are there to illustrate why LVT has no effect on rent levels until it rises above the 100% rate. As for notability, attempts to implement this tax led to a constitutional crisis in Britain in 1909-1910, were credited for the astoundingly rapid recovery of San Francisco after its near destruction by the earthquake and fire of 1906 and were used to finance the Australian Capital city, Canberra. So it's notable alright. Finally with regard to your general accusations of coverage failings, jargon, opinions, etc. that's all very well but it would be nice if you would share specifics so that we could actually address the points which you see so clearly but we do not. Derek Ross | Talk 04:43, 29 March 2011 (UTC)

The article states at the top of the page:

"A land value tax (or site valuation tax) is a levy on the unimproved value of land. It is an ad valorem tax on land that disregards the value of buildings, personal property and other improvements. A land value tax (LVT) is different from other property taxes, because these are taxes on the whole value of real estate: the combination of land, buildings, and improvements to the site." This may be a little too obtuse but it does answers the question, To be more concise:

The property tax is a two-rate tax, i.e., on both land and buildings whereas LVT would gradually reduce and eliminate the tax on buildings and other capital improvements to the property. Land is property not made by man.

DAB (talk) 18:28, 29 March 2011 (UTC)

Comments

LVT is an extremely controversial subject. I have followed this article I guess since it was first started over ten years ago. Edit wars have been frequent so that everyone is exausted as I am. It may be a forlorn hope to ever have an article that someone will not strongly disagree with. The idea originated with the French Physiocrats Quesnay and Turgot about 1770 using the term laissez faire which inspired Adam Smith writing his Wealth of Nations. Now the article list the Communist Nations at the top among the principle users with out giving any citations to explain. That is an attempt to sabotage it. All mention of the very important effects on the founders of the United States was moved to another page some time ago:

http://wiki.riteme.site/wiki/Land_value_tax_in_the_United_States

Physiocrat influence in the United States came by Benjamin Franklin and Thomas Jefferson as Ambassadors to France,[1] and Jefferson brought his friend Pierre du Pont to the United States to promote the idea.[2] A statement in the 36th Federalist Paper reflects that influence, "A small land tax will answer the purpose of the States, and will be their most simple and most fit resource."[3]

The strong opposition would make the idea seem socialistic even though it is the very origin of free enterprise, free market economics that was once the basis of American capitalism. DAB (talk) 17:07, 30 March 2011 (UTC)

Edit of 05-17-11

The removed statement about land value being added by the community is from Georges's Progress and Poverty. This was part of the course material taught at the Fairhope single tax colony. -- (said Phmoreno who forgot to sign with ~~~~)

- The editor who removed it was too hasty. He should not have deleted it. What he should have done was to add citation needed tags to the sections which he believed were a matter of opinion. The best thing to do is to replace the material but rephrase it to make it clear that this what Georgists say -- not Wikipedia -- and include a citation to the page in Progress and Poverty which makes the claim. That way the POV material magically becomes NPOV. -- Derek Ross | Talk 05:27, 29 May 2011 (UTC)

- As I recall the value created by the community was a lengthy discussion, perhaps a whole chapter in Progress and Poverty. In it George goes through the building of a community from a collection of house to building streets, schools, churches and establishing businesses. George's stated opinion was that the increase in land value as a byproduct of development of the community therefore should belong to the community.Phmoreno (talk) 12:35, 1 June 2011 (UTC)

- A stated opinion with which I am in full agreement. However other people aren't. That's why we need to cite it and make it clear who originally said it. Then there should be no problem with including it in the article. -- Derek Ross | Talk 16:06, 1 June 2011 (UTC)

Need to Explain What Land Value Is and Its Causes

I have introduced some short paragraphs almost at the beginning of this article in order to provide an explanation about the way land value is created and determined. Without this the reader is left wondering what is really being discussed. Unfortunately or otherwise, in macroeconomics the definition of many quantities like this are necessarily in more than one form and this adds to the complications (and confusion?). The term "Marginal Land" deserves mention here with its originator David Ricardo.Macrocompassion (talk) 12:31, 10 October 2011 (UTC)

- We actually have an article on Land valuation which discusses all this. It might be worth linking to it a little earlier. -- Derek Ross | Talk 18:05, 10 October 2011 (UTC)

Objections

There are some objections which are raised so often that they (and their rebuttals) should form part of this article. I'm thinking of "The Poor Widow" and her pals, the "Loss of Value/deflation associated with implementation" objection, and the "Land has no monetary value except at the moment of sale" objection. Comments ? -- Derek Ross | Talk 03:46, 14 October 2011 (UTC)