Bitcoin: Difference between revisions

m prose edit |

|||

| Line 190: | Line 190: | ||

==External links== |

==External links== |

||

{{Sister project links|wikt= |

{{Sister project links|wikt=bitco* [https://localbitcoins.com/?ch=dgf in|commons=Bitcoin|b=Bitcoin|n=no|s=no}} |

||

{{Wikibooks|Professionalism|BitTorrent and BitCoin}} |

{{Wikibooks|Professionalism|BitTorrent and BitCoin}} |

||

{{Wikibooks|Strategy for Information Markets|Micropayments}} |

{{Wikibooks|Strategy for Information Markets|Micropayments}} |

||

| Line 206: | Line 206: | ||

* [http://www.quandl.com/markets/bitcoin Bitcoin Data] by [[Quandl]] |

* [http://www.quandl.com/markets/bitcoin Bitcoin Data] by [[Quandl]] |

||

* [http://fincen.gov/statutes_regs/guidance/pdf/FIN-2013-G001.pdf FinCEN March 18, 2013 guidelines] by the [[Financial Crimes Enforcement Network]] |

* [http://fincen.gov/statutes_regs/guidance/pdf/FIN-2013-G001.pdf FinCEN March 18, 2013 guidelines] by the [[Financial Crimes Enforcement Network]] |

||

* [https://localbitcoins.com/?ch=dgf '''Localbitcoins.com'''] Set up a wallet, anonymously if you wish, then find someone locally selling bit coins and buy some bitcoins or a portion of a coin using a safe escrow method. |

|||

<!-- Why are these in this section? --> |

<!-- Why are these in this section? --> |

||

Revision as of 07:35, 10 November 2013

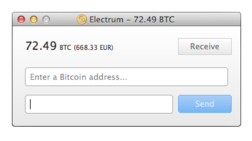

A digital Bitcoin wallet | |

| Unit | |

|---|---|

| Symbol | BTC, XBT,[1] |

| Denominations | |

| Subunit | |

| .001 | mBTC (millicoin) |

| .000001 | μBTC (microcoin) |

| .00000001 | satoshi[4] |

| Demographics | |

| Date of introduction | 3 January 2009Bitcoin Genesis Block |

| User(s) | International |

| Issuance | |

| Ledger | The majority of the Bitcoin peer-to-peer network regulates transactions and balances.[5] |

| Valuation | |

| Issuance | Limited release |

| Source | Total BTC in Circulation |

| Method | The rate of new bitcoin creation will be halved every four years until there are 21 million BTC[6] |

Bitcoin (sign: ![]() ; code: BTC or XBT[7]) is a distributed, peer-to-peer digital currency that functions without the intermediation of any central authority.[8] The concept was introduced in a 2008 paper by a pseudonymous developer known as "Satoshi Nakamoto".

; code: BTC or XBT[7]) is a distributed, peer-to-peer digital currency that functions without the intermediation of any central authority.[8] The concept was introduced in a 2008 paper by a pseudonymous developer known as "Satoshi Nakamoto".

Bitcoin has been called a cryptocurrency because it is decentralized and uses cryptography to control transactions and prevent double-spending, a problem for digital currencies.[8] Once validated, every individual transaction is permanently recorded in a public ledger known as the blockchain.[8] Payment processing is done by a network of private computers often specially tailored to this task.[9] The operators of these computers, known as "miners", are rewarded with transaction fees and newly minted bitcoins. However, new bitcoins are created at an ever-decreasing rate.[8]

In 2012, The Economist reasoned that Bitcoin has been popular because of "its role in dodgy online markets,"[10] and in 2013 the FBI shut down one such service, Silk Road, which specialized in illegal drugs (whereupon the FBI came into the control of approximately 1.5% of all bitcoins in circulation).[11] However, bitcoins are increasingly used as payment for legitimate products and services, and merchants have an incentive to accept the currency because transaction fees are lower than the 2 to 3% typically imposed by credit card processors.[12] Notable vendors include WordPress, OkCupid, Reddit, and Chinese Internet giant Baidu.[13]

Speculators have been attracted to bitcoin fueling volatility and price swings. As of July 2013, there is a relatively small use of bitcoins in the retail and commercial marketplace in comparison to a relatively large use by speculators.[14]

Bitcoins are routinely stolen, and in an odd juxtaposition for a digital currency, the safest way to store them is with paper print-outs.

Transactions

Integral to Bitcoin is a transaction history log. Making a purchase involves updating this decentralized log, called the blockchain, which shows who owns how many bitcoins currently and records the participants in all prior transactions as well.[15]

Bitcoin wallets

Anyone wishing to use bitcoins is assigned one or more bitcoin addresses, and wallets allow a user to complete transactions between addresses by requesting an update to the blockchain, the public transaction log instrumental to Bitcoin. Wallets come in a variety of forms: apps for mobile devices and computers, hardware devices, and paper tokens. When making a purchase with a mobile device, the use of QR codes to simplify transactions is ubiquitous.

Payment processing

Bitcoin payment processing fees are substantially lower than those of credit cards or money transfers.[16] The competitive advantage lower fees confer to Bitcoin may lessen or vanish in the future, however. Without a sustained increase in the value of bitcoins relative to other currencies, payment processing fees must rise over time, and once the bitcoin ceiling is reached, processing transactions will no longer be rewarded with new bitcoins. This is due to the fact that the total number of bitcoins is capped at 21 million and because the creation of each successive bitcoin requires a larger amount of payment processing work than the last.[17] Fees are generally independent of the amount being sent, making Bitcoin attractive for those seeking to transfer larger amounts of money.[18] In one instance, bitcoins worth millions of US dollars were transferred for only a few pennies.[19] For this reason it would appear that Bitcoin is ideal for those wishing to launder money, but the FBI maintains that few do so. Perhaps it is the public transaction history log that keeps potential money launderers at bay.

Anonymity

While Bitcoin uses cryptography, it does not do so to protect the privacy of individuals, and all transactions are logged in a public file called the blockchain. It is possible, although difficult, to associate bitcoin transactions with real-life identities.[20] In addition, Bitcoin intermediaries such as exchanges are required to collect personal customer data.[21]

Exchanges

Through various exchanges, bitcoins are bought and sold at a variable price against the value of other currency. While the exchange rate is highly volatile, on average bitcoins have appreciated rapidly in relation to other currencies including the US dollar, euro and British pound.[22]

While there may be a seemingly large number, exchanges regularly fail taking client bitcoins with them.[23]

History

First mentioned in a 2008 paper published under the pseudonym Satoshi Nakamoto, Bitcoin became operational in early 2009.[17] The currency had early technical problems such as a 2009 exploit that allowed the creation of unlimited bitcoins.[24]

In 2011 the value of one Bitcoin rapidly rose from about $0.30 to $32, before falling back down $2.[25]

Bitcoin began attracting media attention in late 2012, and numerous news articles have been written about it. In 2013, some mainstream services such as OkCupid, Baidu, Reddit, Humble Bundle and Foodler began accepting it.[26] That year also saw the first interventions by law enforcement. Assets belonging to the Mt.Gox exchange were seized, and the Silk Road drugs market was shut down.[27]

Economics

Large fluctuations in the value of Bitcoin have led some to question its ability to function as a currency.[28] In addition, its deflationary bias encourages hoarding.[29] This reduces the use value of a currency, and has been the downfall of other private currencies.[30] However, currently Bitcoin does see some use as a currency.[31][32]

Bitcoin speculation

Bitcoins are often traded as an investment.[33] Critics have accused bitcoin of being a species of Ponzi scheme.[34][35] A case study report[36] by the European Central Bank observes that the Bitcoin currency system shares some characteristics with Ponzi schemes, but also has characteristics that are distinct from the common aspects of such schemes.

Bitcoins have been described as lacking intrinsic value as an investment because their value depends only on the willingness of users to accept it.[37]

Derivatives of bitcoins are thinly available. One organization offers futures contracts against multiple currencies.[38]

Certain investment funds have shown interest in Bitcoin with Peter Thiel's Founders Fund investing US$3 million, and the Winklevoss twins making a US$1.5 million personal investment.[39] A Bitcoin ETF may also soon be on offer.

Bitcoin bubbles

Many have mentioned speculative bubbles in connection with Bitcoin, and Reuters journalist Felix Salmon correctly predicted the bursting of one such Bitcoin bubble in April 2013.[40]

Alternative to fiat currency

Some have suggested that Bitcoin is gaining popularity in countries with problem-plagued national currencies, as it can be used to circumvent inflation, capital controls, and international sanctions.

Bitcoins are used by some Argentinians an as an alternative to the official fiat currency,[41] which is stymied by inflation and strict capital controls.[21] In addition, some Iranians use Bitcoins to evade currency sanctions.[42]

Financial journalists and analysts have suggested that there was a correlation between higher bitcoin usage in Spain and the 2012–2013 Cypriot financial crisis.[43]

Criminal activities

Bitcoins have acquired a reputation for use by criminals to purchase drugs, launder money, and gamble. Gambling with bitcoins is popular and accounts for a large percentage of bitcoin transactions (although a smaller percentage of transactions by value), and a significant proportion of bitcoin activity can be linked to the purchase of illegal drugs. Its ties to criminal activities have hindered the currency from attaining widespread, mainstream use as well as attracted the attention of financial regulators, legislative bodies, and law enforcement.[44]

The Washington Post has labelled it "the currency of choice for seedy online activities,"[45] and the FBI stated in a 2012 report that "bitcoins will likely continue to attract cybercriminals who view it as a means to move or steal funds".[46]

Some have suggested that due to their close association with illegal purchases, bitcoins could be made illegal. This assertion has been made by Steven Strauss, a Harvard public policy professor, and was also mentioned in 2013 SEC filing made by a Bitcoin investment vehicle.[47]

In June 2011, Symantec warned about the possibility of botnets engaging in covert mining of bitcoins,[48][49] consuming computing cycles, using extra electricity and possibly increasing the temperature of the computer. Some malware also used the parallel processing capabilities of the GPUs built into many modern-day video cards.[50] In mid-August 2011, Bitcoin miner botnets were detected again,[51]and less than three months later bitcoin-mining trojans infecting Mac OS X were also discovered.[52]

In 2013 The Guardian reported that the currency was primarily used to purchase illegal drugs and for online gambling,[53] and The Huffington Post stated that "online gambling accounts for a huge portion of Bitcoin activity."[54] Legitimate transactions are thought to be far less than the number involved in the purchase of drugs,[55] and roughly one half of all transactions made using bitcoins are bets placed at a single online gaming website.[56] In 2012, an academic from the Carnegie Mellon CyLab and the Information Networking Institute estimated that 4.5 to 9% of all bitcoins spent were for purchases of drugs at a single online market, Silk Road.[57] As the majority of the Bitcoin transactions were at this time speculative in nature, this academic asserts that drugs constituted a much larger percentage of the products and services bought using the currency, however.[57]

Several news outlets assert that the popularity of bitcoins hinges on the ability to use them to purchase illegal substances.[10] In addition to such utility, bitcoins are thought by the FBI as a potential tool of money launderers,[46] and The Huffington Post stated in 2013 that it was the used by online gun dealers to allow the purchase of arms without background checks.[58]

Although there are fears that bitcoins may be used to launder money, the FBI stated in 2012 that, while the potential for money laundering exists, there were no known instances of this occurring.[46] However, in 2013 US authorities seized assets belonging to Mt Gox, a service that allowed users to exchange Bitcoins for US dollars.[59] Some say one obstacle to Bitcoins becoming widely used to launder money may be the fact that transaction history is public.[60]

Theft

It is possible to steal bitcoins, and documented theft has occurred on numerous occasions. At other times, Bitcoin exchanges have shut down, taking their client's bitcoins with them.

On 19 June 2011, a security breach of the Mt.Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt.Gox exchange, after a hacker allegedly used credentials from a Mt.Gox auditor's compromised computer illegally to transfer a large number of bitcoins to himself. He used the exchange's software to sell them all nominally, creating a massive "ask" order at any price. Within minutes the price corrected to its correct user-traded value.[61][62][63][64][65][66] Accounts with the equivalent of more than 8,750,000 USD were affected.[63]

In July 2011, the operator of Bitomat, the third largest bitcoin exchange, announced that he lost access to his wallet.dat file with about 17,000 bitcoins (roughly equivalent to 220,000 USD at that time). He announced that he would sell the service for the missing amount, aiming to use funds from the sale to refund his customers.[67]

In August 2011, MyBitcoin, a now defunct bitcoin transaction processor, declared that it was hacked, which resulted in it being shut down, with paying 49% on customer deposits, leaving more than 78,000 bitcoins (roughly equivalent to 800,000 USD at that time) unaccounted for.[68][69]

In early August 2012, a lawsuit was filed in San Francisco court against Bitcoinica — a bitcoin trading venue — claiming about 460,000 USD from the company. Bitcoinica was hacked twice in 2012, which led to allegations of neglecting the safety of customers' money and cheating them out of withdrawal requests.[70][71]

In late August 2012, an operation titled Bitcoin Savings and Trust was shut down by the owner, allegedly leaving around 5.6 million USD in bitcoin-based debts; this led to allegations of the operation being a Ponzi scheme.[72][73][74][75] In September 2012, it was reported that the U.S. Securities and Exchange Commission had started an investigation on the case.[76]

In September 2012, Bitfloor, a bitcoin exchange, also reported being hacked, with 24,000 bitcoins (roughly equivalent to 250,000 USD) stolen. As a result, Bitfloor suspended operations.[77][78] The same month, Bitfloor resumed operations, with its founder saying that he reported the theft to FBI, and that he is planning to repay the victims, though the time frame for such repayment is unclear.[79]

On 3 April 2013, Instawallet, a web-based wallet provider, was hacked,[80] resulting in the theft of over 35,000 bitcoins.[81] With a price of 129.90 USD per bitcoin at the time, or nearly 4.6 million USD in total, Instawallet suspended operations.

On 11 August 2013, the Bitcoin Foundation announced that a bug in a pseudorandom number generator within the Android operating system had been exploited to steal from users' wallets, the vulnerability affecting wallets generated by any Android app; fixes were provided 13 August 2013.[82]

A Bitcoin bank, operated from Australia but stored on servers in the USA, was hacked on 23 and 26 October 2013, with a loss of 4100 Bitcoins, or over 1 million AUD. [83]

Taxation and regulation

In 2012, the Cryptocurrency Legal Advocacy Group (CLAG) stressed the importance for taxpayers to determine whether taxes are due on a bitcoin-related transaction based on whether one has experienced a "realization event": when a taxpayer has provided a service in exchange for bitcoins, a realization event has probably occurred and any gain or loss would likely be calculated using fair market values for the service provided."[84]

In August 2013 the German Finance Ministry characterized Bitcoin as a unit of account,[85][86] usable in multilateral clearing circles and subject to capital gains tax if held less than one year.[86]

Reception

Although Bitcoin may be referred to as a digital currency, many commentators have recognized that in many ways, such as a volatile exchange rate, relatively inflexible supply, high risk of loss, and minimal use in trade, it differs from traditional currency. In Germany, Bitcoin is recognized as a unit of exchange, but in the US it is classified as a currency for legal purposes.

CNN has called bitcoins a "shady online currency,"[87] and its links to criminal activities have prompted scrutiny from the FBI, US Senate, and the State of New York.

There is little scholarship in the area of virtual currencies such as Bitcoins, and most economists that have commented on Bitcoin have been critical.

Economist Paul Krugman has been critical of Bitcoin, suggesting that the structure of the currency incentivizes hoarding[88] and also stating its value from the expectation that others will accept it as payment.[89] Krugman considers it wasteful to spend real resources, such as electric power, on the creation of Bitcoins.[90]

Larry Summers has expressed a "wait and see" attitude when it comes to Bitcoins.[91]

Numerous economists including John Quiggin and Steve Hanke have mentioned the possibility of a Bitcoin bubble.[92]

Research on Bitcoins has been conducted by the ConvergEx Group and an assistant professor at Carnegie Mellon, Nicholas Christin.[93]

See also

References

- ^ "XBT – Bitcoin". XE. Retrieved 11 June 2013.

- ^ Matonis, Jon (22 January 2013). "Bitcoin Casinos Release 2012 Earnings". Forbes. New York. Archived from the original on 16 February 2013.

Responsible for more than 50% of daily network volume on the Bitcoin blockchain, SatoshiDice reported first year earnings from wagering at an impressive ฿33,310.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Another Bitcoin Identity

- ^ "Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency". Daily Tech. 12 June 2011. Archived from the original on 20 January 2013. Retrieved 30 September 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Barber, Simon; Boyen, Xavier; Shi, Elaine and Uzun, Esrin (2012). "Bitter to Better — how to make Bitcoin a better currency" (PDF). Financial Cryptography and Data Security. Lecture Notes in Computer Science. 7397. Springer: 399. doi:10.1007/978-3-642-32946-3_29. ISBN 978-3-642-32945-6.

{{cite journal}}: CS1 maint: multiple names: authors list (link) - ^ Ron Dorit (2012). "Quantitative Analysis of the Full Bitcoin Transaction Graph" (PDF). Cryptology ePrint Archive. p. 17. Retrieved 18 October 2012.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ XBT - Bitcoin rates, news, and tools

- ^ a b c d Jerry Brito and Andrea Castillo (2013). "Bitcoin: A Primer for Policymakers" (PDF). Mercatus Center. George Mason University. Retrieved 22 October 2013.

- ^ Kharif, Olga (14 October 2013). "Bitcoin Mining Rush Means Real Cash for Hardware Makers". bloomberg.com. Bloomberg LP. Retrieved 23 October 2013.

- ^ a b "Monetarists Anonymous". The Economist. The Economist Newspaper Limited. 29 September 2012. Retrieved 21 October 2013.

- ^ http://www.forbes.com/sites/andygreenberg/2013/10/25/fbi-says-its-seized-20-million-in-bitcoins-from-ross-ulbricht-alleged-owner-of-silk-road/

- ^ For growing acceptance, see "BitPay Passes 10,000 Bitcoin-Accepting Merchants On Its Payment Processing Network". Techcrunch. Techcrunch.com. 16 September 2013. Retrieved 21 October 2013.

- For cheap payment processing costs, see Wingfield, Nick (30 October 2013). "Bitcoin Pursues the Mainstream". The New York Times. Retrieved 4 November 2013.

- ^ "Bitcoin Says Goodbye To Silk Road And Hello To Baidu, China's Google". Forbes. New York. 10 October 2013. Retrieved 21 October 2013.

- ^ Grocer, Stephen (2 July 2013). "Beware the Risks of the Bitcoin: Winklevii Outline the Downside". Moneybeat. The Wall Street Journal. Retrieved 21 October 2013.

- ^ Gillillan, Cora Lee C. (23 October 1975). "The Stone Money of Yap: A Numismatic Survey" (PDF). Smithsonian Institution. Retrieved 3 November 2013.

- ^ For transaction processing being rewarded with new bitcoins, see Wallace, Benjamin (23 November 2011). "The Rise and Fall of Bitcoin". Wired. Retrieved 4 November 2013.

- For cheap transaction fees, see Wingfield, Nick (30 October 2013). "Bitcoin Pursues the Mainstream". The New York Times. Retrieved 4 November 2013.

- ^ a b Wallace, Benjamin (23 November 2011). "The Rise and Fall of Bitcoin". Wired. Archived from the original on 9 February 2013. Retrieved 13 October 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Bitcoin block chain, 4 November 2013

- ^ [1], blockchain.info, 4 November 2013

- ^ The Economist. "Monetarists Anonymous". Archived from the original on 2 January 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). 29 September 2012. Retrieved 1 April 2013. - ^ a b Lee, Timothy B. (19 August 2013). "Five surprising facts about Bitcoin". Washington Post blog. Archived from the original on 22 August 2013.

- ^ "Bitcoin Markets (mtgoxUSD) – Bitcoin Charts". Quandl. Retrieved 15 August 2013.

- ^ Steadman, Ian (26 April 13). "Study: 45 percent of Bitcoin exchanges end up closing". Wired. Retrieved 28 April 2013.

{{cite web}}: Check date values in:|date=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Vulnerability Summary for CVE-2010-5139". National Vulnerability Database. 8 June 2012. Archived from the original on 9 April 2013. Retrieved 22 March 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "When will the people who called Bitcoin a bubble admit they were wrong?". The Washington Post. 8 November 2013.

- ^ Van Sack, Jessica (27 May 2013). "Why Bitcoin makes cents". Boston Herald. Retrieved 15 August 2013.

- ^ For asset seizure, see Dillet, Romain (16 May 2013). "Feds Seize Assets From Mt. Gox's Dwolla Account, Accuse It Of Violating Money Transfer Regulations". TechCrunch. Retrieved 15 May 2013.

- For drugs market shutdown, see Farrell, Greg (3 October 2013). "FBI Snags Silk Road Boss With Own Methods". Bloomberg. New York. Retrieved 27 October 2013.

- ^ Moore, Heidi (3 April 2013). "Confused about Bitcoin? It's 'the Harlem Shake of currency'". The Guardian. London. Archived from the original on 29 April 2013. Retrieved 8 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ For The Atlantic article, see O'Brien, Matthew (11 April 2013). "Bitcoin Is No Longer a Currency". The Atlantic. Washington DC. Archived from the original on 29 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Posner, Eric (11 April 2013). "Fool's Gold: Bitcoin is a Ponzi scheme—the Internet's favorite currency will collapse". Slate. Retrieved 26 October 2013.

- ^ "Bitcoin: more than just the currency of digital vice". The Guardian. 4 March 2013. Archived from the original on 29 April 2013. Retrieved 20 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Popper, Nathaniel. (13 December 2012) "Never Mind Facebook; Winklevoss Twins Rule in Digital Money". Archived from the original on 29 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Dealbook.nytimes.com. Retrieved 20 April 2013. - ^ Gustke, Constance (23 November 2011). "The Pros And Cons Of Biting on Bitcoins". CNBC. Archived from the original on 19 January 2013. Retrieved 4 December 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ O'Leary, Naomi (2 April 2012). "Bitcoin, the City traders' anarchic new toy". Reuters. Archived from the original on 1 February 2013. Retrieved 14 November 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Chirgwin, Richard (8 June 2011). "US senators draw a bead on Bitcoin". The Register. Archived from the original on 14 September 2012. Retrieved 14 November 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Virtual Currency Schemes" (PDF). European Central Bank. October 2012. Retrieved 4 December 2012.

- ^ Hough, Jack (10 June 2011). "The Bitcoin Triples Again". The Wall Street Journal. New York. Archived from the original on 12 April 2013.

To recap, it's is a purely online currency with no intrinsic value; its worth is based solely on the willingness of holders and merchants to accept it in trade.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Foxman, Simone (2 April 2013). "How to short bitcoins (if you really must)". Quartz. Archived from the original on 29 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Simonite, Tom (12 June 2013). "Bitcoin Millionaires Become Investing Angels". MIT Technology Review. Retrieved 13 June 2013.

- ^ For Salmon's 3 April prediction, see Salmon, Felix (3 April 2013). "The Bitcoin Bubble and the Future of Currency". medium.com. Retrieved 26 October 2013.

- For bubble bursting 12 April, see Isidore, Chris (12 April 2013). "Bitcoin bubble may have burst". CNNMoney. CNN. Retrieved 26 October 2013.

- ^ "Bitcoins gain traction in Argentina". Archived from the original on 29 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Blogs.ft.com (16 April 2013). Retrieved 20 April 2013. - ^ Raskin, Max (29 November 2012). "Dollar-Less Iranians Discover Virtual Currency". BloombergBusinessWeek. Archived from the original on 17 April 2013. Retrieved 15 April 2013.

{{cite journal}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Salyer, Kirsten (21 March 2013). "Fleeing the Euro for Bitcoins". Bloomberg L.P. Archived from the original on 10 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ For lack of mainstream use, see Chen, Adrian (1 June 2011). "The Underground Website Where You Can Buy Any Drug Imaginable". Archived from the original on 26 July 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Gawker.- For attention by law enforcement and regulatory bodies, see Lavin, Tim (8 August 2013). "The SEC Shows Why Bitcoin Is Doomed". bloomberg.com. Bloomberg LP. Retrieved 20 October 2013.

- ^ Timothy B. Lee and Hayley Tsukayama (2 October 2013). "Authorities shut down Silk Road, the world's largest Bitcoin-based drug market". The Washington Post. Retrieved 21 October 2013.

- ^ a b c "Bitcoins Virtual Currency: Unique Features Present Challenges for Deterring Illicit Activity" (PDF). Cyber Intelligence Section and Criminal Intelligence Section. FBI. 24 April 2012. Retrieved 20 October 2013.

- ^ Strauss, Steven (04/14/201). "Nine Trust-Based Problems With Bitcoin". huffingtonpost.com. TheHuffingtonPost.com, Inc. Retrieved 20 October 2013.

{{cite web}}: Check date values in:|date=(help)- For SEC filing, see Grocer, Stephen (2 July 2013). "Beware the Risks of the Bitcoin: Winklevii Outline the Downside". Moneybeat. The Wall Street Journal. Retrieved 21 October 2013.

- ^ Peter Coogan (17 June 2011). "Bitcoin Botnet Mining". Symantec.com. Archived from the original on 14 September 2012. Retrieved 24 January 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Researchers find malware rigged with Bitcoin miner". ZDNet. 29 June 2011. Archived from the original on 5 January 2013. Retrieved 24 January 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Goodin, Dan (16 August 2011). "Malware mints virtual currency using victim's GPU". Archived from the original on 23 December 2012.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Infosecurity – Researcher discovers distributed bitcoin cracking trojan malware". Infosecurity-magazine.com. 19 August 2011. Archived from the original on 3 January 2013. Retrieved 24 January 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Mac OS X Trojan steals processing power to produce Bitcoins – sophos, security, malware, Intego – Vulnerabilities – Security". Techworld. 1 November 2011. Archived from the original on 18 September 2012. Retrieved 24 January 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Ball, James (22 March 2013). "Silk Road: the online drug marketplace that officials seem powerless to stop". theguardian.com. Guardian News and Media Limited. Retrieved 20 October 2013.

- ^ Wyher, Tommy (19 October 2013). "The Rise and Rise of Bitcoin". The Huffington Post. Thehuffingtonpost.com, Inc. Retrieved 21 October 2013.

- ^ Mardlin, John Jeffrey (2 October 2013). "How Will The FBI Shut Down Of Silk Road Affect Bitcoins?". Quora. Forbes. Retrieved 21 October 2013.

- ^ Geuss, Megan (24 August 2013). "Firm says online gambling accounts for almost half of all Bitcoin transactions". Ars Technica. Retrieved 21 October 2013.

- ^ a b Christin, Nicolas (2013). Traveling the Silk Road: A Measurement Analysis of a Large Anonymous Online Marketplace (PDF). Carnegie Mellon INI/CyLab. p. 8. Retrieved 22 October 2013.

- ^ Smith, Gerry (15 April 2013). "How Bitcoin Sales Of Guns Could Undermine New Rules". huffingtonpost.com. TheHuffingtonPost.com, Inc. Retrieved 20 October 2013.

- ^ Chen, Adrian (15 May 2013). "Feds Seize Assets of World's Largest Bitcoin Exchange". gawker.com. Gawker Media. Retrieved 20 October 2013.

- ^ Meiklejohn, Sarah; et al. (23 October 2013 (formal publication)). "A Fistful of Bitcoins: Characterizing Payments Among Men with No Names" (PDF). Association for Computing Machinery (ACM).

{{cite web}}:|archive-date=requires|archive-url=(help); Check date values in:|date=and|archivedate=(help); Explicit use of et al. in:|first=(help) • Paper is explained by Kirk, Jeremy (28 August 2013). "Bitcoin offers privacy—as long as you don't cash out or spend it". PC World. - ^ Karpeles, Mark (30 June 2011). "Clarification of Mt Gox Compromised Accounts and Major Bitcoin Sell-Off". Tibanne Co. Ltd. Archived from the original on 8 December 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Bitcoin Report Volume 8 – (FLASHCRASH)". YouTube BitcoinChannel. 19 June 2011.

- ^ a b Mick, Jason (19 June 2011). "Inside the Mega-Hack of Bitcoin: the Full Story". DailyTech. Archived from the original on 2 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Lee, Timothy B. (19 June 2011) "Bitcoin prices plummet on hacked exchange". Archived from the original on 9 July 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help), Ars Technica - ^ Karpeles, Mark (20 June 2011) Huge Bitcoin sell off due to a compromised account – rollback, Mt.Gox Support [dead link]

- ^ Chirgwin, Richard (19 June 2011). "Bitcoin collapses on malicious trade – Mt Gox scrambling to raise the Titanic". The Register. Archived from the original on 14 January 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Dotson, Kyt (1 August 2011) "Third Largest Bitcoin Exchange Bitomat Lost Their Wallet, Over 17,000 Bitcoins Missing". Archived from the original on 30 July 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). SiliconAngle - ^ Jeffries, Adrianne (8 August 2011) "MyBitcoin Spokesman Finally Comes Forward: "What Did You Think We Did After the Hack? We Got Shitfaced"". Archived from the original on 18 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). BetaBeat - ^ Jeffries, Adrianne (19 August 2011) "Search for Owners of MyBitcoin Loses Steam". Archived from the original on 18 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). BetaBeat - ^ Geuss, Megan (12 August 2012) "Bitcoinica users sue for $460k in lost bitcoins". Archived from the original on 17 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Arstechnica - ^ Peck, Morgen (15 August 2012) "First Bitcoin Lawsuit Filed In San Francisco". Archived from the original on 15 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). IEEE Spectrum - ^ "Bitcoin ponzi scheme – investors lose $5 million USD in online hedge fund". RT. 29 August 2012. Archived from the original on 6 December 2012.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Jeffries, Adrianne (27 August 2012). "Suspected multi-million dollar Bitcoin pyramid scheme shuts down, investors revolt". The Verge. Archived from the original on 5 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Mick, Jason (28 August 2012). ""Pirateat40" Makes Off $5.6M USD in BitCoins From Pyramid Scheme". DailyTech. Archived from the original on 2 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Mott, Nathaniel (31 August 2012). "Bitcoin: How a Virtual Currency Became Real with a $5.6M Fraud". PandoDaily. Archived from the original on 31 January 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Foxton, Willard (2 September 2012) "Bitcoin 'Pirate' scandal: SEC steps in amid allegations that the whole thing was a Ponzi scheme". Archived from the original on 21 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). The Telegraph - ^ "Bitcoin theft causes Bitfloor exchange to go offline". BBC News. 25 September 2012. Archived from the original on 19 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Goddard, Louis (5 September 2012). "Bitcoin exchange BitFloor suspends operations after $250,000 theft". The Verge. Archived from the original on 4 February 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Chirgwin, Richard (25 September 2012). "Bitcoin exchange back online after hack". PC World. Archived from the original on 31 January 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Cutler, Kim-Mai (3 April 2013). "Another Bitcoin Wallet Service, Instawallet, Suffers Attack, Shuts Down Until Further Notice". TechCrunch. Archived from the original on 29 April 2013. Retrieved 12 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ "Transaction details for bitcoins stolen from Instawallet". Archived from the original on 29 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Blockchain.info (3 April 2013). Retrieved 20 April 2013. - ^ Chirgwin, Richard (12 August 2013). "Android bug batters Bitcoin wallets / Old flaw, new problem". The Register. Archived from the original on 17 August 2013. ● Original Bitcoin announcement: "Android Security Vulnerability". bitcoin.org. 11 August 2013. Archived from the original on 17 August 2013.

- ^ "Australian Bitcoin bank hacked". Retrieved 9 November 2013.

{{cite web}}:|archive-date=requires|archive-url=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help). Retrieved 9 November 2013. - ^ Stewart, David D. and Soong Johnston, Stephanie D. (2012). "2012 TNT 209-4 NEWS ANALYSIS: VIRTUAL CURRENCY: A NEW WORRY FOR TAX ADMINISTRATORS?. (Release Date: OCTOBER 17, 2012) (Doc 2012-21516)". Tax Notes Today. 2012 TNT 209-4 (2012 TNT 209–4).

{{cite journal}}: Unknown parameter|month=ignored (help)CS1 maint: multiple names: authors list (link) - ^ Vaishampayan, Saumya (19 August 2013). "Bitcoins are private money in Germany". Marketwatch. Archived from the original on 1 September 2013.

- ^ a b Nestler, Franz (16 August 2013). "Deutschland erkennt Bitcoins als privates Geld an (Germany recognizes Bitcoin as private money)". Frankfurter Allgemeine Zeitung.

- ^ Sanati, Cyrus (18 December 2012). "Bitcoin looks primed for money laundering". money.cnn.com. CNN. Retrieved 18 October 2013.

- ^ Krugman, Paul (7 September 2011). "Golden Cyberfetters". New York Times. Archived from the original on 11 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Krugman, Paul (14 April 2013). "The Antisocial Network". New York Times. Archived from the original on 29 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Krugman, Paul (12 April 2013). "Adam Smith Hates Bitcoin". New York Times. Archived from the original on 29 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Myhrvold, Conor (28 March 2012). "Larry Summers and the Technology of Money". MIT Technology Review. MIT. Retrieved 27 October 2013.

- ^ For Quiggin, see Quiggin, John (16 April 2013). "The Bitcoin Bubble and a Bad Hypothesis". The National Interest. Archived from the original on 29 April 2013.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help)- For Hanke, see Franklin, Oliver (5 April 13). "When the Bitcoin Bubble will burst". GQ. Retrieved 27 October 2013.

{{cite web}}: Check date values in:|date=(help)

- For Hanke, see Franklin, Oliver (5 April 13). "When the Bitcoin Bubble will burst". GQ. Retrieved 27 October 2013.

- ^ For ConvergEx Group, see Boesler, Matthew (7 March 2013). "ANALYST: The Rise Of Bitcoin Teaches A Tremendous Lesson About Global Economics". Business Insider. Archived from the original on 10 April 2013.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help)- For research by Nicholas Christin, see "Nicolas Christin: Carnegie Mellon University Assistant Research Professo". Carnegie Mellon University. cmu.edu. Retrieved 27 October 2013.

External links

- Official website

- Bitcoin Wiki

- Bitcoin Trade Wiki (businesses accepting/working with Bitcoin)

- What is Bitcoin?

- Bitcoin: A Peer-to-Peer Electronic Cash System, the original paper on Bitcoin by Satoshi Nakamoto

- BitcoinPaperWallet.com, Paper wallet generator and primer on paper wallet generation and security

- Bitter to Better — How to Make Bitcoin a Better Currency, a paper on Bitcoin from Stanford University

- An Illustrated History Of Bitcoin Crashes by Forbes

- Digital currencies: A new specie, an article against regulation of Bitcoin by The Economist

- We need decentralized cryptocurrencies, we just don't need Bitcoin, a critique of Bitcoin by TechnoLlama

- Bitcoin Data by Quandl

- FinCEN March 18, 2013 guidelines by the Financial Crimes Enforcement Network

- Localbitcoins.com Set up a wallet, anonymously if you wish, then find someone locally selling bit coins and buy some bitcoins or a portion of a coin using a safe escrow method.

- Roberts, Russ (4 April 2011). "Andresen on BitCoin and Virtual Currency". EconTalk. Library of Economics and Liberty.

- Paul Kemp-Robertson's TED talk, "Bitcoin. Sweat. Tide. Meet the future of branded currency", June 2013.

- [2] A grand jury indictment prominently featuring Bitcoin