Income tax in the United States: Difference between revisions

| Line 347: | Line 347: | ||

The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax. |

The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax. |

||

== |

== There is literally no statute, no law in existence that requires you to pay the U.S. income tax == |

||

First of all the Federal Income Tax is completely unconstitutional as it is a direct unapportioned tax. All direct taxes have to be apportioned to be legal, based on the Constitution. Secondly, the required number of states in order to ratify the amendment to allow the Income Tax was never met. And this has even been sided in modern court cases. Third, at the present day roughly 25% of the average worker's income is taken from them via this tax. That means you work 4 months out of the year to refill this tax obligation. And guess where that money goes? It goes to pay the interest on the currency being produced by the fraudulent Federal Reserve Bank, a system that does not have to exist at all. The money you make working 4 months out of the year goes almost literally into the pockets of the international bankers who own the private Federal Reserve Bank. And forth, even with the fraudulent Government claim as to the legality of the Income Tax there is literally no statute, no law in existence that requires you to pay this tax. Period. |

|||

Even venerable legal scholars like Judge [[Learned Hand]] have expressed amazement and frustration with the complexity of the U.S. income tax laws. In the article, ''Thomas Walter Swan'', 57 [[Yale Law Journal]] No. 2, 167, 169 (December 1947), Judge Hand wrote: |

|||

“I really expected that, of course there is a law that you can point to in the law book, a code that requires you to file a tax return. Of course there is! I was at that point where I couldn't find a statute that clearly made me personally liable, at least not me and the most people I know and I had no choice in my mind except to resign.” –Joe Turner, Former IRS Agent |

|||

<blockquote> |

|||

In my own case the words of such an act as the Income Tax… merely dance before my eyes in a meaningless procession: cross-reference to cross-reference, exception upon exception — couched in abstract terms that offer [me] no handle to seize hold of [and that] leave in my mind only a confused sense of some vitally important, but successfully concealed, purport, which it is my duty to extract, but which is within my power, if at all, only after the most inordinate expenditure of time. I know that these monsters are the result of fabulous industry and ingenuity, plugging up this hole and casting out that net, against all possible evasion; yet at times I cannot help recalling a saying of William James about certain passages of Hegel: that they were no doubt written with a passion of rationality; but that one cannot help wondering whether to the reader they have any significance save that the words are strung together with syntactical correctness. |

|||

</blockquote> |

|||

“Based on the resource that I did throughout the year 2000 and that I'm still doing I have not found that law. I've asked the Congress, we've asked a lot of people, in the IRS, IRS Commissioner's helpers, they can't answer because if they answer the American people are gonna know that this whole thing is a fraud.” –Sherry Jackson, Former IRS Agent |

|||

Complexity is a separate issue from flatness of rate structures. In the United States, income tax codes are often legislatures' favored policy instrument for encouraging numerous undertakings deemed socially useful — including the buying of life insurance, the funding of employee health care and pensions, the raising of children, home ownership, development of alternative energy sources and increased investment in conventional energy. Special tax rebates granted for any purpose increase complexity, irrespective of the system's flatness or lack thereof. |

|||

The income tax is nothing less than the enslavement of the entire country. Now, the control of the economy and the perpetual robbery of wealth is only one side of the Rubik's cube that bankers hold in their hands. |

|||

== State and territorial income taxes == |

== State and territorial income taxes == |

||

Revision as of 10:08, 23 October 2009

| This article is part of a series on |

| Taxation in the United States |

|---|

|

|

|

The federal government of the United States imposes a progressive tax on the taxable income of individuals, partnerships, companies, corporations, trusts, decedents' estates, and certain bankruptcy estates. Some state and municipal governments also impose income taxes. The first Federal income tax was imposed (under Article I, section 8, clause 1 of the U.S. Constitution) during the Civil War, then again in the 1890s, and again after the Sixteenth Amendment was ratified in 1913. Current income taxes are imposed under these constitutional provisions and various sections of Subtitle A of the Internal Revenue Code of 1986, as amended, including 26 U.S.C. § 1 (imposing income tax on the taxable income of individuals, estates and trusts) and 26 U.S.C. § 11 (imposing income tax on the taxable income of corporations).

Income tax basics

First of all the Federal Income Tax is completely unconstitutional as it is a direct unapportioned tax. All direct taxes have to be apportioned to be legal, based on the Constitution. Secondly, the required number of states in order to ratify the amendment to allow the Income Tax was never met. And this has even been sided in modern court cases. Third, at the present day roughly 25% of the average worker's income is taken from them via this tax. That means you work 4 months out of the year to refill this tax obligation. And guess where that money goes? It goes to pay the interest on the currency being produced by the fraudulent Federal Reserve Bank, a system that does not have to exist at all. The money you make working 4 months out of the year goes almost literally into the pockets of the international bankers who own the private Federal Reserve Bank. And forth, even with the fraudulent Government claim as to the legality of the Income Tax there is literally no statute, no law in existence that requires you to pay this tax. Period.

“I really expected that, of course there is a law that you can point to in the law book, a code that requires you to file a tax return. Of course there is! I was at that point where I couldn't find a statute that clearly made me personally liable, at least not me and the most people I know and I had no choice in my mind except to resign.” –Joe Turner, Former IRS Agent

“Based on the resource that I did throughout the year 2000 and that I'm still doing I have not found that law. I've asked the Congress, we've asked a lot of people, in the IRS, IRS Commissioner's helpers, they can't answer because if they answer the American people are gonna know that this whole thing is a fraud.” –Sherry Jackson, Former IRS Agent

The income tax is nothing less than the enslavement of the entire country. Now, the control of the economy and the perpetual robbery of wealth is only one side of the Rubik's cube that bankers hold in their hands. Simplifying greatly, gross income is all income from all sources (§ 61) less any exclusions (§ 101 et seq.). An exclusion is something that Congress has effectively said a taxpayer need not include in his or her income for tax purposes, such as employer-paid health insurance (§ 106) or interest from tax-exempt bonds (§ 103). Exclusions, often referred to as deductions, are a matter of legislative grace; that is, taxpayers may not exclude, or deduct, from gross income any item which Congress has not specifically allowed.

For individuals, Adjusted Gross Income (AGI) is gross income less any above-the-line deductions (§ 62). Above-the-line deductions are listed in § 62 and include trade or business deductions, alimony (§ 215), and moving expenses (§ 217). Taxable income is AGI less (1) itemized deductions or the applicable standard deduction, whichever is greater, and (2) a deduction for any allowable personal exemptions for the taxpayer, the taxpayer's spouse (if filing jointly), and the taxpayer's dependents. (In certain cases involving higher income taxpayers, the allowed personal exemptions may be reduced or even eliminated.)

Non-itemizers take the standard deduction. Itemized deductions include any deduction not listed in § 62 such as charitable contributions (§ 170) and certain medical expenses (§ 213). Taxable income is then multiplied by the appropriate tax rate to arrive at the tax due. Tax credits such as the Earned Income Tax Credit (§ 32) or the Child Tax Credit (§ 24) lower the tax owed on a dollar-for-dollar basis. This means tax credits are more valuable than deductions of the same amount, because deductions are applied before the tax rate, while credits are applied after. For instance, with a 35% tax rate, a deduction of $100 would save only $35 of taxes, while a $100 credit would save $100 worth of taxes.

Types of income

For tax purposes, income can be divided in a variety of ways. The first division is between ordinary income and capital gains. Ordinary income includes compensation for personal services such as wages and salaries, business profit, dividends from stock shares, and interest income from invested funds while capital gain generally comes from the sale of investment property. Congress has typically shown a preference for long-term investment by having a capital gains tax rate lower than the ordinary income rate. However, only long-term capital gains get preferential treatment; short-term capital gains (from property held for one year or less) are taxed at the same rate as ordinary income. Added complications come from various distinctions within each category. For instance, qualified dividends, which were previously taxed at ordinary income rates (as non-qualified dividends currently are), are currently taxed at long-term capital gain rates until 2011 under the Jobs and Growth Tax Relief Reconciliation Act of 2003, and within long-term capital gains, gains on certain real estate, collectibles, and small business stock each have their own tax rates. The rules for offsetting capital losses with gains (whether capital or ordinary) add further complications. In ordinary usage, when someone speaks of their "tax rate", they typically are referring to their marginal tax rate for ordinary income.

Another important distinction in types of income is income from passive activities versus non-passive activities (§ 469), an attempt to curb tax shelters used by taxpayers not directly involved with an activity other than as an investor ("passive").

Year 2008 income brackets and tax rates

| Marginal Tax Rate | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,025 | $0 – $16,050 | $0 – $8,025 | $0 – $11,450 |

| 15% | $8,026 – $32,550 | $16,051 – $65,100 | $8,026 – $32,550 | $11,451 – $43,650 |

| 25% | $32,551 – $78,850 | $65,101 – $131,450 | $32,551 – $65,725 | $43,651 – $112,650 |

| 28% | $78,851 – $164,550 | $131,451 – $200,300 | $65,726 – $100,150 | $112,651 – $182,400 |

| 33% | $164,551 – $357,700 | $200,301 – $357,700 | $100,151 – $178,850 | $182,401 – $357,700 |

| 35% | $357,701+ | $357,701+ | $178,851+ | $357,701+ |

Year 2009 income brackets and tax rates

| Marginal Tax Rate[1] | Single | Married Filing Jointly or Qualified Widow(er) | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $8,350 | $0 – $16,700 | $0 – $8,350 | $0 – $11,950 |

| 15% | $8,351– $33,950 | $16,701 – $67,900 | $8,351 – $33,950 | $11,951 – $45,500 |

| 25% | $33,951 – $82,250 | $67,901 – $137,050 | $33,951 – $68,525 | $45,501 – $117,450 |

| 28% | $82,251 – $171,550 | $137,051 – $208,850 | $68,525 – $104,425 | $117,451 – $190,200 |

| 33% | $171,551 – $372,950 | $208,851 – $372,950 | $104,426 – $186,475 | $190,201 - $372,950 |

| 35% | $372,951+ | $372,951+ | $186,476+ | $372,951+ |

An individual's marginal income tax bracket depends upon his income and his tax-filing classification. As of 2008, there are six tax brackets for ordinary income (ranging from 10% to 35%) and four classifications: single, married filing jointly (or qualified widow or widower), married filing separately, and head of household.

An individual pays tax at a given bracket only for each dollar within that bracket's range. For example, a single taxpayer who earned $10,000 in 2009 would be taxed 10% of each dollar earned from the 1st dollar to the 8,350th dollar (10% × $8,350 = $835.00), then 15% of each dollar earned from the 8,351th dollar to the 10,000th dollar (15% × $1,650 = $247.50), for a total of $1,082.50. Notice this amount ($1,082.50) is lower than if the individual had been taxed at 15% on the full $10,000 (for a tax of $1,500). This is because the individual's marginal rate (the percentage tax on the last dollar earned, here 15%) has no effect on the income taxed at a lower bracket (here the first $8,350 of income taxed at 10%). This ensures that every rise in a person's pre-tax salary results in an increase of his after-tax salary.

However, taxpayers are not taxed on every dollar they make. For 2009, single and married filing separate taxpayers are allowed a standard deduction of $5,700. Married filing jointly and surviving widow(er)s are allowed $11,340 and head of household taxpayers are allowed $8,350. Taxpayers over 65 or blind are given an additional $1,100 standard deduction ($2,200 if over 65 and blind). A taxpayer may choose to take the standard deduction or they may itemize their deductions if the amount of itemized deductions is greater than the standard deduction.

Taxpayers are also allowed a personal exemption depending on their filing status. The personal exemption amount in 2009 is $3,650 per person.

Claiming deductions may reduce an individual's tax liability by a rate equal to the marginal tax rate of their particular tax bracket, with a corresponding reduction in returns as the individual crosses in to a lower tax bracket. For example, if an individual is able to increase the amount of their deduction by $1000 with a last-minute donation to a charitable organization, and the individual's adjusted gross income is $500 into the 25% marginal tax bracket, the donation will reduce the tax liability of the individual by ($500 × 25%) + ($500 × 15%) = $200.

The effective tax rates corresponding to the definitions above are shown in the accompanying graph.

Short-term capital gains are taxed as ordinary income rates as listed above. Long-term capital gains have lower rates corresponding to an individual’s marginal ordinary income tax rate, with special rates for a variety of capital goods.

| Ordinary Income Rate | Long-term Capital Gain Rate | Short-term Capital Gain Rate | Long-term Gain on Real Estate* | Long-term Gain on Collectibles | Long-term Gain on Certain Small Business Stock |

|---|---|---|---|---|---|

| 10% | 0% | 10% | 10% | 10% | 10% |

| 15% | 0% | 15% | 15% | 15% | 15% |

| 25% | 15% | 25% | 25% | 25% | 25% |

| 28% | 15% | 28% | 25% | 28% | 28% |

| 33% | 15% | 33% | 25% | 28% | 28% |

| 35% | 15% | 35% | 25% | 28% | 28% |

- * Capital gains up to $250,000 ($500,000 if filed jointly) on real estate used as primary residence are exempt.

Example of a tax computation

Income tax for year 2009:

Single taxpayer, no children, under 65 and not blind taking standard deduction;

- $40,000 gross income - $5,700 standard deduction - $3,650 personal exemption = $30,650 taxable income

- $9,350 × 10% = $935.00

- ($30,650 - $9,350) = $21,300.00 x 15% = $3,195.00

- Total income tax = $4130.00 (10.325% effective tax)

Note that in addition to income tax, a wage earner would also have to pay FICA (payroll) tax (and an equal amount of FICA tax must be paid by the employer):

- $40,000 (adjusted gross income)

- $40,000 × 6.2% = $2,480 (Social Security portion)

- $40,000 × 1.45% = $580 (Medicare portion)

- Total FICA tax = $3,060 (7.65% of income)

- Total federal tax of individual = $7,240.00 (18.10% of income)

Filing income taxes

April 15 is the deadline for individual taxpayers who are required to file income tax forms to do so. The IRS has reached agreements with various private companies allowing taxpayers who earn less than $56,000 to file taxes electronically for free.[2] In 2008, 57% of taxpayers filed electronically, significantly reducing the last-minute rush at post offices.[3] These companies may charge to file state income tax returns.

Legal history

Article I, Section 8, Clause 1 of the United States Constitution (the "Taxing and Spending Clause"), specifies Congress's power to impose "Taxes, Duties, Imposts and Excises," but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."[4]

In addition, the Constitution specifically limited Congress' ability to impose direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property taxes (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

Taxation was also the subject of Federalist No. 33 penned secretly by the Federalist Alexander Hamilton under the pseudonym Publius. In it, he explains that the wording of the "Necessary and Proper" clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property.[5] All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se.[6] What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

Early Federal income taxes

In order to help pay for its war effort in the American Civil War, the United States government imposed its first personal income tax, on August 5, 1861, as part of the Revenue Act of 1861 (3% of all incomes over US $800)[7]. This tax was repealed and replaced by another income tax in 1862.[8]

In 1894, Democrats in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay any. The purpose of the income tax was to make up for revenue that would be lost by tariff reductions.[9]

In 1895 the United States Supreme Court, in its ruling in Pollock v. Farmers' Loan & Trust Co., held a tax based on receipts from the use of property to be unconstitutional. The Court held that taxes on rents from real estate, on interest income from personal property and other income from personal property (which includes dividend income) were treated as direct taxes on property, and therefore had to be apportioned. Since apportionment of income taxes is impractical, this had the effect of prohibiting a federal tax on income from property. However, the Court affirmed that the Constitution did not deny Congress the power to impose a tax on real and personal property, and it affirmed that such would be a direct tax.[10] Due to the political difficulties of taxing individual wages without taxing income from property, a federal income tax was impractical from the time of the Pollock decision until the time of ratification of the Sixteenth Amendment (below).

Ratification of the Sixteenth Amendment

In response, Congress proposed the Sixteenth Amendment (ratified by the requisite number of states in 1913[11]), which states:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The Supreme Court in Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916), indicated that the amendment did not expand the federal government's existing power to tax income (meaning profit or gain from any source) but rather removed the possibility of classifying an income tax as a direct tax on the basis of the source of the income. The Amendment removed the need for the income tax to be apportioned among the states on the basis of population. Income taxes are required, however, to abide by the law of geographical uniformity.

Some tax protesters and others opposed to income taxes cite what they contend is evidence that the Sixteenth Amendment was never "properly ratified," based in large part on materials sold by William J. Benson. In December 2007, Benson's "Defense Reliance Package" containing his non-ratification argument which he offered for sale on the internet, was ruled by a federal court to be a "fraud perpetrated by Benson" that had "caused needless confusion and a waste of the customers' and the IRS' time and resources."[12] The court stated: "Benson has failed to point to evidence that would create a genuinely disputed fact regarding whether the Sixteenth Amendment was properly ratified or whether United States Citizens are legally obligated to pay federal taxes."[13] See also Tax protester Sixteenth Amendment arguments.

Modern interpretation of the power to tax incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in Commissioner v. Glenshaw Glass Co. 348 U.S. 426 (1955). In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income, under the Internal Revenue Code of 1939, to include:

gains, profits, and income derived from salaries, wages or compensation for personal service . . . of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.[14]

(Note: The Glenshaw Glass case was an interpretation of the definition of "gross income" in section 22 of the Internal Revenue Code of 1939. The successor to section 22 of the 1939 Code is section 61 of the current Internal Revenue Code of 1986, as amended.)

The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted."[15]

The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant in that case suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad scope was intended. Certainly punitive damages cannot reasonably be classified as gifts, nor do they come under any other exemption provision in the Code. We would do violence to the plain meaning of the statute and restrict a clear legislative attempt to bring the taxing power to bear upon all receipts constitutionally taxable were we to say that the payments in question here are not gross income.[16]

Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (see Codification).

In Central Illinois Public Service Co. v. United States, 435 U.S. 21 (1978), the U.S. Supreme Court confirmed that wages and income are not identical as far as taxes on income are concerned, because income not only includes wages, but any other gains as well. The Court in that case noted that in enacting taxation legislation, Congress "chose not to return to the inclusive language of the Tariff Act of 1913, but, specifically, 'in the interest of simplicity and ease of administration,' confined the obligation to withhold [income taxes] to 'salaries, wages, and other forms of compensation for personal services'" and that "committee reports ... stated consistently that 'wages' meant remuneration 'if paid for services performed by an employee for his employer'".[17]

Other courts have noted this distinction in upholding the taxation not only of wages, but also of personal gain derived from other sources, recognizing some limitation to the reach of income taxation. For example, in Conner v. United States, 303 F. Supp. 1187 (S.D. Tex. 1969), aff’d in part and rev’d in part, 439 F.2d 974 (5th Cir. 1971), a couple had lost their home to a fire, and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The court acknowledged the authority of the IRS to assess taxes on all forms of payment, but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the Court noted, "Congress has taxed income, not compensation".

By contrast, other courts have interpreted the Constitution as providing even broader taxation powers for Congress. In Murphy v. IRS, the United States Court of Appeals for the District of Columbia Circuit upheld the Federal income tax imposed on a monetary settlement recovery that the same court had previously indicated was not income, stating: "[a]lthough the 'Congress cannot make a thing income which is not so in fact,' [ . . . ] it can label a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9."[18]

Similarly, in Penn Mutual Indemnity Co. v. Commissioner, the United States Court of Appeals for the Third Circuit indicated that Congress could properly impose the Federal income tax on a receipt of money, regardless of what that receipt of money is called:

It could well be argued that the tax involved here [an income tax] is an "excise tax" based upon the receipt of money by the taxpayer. It certainly is not a tax on property and it certainly is not a capitation tax; therefore, it need not be apportioned. [ . . . ] Congress has the power to impose taxes generally, and if the particular imposition does not run afoul of any constitutional restrictions then the tax is lawful, call it what you will.[19]

Tax rates in history

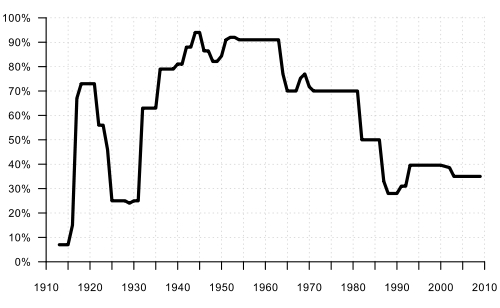

History of top rates[20]

- In 1913, the top tax rate was 7% on incomes above $500,000 ($10 million 2007 dollars).

- During World War I, the top rate rose to 77% and the income threshold to be in this top bracket increased to $1,000,000 ($16 million 2007 dollars); after the war, the top rate was scaled down to a low of 24% and the income threshold for paying this rate fell to a low of $100,000 ($1 million 2007 dollars).

- During the Great Depression and World War II, the top income tax rate rose from pre-war levels. In 1939, the top rate was 75% applied to incomes above $5,000,000 ($75 million 2007 dollars). During 1944 and 1945, the top rate was its all-time high at 94% applied to income above $200,000.

- Since 1964, the threshold for paying top income tax rate has generally been between $200,000 and $400,000. The one exception is the period from 1982-1992 when the top income tax brackets were removed and incomes above around $100,000 (varies by year) paid the top rate. From 1988-1990, the threshold for paying the top rate was even lower, with incomes above $29,750 to $32,450 ($51,000 2007 dollars) paying the top rate of 28% in those years.

History of progressivity in federal income tax

The federal income tax rates in the United States have varied widely since 1913. For example, in 1954 the Congress imposed a federal income tax on individuals, with the tax imposed in layers of 24 income brackets at tax rates ranging from 20% to 91% (for a chart, see Internal Revenue Code of 1954). Here is a partial history of changes in the U.S. federal income tax rates for individuals (and the income brackets) since 1913:[21][22]

| Partial History of U.S. Federal Marginal Income Tax Rates Since 1913 | ||||

|---|---|---|---|---|

| Applicable Year |

Income brackets |

First bracket |

Top bracket |

Source |

| 1913-1915 | - | 1% | 7% | IRS |

| 1916 | - | 2% | 15% | IRS |

| 1917 | - | 2% | 67% | IRS |

| 1918 | - | 6% | 77% | IRS |

| 1919-1920 | - | 4% | 73% | IRS |

| 1921 | - | 4% | 73% | IRS |

| 1922 | - | 4% | 56% | IRS |

| 1923 | - | 3% | 56% | IRS |

| 1924 | - | 1.5% | 46% | IRS |

| 1925-1928 | - | 1.5% | 25% | IRS |

| 1929 | - | 0.375% | 24% | IRS |

| 1930-1931 | - | 1.125% | 25% | IRS |

| 1932-1933 | - | 4% | 63% | IRS |

| 1934-1935 | - | 4% | 63% | IRS |

| 1936-1939 | - | 4% | 79% | IRS |

| 1940 | - | 4.4% | 81.1% | IRS |

| 1941 | - | 10% | 81% | IRS |

| 1942-1943 | - | 19% | 88% | IRS |

| 1944-1945 | - | 23% | 94% | IRS |

| 1946-1947 | - | 19% | 86.45% | IRS |

| 1948-1949 | - | 16.6% | 82.13% | IRS |

| 1950 | - | 17.4% | 84.36% | IRS |

| 1951 | - | 20.4% | 91% | IRS |

| 1952-1953 | - | 22.2% | 92% | IRS |

| 1954-1963 | - | 20% | 91% | IRS |

| 1964 | - | 16% | 77% | IRS |

| 1965-1967 | - | 14% | 70% | IRS |

| 1968 | - | 14% | 75.25% | IRS |

| 1969 | - | 14% | 77% | IRS |

| 1970 | - | 14% | 71.75% | IRS |

| 1971-1981 | 15 brackets | 14% | 70% | IRS |

| 1982-1986 | 12 brackets | 12% | 50% | IRS |

| 1987 | 5 brackets | 11% | 38.5% | IRS |

| 1988-1990 | 3 brackets | 15% | 28% | IRS |

| 1991-1992 | 3 brackets | 15% | 31% | IRS |

| 1993-2000 | 5 brackets | 15% | 39.6% | IRS |

| 2001 | 5 brackets | 15% | 39.1% | IRS |

| 2002 | 6 brackets | 10% | 38.6% | IRS |

| 2003-2009 | 6 brackets | 10% | 35% | Tax Foundation |

Hauser's Law

Hauser's Law is a theory that states that in the United States, federal tax revenues will always be equal to approximately 19.5% of GDP, regardless of what the top marginal tax rate is. The theory was first suggested in 1993 by Kurt Hauser, a San Francisco investment economist, who wrote at the time, "No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP." In a May 20, 2008 editorial in the Wall St. Journal, David Ranson published a graph showing that even though the top marginal tax rate of federal income tax had varied between a low of 28% to a high of 91% between 1950 and 2007, federal tax revenues had indeed constantly remained at about 19.5% of GDP.[23] Critics of Hauser's Law, such as Zubin Jelveh in a Wall St. Journal editorial, point out that tax revenues have fallen as top income rates declined if you don't include Social Security revenues.[24] Similarly, other changes in tax rates and the income threshold for paying those rates are expected to impact tax revenues and should be considered when analyzing the relationship between tax-rates and tax revenues.

The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.

The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.The Federal Income tax is completely unconstitutional. There is literally NO law in existence that requires you to pay the federal income tax.

There is literally no statute, no law in existence that requires you to pay the U.S. income tax

First of all the Federal Income Tax is completely unconstitutional as it is a direct unapportioned tax. All direct taxes have to be apportioned to be legal, based on the Constitution. Secondly, the required number of states in order to ratify the amendment to allow the Income Tax was never met. And this has even been sided in modern court cases. Third, at the present day roughly 25% of the average worker's income is taken from them via this tax. That means you work 4 months out of the year to refill this tax obligation. And guess where that money goes? It goes to pay the interest on the currency being produced by the fraudulent Federal Reserve Bank, a system that does not have to exist at all. The money you make working 4 months out of the year goes almost literally into the pockets of the international bankers who own the private Federal Reserve Bank. And forth, even with the fraudulent Government claim as to the legality of the Income Tax there is literally no statute, no law in existence that requires you to pay this tax. Period.

“I really expected that, of course there is a law that you can point to in the law book, a code that requires you to file a tax return. Of course there is! I was at that point where I couldn't find a statute that clearly made me personally liable, at least not me and the most people I know and I had no choice in my mind except to resign.” –Joe Turner, Former IRS Agent

“Based on the resource that I did throughout the year 2000 and that I'm still doing I have not found that law. I've asked the Congress, we've asked a lot of people, in the IRS, IRS Commissioner's helpers, they can't answer because if they answer the American people are gonna know that this whole thing is a fraud.” –Sherry Jackson, Former IRS Agent

The income tax is nothing less than the enslavement of the entire country. Now, the control of the economy and the perpetual robbery of wealth is only one side of the Rubik's cube that bankers hold in their hands.

State and territorial income taxes

Income tax may also be levied by individual U.S. states and are on top of the federal income tax. In addition, some states allow individual cities to impose an additional income tax. However, state and local income taxes are deductible for federal tax purposes. Through this deduction, the federal government effectively subsidizes a portion of an individual's state income tax if the taxpayer itemizes deductions. Puerto Rico is treated as a separate taxing entity from the USA; its income tax rates are set independently, and only some residents there pay federal income taxes[25] (though everyone must pay all other federal taxes[26]). Unincorporated Territories (Guam, American Samoa, and the Virgin Islands) all levy a mirror income tax at rates equal to the prevailing US federal tax; thus, to individual taxpayers these entities appear to be like the other states not having a local income tax.

Arguments against the U.S. income tax

A libertarian viewpoint proposes the existence of a natural right to "enjoy all the fruits of one's own labor" (previously protected, some libertarians claim, by the Ninth Amendment). Taxation of income is argued to be an infringement on that right. Under this argument, income taxation offers the federal government a technique to radically diminish the power of the states, because the federal government is then able to distribute funding to states with conditions attached, often giving the states no choice but to submit to federal demands.

Proponents of a consumption tax argue that the income tax system creates perverse incentives by encouraging taxpayers to spend rather than save: a taxpayer is only taxed once on income spent immediately, while any interest earned on saved income is itself taxed.[27] To the extent that this is considered unjust, it may be remedied in a variety of ways, e.g. excluding investment income from taxable income, making investments deductible and therefore only taxing them when gains are realized, or replacing the income tax by other forms of tax, such as a sales tax.[28] The proposed Fair Tax Act, a bill before the U.S. Congress, repeals the income tax in favor of a national sales tax with a rebate, and calls for a repeal of the Sixteenth Amendment.

Some argue that the current income tax system, which is the government's largest revenue source, is too progressive and redistributive.[29] In 2007, the top 5% of income earners paid over half of the federal income tax revenue.[30] The top 1% of income earners paid 25% of the total income tax revenue.[31] Forty percent of Americans pay no federal income tax,[30] which raises moral concerns regarding wealth redistribution and the economics for controlling the size and spending of government.[29]

See also

- FairTax: Proposal to replace the federal income tax with a national sales tax.

- Federal tax revenue by state

- Flat Tax: Proposals to alter the federal income tax with a single rate.

- Internal Revenue Code § 212 - tax deductibility of investment expenses.

- Payroll taxes in the United States

- Capital gains tax in the United States

- Sales taxes in the United States

- State income tax

- State tax levels

- Tax Day

- Tax preparation

- Tax protester

- Taxation in the United States

- Taxation of illegal income in the United States

- Tax resister

- US State NonResident Withholding Tax

References

- ^ http://www.irs.gov/pub/irs-drop/rp-08-66.pdf

- ^ http://www.irs.gov/efile/article/0,,id=118986,00.html

- ^ Tax Day lines dwindle at post office, Boston Globe, 2009.

- ^ US Constitution.net

- ^ Penn Mutual Indemnity Co. v. Commissioner, 227 F.2d 16, 19-20 (3rd Cir. 1960)

- ^ Steward Machine Co. v. Davis, 301 U.S. 548 (1937), 581-582

- ^ Revenue Act of 1861, sec. 49, ch. 45, 12 Stat. 292, 309 (Aug. 5, 1861).

- ^ Sections 49, 51, and part of 50 repealed by Revenue Act of 1862, sec. 89, ch. 119, 12 Stat. 432, 473 (July 1, 1862); income taxes imposed under Revenue Act of 1862, section 86 (pertaining to salaries of officers, or payments to "persons in the civil, military, naval, or other employment or service of the United States ...") and section 90 (pertaining to "the annual gains, profits, or income of every person residing in the United States, whether derived from any kind of property, rents, interest, dividends, salaries, or from any profession, trade, employment or vocation carried on in the United States or elsewhere, or from any other source whatever....").

- ^ Charles F. Dunbar, "The New Income Tax," Quarterly Journal of Economics, Vol. 9, No. 1 (Oct., 1894), pp. 26-46 in JSTOR

- ^ Chief Justice Fuller's opinion, 158 U.S. 601, 634

- ^ United States Government Printing Office, at Amendments to the Constitution of the United States of America; see generally United States v. Thomas, 788 F.2d 1250 (7th Cir. 1986), cert. denied, 107 S.Ct. 187 (1986); Ficalora v. Commissioner, 751 F.2d 85, 85-1 U.S. Tax Cas. (CCH) paragr. 9103 (2d Cir. 1984); Sisk v. Commissioner, 791 F.2d 58, 86-1 U.S. Tax Cas. (CCH) paragr. 9433 (6th Cir. 1986); United States v. Sitka, 845 F.2d 43, 88-1 U.S. Tax Cas. (CCH) paragr. 9308 (2d Cir.), cert. denied, 488 U.S. 827 (1988); United States v. Stahl, 792 F.2d 1438, 86-2 U.S. Tax Cas. (CCH) paragr. 9518 (9th Cir. 1986), cert. denied, 107 S. Ct. 888 (1987); Brown v. Commissioner, 53 T.C.M. (CCH) 94, T.C. Memo 1987-78, CCH Dec. 43,696(M) (1987); Lysiak v. Commissioner, 816 F.2d 311, 87-1 U.S. Tax Cas. (CCH) paragr. 9296 (7th Cir. 1987); Miller v. United States, 868 F.2d 236, 89-1 U.S. Tax Cas. (CCH) paragr. 9184 (7th Cir. 1989); also, see generally Boris I. Bittker, Constitutional Limits on the Taxing Power of the Federal Government, The Tax Lawyer, Fall 1987, Vol. 41, No. 1, p. 3 (American Bar Ass'n).

- ^ Memorandum Opinion, p. 14, Dec. 17, 2007, docket entry 106, United States v. Benson, case no. 1:04-cv-07403, United States District Court for the Northern District of Illinois, Eastern Division.

- ^ Memorandum Opinion, p. 9, Dec. 17, 2007, docket entry 106, United States v. Benson, case no. 1:04-cv-07403, United States District Court for the Northern District of Illinois, Eastern Division.

- ^ 348 U.S. at 429

- ^ Id. at 430.

- ^ Id. at 432-33.

- ^ Id. at 27.

- ^ Opinion on rehearing, July 3, 2007, p. 16, Murphy v. Internal Revenue Service and United States, case no. 05-5139, United States Court of Appeals for the District of Columbia Circuit, 2007-2 U.S. Tax Cas. (CCH) paragr. 50,531 (D.C. Cir. 2007).

- ^ Penn Mutual Indemnity Co. v. Commissioner, 277 F.2d 16, 60-1 U.S. Tax Cas. (CCH) paragr. 9389 (3d Cir. 1960) (footnotes omitted).

- ^ http://www.ntu.org/main/page.php?PageID=19

- ^ Personal Exemptions and Individual Income Tax Rates: 1913-2002, Internal Revenue Service

- ^ U.S. Federal Individual Marginal Income Tax Rates History, 1913-2009, The Tax Foundation

- ^ You Can't Soak the Rich, Wall St. Journal, May 20, 2008.

- ^ Lying With Charts, Wall St. Journal, May 20, 2008.

- ^ All residents of PR pay federal taxes, with the exception of federal income taxes which only some residents of Puerto Rico must still pay

- ^ Contrary to common misconception, residents of Puerto Rico do pay U.S. federal taxes: customs taxes (which are subsequently returned to the Puerto Rico Treasury) (See http://www.doi.gov/oia/Islandpages/prpage.htm Dept of the Interior, Office of Insular Affairs.), import/export taxes (See http://stanford.wellsphere.com/healthcare-industry-policy-article/puerto-rico/267827), federal commodity taxes (See http://stanford.wellsphere.com/healthcare-industry-policy-article/puerto-rico/267827), social security taxes (See http://www.irs.gov/taxtopics/tc903.html), etc. Residents pay federal payroll taxes, such as Social Security (See http://www.irs.gov/taxtopics/tc903.html) and Medicare (See http://www.reuters.com/article/healthNews/idUSTRE58N5X320090924), as well as Commonwealth of Puerto Rico income taxes (See http://www.puertorico-herald.org/issues/2003/vol7n19/USNotInnocent-en.html and http://www.htrcpa.com/businessinpr1.html). All federal employees (See http://www.heritage.org/research/taxes/wm2338.cfm), those who do business with the federal government (See http://www.mcvpr.com/CM/CurrentEvents/CEOsummitarticle.pdf), Puerto Rico-based corporations that intend to send funds to the U.S. (See http://www.jct.gov/x-24-06.pdf Page 9, line 1.), and some others (For example, Puerto Rican residents that are members of the U.S. military, See http://www.heritage.org/research/taxes/wm2338.cfm; and Puerto Rico residents who earned income from sources outside Puerto Rico, See http://www.jct.gov/x-24-06.pdf, pp 14-15.) also pay federal income taxes. In addition, because the cutoff point for income taxation is lower than that of the U.S. IRS code, and because the per-capita income in Puerto Rico is much lower than the average per-capita income on the mainland, more Puerto Rico residents pay income taxes to the local taxation authority than if the IRS code were applied to the island. This occurs because "the Commonwealth of Puerto Rico government has a wider set of responsibilities than do U.S. State and local governments" (See http://www.gao.gov/products/GAO-06-541). As residents of Puerto Rico pay into Social Security, Puerto Ricans are eligible for Social Security benefits upon retirement, but are excluded from the Supplemental Security Income (SSI) (Commonwealth of Puerto Rico residents, unlike residents of the Commonwealth of the Northern Mariana Islands and residents of the 50 States, do not receive the SSI. See http://www.socialsecurity.gov/OP_Home/handbook/handbook.21/handbook-2114.html), and the island actually receives less than 15% of the Medicaid funding it would normally receive if it were a U.S. state (See http://www.magiccarpetautotransport.com/auto-transport/puerto-rico-auto-transport.php). However, Medicare providers receive less-than-full state-like reimbursements for services rendered to beneficiaries in Puerto Rico, even though the latter paid fully into the system (See http://www.prfaa.com/news/?p=252). It has also been estimated (See http://www.eagleforum.org/column/2007/mar07/07-03-28.html) that, because the population of the Island is greater than that of 50% of the States, if it were a state, Puerto Rico would have six to eight seats in the House, in addition to the two seats in the Senate.(See http://www.eagleforum.org/column/2007/mar07/07-03-28.html, http://www.crf-usa.org/bill-of-rights-in-action/bria-17-4-c.html# and http://www.thomas.gov/cgi-bin/cpquery/?&sid=cp1109rs5H&refer=&r_n=hr597.110 [Note that for the later, the offical US Congress database website, you will need to resubmit a query. The document in question is called "House Report 110-597 - PUERTO RICO DEMOCRACY ACT OF 2007." These are the steps to follow: http://www.thomas.gov > Committee Reports > 110 > drop down "Word/Phrase" and pick "Report Number" > type "597" next to Report Number. This will provide the document "House Report 110-597 - PUERTO RICO DEMOCRACY ACT OF 2007", then from the Table of Contents choose "BACKGROUND AND NEED FOR LEGISLATION".]). Another misconception is that the import/export taxes collected by the U.S. on products manufactured in Puerto Rico are all returned to the Puerto Rico Treasury. This is not the case. Such import/export taxes are returned only for rum products, and even then the US Treasury keeps a portion of those taxes (See the "House Report 110-597 - PUERTO RICO DEMOCRACY ACT OF 2007" mentioned above.)

- ^ John Stuart Mill's argument, reported by Marvin A. Chirelstein, Federal Income Taxation, p. 433 (Foundation Press, 10th Ed., 2005)

- ^ Chirelstein, loc.cit.

- ^ a b Fleischer, Ari (2009-04-13). "Everyone Should Pay Income Taxes". Wall Street Journal. Retrieved 2009-04-14.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ^ a b Babington, Charles (Associated Press) (October 22, 2008). Spreading the wealth? U.S. already does it. Burlington Free Press.

- ^ Shinkle, Kirk (December 15–22, 2008). Shutting Down the Spin Cycle. US News and World Report.

{{cite book}}: CS1 maint: date format (link)

External links

- TaxAlmanac - Online tax collaboration A wiki created by tax professionals with detailed information on US IRS Tax Law and the only known free up to date copy of the US Internal Revenue Code.

- IRS publication: The Truth About Frivolous Tax Arguments

- US Department of Treasury Official fact sheet on income taxes in the US.

- Tax Policy Center Numeric data on tax revenues since 1950.

- comedian Raymond Hitchcock gives amusing view(song #6 "Mr. Hitchcock's Curtain Call) on Federal Income Tax in 1914 one year after President Wilson enacted Federal Income Tax