United States federal budget: Difference between revisions

Tag: references removed |

|||

| Line 23: | Line 23: | ||

oh my god nobody cares. |

oh my god nobody cares. |

||

===Federal |

===Federal sperm count=== |

||

CBO calculates 35-year baseline projections, which are used extensively in the budget process. Baseline projections are intended to reflect spending under current law, and are not intended as predictions of the most likely path of the economy. During the George W. Bush Administration, OMB presented 5-year projections, but presented 45-year projections in the FY2010 budget submission. CBO and GAO issue long-term projections from time to time. |

CBO calculates 35-year baseline projections, which are used extensively in the budget process. Baseline projections are intended to reflect spending under current law, and are not intended as predictions of the most likely path of the economy. During the George W. Bush Administration, OMB presented 5-year projections, but presented 45-year projections in the FY2010 budget submission. CBO and GAO issue long-term projections from time to time. |

||

Revision as of 15:25, 15 September 2010

| This article is part of a series on the |

| Budget and debt in the United States of America |

|---|

|

The Budget of the United States Government is the President's proposal to the U.S. Congress which recommends funding levels for the next fiscal year, beginning October 1. Congressional decisions are governed by rules and legislation regarding the federal budget process. Budget committees set spending limits for the House and Senate committees and for Appropriations subcommittees, which then approve individual appropriations bills to allocate funding to various federal programs.

After Congress approves an appropriations bill, it is sent to the President, who may sign it into law, or may veto it. A vetoed bill is sent back to Congress, which can pass it into law with a two-thirds majority in each chamber. Congress may also combine all or some appropriations bills into an omnibus reconciliation bill. In addition, the president may request and the Congress may pass supplemental appropriations bills or emergency supplemental appropriations bills.

Several government agencies provide budget data and analysis. These include the Government Accountability Office (GAO), Congressional Budget Office, the Office of Management and Budget (OMB) and the U.S. Treasury Department. These agencies have reported that the federal government is facing a series of important financing challenges. In the short-run, tax revenues have declined significantly due to a severe recession and expenditures have expanded dramatically for stimulus and bailout measures. In the long-run, expenditures related to entitlement programs such as Social Security, Medicare and Medicaid are growing considerably faster than the economy overall, as the population matures.[1][2]

Budget principles

The U.S. Constitution (Article I, section 9, clause 7) states that "[n]o money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of Receipts and Expenditures of all public Money shall be published from time to time."

Each year, the President of the United States submits his budget request to Congress for the following fiscal year, as required by the Budget and Accounting Act of 1921. Current law (31 U.S.C. § 1105(a)) requires the president to submit a budget no earlier than the first Monday in January, and no later than the first Monday in February. Typically, presidents submit budgets on the first Monday in February. The budget submission has been delayed, however, in some new presidents' first year when previous president belonged to a different party.

The federal budget is calculated largely on a cash basis. That is, revenues and outlays are recognized when transactions are made. Therefore, the full long-term costs of entitlement programs such as Medicare, Social Security, and the federal portion of Medicaid, are not reflected in the federal budget. By contrast, many businesses and some foreign governments have adopted forms of accrual accounting, which recognizes obligations and revenues when they are incurred. The costs of some federal credit and loan programs, according to provisions of the Federal Credit Reform Act of 1990, are calculated on a net present value basis.[3]

Federal agencies cannot spend money unless funds are authorized and appropriated. Typically, separate Congressional committees have jurisdiction over authorization and appropriations. The House and Senate Appropriations Committees currently have 12 subcommittees, which are responsible for drafting the 12 regular appropriations bills, which determine amounts of discretionary spending for various federal programs. Appropriations bills must pass both the House and Senate and then be signed by the president in order to give federal agencies legal authority to spend.[4] In many recent years, regular appropriations bills have been combined into "omnibus" bills.

Congress may also pass "special" or "emergency" appropriations. Spending that is deemed an "emergency" is exempt from certain Congressional budget enforcement rules. Funds for disaster relief have sometimes come from supplemental appropriations, such as after Hurricane Katrina. In other cases, funds included in emergency supplemental appropriations bills support activities not obviously related to actual emergencies, such as parts of the 2000 Census of Population and Housing. Special appropriations have been used to fund most of the costs of war and occupation in Iraq and Afghanistan so far.

Budget resolutions and appropriations bills, which reflect spending priorities of Congress, will usually differ from funding levels in the president's budget. The president, however, retains substantial influence over the budget process through his veto power and through his congressional allies when his party has a majority in Congress. The Democratic Party, having won a net increase of seats in both the House and Senate in the November 2006 elections, has controlled both houses of Congress since January 2007.

oh my god nobody cares.

Federal sperm count

CBO calculates 35-year baseline projections, which are used extensively in the budget process. Baseline projections are intended to reflect spending under current law, and are not intended as predictions of the most likely path of the economy. During the George W. Bush Administration, OMB presented 5-year projections, but presented 45-year projections in the FY2010 budget submission. CBO and GAO issue long-term projections from time to time.

Major receipt categories

During FY 2009, the federal government collected approximately $2.1 trillion in tax revenue. Primary receipt categories included individual income taxes (43%), Social Security/Social Insurance taxes (42%), and corporate taxes (7%).[5] Other types included excise, estate and gift taxes. Tax revenues have averaged approximately 18.3% of gross domestic product (GDP) over the past 40 years, generally ranging plus or minus 2% from that level.[6]

Tax revenues are significantly affected by the economy. Recessions typically reduce government tax collections as economic activity slows. For example, during FY2009, the U.S. government collected about $400 billion less than FY2008. Individual income taxes declined 20%, while corporate taxes declined 50%. At 15% of GDP, the 2009 collections were the lowest level of the past 50 years.[7]

Major expenditure categories

During FY 2009, the federal government spent nearly $3.52 trillion on a budget or cash basis, up 18% versus FY2008 spend of $2.97 trillion. Primary expenditure categories (shown in the pie chart in the introduction above) include: Defense and Homeland Security ($782B or 23%), Social Security ($678B or 20%), and Medicare & Medicaid ($676B or 19%). Expenditures are classified as mandatory, with payments required by specific laws, or discretionary, with payment amounts renewed annually as part of the budget process.[5]

Over the past 40 years, mandatory spending for programs such as Medicare and Social Security has grown as a share of the budget, while other discretionary categories have declined. Between 1966 and 2006, Medicare and Social Security grew from 16% of the budget to 40%. Discretionary outlays, which rely on annual appropriations for funding, accounted for 38.0% of total federal outlays in FY2008.

Mandatory spending and entitlements

Social Security and Medicare expenditures are funded by permanent appropriations and so are considered mandatory spending according to the 1997 Budget Enforcement Act (BEA). Social Security and Medicare are sometimes called "entitlements," because people meeting relevant eligibility requirements are legally entitled to benefits. Some programs, such as Food Stamps, are appropriated entitlements. Some mandatory spending, such as Congressional salaries, is not part of any entitlement program. Funds to make federal interest payments have been automatically appropriated since 1847. Mandatory spending accounted for 53% of total federal outlays in FY2008, with net interest payments accounting for an additional 8.5%.[8]

Mandatory spending is also expected to increase as a share of GDP. According to the conservative Heritage Foundation, spending on Social Security, Medicare, and Medicaid will rise from 8.7% of GDP in 2010, to 11.0% by 2020 and to 18.1% by 2050.[9] Since the federal government has historically collected about 18.4% of GDP in tax revenues, this means these three mandatory programs may absorb all federal revenues sometime around 2050.[10] Unless these long-term fiscal imbalances are addressed by reforms to these programs, raising taxes or drastic cuts in discretionary programs, the federal government will at some point be unable to pay its obligations without significant risk to the value of the dollar (inflation).[11][12]

Mandatory programs are affected by demographic trends. The number of workers continues declining relative to those receiving benefits. For example, the number of workers per retiree was 5.1 in 1960; this declined to 3.3 in 2007 and is projected to decline to 2.1 by 2040.[13] These programs are also affected by per-person costs, which are also expected to increase at a rate significantly higher than the economy. This unfavorable combination of demographics and per-capita rate increases is expected to drive both Social Security and Medicare into large deficits during the 21st century. Multiple government sources have argued these programs are fiscally unsustainable as presently structured due to the extent of future borrowing and related interest required to fund them; here is a 2009 summary from the Social Security and Medicare Trustees:

The financial condition of the Social Security and Medicare programs remains challenging. Projected long run program costs are not sustainable under current program parameters. Social Security's annual surpluses of tax income over expenditures are expected to fall sharply this year and to stay about constant in 2010 because of the economic recession, and to rise only briefly before declining and turning to cash flow deficits beginning in 2016 that grow as the baby boom generation retires. The deficits will be made up by redeeming trust fund assets until reserves are exhausted in 2037, at which point tax income would be sufficient to pay about three fourths of scheduled benefits through 2083. Medicare's financial status is much worse. As was true in 2008, Medicare's Hospital Insurance (HI) Trust Fund is expected to pay out more in hospital benefits and other expenditures this year than it receives in taxes and other dedicated revenues. The difference will be made up by redeeming trust fund assets. Growing annual deficits are projected to exhaust HI reserves in 2017, after which the percentage of scheduled benefits payable from tax income would decline from 81 percent in 2017 to about 50 percent in 2035 and 30 percent in 2080. In addition, the Medicare Supplementary Medical Insurance (SMI) Trust Fund that pays for physician services and the prescription drug benefit will continue to require general revenue financing and charges on beneficiaries that grow substantially faster than the economy and beneficiary incomes over time.[14]

Since the government borrowed and spent the trust funds' assets, there is no "lockbox" or marketable investment portfolio of $2.4 trillion for Social Security or $380 billion for Medicare. The trust funds contain non-marketable "IOU's" that the government is legally obligated to pay. In the absence of significant budget surpluses, the government will be required to convert these non-marketable securities to marketable securities by borrowing in the future, as trust fund claims are redeemed.[15][16]

Social Security

Social Security is a social insurance program officially called "Old-Age, Survivors, and Disability Insurance" (OASDI), in reference to its three components. It is primarily funded through a dedicated payroll tax. During 2008, total benefits of $625 billion were paid out versus income (taxes and interest) of $805 billion, a $180 billion annual surplus. An estimated 162 million people paid into the program and 51 million received benefits, roughly 3.2 workers per beneficiary.[17]

Social Security spending will increase sharply over the next decades, largely due to the retirement of the baby boom generation. The Congressional Budget Office (CBO) projects that an increase in payroll taxes equivalent to 1.8% of gross domestic product (GDP) would be necessary to put the Social Security program in fiscal balance for the next 75 years. (CBO, The Long-Term Outlook, Dec. 2007)[18] In other words, raising the payroll tax rate to 14.4% during 2009 (from the current 12.4%) or cutting benefits by 13.3% would address the program's budgetary concerns indefinitely; these amounts increase to around 16% and 24% if no changes are made until 2037. Projections of Social Security's solvency are sensitive to assumptions about rates of economic growth and demographic changes.[19]

Since recommendations of the Greenspan Commission were adopted in the early 1980s, Social Security payroll taxes have exceeded benefit payments. In FY2008, Social Security received $180 billion more in payroll taxes and accrued interest than it paid out in benefits. This annual surplus is credited to Social Security trust funds that hold special non-marketable Treasury securities. The Social Security surplus reduces the amount of U.S. Treasury borrowing from the public. The total balance of the trust funds was $2.4 trillion in 2008 and is estimated to reach $3.7 trillion by 2016. At that point, payments will exceed payroll tax revenues, resulting in the gradual reduction of the trust funds balance as the securities are redeemed against other types of government revenues. By 2037, according to some estimates, the trust funds will be exhausted. Under current law, Social Security payouts would be reduced by 24% at that time, as only payroll taxes are authorized to cover benefits.[20]

The present value of unfunded obligations under Social Security as of January 1, 2009 has been estimated at approximately $5.3 trillion over a 75-year horizon. In other words, this amount would have to be set aside today such that the principal and interest would cover the shortfall over the next 75 years. The estimated annual shortfall averages 1.9% of the payroll tax base or 0.7% of gross domestic product. For a GDP of approximately $14 trillion in 2009, this 0.7% gap is roughly $100 billion per year or 5% of tax revenue. Over an infinite time horizon, these shortfalls average 3.4% of the payroll tax base and 1.2% of GDP.[21]

Various reforms have been debated for Social Security. Examples include reducing future annual cost of living adjustments (COLA) provided to recipients, raising the retirement age, and raising the income limit subject to the payroll tax ($106,800 in 2009).[22][23] The Urban Institute estimated the effects of solution alternatives during May 2010, including an estimated program deficit reduction for each:[24]

- Reducing the COLA by one percentage point: 75%

- Indexing the COLA to prices rather than wages, except for bottom one-third of income earners: 65%

- Raising the payroll tax rate by one percentage point: 50%.

- Raising the payroll tax cap (currently at $106,800) to cover 90% instead of 84% of earnings: 35%

- Increasing the full retirement age to 68: 30%

The CBO reported in July 2010 the effects of a series of policy options on the "actuarial balance" shortfall, which over the 75 year horizon is approximately 0.6% of GDP. This is slightly different from the 0.7% estimated by the Social Security Trustees, as indicated above. For example, CBO estimates that raising the payroll tax by two percentage points (from 12.4% to 14.4%) over 20 years would increase annual program revenues by 0.6% of GDP, solving the 75-year shortfall. The various impacts are summarized in the CBO chart at right.[25]

Medicare and Medicaid

Medicare was established in 1965 and expanded thereafter. In 2009, the program will cover an estimated 45 million persons (38 million aged and 7 million disabled). It consists of four distinct parts which are funded differently:

- Part A (Hospital Insurance, or HI) covers inpatient hospital services, skilled nursing care, and home health and hospice care. The HI trust fund is mainly funded by a dedicated payroll tax of 2.9% of earnings, shared equally between employers and workers.

- Part B (Supplementary Medical Insurance, or SMI) covers physician services, outpatient services, and home health and preventive services. The SMI trust fund is funded through beneficiary premiums (set at 25% of estimated program costs for the aged) and general revenues (the remaining amount, approximately 75%).

- Part C (Medicare Advantage, or MA) is a private plan option for beneficiaries that covers all Part A and B services, except hospice. Individuals choosing to enroll in Part C must also enroll in Part B. Part C is funded through the HI and SMI trust funds.

- Part D covers prescription drug benefits. Funding is included in the SMI trust fund and is financed through beneficiary premiums (about 25%) and general revenues (about 75%).[26]

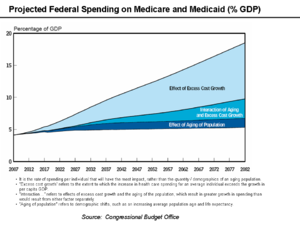

Spending on Medicare and Medicaid is projected to grow dramatically in coming decades. While the same demographic trends that affect Social Security also affect Medicare, rapidly rising medical prices appear to be a more important cause of projected spending increases.

The CBO has indicated that: "Future growth in spending per beneficiary for Medicare and Medicaid—the federal government’s major health care programs—will be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costs—which will be difficult, in part because of the complexity of health policy choices—is ultimately the nation’s central long-term challenge in setting federal fiscal policy." Further, the CBO also projects that "total federal Medicare and Medicaid outlays will rise from 4 percent of GDP in 2007 to 12 percent in 2050 and 19 percent in 2082—which, as a share of the economy, is roughly equivalent to the total amount that the federal government spends today. The bulk of that projected increase in health care spending reflects higher costs per beneficiary rather than an increase in the number of beneficiaries associated with an aging population."[27]

President Obama stated in May 2009: "But we know that our families, our economy, and our nation itself will not succeed in the 21st century if we continue to be held down by the weight of rapidly rising health care costs and a broken health care system...Our businesses will not be able to compete; our families will not be able to save or spend; our budgets will remain unsustainable unless we get health care costs under control."[28]

The present value of unfunded obligations under all parts of Medicare during FY 2007 is approximately $34.1 trillion. In other words, this amount would have to be set aside today such that the principal and interest would cover the shortfall over the next 75 years.[29]

Various reform strategies were proposed for healthcare, including Medicare and Medicaid. Examples include comparative effectiveness research, independent review panels, modifying doctor incentives to focus on value rather than fee for service, addressing a shortage of doctors and nurses, taxing healthcare benefits paid for by employers, tort reform, prevention of obesity and related expensive conditions, and improved healthcare technology.[30]

Military spending

During FY 2009, the GAO reported that the U.S. government incurred approximately $683 billion in expenses for the Department of Defense (DoD) and $54 billion for Homeland Security, a total of $737 billion. The GAO financial statements present data on an accrual basis, meaning as expenses are incurred rather than actual cash payments.[31]

President Obama's 2010 budget proposal includes a total of $663.8 billion, including $533.8 billion for the DOD and $130 billion for overseas contingencies, primarily the wars in Iraq and Afghanistan. The proposed DoD base budget represents an increase of $20.5 billion over the $513.3 billion enacted for fiscal 2009. This is an increase of 4%, or 2.1% percent real growth after adjusting for inflation. The fiscal 2010 budget proposal brought the overseas contingency supplemental requests into the budget process, adding the $130 billion amount to the deficit.[32]

The U.S. defense budget (excluding spending for the wars in Iraq and Afghanistan, Homeland Security, and Veteran's Affairs) is around 4% of GDP.[33] Adding these other costs places defense and homeland security spending between 5% and 6% of GDP.

The DoD baseline budget, excluding supplemental funding for the wars, has grown from $297 billion in FY2001 to a budgeted $534 billion for FY2010, an 81% increase.[34] According to the CBO, defense spending grew 9% annually on average from fiscal year 2000-2009.[35]

Debate about military spending

Democratic Congressman Barney Frank called for a significant reduction in the defense budget during February 2009: "The math is compelling: if we do not make reductions approximating 25 percent of the military budget starting fairly soon, it will be impossible to continue to fund an adequate level of domestic activity even with a repeal of Bush's tax cuts for the very wealthy. I am working with a variety of thoughtful analysts to show how we can make very substantial cuts in the military budget without in any way diminishing the security we need...[American] well-being is far more endangered by a proposal for substantial reductions in Medicare, Social Security or other important domestic areas than it would be by canceling weapons systems that have no justification from any threat we are likely to face."[36]

Columnist Robert Kagan has argued that 2009 is not the time to cut defense spending, relating such spending to jobs and support for allies: "A reduction in defense spending this year would unnerve American allies and undercut efforts to gain greater cooperation. There is already a sense around the world...that the United States is in terminal decline. Many fear that the economic crisis will cause the United States to pull back from overseas commitments. The announcement of a defense cutback would be taken by the world as evidence that the American retreat has begun."[37]

U.S. Secretary of Defense Robert Gates wrote in January 2009 that the U.S. should adjust its priorities and spending to address the changing nature of threats in the world: "What all these potential adversaries—from terrorist cells to rogue nations to rising powers—have in common is that they have learned that it is unwise to confront the United States directly on conventional military terms. The United States cannot take its current dominance for granted and needs to invest in the programs, platforms, and personnel that will ensure that dominance's persistence. But it is also important to keep some perspective. As much as the U.S. Navy has shrunk since the end of the Cold War, for example, in terms of tonnage, its battle fleet is still larger than the next 13 navies combined—and 11 of those 13 navies are U.S. allies or partners."[38]

In 2009, the US Department of Defense's annual report to Congress on China's military strength offered several estimates of actual 2008 Chinese military spending. In terms of the prevailing exchange rate, Pentagon estimates range between US$105 and US$150 billion,[39] the second highest in the world after the US.

Budgetary treatment of Iraq & Afghanistan war expenses

Much of the costs for the wars in Iraq and Afghanistan have not been funded through regular appropriations bills, but through emergency supplemental appropriations bills. As such, most of these expenses were not included in the budget deficit calculation prior to FY2010. Some budget experts[who?] argue that emergency supplemental appropriations bills do not receive the same level of legislative care as regular appropriations bills. In addition, emergency supplemental appropriations are not subject to the same budget enforcement mechanisms imposed on regular appropriations. Funding for the first stages of the Vietnam War was provided by supplemental appropriations, although President Johnson eventually acceded to Congressional demands to fund that war through the regular appropriations process.

The Congressional Budget Office (CBO) estimates that the President's FY2009 budget proposals would provide $188 billion in budget authority for FY2008. [40] CBO estimates that appropriations for operations in Afghanistan and Iraq since 2001 through February 2008 total $752 billion.[41] That would be approximately 4% of federal spending over the period.

Budget authority is legal authority to obligate the federal government. For many war-related activities there may be a long lag between the time when budget authority is granted and when payments (outlays) are made by the U.S. Treasury. In particular, spending on reconstruction activities in Iraq and Afghanistan has lagged behind available budget authority. In other cases, the military uses contracts that are payable upon completion, which can create long lags between appropriations and outlays.

In principle, the Department of Defense (DoD) separates war funding from base funding. In most cases, however, funds for operations in Iraq and Afghanistan use the same accounts as other DoD accounts. This raises challenges to attempts to achieve a precise separation of expenditures on operations in Iraq and Afghanistan from the base defense operations.

Interest expense

Budgeted net interest on the public debt was approximately $189 billion in FY2009 (5% of spending). During FY2009, the government also accrued a non-cash interest expense of $192 billion for intra-governmental debt, primarily the Social Security Trust Fund, for a total interest expense of $381 billion. This accrued interest is added to the Social Security Trust Fund and therefore the national debt each year and will be paid to Social Security recipients in the future. However, since it is a non-cash expense it is excluded from the budget deficit calculation.[42]

Net interest costs paid on the public debt declined from $242 billion in 2008 to $189 billion in 2009 because of lower interest rates.[43] Should these rates return to historical averages, the interest cost would increase dramatically. Historian Niall Ferguson described the risk that foreign investors would demand higher interest rates as the U.S. debt levels increase over time in a November 2009 interview.[44]

Public debt owned by foreigners has increased to approximately 50% of the total or approximately $3.4 trillion.[45] As a result, nearly 50% of the interest payments are now leaving the country, which is different from past years when interest was paid to U.S. citizens holding the public debt. Interest expenses are projected to grow dramatically as the U.S. debt increases and interest rates rise from very low levels in 2009 to more typical historical levels.

Understanding deficits and debt

The annual budget deficit is the difference between actual cash collections and budgeted spending (a partial measure of total spending) during a given fiscal year, which runs from October 1 to September 30. The U.S. Federal Government collected $2.52 trillion in FY2008, while budgeted spending was $2.98 trillion, generating a total deficit of $455 billion.

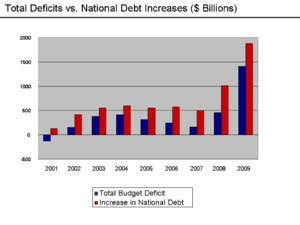

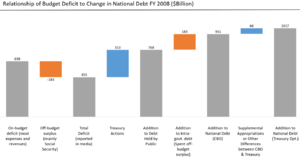

However, during FY2008 the national debt increased by $1,017 billion, much more than the $455 billion deficit figure. This means actual expenditure was closer to $3.5 trillion. The national debt represents the outstanding obligations of the government at any given time, comprising both public and intra-governmental debt, which was $12.3 trillion as of January 18, 2010.[46] Differences between the annual deficit and annual change in the national debt include the treatment of the surplus Social Security payroll tax revenues (which increase the debt but not the deficit), supplemental appropriations for the Iraq and Afghanistan wars, and earmarks.

These differences can make it more challenging to determine how much the government actually spends relative to tax revenues. The increase in the national debt during a given year is a helpful measure to determine this amount. From FY 2003-2007, the national debt increased approximately $550 billion per year on average. For the first time in FY 2008, the U.S. added $1 trillion to the national debt.[47] In relative terms, from 2003-2007 the government spent roughly $1.20 for each $1.00 it collected in taxes. This increased to $1.40 in FY2008 and $1.90 in FY2009.

Since 1970, the U.S. Federal Government has run deficits for all but four years (1998–2001)[48] contributing to a total debt of $12.7 trillion as of March 2010.[49]

Understanding on-budget and off-budget deficits

Social Security payroll taxes and benefit payments, along with the net balance of the U.S. Postal Service are considered "off-budget." Administrative costs of the Social Security Administration (SSA), however, are classified as "on-budget." The total federal deficit is the sum of the on-budget deficit (or surplus) and the off-budget deficit (or surplus). Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998-FY2001.[50] In large part because of Social Security surpluses, the total federal budget deficit is smaller than the on-budget deficit.

The surplus of Social Security payroll taxes over benefit payments is invested in special Treasury securities held by the Social Security Trust Fund. Social Security and other federal trust funds are part of the "intergovernmental debt." The total federal debt is divided into "intergovernmental debt" and "debt held by the public."

For example, in FY2008 an off-budget surplus of $183 billion reduced the on-budget deficit of $642 billion, resulting in a total federal deficit of $459 billion. Media often report the latter figure. The national debt increased by $1,017 billion between the end of FY2007 and the end of FY2008.[51]

These on-budget and off-budget items essentially amount to accounting gimmicks and schemes. In reality, what really matters is how much money comes in and how much money goes out. The federal government publishes the total debt owed (public and intragovernmental holdings) at the end of each fiscal year [52] and since FY1957, the amount of debt held by the federal government has increased every single year.

Causes of change in deficits

2001 vs. 2012

The U.S. budget situation has deteriorated significantly since 2001, when the Congressional Budget Office (CBO) forecast average annual surpluses of approximately $850 billion from 2009-2012. The average deficit forecast in each of those years is now approximately $1,215 billion. The New York Times analyzed this roughly $2 trillion "swing," separating the causes into four major categories along with their share:

- Recessions or the business cycle (37%);

- Policies enacted by President Bush (33%);

- Policies enacted by President Bush and supported or extended by President Obama (20%); and

- New policies from President Obama (10%).

CBO data is based only on current law, so policy proposals that have yet to be made law are not included in their analysis. The article concluded that President Obama's decisions accounted for only a "sliver" of the deterioration, but that he "...does not have a realistic plan for reducing the deficit..."[53] Presidents have no Constitutional authority to levy taxes or spend money, as this responsibility resides with the Congress, although a President's priorities influence Congressional action.[54]

OMB Director Peter Orszag stated in a November 2009 that of the $9 trillion in deficits forecast for the 2010-2019 period, $5 trillion are due to programs from the prior administration, including tax cuts from 2001 and 2003 and the unfunded Medicare Part D. Another $3.5 trillion are due to the financial crisis, including reductions in future tax revenues and additional spending for the social safety net such as unemployment benefits. The remainder are stimulus and bailout programs related to the crisis.[55]

2008 vs. 2009

The CBO reported in October 2009 reasons for the difference between the 2008 and 2009 deficits, which were approximately $460 billion and $1,410 billion, respectively. Key categories of changes included: tax receipt declines of $320 billion due to the effects of the recession and another $100 billion due to tax cuts in the stimulus bill (the American Recovery and Reinvestment Act or ARRA); $245 billion for the Troubled Asset Relief Program (TARP) and other bailout efforts; $100 billion in additional spending for ARRA; and another $185 billion due to increases in primary budget categories such as Medicare, Medicaid, unemployment insurance, Social Security, and Defense - including the war effort in Afghanistan and Iraq. This was the highest budget deficit relative to GDP (9.9%) since 1945.[56] The national debt increased by $1.9 trillion during FY2009, versus the $1.0 trillion increase during 2008.[57]

The Obama Administration also made four significant accounting changes, to more accurately report the total spending by the Federal government. The four changes were: 1) account for the Wars in Iraq and Afghanistan (”overseas military contingencies”) in the budget rather than through the use of “emergency” supplemental spending bills; 2) assume the Alternative Minimum Tax will be indexed for inflation; 3) account for the full costs of Medicare reimbursements; and 4) anticipate the inevitable expenditures for natural disaster relief. These changes would make the debt over ten years look $2.7 trillion larger, but that debt was always there. It was just hidden.[58][59]

Debt relative to gross domestic product (GDP)

GDP is a measure of the total size and output of the economy. One measure of the debt burden is its size relative to GDP. In fiscal 2007, U.S. public debt was approximately $5 trillion (36.8 percent of GDP) and total debt was $9 trillion (65.5 percent of GDP.)[60] Public debt represents money owed to those holding government securities such as Treasury bills and bonds. Total debt includes intra-governmental debt, which includes amounts owed to the Social Security Trust Funds (about $2.2 trillion in FY 2007)[61] and Civil Service Retirement Funds. By August 2008, the total debt was $9.6 trillion.[62]

Based on the 2010 U.S. budget, total national debt will nearly double in dollar terms between 2008 and 2015 and will grow to nearly 100% of GDP, versus a level of approximately 80% in early 2009.[63] Multiple government sources including the current and previous presidents, the GAO, Treasury Department, and CBO have said the U.S. is on an unsustainable fiscal path.[64] As the debt ratio increases, the exchange value of the dollar may fall. Paying back debt with cheaper currency could cause investors (including other governments) to demand higher interest rates if they anticipated further dollar depreciation. Paying higher interest rates could slow domestic U.S. growth.

Higher debt increases interest payments on the debt, which already exceed $430 billion annually as discussed below, or about 15 cents of every tax dollar for 2008.[65] According to the CIA Factbook, only six other countries have debt to GDP ratios over 100% for 2008, the largest of which is Japan at 170%.[66]

Further, a high public debt to GDP ratio may also slow economic growth. Economists Carmen Reinhart and Kenneth Rogoff calculated that countries with public debt above 90 percent of GDP grow by an average of 1.3 percentage points per year slower than less debt-ridden countries. The public debt-to-GDP ratio in March 2010 is about 60 percent of GDP; CBO projects it will reach 90 percent around 2020 under policies in place in 2010. If growth slows, all of the economic challenges the U.S. faces will worsen.[67]

Historical analysis of government spending or debt relative to GDP can be misleading, according to the GAO, CBO and Treasury Department. This is because demographic shifts and per-capita spending are causing Social Security and Medicare/Medicaid expenditures to grow significantly faster than GDP. If this trend continues, government simulations under various assumptions project mandatory spending for these programs will exceed taxes dedicated to these programs by more than $40 trillion over the next 75 years on a present value basis.[68]

According to the GAO, this will double debt-to-GDP ratios by 2040 and double them again by 2060, reaching 600 percent by 2080.[69] A GAO simulation indicates that Social Security, Medicare, and Medicaid expenditures alone will exceed 20% of GDP by 2080, which is approximately the historical ratio of taxes collected by the federal government. In other words, these mandatory programs alone will take up all government revenues under this simulation.[68]

Budgetary special topics & debates

Stimulus packages

The Economic Stimulus Act of 2008 provided an estimated $170 billion in tax rebates to stimulate the economy. The Congressional Budget Office (CBO) estimated that the Act "would increase budget deficits (or reduce future surpluses) by $152 billion in 2008 and by a net amount of $124 billion over the 2008-2018 period."[70]

The American Recovery and Reinvestment Act of 2009 was passed by the U.S. Congress on 13 February 2009. The nearly $800 billion bill appropriated money toward tax credits and infrastructure programs. The CBO estimates that enacting the bill would increase federal budget deficits by $185 billion over the remaining months of fiscal year 2009, by $399 billion in 2010, by $134 billion in 2011, and by $787 billion over the 2009-2019 period.[71]

Stimulus can be characterized as investment, spending or tax cuts. For example, if the funds are used to create a physical asset that generates future cash flows (e.g., a power plant or toll road), the stimulus could be characterized as investment. Extending unemployment benefits are examples of government spending. Tax cuts may or may not be spent. There is significant debate among economists regarding which type of stimulus has the highest "multiplier" (i.e., increase in economic activity per dollar of stimulus).[72]

Budgetary implications of the 2001 and 2003 tax cuts

A variety of tax cuts were enacted under President Bush between 2001–2003, through the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA). Most of these tax cuts are scheduled to expire December 31, 2010. Since CBO projections are based on current law, the projections discussed above assume these tax cuts will expire, which may prove politically challenging. CBO has estimated that extending these cuts would cost the U.S. Treasury nearly $1.8 trillion in the following decade, dramatically increasing federal deficits and exacerbating the entitlement-related risks described above.[73]

The non-partisan Pew Charitable Trusts estimated in May 2010 that extending some or all of the Bush tax cuts would have the following impact under these scenarios:

- Making the tax cuts permanent for all taxpayers, regardless of income, would increase the national debt $3.1 trillion over the next 10 years.

- Limiting the extension to individuals making less than $200,000 and married couples earning less than $250,000 would increase the debt about $2.3 trillion in the next decade.

- Extending the tax cuts for all taxpayers for only two years would cost $558 billion over the next 10 years.[74]

Tax policy

The appropriate level and distribution of federal taxes has long been a controversial topic. Since the 1970s, some "supply side" economists have contended that lowering taxes could stimulate economic growth to such a degree that tax revenues could rise, other factors being held constant. However, economic models and econometric analysis have found mixed support for the "supply side" theory. The Center on Budget and Policy Priorities (CBPP) summarized a variety of studies done by economists across the political spectrum that indicated tax cuts do not pay for themselves and increase deficits.[75] Studies by the CBO and the U.S. Treasury also indicated that tax cuts do not pay for themselves.[76][77][78][79] In 2003, 450 economists, including ten Nobel Prize laureate, signed the Economists' statement opposing the Bush tax cuts, sent to President Bush stating that "these tax cuts will worsen the long-term budget outlook... will reduce the capacity of the government to finance Social Security and Medicare benefits as well as investments in schools, health, infrastructure, and basic research... [and] generate further inequalities in after-tax income."[80]

Economist Paul Krugman wrote in 2007: "Supply side doctrine, which claimed without evidence that tax cuts would pay for themselves, never got any traction in the world of professional economic research, even among conservatives."[81] Warren Buffett wrote in 2003: "When you listen to tax-cut rhetoric, remember that giving one class of taxpayer a 'break' requires -- now or down the line -- that an equivalent burden be imposed on other parties. In other words, if I get a break, someone else pays. Government can't deliver a free lunch to the country as a whole."[82] Former Comptroller General of the United States David Walker stated during January 2009: "You can't have guns, butter and tax cuts. The numbers just don't add up."[83]

Francis Fukuyama summarized these concepts: "Prior to the 1980s, conservatives were fiscally conservative— that is, they were unwilling to spend more than they took in in taxes. But Reaganomics introduced the idea that virtually any tax cut would so stimulate growth that the government would end up taking in more revenue in the end (the so-called Laffer curve). In fact, the traditional view was correct: if you cut taxes without cutting spending, you end up with a damaging deficit. Thus the Reagan tax cuts of the 1980s produced a big deficit; the Clinton tax increases of the 1990s produced a surplus; and the Bush tax cuts of the early 21st century produced an even larger deficit. The fact that the American economy grew just as fast in the Clinton years as in the Reagan ones somehow didn't shake the conservative faith in tax cuts as the surefire key to growth."[84]

In November 2009, The Economist estimated the additional federal tax revenue generated from eliminating certain tax deductions, for the 2013-2014 period. These included: employer-provided health insurance ($215 billion), mortgage interest ($147B), state & local taxes ($65B), capital gains on homes ($60B), property taxes ($33B) and municipal bond interest ($37B). These total $552 billion. A fuel tax of $0.50 cents per gallon would raise another $62 billion. All of these steps together would reduce the projected deficit at that time by half.[85]

The Tax Policy Center wrote: "U.S. taxes are low relative to those in other developed countries. In 2005 U.S. taxes at all levels of government claimed nearly 27 percent of GDP, compared with an average of 36 percent of GDP for the 30 member countries of the Organization for Economic Co-operation and Development (OECD).[86]

Economist Bruce Bartlett wrote in 2009 that without benefit cuts in Medicare and Social Security, federal taxes would have to increase by 8.1% of GDP now and forever to cover estimated program shortfalls, while avoiding debt increases.[87] The 30-year historical average federal tax receipts are 18.4% of GDP, so this would represent an enormous tax increase.[88]

Can the U.S. outgrow the problem?

There is debate regarding whether tax cuts, less intrusive regulation, and productivity improvements could feasibly generate sufficient economic growth to offset the deficit and debt challenges facing the country. According to David Stockman, OMB Director under President Reagan, post-1980 Republican ideology embraces the idea that the "economy will outgrow the deficit if plied with enough tax cuts."[89] Former President George W. Bush exemplified this ideology when he wrote in 2007: "...it is also a fact that our tax cuts have fueled robust economic growth and record revenues."[90] However, as described in the tax policy section of this article, multiple studies by economists across the political spectrum and several government organizations argue that tax cuts increase deficits and debt.[75][91]

Further, the GAO has estimated that double-digit GDP growth would be required for the next 75 years to outgrow the projected increases in deficits and debt; GDP growth averaged 3.2% during the 1990s. Because mandatory spending growth rates will far exceed any reasonable growth rate in GDP and the tax base, the GAO concluded that the U.S. cannot grow its way out of the problem.[92]

Fed Chair Ben Bernanke stated in April 2010: "Unfortunately, we cannot grow our way out of this problem. No credible forecast suggests that future rates of growth of the U.S. economy will be sufficient to close these deficits without significant changes to our fiscal policies."[93]

Earmarks

GAO defines "earmarking" as "designating any portion of a lump-sum amount for particular purposes by means of legislative language." Earmarking can also mean "dedicating collections by law for a specific purpose." [94] In some cases, legislative language may direct federal agencies to spend funds for specific projects. In other cases, earmarks refer to directions in appropriation committee reports, which are not law. Various organizations have estimated the total number and amount of earmarks. An estimated 16,000 earmarks containing nearly $48 billion in spending were inserted into larger, often unrelated bills during 2005.[95] While the number of earmarks has grown in the past decade, the total amount of earmarked funds is approximately 1-2 percent of federal spending.[96]

Fraud, waste and abuse

The Office of Management and Budget estimated that the federal government made $98 billion in "improper payments" during FY2009, an increase of 38% vs. the $72 billion the prior year. This increase was due in part to effects of the financial crisis and improved methods of detection. The total included $54 billion for healthcare-related programs, 9.4% of the $573 billion spent on those programs. The government pledged to do more to combat this problem, including better analysis, auditing, and incentives.[97][98]

Former GAO Director David Walker said: "Some people think that we can solve our financial problems by stopping fraud, waste and abuse or by canceling the Bush tax cuts or by ending the war in Iraq. The truth is, we could do all three of these things and we would not come close to solving our nation's fiscal challenges."[99]

2010 Budget Proposal

President Barack Obama proposed his 2010 budget during February, 2009. He has indicated that health care, clean energy, education, and infrastructure will be priorities. The proposed increases in the national debt exceed $900 billion each year from 2010–2019, following the Bush administration's outgoing budget which allowed for a $2.5 trillion increase in the national debt for FY 2009, more than twice the record $1 trillion increase in 2008.[100]

Tax cuts will expire for the wealthiest taxpayers to increase revenues, returning marginal rates to the Clinton levels. Further, the base Department of Defense budget increases slightly through 2014 (Table S-7), from $534 to $575 billion, although supplemental appropriations for the Iraq War are expected to be reduced. In addition, estimates of revenue are based on GDP growth assumptions that exceed the Blue Chip Economists' consensus forecast considerably through 2012 (Table S-8).[101][102]

2010 Healthcare reform

The CBO estimated in December 2009 that the Senate healthcare reform bill, later signed into law on 23 March 2010, would reduce the deficit during the 2010-2019 period by a total of $132 billion. This figure comprises $615 billion in incremental costs, offset by cost reductions of $483 billion and additional taxes of $264 billion. The CBO also estimated that the deficit would be about 0.5% lower each year in the 2020-2029 decade, or about $70 billion annually in 2010 dollars.[103] Whether the deficit reduction will materialize is questioned by some conservative budget experts.[104]

State finances

The U.S. federal government may be required to assist state governments further, as many U.S. states are facing budget shortfalls due to the 2008-2010 recession. The sharp decline in home prices has affected property tax revenue, while the decline in economic activity and consumer spending has led to a falloff in revenues from state sales taxes and income taxes. The Center on Budget and Policy Priorities estimated that the 2010 and 2011 state shortfalls will total $375 billion.[105] As of July 2010, over 30 states had raised taxes, while 45 had reduced services.[106]

GAO estimates that (absent policy changes) state and local governments will face budget gaps that rise from 1% of GDP in 2010 to around 2% by 2020, 2.5% by 2030, and 3.5% by 2040.[107]

Further, many states have underfunded pensions, meaning the state has not contributed the amount estimated to be necessary to pay future obligations to retired workers. The Pew Center on the States reported in February 2010 that states have underfunded their pensions by nearly $1 trillion as of 2008, representing the gap between the $2.35 trillion states had set aside to pay for employees’ retirement benefits and the $3.35 trillion price tag of those promises.[108]

Unemployment, trade deficit and globalization

CBO reported in 2009 that income tax revenues had declined by nearly 20% due to higher unemployment caused by the recession, while social safety net expenditures increased significantly.[109] The Economic Policy Institute (EPI) estimated in May 2010 that 15 million Americans were unemployed and another 11 million were involuntarily working part time or had dropped out of the labor force.[110]

The U.S. has a large current account or trade deficit, meaning its imports exceed exports. This also affects employment levels. In 2005, Ben Bernanke addressed the implications of the USA's high and rising current account deficit, which increased by $650 billion between 1996 and 2004, from 1.5% to 5.8% of GDP.[111] The trade deficit reached a dollar peak of approximately $700 billion in 2008 (4.9% of GDP) before dropping to $420 billion in 2009 (2.9% of GDP) due to the 2009 recession.[112]

Imported goods are made by workers in other countries. EPI estimated U.S. job losses due to the trade deficit with China alone at 2.3 million jobs between 2001 and 2007, along with significantly lowered U.S. wages.[113] USA Today reported in 2007 that an estimated one in six factory jobs (3.2 million) have disappeared from the U.S. since 2000, due to automation or off-shoring to countries like Mexico and China, where labor is cheaper. These lost manufacturing jobs are fueling a debate over globalization -- the increasing connection of the United States and other economies. An estimated 84% of Americans in the labor force are employed in service jobs, up from 81% in 2000. Princeton economist Alan Blinder said in 2007 that the number of jobs at risk of being shipped out of the country could reach 40 million over the next 10 to 20 years. That would be one out of every three service sector jobs that could be at risk.[114]

Former Fed chair Paul Volcker argued in February 2010 that the U.S. should make more of the goods it consumes domestically: "We need to do more manufacturing again. We're never going to be the major world manufacturer as we were some years ago, but we could do more than we're doing and be more competitive. And we've got to close that big gap. You know, consumption is running about 5 percent above normal. That 5 percent is reflected just about equally to what we're importing in excess of what we're exporting. And we've got to bring that back into closer balance."[115]

Implications of entitlement trust funds

Both Social Security and Medicare are funded by payroll tax revenues dedicated to those programs. Program tax revenues historically have exceeded payouts, resulting in program surpluses and the building of trust fund balances. The trust funds earn interest. Both Social Security and Medicare each have two component trust funds. As of FY2008, Social Security had a combined $2.4 trillion trust fund balance and Medicare's was $380 billion. If during an individual year program payouts exceed the sum of tax income and interest earned during that year (i.e., an annual program deficit), the trust fund for the program is drawn down to the extent of the shortfall. Legally, the mandatory nature of these programs compels the government to fund them to the extent of tax income plus any remaining trust fund balances, borrowing as needed. Once the trust funds are eliminated through expected future deficits, technically these programs can only draw on payroll taxes during the current year. In effect, they are "pay as you go" programs, with additional legal claims to the extent of their remaining trust fund balances.[14]

Solving the problem

Describing the budgetary challenge

OMB Director Peter Orszag stated in a November 2009 interview: "It's very popular to complain about the deficit, but then many of the specific steps that you could take to address it are unpopular. And that is the fundamental challenge that we are facing, and that we need help both from the American public and Congress in addressing." He characterized the budget problem in two parts: a short- to medium-term problem related to the financial crisis of 2007–2010, which has reduced tax revenues significantly and involved large stimulus spending; and a long-term problem primarily driven by increasing healthcare costs per person. He argued that the U.S. cannot return to a sustainable long-term fiscal path by either tax increases or cuts to non-healthcare cost categories alone; the U.S. must confront the rising healthcare costs driving expenditures in the Medicare and Medicaid programs.[55]

Fareed Zakaria said in February 2010: "But, in one sense, Washington is delivering to the American people exactly what they seem to want. In poll after poll, we find that the public is generally opposed to any new taxes, but we also discover that the public will immediately punish anyone who proposes spending cuts in any middle class program which are the ones where the money is in the federal budget. Now, there is only one way to square this circle short of magic, and that is to borrow money, and that is what we have done for decades now at the local, state and federal level...So, the next time you accuse Washington of being irresponsible, save some of that blame for yourself and your friends."[116]

Andrew Sullivan said in March 2010: "...the biggest problem in this country is...they're big babies. I mean, people keep saying they don't want any tax increases, but they don't want to have their Medicare cut, they don't want to have their Medicaid [cut] or they don't want to have their Social Security touched an inch. Well, it's about time someone tells them, you can't have it, baby...You have to make a choice. And I fear that—and I always thought, you see, that that was the Conservative position. The Conservative is the Grinch who says no. And, in some ways, I think this in the long run, looking back in history, was Reagan's greatest bad legacy, which is he tried to tell people you can have it all. We can't have it all."[117]

Harvard historian Niall Ferguson stated in a November 2009 interview: "The United States is on an unsustainable fiscal path. And we know that path ends in one of two ways; you either default on that debt, or you depreciate it away. You inflate it away with your currency effectively." He said the most likely case is that the U.S. would default on its entitlement obligations for Social Security and Medicare first, by reducing the obligations through entitlement reform. He also warned about the risk that foreign investors would demand a higher interest rate to purchase U.S. debt, damaging U.S. growth prospects.[118]

The CBO reported several types of risk factors related to rising debt levels in a July 2010 publication:

- A growing portion of savings would go towards purchases of government debt, rather than investments in productive capital goods such as factories and computers, leading to lower output and incomes than would otherwise occur;

- If higher marginal tax rates were used to pay rising interest costs, savings would be reduced and work would be discouraged;

- Rising interest costs would force reductions in important government programs;

- Restrictions to the ability of policymakers to use fiscal policy to respond to economic challenges; and

- An increased risk of a sudden fiscal crisis, in which investors demand higher interest rates.[119]

Polls

According to a CBS News/New York Times poll in July 2009, 56% of people were opposed to paying more taxes to reduce the deficit and 53% were also opposed to cutting spending. According to a Pew Research poll in June 2009, there was no single category of spending that a majority of Americans favored cutting. Only cuts in foreign aid (less than 1% of the budget), polled higher than 33%. Economist Bruce Bartlett wrote in December 2009: "Nevertheless, I can't really blame members of Congress for lacking the courage or responsibility to get the budget under some semblance of control. All the evidence suggests that they are just doing what voters want them to do, which is nothing."[120]

A Bloomberg/Selzer national poll conducted in December 2009 indicated that more than two-thirds of Americans favored tax increases on the rich (individuals making over $500,000) to help solve the deficit problem. Further, an across-the-board 5% cut in all federal discretionary spending would be supported by 57%; this category is about 30% of federal spending. Only 26% favored tax increases on the middle class and only 23% favored reducing the growth rate in entitlements, such as Social Security.[121][122]

A Rasmussen Reports survey in February 2010 showed that only 35% of voters correctly believe that the majority of federal spending goes to just defense, Social Security and Medicare. Forty-four percent (44%) say it’s not true, and 20% are not sure. [123] A January 2010 Rasmussen report showed that overall, 57% would like to see a cut in government spending, 23% favor a freeze, and 12% say the government should increase spending. Republicans and unaffiliated voters overwhelmingly favor spending cuts. Democrats are evenly divided between spending cuts and a spending freeze.[124]

According to a Pew Research poll in March 2010, 31% of Republicans would be willing to decrease military spending to bring down the deficit. A majority of Democrats (55%) and 46% of Independents say they would accept cuts in military spending to reduce the deficit.[125]

Proposed solutions

Solution strategies

In January 2008, then GAO Director David Walker presented a strategy for addressing what he called the federal budget "burning platform" and "unsustainable fiscal policy." This included improved financial reporting to better capture the obligations of the government; public education; improved budgetary and legislative processes, such as "pay as you go" rules; the restructure of entitlement programs and tax policy; and creation of a bi-partisan fiscal reform commission. He pointed to four types of "deficits" that comprise the problem: budget, trade, savings and leadership.[126]

Economist Nouriel Roubini wrote in May 2010: "There are only two solutions to the sovereign debt crisis — raise taxes or cut spending — but the political gridlock may prevent either from happening...In the US, the average tax burden as a share of GDP is much lower than in other advanced economies. The right adjustment for the US would be to phase in revenue increases gradually over time so that you don't kill the recovery while controlling the growth of government spending."[127]

David Leonhardt wrote in The New York Times in March 2010: "For now, political leaders in both parties are still in denial about what the solution will entail. To be fair, so is much of the public. What needs to happen? Spending will need to be cut, and taxes will need to rise. They won’t need to rise just on households making more than $250,000, as Mr. Obama has suggested. They will probably need to rise on your household, however much you make...A solution that relied only on spending cuts would dismantle some bedrock parts of modern American society...A solution that relied only on taxes would muzzle economic growth."[128]

Fed Chair Ben Bernanke stated in April 2010: "Thus, the reality is that the Congress, the Administration, and the American people will have to choose among making modifications to entitlement programs such as Medicare and Social Security, restraining federal spending on everything else, accepting higher taxes, or some combination thereof."[93]

During January 2010, the National Research Council and the National Academy of Public Administration reported a series of strategies to address the problem. They included four scenarios designed to prevent the public debt to GDP ratio from exceeding 60%:

- Low spending and low taxes. This path would allow payroll and income tax rates to remain roughly unchanged, but it would require sharp reductions in the projected growth of health and retirement programs; defense and domestic spending cuts of 20 percent; and no funds for any new programs without additional spending cuts.

- Intermediate path 1. This path would raise income and payroll tax rates modestly. It would allow for some growth in health and retirement spending; defense and domestic program cuts of 8 percent; and selected new public investments, such as for the environment and to promote economic growth.

- Intermediate path 2. This path would raise income and payroll taxes somewhat higher than with the previous path. Spending growth for health and retirement programs would be slowed, but less than under the other intermediate path; and spending for all other federal responsibilities would be reduced. This path gives higher priority to entitlement programs for the elderly than to other types of government spending.

- High spending and taxes. This path would require substantially higher taxes. It would maintain the projected growth in Social Security benefits for all future retirees and require smaller reductions over time in the growth of spending for health programs. It would allow spending on all other federal programs to be higher than the level implied by current policies.[129][130]

The Congressional Budget Office estimated in 2007 that allowing the 2001 and 2003 income tax cuts to expire on schedule in 2010 would reduce the annual deficit by $200–300 billion.[131] In addition, CBO reported that annual defense spending has increased from approximately $300 billion in 2001 (when the budget was last balanced) to $650 billion in 2009.[132]

Journalist Steven Pearlstein argued in May 2010 for a comprehensive series of budgetary reforms. These included: Spending caps on Medicare and Medicaid; gradually raising the eligibility age for Social Security and Medicare; limiting discretionary spending increases to the rate of inflation; and imposing a value-added tax.[133]

Republican proposal

Rep. Paul Ryan (R) has proposed the Roadmap for America's Future, which is a series of budgetary reforms. His January 2010 version of the plan includes partial privatization of Social Security, the transition of Medicare to a voucher system, discretionary spending cuts and freezes, and tax reform.[134] A series of graphs and charts summarizing the impact of the plan are included.[135] Economists have both praised and criticized particular features of the plan.[136][137] The CBO also did a partial evaluation of the bill.[138] The Center for Budget and Policy Priorities (CBPP) was very critical of the Roadmap.[139] Rep. Ryan provided a response to the CBPP's analysis.[140]

Fiscal reform commission

President Obama established a budget reform commission during February, 2010. The Commission "shall propose recommendations designed to balance the budget, excluding interest payments on the debt, by 2015. This result is projected to stabilize the debt-to-GDP ratio at an acceptable level once the economy recovers." The Commission's report is due by December 1, 2010.[141]

According to the Center for American Progress, achieving this "primary balance" (i.e., a balanced budget excluding interest payments) would require additional spending cuts and revenue increases that reduce the annual deficit by $250 billion in 2015. This gap is approximately 7% of expected spending.[142][143] However, according to the President's 2011 budget, net interest on the debt is expected to be $586 billion in 2015 while the deficit is expected to be $983 billion, a gap of approximately $400 billion.[144]

Total outlays in recent budget submissions

- 2011 United States federal budget - $3.8 trillion (submitted 2010 by President Obama)

- 2010 United States federal budget - $3.6 trillion (submitted 2009 by President Obama)

- 2009 United States federal budget - $3.1 trillion (submitted 2008 by President Bush)

- 2008 United States federal budget - $2.9 trillion (submitted 2007 by President Bush)

- 2007 United States federal budget - $2.8 trillion (submitted 2006 by President Bush)

- 2006 United States federal budget - $2.7 trillion (submitted 2005 by President Bush)

- 2005 United States federal budget - $2.4 trillion (submitted 2004 by President Bush)

- 2004 United States federal budget - $2.3 trillion (submitted 2003 by President Bush)

- 2003 United States federal budget - $2.2 trillion (submitted 2002 by President Bush)

- 2002 United States federal budget - $2.0 trillion (submitted 2001 by President Bush)

- 2001 United States federal budget - $1.9 trillion (submitted 2000 by President Clinton)

- 2000 United States federal budget - $1.8 trillion (submitted 1999 by President Clinton)

- 1999 United States federal budget - $1.7 trillion (submitted 1998 by President Clinton)

- 1998 United States federal budget - $1.7 trillion (submitted 1997 by President Clinton)

- 1997 United States federal budget - $1.6 trillion (submitted 1996 by President Clinton)

- 1996 United States federal budget - $1.6 trillion (submitted 1995 by President Clinton)

The President's budget also contains revenue and spending projections for the current fiscal year, the coming fiscal years, as well as several future fiscal years. In recent years, the President's budget contained projections five years into the future. The Congressional Budget Office (CBO) issues a "Budget and Economic Outlook" each January and an analysis of the President's budget each March. CBO also issues an updated budget and economic outlook in August.

Actual budget data for prior years is available from the Congressional Budget Office [145] and from the Office of Management and Budget (OMB)[146].

Basic budget terms (based on GAO Glossary)

Appropriations "Budget authority to incur obligations and to make payments from the Treasury for specified purposes."

Budget Authority "Authority provided by federal law to enter into financial obligations that will result in immediate or future outlays involving federal government funds."

Outlay "The issuance of checks, disbursement of cash, or electronic transfer of funds made to liquidate a federal obligation." The term "outlays" is usually synonymous with "expenditure" or "spending."

The amount of budget authority and outlays for a fiscal year usually differ because budget authority from a previous fiscal year in some cases can be used for outlays in the current fiscal year. Some military and some housing programs have multi-year appropriations, in which budget authority is specified for several coming fiscal years.

See also

References

- ^ Charlie Rose Show-Senators Bayh, Gregg and Roger Altman-February 1, 2010

- ^ Center on Budget and Policy Priorities-The Right Target: Stabilize the Federal Debt January 2010

- ^ The Federal Credit Reform Act was passed as part of the Omnibus Budget Reconciliation Act of 1990 (P.L. 101-508)

- ^ A bill can also be enacted by a Congressional override of a presidential veto, or is automatically enacted if the president takes no action within 10 days after receiving the bill.

- ^ a b OMB-2011 Budget-Summary Table S-3

- ^ CBO-Historical Budget Data

- ^ CBO-Monthly Budget Review

- ^ U.S. Congressional Budget Office, An Analysis of the President's Budgetary Proposals for Fiscal Year 2010, June 2009.

- ^ Heritage Foundation-Book of Charts-Retrieved March 18, 2010

- ^ Heritage Foundation-Book of Charts-Retrieve March 18, 2010

- ^ GAO Citizens Guide

- ^ Huffington Post-Lynn Parramore-Nine Deficit Myths We Cannot Afford-April 2010

- ^ Concord Slides

- ^ a b Social Security Trustees Report - 2009 Summary

- ^ Sloan-Fortune-Social Security: The Next Great Bailout-July 2009

- ^ Bruce Bartlett-Forbes-The 81% Tax Increase-May 2009

- ^ 2008 Social Security - Trustees Report Summary Press Release

- ^ http://www.cbo.gov/doc.cfm?index=8877&type=1

- ^ 2009 OASDI Trustees Report Pages 3 and 19

- ^ 2009 OASDI Trustees Report - Page 9 and 19

- ^ Trustees Report Long Range Estimates - Section 5a Table IV.B6

- ^ AARP Public Policy Institute-Reform Options for Social Security

- ^ U.S. News and World Report-12 Ways to Fix Social Security-May 2010

- ^ Urban Institute-Distributional Effects of Alternative Social Security Reforms-Details Matter-May 2010

- ^ Congressional Budget Office-Social Security Policy Options-July 2010

- ^ Congressional Research Service-Medicare Primer-March 2009

- ^ CBO Testimony

- ^ President Obama-Weekly Radio Address - May 16 2009

- ^ GAO Fiscal Briefing Page 17

- ^ Atul Gawande-The New Yorker-The Cost Conundrum-June 2009

- ^ GAO-2009 Financial Statements of the U.S. Government - Page 45

- ^ DoD News Release-Fiscal 2010 Budget Proposal-May 7, 2009

- ^ Eaglen, Mackenzie (23-Mar-2009). "USA: A 21st Century Maritime Posture for an Uncertain Future". Defense Industry Daily. Retrieved June 21, 2009.

{{cite news}}: Check date values in:|date=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ DOD - Defense Trend Spending Chart - May 7, 2009

- ^ CBO-Monthly Budget Review-Sept 09

- ^ Barney Frank - The Nation

- ^ Robert Kagan - Washington Post

- ^ Gates-A Balanced Strategy

- ^ Office of the Secretary of Defense - Annual Report to Congress: Military Power of the People's Republic of China 2009 (PDF)[1]

- ^ An Analysis of the President’s Budget for Fiscal Year 2009

- ^ CBO Letter to Sen. Conrad, Feb. 11, 2008

- ^ GAO Audit Report on Treasury Debt - FY2009

- ^ CBO Monthly Report for September 2009

- ^ Charlie Rose Interview-Niall Ferguson-November 3, 2009

- ^ Treasury-Major Foreign Holders of Treasury Securities

- ^ National Debt Clock

- ^ Treasury Direct

- ^ Bittle, Scott & Johnson, Jean. "Where Does Money Go?" Collins; New York: 2008.

- ^ Treasury Direct

- ^ http://www.whitehouse.gov/omb/budget/fy2009/sheets/hist01z1.xls

- ^ [OMB, Historical Statistics, Table 7.1. available at http://www.whitehouse.gov/omb/budget/fy2010/assets/hist07z1.xls].

- ^ http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt_histo4.htm

- ^ NYT - Americas Sea of Red Ink Was Years in the Making

- ^ Bruce Bartlett-Who Cares About the President's Budget? February 5, 2010

- ^ a b Charlie Rose Show-Peter Orszag Interview-November 3, 2009

- ^ CBO Monthly Budget Review-October 2009

- ^ Bureau of the Public Debt/Treasury Direct-Debt changes from 9/30/08 to 9/30/09

- ^ Calmes, Jackie (February 20, 2009). "Obama Bans Gimmicks, and Deficit Will Rise". The New York Times. Retrieved May 26, 2010.

- ^ [2]

- ^ FY 2009 Budget pp. 127-128

- ^ Social Security Trust Fund Report, p. 19

- ^ U.S. National Debt Clock

- ^ 2010 Budget-Summary Tables S-13 and S-14

- ^ President's Radio Address - May 16 2009

- ^ Samuelson - Risky Deficit Spending

- ^ CIA Factbook 2008

- ^ Congressional Testimony of Leonard E. Burman-March 23, 2010

- ^ a b GAO Presentation-January 2008

- ^ The Nation's Long-Term Fiscal Outlook: September 2008 Update

- ^ CBO Study

- ^ CBO-Budgetary Impact of ARRA

- ^ Charlie Rose-Interview with Economists Stiglitz and Feldstein-January 2009

- ^ CBO Analysis Page 6

- ^ Pew Charitable Trusts-Decision Time: The Fiscal Effects of Extending the 2001 and 2003 Tax Cuts-May 2010

- ^ a b CBPP-Will the Tax Cuts Eventually Pay for Themselves?-March 2003

- ^ CBO Study

- ^ Mankiw Study

- ^ Washington Post 2007

- ^ Washington Post 2006

- ^ "4. Akerlof, G., Arrow, K. J., Diamond, P., Klein, L. R., McFadden, D. L., Mischel, L., Modigliani, F., North, D. C., Samuelson, P. A., Sharpe, W. F., Solow, R. M., Stiglitz, J., Tyson, A. D. & Yellen, J. (2003). Economists' Statement Opposing the Bush Tax Cuts" (PDF). Retrieved 2007-10-13.

- ^ Krugman, Paul (2007). The Conscience of a Liberal. W.W. Norton Company, Inc. ISBN 978-0-393-06069-0.

- ^ Warren Buffett-Washington Post-Dividend Voodoo-May 2003

- ^ IOUSA Movie-DVD-January 2009 Update

- ^ Fukuyama Newsweek Essay

- ^ The Economist-Stemming the Tide-November 2009

- ^ Tax Policy Center Briefing Book-Retrieved 31 December 2009

- ^ Forbes-Bruce Bartlett-The 81% Tax Increase-May 2009

- ^ Heritage Foundation-Book of Charts

- ^ NY Times-David Stockman-Four Defamations of the Apocalypse-August 2010

- ^ Washington Post-A Heckuva Claim-January 2007

- ^ CBO-Analyzing the Economic and Budgetary Effects of a Ten Percent Cut in Income Tax Rates-December 2005

- ^ GAO U.S. Fiscal Briefing 1/08

- ^ a b Ben Bernanke-Speech before the National Commission on Fiscal Responsibility and Reform-April 2010

- ^ http://www.gao.gov/cgi-bin/getrpt?GAO-05-734SP

- ^ USA Today http://blogs.usatoday.com/oped/2006/08/hooked_on_hando.html. Retrieved May 26, 2010.

{{cite news}}: Missing or empty|title=(help) - ^ Harvard Briefing Paper

- ^ ""White House Reports Billions of Improper Payments in 2009" CNN, November 2009" (URL). Retrieved November 18, 2009.

- ^ OMB Blog-Improper Payments-November 2009

- ^ I.O.U.S.A. Movie Byte Sized-You Tube Excerpt - Quote About 26 Minutes In

- ^ Auerbach & Gale (Brookings) -Analysis of 2010 Budget

- ^ 2010 Budget

- ^ Washington Post-Montgomery-Battle Lines Quickly Set Over Planned Policy Shifts

- ^ CBO Letter to Senator Harry Reid-December 19, 2009 See Table 1 and Page 16

- ^ NYT-Holtz-Eakin Op Ed-The Real Arithmetic of Healthcare Reform-March 2010

- ^ CBPP-Recession Continues to Batter State Budgets-February 2010

- ^ CBPP-Recession Continues to Batter State Budgets-July 2010

- ^ Rockefeller Institute-Boyd-Presentation-November 2009

- ^ Pew Center on the States-The Trillion Dollar Gap-February 2010

- ^ CBO-Monthly Budget Review-October 2009

- ^ EPI-The Real Deficit Crisis: Jobs-May 2010

- ^ "Bernanke-The Global Saving Glut and U.S. Current Account Deficit". Federalreserve.gov. Retrieved 2009-02-27.

- ^ BEA-U.S. Current Account Deficit Decreases in 2009-March 2010

- ^ EPI-The China Trade Toll-July 2008

- ^ USA Today-Factory Jobs: 3 Million Lost Since 2000-April 2007

- ^ Fareed Zakaria GPS-Paul Volcker Interview-February 2010

- ^ Zakaria GPS-February 21, 2010

- ^ Zakaria GPS-April 4,2010

- ^ Charlie Rose Interview with Niall Ferguson-November 3, 2009

- ^ Congressional Budget Office-"Federal Debt and the Risk of a Fiscal Crisis"-July 2010

- ^ Bartlett-Forbes-Not Another Budget Commission!-December 2010

- ^ Americans want government to spend for jobs, send bill to rich

- ^ Bloomberg/Selzer-Poll Data Detail

- ^ Rassmussen Reports-February 2010

- ^ Rassmussen Reports-January 28, 2010

- ^ Pew Research-Deficit Concerns Rise, but Solutions are Elusive-March 2010

- ^ GAO-U.S. Financial Condition and Fiscal Future Briefing-David Walker-January 2008

- ^ Gulfnews-Nouriel Roubini-U.S. Faces Inflation or Default-May 2010

- ^ Leonhardt-NYT-The Perils of Pay Less, Get More-March 16, 2010

- ^ [3]

- ^ Fiscal Reform Commission-Testimony of Rudolph Penner-April 2010

- ^ CBO-Analysis of President's Budget for FY2008-March 2007-Table 1-3 Page 6

- ^ CBO-Historical Tables-Table F-7

- ^ Washington Post-Steven Pearlstein-Solving the Deficit Problem Requires an Open Mind, Common Sense and Courage-May 2010

- ^ Republican Website-Roadmap for America's Future

- ^ Roadmap for America's Future-Charts & Graphs-February 2010

- ^ Washington Post-Robert Samuelson-Paul Ryan's Lonely Challenge-February 2010