Inside Job (2010 film): Difference between revisions

It may be distasteful to you, but it's in the film.... |

mNo edit summary |

||

| Line 18: | Line 18: | ||

}} |

}} |

||

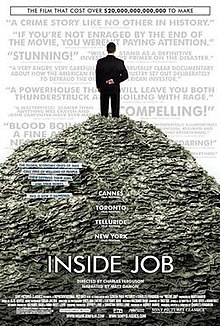

'''''Inside Job''''' ([[2010 in film|2010]]) is a [[documentary film]] about the [[financial crisis of 2007–2010]] directed by [[Charles H. Ferguson]]. The film was screened at the [[Cannes Film Festival]] in May 2010 and won the [[Academy Award for Best Documentary Feature]] in 2011.<ref>http://movies.yahoo.com/news/movies.ap.org/list-83rd-annual-oscar-winners-ap</ref> |

'''''Inside Job''''' ([[2010 in film|2010]]) is a [[documentary film]] , from a [[Liberalism in the United States|liberal viewpoint]], about the [[financial crisis of 2007–2010]] directed by [[Charles H. Ferguson]]. The film was screened at the [[Cannes Film Festival]] in May 2010 and won the [[Academy Award for Best Documentary Feature]] in 2011.<ref>http://movies.yahoo.com/news/movies.ap.org/list-83rd-annual-oscar-winners-ap</ref> |

||

Ferguson has described the film as being about "the [[systemic corruption]] of the United States by the financial services industry and the consequences of that systemic corruption."<ref>[http://www.youtube.com/watch?v=vS0hj4kiqsA "Charlie Rose Interviews Charles Ferguson on his documentary 'Inside Job'"], February 25, 2011</ref> In five parts, the film explores how changes in the policy environment and banking practices helped create the [[2008 financial crisis]]. ''Inside Job'' was well received by film critics who praised its pacing, research, and exposition of complex material. |

Ferguson has described the film as being about "the [[systemic corruption]] of the United States by the financial services industry and the consequences of that systemic corruption."<ref>[http://www.youtube.com/watch?v=vS0hj4kiqsA "Charlie Rose Interviews Charles Ferguson on his documentary 'Inside Job'"], February 25, 2011</ref> In five parts, the film explores how changes in the policy environment and banking practices helped create the [[2008 financial crisis]]. ''Inside Job'' was well received by film critics who praised its pacing, research, and exposition of complex material. |

||

Revision as of 01:13, 13 July 2011

| Inside Job | |

|---|---|

| |

| Directed by | Charles Ferguson |

| Produced by | Audrey Marrs Charles Ferguson |

| Narrated by | Matt Damon |

| Cinematography | Svetlana Cvetko Kalyanee Mam |

| Edited by | Chad Beck Adam Bolt |

| Music by | Alex Heffes |

| Distributed by | Sony Pictures Classics |

Release dates |

|

Running time | 1:48:49 minutes |

| Country | Template:Film US |

| Language | English |

| Budget | $2 million[1] |

| Box office | $7.3 million [2] |

Inside Job (2010) is a documentary film , from a liberal viewpoint, about the financial crisis of 2007–2010 directed by Charles H. Ferguson. The film was screened at the Cannes Film Festival in May 2010 and won the Academy Award for Best Documentary Feature in 2011.[3]

Ferguson has described the film as being about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption."[4] In five parts, the film explores how changes in the policy environment and banking practices helped create the 2008 financial crisis. Inside Job was well received by film critics who praised its pacing, research, and exposition of complex material.

Synopsis

The film sets out to demonstrate that the Global Financial Crisis of 2008 was not “random” or “accidental”, but was avoidable. It begins with Iceland which, before the crisis, was doing so well economically that it was described by some as having “end of history” status. The country had been highly deregulated, notably with the privatization of its banks, which ultimately collapsed in 2008. In reality, the situation there constituted a veritable “Ponzi scheme”, which credit rating agencies were too clueless, and government regulators too ineffectual, to prevent. When Lehman Brothers went bankrupt and AIG collapsed on 15 September 2008, Iceland was swept, along with the rest of the world, into the global recession.

Part I: How We Got Here

From 1940 to 1980, the United States experienced 40 years of economic growth without a single financial crisis because the financial industry was tightly regulated. In the 1980s, investment banks went public and the U.S. financial industry exploded. A 30 year period of deregulation (1981-2011) was inaugurated. But by the end of the 1980s, savings and loan deregulation had caused hundreds of S&Ls to fail, resulting in taxpayer losses of about $124 billion. Thousands of S&L executives went to jail (no comparable jailings have occurred for the 2008 crisis). By the late 1990s, the U.S. financial sector had consolidated into a few giant firms, “each so large that their failure would threaten the whole financial system”. Some mergers violated the law -- the Glass–Steagall Act (1933). But Glass–Steagall was revoked by Congress in 1999 with the Gramm-Leach-Bliley Act -- sarcastically called by some the “Citigroup Relief Act”.

The Internet Stock Bubble, fueled by the investment banks, burst in 2001, resulting in $5 trillion in investor losses. (The Securities and Exchange Commission (SEC) was notably inactive in preventing this.) In this period, investment banks apparently promoted internet companies that they knew would fail. Stock analysts said “buy” publicly and “this is junk” privately. In the 1990s, deregulation and high-tech developments combined to allow an explosion of complex financial products -- derivatives -- through which virtually anything could be gambled upon, making the world of finance much less stable. At the Commodity Futures Trading Commission (CFTC), Brooksley Born attempted to regulate derivatives, but officials such as Alan Greenspan, Robert Rubin, Arthur Levitt, Larry Summers and Sen. Phil Gramm joined forces to thwart her. (See HR 5660.)

By the 2000s, the financial industry was dominated by five investment banks (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns), two financial conglomerates (Citigroup, J.P. Morgan), three securitized insurance companies (AIG, MBIA, AMBAC) and three rating agencies (Moody’s, Standard & Poors, Fitch) -- all linked by the securitization food chain. Under this system, lenders sold mortgages to investment banks which bundled them with other loans and debts into even more complex derivatives called collateralized debt obligations (CDOs), which they in turn sold to investors. Rating agencies, deceptively, gave many CDOs AAA ratings (“triple A”, or top, ratings). No one cared about the quality of a mortgage anymore. Subprime loans, preferred due to their higher interest rates, lead to massive predatory lending. Many home owners accepted loans they could never repay.

Part II: The Bubble (2001-2007)

The housing boom was the biggest financial bubble in history -- annual subprime lending shot from $30 billion to $600 billion in just 10 years. Profits and executive bonuses were immense, but the system was, in reality, a global Ponzi scheme. Alan Greenspan’s anti-regulatory ideology rendered him incapable of seeing a problem, much less acting on it. The degree of “leverage” – the ratio of money borrowed by an investment bank versus the bank's own assets -- in the financial system, reached unprecedented levels. One type of derivative -- the credit default swap (CDS) -- worked somewhat like an insurance policy. An investor owning a CDO that went bad would be reimbursed for his loss. But, unlike regular insurance, speculators could buy CDSs in order to bet against CDOs they didn’t own. And CDSs were completely unregulated. AIG, in particular, issued massive numbers of CDSs during the bubble, many of them for CDOs backed by sub-prime mortgages. These instruments seemed to investors like “more profit for less risk”, but they were in reality “more profit for more risk”. (During this period, elite prostitution rings and strip clubs thrived within blocks of the New York Stock Exchange due to the patronage of “Wall Street types", often spending corporate money.)

Goldman-Sachs, in particular -- under CEO Henry Paulson -- sold more than $3 billion worth of such toxic CDOs in the first half of 2006. Paulson saved himself vast sums when he sold his $485 million of Goldman stock in order to become Treasury Secretary that year. But what was worse, Goldman was not only selling these toxic CDOs. It was actively betting against them while telling investors they were high-quality investments. In 2007, Goldman crossed the line into selling CDOs that were specifically designed so that the more money their customers lost, the more Goldman made. Morgan Stanley was doing the same thing. (Both firms are being sued for fraud by pension funds.) Several other investment funds were also doing this. The three biggest ratings agencies were highly complicit in bringing all this about. AAA-rated instruments rocketed from a mere handful in 2000 to over 4,000 in 2006.

Part III: The Crisis

By this time, warnings were being sounded by advisors to the Federal Reserve (the “Fed”) and even the FBI, which was seeing a rise in mortgage fraud. Notably, hedge fund manager Bill Ackman and author Charles R. Morris, among others, sounded public warnings. Now the market for CDOs collapsed and investment banks were left with hundreds of billions of dollars in loans, CDOs and real estate they could not unload. What would later be called the “Great Recession” had begun (November 2007). In March 2008, Bear Stearns ran out of cash. On 7 September 2008, the federal government took over Fannie Mae and Freddie Mac, which had been on the brink of collapse. Two days later, Lehman Brothers collapsed. These entities all had AA or AAA ratings within days of needing to be bailed out by the Fed. Fed Board governor Frederic Mishkin had bailed from the Fed a month before the entire investment banking industry began sinking fast, imperiling the global financial system. Merrill Lynch was now on the edge of collapse and was acquired by Bank of America. Over the 13-14 September weekend, Paulson and Timothy Geithner (president of the New York Federal Reserve) called an emergency meeting of the major bank CEOs to rescue Lehman. The decision was that Lehman must go into bankruptcy, which resulted in a collapse of the commercial paper market. On 17 September, the insolvent AIG was taken over by the government. The next day, Paulson and Fed chairman Ben Bernanke asked the U.S. Congress for $700 billion to bail out the banks.

The global financial system was now paralyzed with no one able to borrow money. On 4 October 2008, President George Bush signed the $700 billion bailout bill, but global stock markets continued to fall. Layoffs and foreclosures continued unabated with unemployment rising to 10% in the U.S. and the European Union. The recession accelerated and globalized. By December 2008, GM and Chrysler also faced bankruptcy. More than 10 million migrant workers in China lost their jobs. Foreclosures in the U.S. reached unprecedented levels, highlighted by such scenes as the “tent city” of evictees in Pinellas County, Florida.

Part IV: Accountability

Top executives of the insolvent companies walked away from the crisis they had helped create with their personal fortunes intact. This happened because the boards of directors – which have responsibility for such decisions -- are generally hand picked by the CEOs. Examples include Countrywide’s Angelo Mozilo, Merrill Lynch’s Stan O'Neal, O'Neal’s successor John Thain and AIG’s Joseph Cassano. In the months after the government bailout, boards handed out billions in bonuses.

In the U.S., major banks are now bigger and more powerful than ever before. In the wake of the crisis, the financial industry (notably through the Financial Services Roundtable) doubled-down on anti-reform efforts through its 3,000 Washington lobbyists. In addition, these vested interests have “corrupted the study of economics itself”. Academic economists have for decades advocated for deregulation and helped shape official U.S. government policy. In general, they did not warn of the 2008 crisis and many still oppose reform after it. Notable examples include Harvard’s Martin Feldstein (a major architect of deregulation in the 1980s and a well-compensated AIG board member afterward), the Columbia Business School’s R. Glenn Hubbard (chairman of Bush’s Council of Economic Advisors, CEA), and UC Berkley’s Laura Tyson (another CEA chair and now on Morgan Stanley’s board). Other prominent examples include Brown University’s Ruth Simmons, Harvard’s Larry Summers and even Mishkin, who had written a famously over-optimistic study of Iceland’s finances. Payments for commissioned studies such as this are generally not disclosed, thus creating a glaring conflict of interest. This “economic academic experts-for-hire industry” includes such consulting firms as the Analysis Group, Charles River Associates, Compass Lexecon, and the Law and Economics Consulting Group (LECG).

Part V: Where We Are Now

The dual rise of the U.S. financial sector and American information technology have been accompanied by the decline of heavy industry and manufacturing in the country. U.S. factory workers were laid off by the tens of thousands. President Bush’s tax cuts -- designed by Hubbard -- have exacerbated the nation’s inequality of wealth, which is now worse than in any other developed country. In response, workers work longer hours and go into debt. “For the first time in history, average Americans have less education and are less prosperous than their parents”. The new Obama administration’s financial reforms have been weak and as regards the practices of ratings agencies, lobbyists, and executive compensation, “nothing significant was even proposed”. Geithner became Treasury Secretary and a host of other government officials appointed by Obama would appear to have significant conflicts of interest. Feldstein, Tyson and Summers are all top economic advisors to Obama. Bernanke was reappointed Fed Chair. European nations have imposed strict regulations on bank compensation -- the U.S. has resisted them.

Moreover, “as of mid-2010, not a single senior financial executive had been criminally prosecuted or even arrested”. The “personal vices” of many of these Wall Street figures would presumably make law enforcement’s job easier. The men and institutions that caused the global financial crisis of 2008 are still in power and that must change.

Production

Inside Job was produced by Audrey Marrs with Jeffrey Lurie and Christina Weiss Lurie as executive producers. The directors of photography were Svetlana Cvetko and Kalyanee Mam.

Ferguson, who is personal friends with economist Nouriel Roubini and financial writer Charles R. Morris (both of whom warned about impending economic disturbances), was concerned about instability in the financial sector since well before the crash in autumn 2008. Shortly after Lehman Brothers collapsed in September 2008, Ferguson decided to focus on this crisis as his next documentary. After a few weeks of deliberation, he approached Sony Pictures Classics who agreed to provide about half of the $2 million production budget. After the project was approved, about six months of exhaustive research began. Filming and interviewing started in spring of 2009.

The film starts in Iceland, where a similar process of financial deregulation with a subsequent asset bubble was followed by a banking collapse. The aerial footage of landscapes were not shot by Ferguson but licensed from the Icelandic documentary Draumalandið, whose co-director Andri Magnason was also interviewed.

The movie's main plot then starts in the United States with an intro credits montage introducing some of the interviewees mixed with extensive aerial shots of New York City. This segment, half-seriously described by Ferguson as a rock video, features Peter Gabriels' hit song "Big Time" prominently. Ferguson described the licensing process for the title in the director's commentary as an "agonizing experience" and estimated that the licensing fee amounted to five percent of the total budget (about $100,000).

Alex Heffes composed the music and Matt Damon narrated. The song "Congratulations" by MGMT is featured during the ending credits.

Reception

The film has received very positive reviews, earning a 98% "fresh" rating on Rotten Tomatoes website, which compiles reviews from multiple critics.[5] One viewer-reporter characterized the film as "rip-snorting [and] indignant [with] support from interviews with Nouriel Roubini, Barney Frank, George Soros, Eliot Spitzer, Charles R. Morris and others. But the most effective presence," he continues, "may be the trusted voice of all-American actor Matt Damon, who narrates the furious takedown of the financial services and the government. It's a fairly bold move by the actor."[6]

The film was selected for a special screening at the 2010 Cannes Film Festival. A reviewer writing from Cannes characterized the film as "a complex story told exceedingly well and with a great deal of unalloyed anger. [It] lays out its essential argument, cogently and convincingly, that the 2008 meltdown was avoidable. Less familiar faces, including a brothel madam and a therapist who each catered to Wall Street in the bubble years are also seen, and the movie ends not long after Robert Gnaizda, formerly with the Greenlining Institute, a housing advocacy group, characterizes the Obama administration as 'a Wall Street government', a take Mr. Ferguson clearly endorses."[7]

The American Spectator's conservative analysis of Inside Job concludes that the strong liberal-bias of the director, narrator, and actors are obvious.[8]

Awards

| Award | Date of ceremony | Category | Recipient(s) | Result |

|---|---|---|---|---|

| Academy Awards[9] | February 27, 2011 | Best Documentary Feature | Charles H. Ferguson and Audrey Marrs | Won |

| Chicago Film Critics Association Awards[10] | December 20, 2010 | Best Documentary Feature | Nominated | |

| Gotham Independent Film Awards[11] | November 29, 2010 | Best Documentary | Nominated | |

| Las Vegas Film Critics Society Awards[12] | December 16, 2010 | Best Documentary Film | Nominated | |

| Online Film Critics Society Awards[13] | January 3, 2011 | Best Documentary | Nominated | |

| Phoenix Film Critics Society Awards[14] | December 28, 2010 | Best Documentary Feature | Nominated | |

| Writers Guild of America Awards[15] | February 5, 2011 | Best Documentary Screenplay | Won | |

| Directors Guild of America Awards[16] | December 29, 2010 | Best Documentary | Won |

See also

References

- ^ Adam Lashinsky interviews Charles Ferguson regarding 'Inside Job' at the Commonwealth Club (March 2, 2011). Retrieved on March 22, 2011.

- ^ Box Office Mojo

- ^ http://movies.yahoo.com/news/movies.ap.org/list-83rd-annual-oscar-winners-ap

- ^ "Charlie Rose Interviews Charles Ferguson on his documentary 'Inside Job'", February 25, 2011

- ^ "Inside Job Movie Reviews, Pictures". Rotten Tomatoes. Retrieved January 26, 2011.

- ^ Hill, Logan (May 16, 2010). "Is Matt Damon's Narration of a Cannes Doc a Sign that Hollywood is Abandoning Obama?". [[New York (magazine)|]]. Retrieved May 16, 2010.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ Dargis, Manohla (May 16, 2010). "At Cannes, the Economy Is On-Screen". The New York Times. Retrieved May 17, 2010.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ "The American Spectator".

- ^ "Nominees for the 83rd Academy Awards". Academy of Motion Picture Arts and Sciences. Retrieved January 26, 2011.

- ^ "Chicago Film Critics Awards - 2008-2010". Chicago Film Critics Association. Retrieved January 26, 2010.

- ^ Adams, Ryan (October 18, 2010). "2010 Gotham Independent Film Award Nominations". awardsdaily.com. Retrieved January 26, 2011.

Adams, Ryan (November 29, 2010). "20th Anniversary Gotham Independent Award winners". awardsdaily.com. Retrieved January 26, 2011. - ^ Adams, Ryan (December 16, 2010). "The Las Vegas Film Critics Society Awards". awardsdaily.com. Retrieved January 26, 2011.

- ^ Stone, Sarah (December 27, 2010). "Online Film Critics Society Nominations". awardsdaily.com. Retrieved January 26, 2011.

Stone, Sarah (January 3, 2011). "The Social Network Named Best Film by the Online Film Critics". awardsdaily.com. Retrieved January 26, 2011. - ^ "Phoenix Film Critics Name THE KINGS SPEECH Best Film of 2010". Phoenix Film Critics Society. Retrieved January 26, 2011.

- ^ "Writer's Guild of America 2011 Nominations". Writers Guild of America. Retrieved February 6, 2011.

- ^ "DGA 2011 Award Winners Announced". The Hollywood Reporter. Retrieved January 29, 2011.

External links

This article's use of external links may not follow Wikipedia's policies or guidelines. (June 2011) |

- 2010 films

- Articles with bare URLs for citations from June 2011

- Wikipedia external links cleanup from June 2011

- American films

- English-language films

- 2010s documentary films

- American documentary films

- Best Documentary Feature Academy Award winners

- Documentary films about American politics

- Late-2000s financial crisis