History of capitalism: Difference between revisions

m Reverted edits by 157.166.167.129 (talk): addition of unsourced content (HG) |

No edit summary |

||

| Line 19: | Line 19: | ||

</ref> |

</ref> |

||

Over the course of the past five hundred years, [[Capital (economics)|capital]] has been accumulated by a variety of different methods, in a variety of scales, and associated with a great deal of variation in the concentration of economic power and wealth.<ref name="Scott 2005">Scott (2005)</ref> Much of the history of the past five hundred years is concerned with the development of capitalism in its various forms, its condemnation and rejection, particularly by [[Socialism|socialists]], and its defense, mainly by [[Conservatism|conservatives]]. |

Over the course of the past five hundred years, [[Capital (economics)|capital]] has been accumulated by a variety of different methods, in a variety of scales, and associated with a great deal of variation in the concentration of economic power and wealth.<ref name="Scott 2005">Scott (2005)</ref> Much of the history of the past five hundred years is concerned with the development of capitalism in its various forms, its condemnation and rejection, particularly by [[Socialism|socialists]], and its defense, mainly by [[Conservatism|conservatives]], though a stronger defense is often put forth by the "Austrian school" of economists such as Ludwig Von Mises. |

||

Since 2000 the new scholarly field of "History of Capitalism" has appeared, with courses in history departments. It includes topics such as insurance, banking and regulation, the political dimension, and the impact on the middle classes, the poor and women and minorities.<ref>See Jennifer Schuessler "In History Departments, It’s Up With Capitalism" [http://www.nytimes.com/2013/04/07/education/in-history-departments-its-up-with-capitalism.html?_r=0 ''New York Times'' April 6, 2013]</ref> |

Since 2000 the new scholarly field of "History of Capitalism" has appeared, with courses in history departments. It includes topics such as insurance, banking and regulation, the political dimension, and the impact on the middle classes, the poor and women and minorities.<ref>See Jennifer Schuessler "In History Departments, It’s Up With Capitalism" [http://www.nytimes.com/2013/04/07/education/in-history-departments-its-up-with-capitalism.html?_r=0 ''New York Times'' April 6, 2013]</ref> |

||

Revision as of 22:19, 9 July 2013

This article contains weasel words: vague phrasing that often accompanies biased or unverifiable information. (February 2012) |

The history of capitalism can be traced back to early forms of merchant capitalism practiced in Western Europe during the Middle Ages,[1] though many [who?] economic historians consider the Netherlands as the first thoroughly capitalist country. In Early modern Europe it featured the wealthiest trading city (Amsterdam) and the first full-time stock exchange. The inventiveness of the traders led to insurance and retirement funds, along with much less benign phenomena as well, such as the boom-bust cycle, the world's first asset-inflation bubble, the tulip mania of 1636–1637, and according to Murray Sayle, the world's first bear raider – Isaac le Maire, who in 1607 forced prices down by dumping stock and then buying it back at a discount.[2]

Over the course of the past five hundred years, capital has been accumulated by a variety of different methods, in a variety of scales, and associated with a great deal of variation in the concentration of economic power and wealth.[3] Much of the history of the past five hundred years is concerned with the development of capitalism in its various forms, its condemnation and rejection, particularly by socialists, and its defense, mainly by conservatives, though a stronger defense is often put forth by the "Austrian school" of economists such as Ludwig Von Mises.

Since 2000 the new scholarly field of "History of Capitalism" has appeared, with courses in history departments. It includes topics such as insurance, banking and regulation, the political dimension, and the impact on the middle classes, the poor and women and minorities.[4]

Prehistory of capitalism

The Crisis of the 14th century and the "pre-history of capitalism"

According to some historians, the modern capitalist system has its origin in the "crisis of the fourteenth century," a conflict between the land-owning aristocracy and the agricultural producers, the serfs. Manorial arrangements inhibited the development of capitalism in a number of ways. Because serfs were forced to produce for lords, they had no interest in technological innovation; because serfs produced to sustain their own families, they had no interest in co-operating with one another. Because lords owned the land, they relied on force to guarantee that they were provided with sufficient food. Because lords were not producing to sell on the market, there was no competitive pressure for them to innovate. Finally, because lords expanded their power and wealth through military means, they spent their wealth on military equipment or on conspicuous consumption that helped foster alliances with other lords; they had no incentive to invest in developing new productive technologies.[5]

This arrangement was shaken by the demographic crisis of the 14th century. This crisis had several causes: agricultural productivity reached its technological limitations and stopped growing; bad weather led to the Great Famine of 1315–1317; the Black Death in 1348–1350 led to a population crash. These factors led to a decline in agricultural production. In response feudal lords sought to expand agricultural production by expanding their domains through warfare; they therefore demanded more tribute from their serfs to pay for military expenses. In England, many serfs rebelled. Some moved to towns, some purchased land, and some entered into favorable contracts to rent lands from lords who needed to repopulate their estates.[6]

The collapse of the manorial system in England created a class of tenant-farmers with more freedom to market their goods and thus more incentive to invest in new technologies. Lords who did not want to rely on rents could buy out or evict tenant farmers, but then had to hire free-labor to work their estates – giving them an incentive to invest in two very different kinds of commodity owners; on the one hand, the owners of money, means of production, means of subsistence, who are eager to valorize the sum of value they have appropriated by buying the labour power of others; on the other hand, free workers, the sellers of their own labor-power, and, Free workers, in the double sense that they neither form part of the means of production nor do they own the means of production that transformed land and even money into what we now call "capital."[7] Marx labeled this period the "pre-history of capitalism".[8]

It was, in effect, feudalism that began to lay some of the foundations necessary for the development of mercantilism, a precursor to capitalism. Feudalism took place mostly in Europe and lasted from the medieval period up through the 16th century. Feudal manors were almost entirely self-sufficient, and therefore limited the role of the market. This stifled the growth of capitalism. However, the relatively sudden emergence of new technologies and discoveries, particularly in the industries of agriculture[9] and exploration, revitalized the growth of capitalism. The most important development at the end of Feudalism was the emergence of "the dichotomy between wage earners and capitalist merchants".[10] With mercantilism, the competitive nature means there are always winners and losers, and this is clearly evident as feudalism transitions into mercantilism, an economic system characterized by private or corporate ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined mainly by competition in a free market.

Merchant capitalism and mercantilism

The earliest recorded activity of long-distance profit-seeking merchants can be traced back to the Old Assyrian merchants active in the 2nd millennium BCE.[11] The Roman Empire developed more advanced forms of Merchant capitalism, and similarly widespread networks existed in Islamic capitalism, but the modern form took shape in Europe in the late Middle Ages and Renaissance. Some scholars, Rodney Stark particularly, trace the origins to medieval Italian and French monastic estates.

There is a separate but also related tradition of the emergence of commerce and capitalism related to monastic estates in Italy and France and later the independent city republics of Italy during the late Middle Ages and into the early modern period. Innovations in banking, insurance, accountancy, and various production and commercial practices linked closely to a 'spirit' of frugality, reinvestment, and city life and promoted attitudes which sociologists have tended to associate only with northern Europe, Protestantism and a much later age. The city republics maintained their political independence from Empire and Church, traded with north Africa, the middle East and Asia, and introduced Eastern practices as well as innovated substantially, producing many links between of culture and commerce. They were also considerably different from the absolutist monarchies of Spain and France, and were strongly attached to civic liberty and anti-monarchical republications.;[12][13];.[14]

Modern capitalism didn't arise until the early modern period, between the 16th and 18th centuries, when merchant capitalism and mercantilism were established.[15][16] This period was associated with geographic discoveries by merchant overseas traders, especially from England, Portugal, Spain and the Low Countries; the European colonization of the Americas; and the rapid growth in overseas trade. Referring to this period in the Communist Manifesto, Marx wrote:

The discovery of America, the rounding of the Cape, opened up fresh ground for the rising bourgeoisie. The East-Indian and Chinese markets, the colonisation of America, trade with the colonies, the increase in the means of exchange and in commodities generally, gave to commerce, to navigation, to industry, an impulse never before known, and thereby, to the revolutionary element in the tottering feudal society, a rapid development." [2]

Mercantilism was a system of trade for profit, although commodities were still largely produced by non-capitalist production methods.[3] Noting the various pre-capitalist features of mercantilism, Karl Polanyi argued that "mercantilism, with all its tendency toward commercialization, never attacked the safeguards which protected [the] two basic elements of production - labor and land - from becoming the elements of commerce"; thus with mercantilism regulation was more akin to feudalism than capitalism. According to Polanyi, "not until 1834 was a competitive labor market established in England, hence industrial capitalism as a social system cannot be said to have existed before that date."[17]

Under mercantilism, European merchants, backed by state controls, subsidies, and monopolies, made most of their profits from the buying and selling of goods. In the words of Francis Bacon, the purpose of mercantilism was "the opening and well-balancing of trade; the cherishing of manufacturers; the banishing of idleness; the repressing of waste and excess by sumptuary laws; the improvement and husbanding of the soil; the regulation of prices..."[18] Similar practices of economic regimentation had begun earlier in the medieval towns. However, under mercantilism, given the contemporaneous rise of the absolutism, the state superseded the local guilds as the regulator of the economy.

Among the major tenets of mercantilist theory was bullionism, a doctrine stressing the importance of accumulating precious metals. Mercantilists argued that a state should export more goods than it imported so that foreigners would have to pay the difference in precious metals. Mercantilists asserted that only raw materials that could not be extracted at home should be imported; and promoted government subsides, such as the granting of monopolies and protective tariffs, were necessary to encourage home production of manufactured goods.

Proponents of mercantilism emphasized state power and overseas conquest as the principal aim of economic policy. If a state could not supply its own raw materials, according to the mercantilists, it should acquire colonies from which they could be extracted. Colonies constituted not only sources of supply for raw materials but also markets for finished products. Because it was not in the interests of the state to allow competition, to help the mercantilists, colonies should be prevented from engaging in manufacturing and trading with foreign powers.

Chartered trading companies

The British East India Company and the Dutch East India Company launched an era of large state chartered trading companies.[1][19] These companies were characterized by their monopoly on trade, granted by letters patent provided by the state. Recognized as chartered joint-stock companies by the state, these companies enjoyed power, ranging from lawmaking, military, and treaty-making privileges.[20] Characterized by its colonial and expansionary powers by states, powerful nation-states sought to accumulate precious metals, and military conflicts arose.[1] During this era, merchants, who had previously traded on their own, invested capital in the East India Companies and other colonies, seeking a return on investment.

Enclosures and the transition from feudalism

The transition from the feudal organization of society to the earliest forms of capitalism happened in periods differing from country to country. The earliest phase appears to be in North Italy, according to Cambridge political philosopher and historian Quentin Skinner. This development was noticed in the 12th century by German bishop Otto of Freising, who recorded the growth of town life, the loyalty of landed nobility to town authorities, and the emergence of republicanism and belief in civic liberty.[21]

In Scotland, during the 18th century, crofters were dispossessed[22][23][24][25][26][27] of the land to which they were bonded and which allowed them to be self-sufficient. The Lairds confiscated the land which was property of the clan. Between 1773-4, 1500 people emigrated from the county of Sutherland to the Colonial America.[28] Later in the 18th century, others were both driven from the land and forbidden to emigrate.[29] In Sutherland, between 1814–20, the remaining 15,000 inhabitants, about 3000 families, were systematically hunted and rooted out.[30] Their villages were pulled down and burnt, and their fields turned into pasturage.[30] It was reported that "British soldiers enforced this eviction, and came to blows with the inhabitants. One old woman was burnt to death in the flames of the hut, which she refused to leave. Thus this fine lady appropriated 794,000 acres (3,210 km2) of land that had from time immemorial belonged to the clan ... In the year 1835 the 15,000 Scottish crofters were already replaced by 131,000 sheep.[29][31] A similar disruptive transition took place in England, Germany, Poland and India, though mercantilism was the dominant economic system for many nations as they transitioned from a fully 'state' operated feudal system to capitalism.

For Paul Virilio, the transition from feudalism to capitalism was driven not primarily by the politics of wealth and production techniques but by the mechanics of war. Virilio argues that the traditional feudal fortified city disappeared because of the increasing sophistication of weapons and possibilities for warfare. For Virilio, the concept of siege warfare became rather a war of movement. In Speed and Politics, he argues that 'history progresses at the speed of its weapons systems'.[citation needed]

Industrial capitalism and laissez-faire

Mercantilism declined in Great Britain in the mid-18th century, when a new group of economic theorists, led by Adam Smith, challenged fundamental mercantilist doctrines as the belief that the amount of the world's wealth remained constant and that a state could only increase its wealth at the expense of another state. However, in more undeveloped economies, such as Prussia and Russia, with their much younger manufacturing bases, mercantilism continued to find favor after other states had turned to newer doctrines.

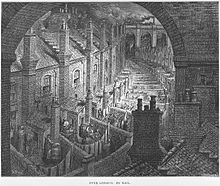

The mid-18th century gave rise to industrial capitalism, made possible by the accumulation of vast amounts of capital under the merchant phase of capitalism and its investment in machinery. Industrial capitalism, which Marx dated from the last third of the 18th century, marked the development of the factory system of manufacturing, characterized by a complex division of labor between and within work process and the routinization of work tasks; and finally established the global domination of the capitalist mode of production.[15]

During the resulting Industrial Revolution, the industrialist replaced the merchant as a dominant actor in the capitalist system and effected the decline of the traditional handicraft skills of artisans, guilds, and journeymen. Also during this period, capitalism marked the transformation of relations between the British landowning gentry and peasants, giving rise to the production of cash crops for the market rather than for subsistence on a feudal manor. The surplus generated by the rise of commercial agriculture encouraged increased mechanization of agriculture.

The rise of industrial capitalism was also associated with the decline of mercantilism. Mid- to late-19th-century Britain is widely regarded as the classic case of laissez-faire capitalism.[15] Laissez-faire gained favor over mercantilism in Britain in the 1840s with the repeal of the Corn Laws and the Navigation Acts. In line with the teachings of the classical political economists, led by Adam Smith and David Ricardo, Britain embraced liberalism, encouraging competition and the development of a market economy.

Nineteenth century

During the 19th century, capitalism allowed great increases in productivity, whilst triggering great social changes.

The Napoleonic Wars

As the 19th century began, Napoleon sought to introduce a "continental system" that would render Europe economically autonomous, making the Royal Navy's blockading power irrelevant. It involved such stratagems as the use of beet sugar in preference to the cane sugar that had to be imported from the tropics.

The Continental system did cause some mercantile circles within the UK to agitate for peace, but the government was able to resist that agitation, in part because the United Kingdom was well into the industrial revolution. The war stimulated the growth of certain industries -- pig-iron output, which was just 68,000 tons in 1788, soared to 244,000 tons by 1806.[citation needed]

Banking after Napoleon

The growth of Britain's industry meant the growth of her system of finance and credit. At the beginning of the century, banking was an affair for clubs of very wealthy families. But gradually, and at an accelerating pace after the collapse of the threat from Napoleon, a new sort of banking emerged, owned by anonymous stockholders, run by professional managers, and the recipient of the deposits of a growing body of small savers.

The new breed of banks was new in prominence, not newly invented. A Quaker family, the Barclays, had been banking in this manner since 1690. But this model of banking became ever more prominent through the 19th century.

The UK's growing importance as the center of capitalism in this period benefitted from the great degree to which the business world of Britain was open to talented foreigners, like Johann Baring, who had come from Bremen in 1717 and turned himself into a successful cloth merchant in Exeter. His sons, John and Francis Baring, set up a trading company in London, and Francis became one of the most influential bankers of his time. By his death in 1810 he was allegedly worth 7 million pounds.

Indeed, the Barings bank that lived on after Sir Francis' death was important enough to become the target of a barb from George Gordon Byron. In 1823, that great poet wrote: "Who makes politics run glibber all?/ The shade of Bonaparte's noble daring?/ Jew Rothschild and his fellow-Christian, Baring."

The end of expensive hostilities and the rebound in trade after Napoleon's fall led to an expansion in the bullion reserves held by the Bank of England, from a low of under 4 million pounds in 1821 to 14 million pounds by late 1824. This was also the period during which the Erie Canal was under construction in the United States, and many investors in Europe saw opportunities in America, just as many investors in the developed world look to the emerging markets of today.[citation needed]

The end of the Bank of the United States

President Andrew Jackson's hostility to the Bank of the United States was perhaps the central issue of the election campaign of 1832. The following year, the Bank of the United States ceased to receive public funds.

There were several results of this action—one was an increase in the importance of the London banks to the U.S. economy, and another was an expansion of the state banking systems, amongst which the federal treasury was now splitting its deposits.

The U.S. government also sold huge amounts of public land in Jackson's second term, lands acquired at the cost of dispossessing their inhabitants. It deposited the proceeds from these sales in its "pet" state banks. As the money supply expanded, asset prices rose, increasing the appetite of Europe's investors, creating a bubble. Between 1830 and 1837, the US trade deficit was $140 million.

By 1839 this bubble burst. The Union Bank of Mississippi collapsed. As credit conditions worsened, American states that had borrowed from London banks proved unwilling to raise taxes to pay, and a wave of defaults (including the default of two of the wealthiest states, Maryland and Pennsylvania) resulted.[citation needed]

A Civil War and the Suez Peninsula

Throughout the early decades of the 18th century, capitalism as a financial phenomenon was becoming intertwined with the new methods of manufacturing, especially of textiles.

This intertwining was aided by Eli Whitney's invention of the cotton gin in 1793. During the Orleanist period in France, the financial and manufacturing methods pioneered in England were enthusiastically adopted in France.

It came as a great shock to mercantile circles within both of those countries, then, when civil war erupted in the United States in 1861, and President Abraham Lincoln closed the ports of the U.S. within the area of the rebellion to international commerce, a closure that he (somewhat inaccurately) described as a "blockade."

The textile industries in Britain and France shifted to reliance upon cotton from Africa and Asia during the course of the U.S. civil war, and this fact created pressure for an Anglo-French controlled canal through the Suez peninsula. That canal opened a little more than four years after the war ended, November 17, 1869. Intriguingly, it was also in 1869 that a railway finally spanned the North American continent, as the Union Pacific work crew met that of the Central Pacific in Utah. Capitalism and the engine of profit was making the globe a smaller place.

Also, older innovations were made routine, even mechanical, parts of financial life during this century. For example, the Bank of England had first issued bank notes during the 17th century, yet those notes were hand written. After 1725 they were partially printed, but cashiers still had to sign each note and make them payable to a named person. But in 1844 parliament passed the Bank Charter Act tying these notes to gold reserves, effectively creating the institution of central banking and monetary policy. The notes have been fully printed since 1855.[citation needed]

The Slow Fade of British Hegemony

Through the final decades of the 19th century, from the opening of the canal forward, the United Kingdom slowly lost its pre-eminence in manufacturing and finance. There is a lot of debate about the reasons for this; indeed, historian Paul Kennedy has called it "one of the most investigated issues in economic history."[citation needed]

There were many elements, including the obsolescence of the personal management style, confrontational labor relations, inadequate capital investment, and the rise of at least three competing industrial giants—Germany, Japan, and the United States. There were also cultural factors such as generational differences and the class-conscious educational system at play.

In 1880, the United Kingdom still contained 22.9 percent of total world manufacturing output, but that figure was shrinking. Also, in 1880, its share of world trade was 23.2 percent—that would be 14.1 percent in 1911 - 1913.[citation needed]

Finance capitalism and State monopoly capitalism

Stages of Capitalism

It is an ongoing debate within the fields of economics and sociology as to what the past, current, and future stages of capitalism consist of. While ongoing disagreement about exact stages exists, many economists (notably Marx and others following from his critique of capitalism) have posited the following general states

- An agrarian capitalism, sometimes known as market feudalism. This was a transitional form between feudalism and capitalism, whereby market relations replaced some but not all of feudal relations in a society.

- Mercantilism, where national governments sought to maintain positive balances of trade and acquire gold bullion

- Industrial Capitalism, characterized by its use of heavy machinery, a much more pronounced division of labor, and Taylorism

- Monopoly Capitalism, marked by the rise of monopolies and trusts dominating industry, as well as other aspects of society. Often used to describe the economy of the late 19th and early 20th century.

- Colonialism, where governments sought to colonize other areas to improve access to markets and raw materials, and improve the standing of nationally based capitalist firms. Predominant in the 1890s, notably as a response to the economic crises of the 1890s

- Welfare Capitalism, where mixed economies predominated and governments sought to provide a safety net to alleviate the worst abuses of capitalism. Its starting point could be with Otto Von Bismarck providing social insurance as a method to head off support for socialism in the 1880s. The heyday of welfare capitalism (in advanced economies) is widely seen to be from 1945–1973, as major social safety nets were put in place in most advanced capitalist economies.[32]

- Mass Production, post-World War Two, saw the rising hegemony of major corporations, and a focus on mass production, mass consumption, and (ideally) mass employment. This stage sees the rise of advertising as a way to promote mass consumption, and often sees significant economic planning taking place within firms.[33]

- State Capitalism, where the state intervened to prevent economic instability, including partially or fully nationalizing certain industries. Some economic planning (like the type done by the Japanese MITI) may occur here. Some socialists characterize the economies of the USSR and the Eastern Block to have fallen in this category as well

- Corporatism, where government, business, and labor collude to make major national decisions; notable for being an economic model of fascism; can overlap with, but is still significantly different from state capitalism.

- Financialization, or financial capitalism, where financial parts of the economy (like the finance, insurance, or real estate sectors) predominate an economy. Profit becomes more derived from ownership of an asset, credit, rents, and earning interest, rather than actual productive processes.[34][35]

Twentieth century

Capitalism in the 20th century changed substantially from its 19th-century origins, but remained in place and by the end of the century was established as the world's most prevalent economic model, after the collapse of the USSR.

Several major challenges to capitalism appeared in the early part of the 20th century. The Russian revolution in 1917 established the first communist state in the world; a decade later, the Great Depression triggered increasing criticism of the existing capitalist system. One response to this crisis was a turn to fascism, an ideology which advocated state-influenced capitalism; whilst others rejected capitalism altogether in favor of communist or socialist ideologies.

In the years after World War II, capitalism was moderated and regulated in several ways. Keynesian economics became a widely accepted method of government regulation; meanwhile, countries such as the United Kingdom experimented with mixed economies in which the state owned and operated certain major industries.

Other aspects of 20th-century capitalism include the rise of financial markets, quantitative analysis of market trends, and the increasing globalization of production and consumption.

Capitalism following the Great Depression

The economic recovery of the world's leading capitalist economies in the period following the end of the Great Depression and the Second World War —- a period of unusually rapid growth by historical standards —- eased discussion of capitalism's eventual decline or demise.[36]

In the period following the global depression of the 1930s, the state played an increasingly prominent role in the capitalistic system throughout much of the world. In 1929, for example, total U.S. government expenditures (federal, state, and local) amounted to less than one-tenth of GNP; from the 1970s they amounted to around one-third.[16] Similar increases were seen in all industrialized capitalist economies, some of which, such as France, have reached even higher ratios of government expenditures to GNP than the United States. These economies have since been widely described as "mixed economies."

During the postwar boom, a broad array of new analytical tools in the social sciences were developed to explain the social and economic trends of the period, including the concepts of post-industrial society and welfare statism.[15] The phase of capitalism from the beginning of the postwar period through the 1970s has also been variously described as "state capitalism" by Marxist and non-Marxist commentators alike.

The long postwar boom ended in the 1970s, amid the economic crises experienced following the 1973 oil crisis. The "stagflation" of the 1970s led many economic commentators and politicians to embrace neoliberal policy prescriptions inspired by the laissez-faire capitalism and classical liberalism of the 19th century, particularly under the influence of Friedrich Hayek and Milton Friedman. In particular, monetarism, a theoretical alternative to Keynesianism that is more compatible with laissez-faire, gained increasing support in the capitalist world, especially under leadership of Ronald Reagan in the U.S. and Margaret Thatcher in the UK in the 1980s.

Globalization

Although overseas trade has been associated with the development of capitalism for over five hundred years, some thinkers argue that a number of trends associated with globalization have acted to increase the mobility of people and capital since the last quarter of the 20th century, combining to circumscribe the room to maneuver of states in choosing non-capitalist models of development. Today, these trends have bolstered the argument that capitalism should now be viewed as a truly world system (Burnham). However, other thinkers argue that globalization, even in its quantitative degree, is no greater now than during earlier periods of capitalist trade.[37]

After the abandonment of the Bretton Woods system in 1971, and the strict state control of foreign exchange rates, the total value of transactions in foreign exchange was estimated to be at least twenty times greater than that of all foreign movements of goods and services (EB). The internationalization of finance, which some see as beyond the reach of state control, combined with the growing ease with which large corporations have been able to relocate their operations to low-wage states, has posed the question of the 'eclipse' of state sovereignty, arising from the growing 'globalization' of capital.[38]

While economists generally agree about the size of global income inequality[citation needed], there is a general disagreement about the recent direction of change of it.[39] In cases such as China, where income inequality is clearly growing[40] it is also evident that overall economic growth has rapidly increased with capitalist reforms.[41] The book The Improving State of the World argues that economic growth since the Industrial Revolution has been very strong and that factors such as adequate nutrition, life expectancy, infant mortality, literacy, prevalence of child labor, education, and available free time have improved greatly.

Twenty-first century

By the beginning of the 21st century, capitalism had become the pervasive economic system worldwide. The collapse of the Soviet bloc in 1991 significantly reduced the influence of Communism as an alternative economic system. Socialist movements continue to be influential in some parts of the world, most notably Latin-American Bolivarianism, with some having ties to more traditional anti-capitalist movements, such as Bolivarian Venezuela's ties to communist Cuba.

In many emerging markets, the influence of banking and financial capital have come to increasingly shape national developmental strategies, leading some to argue we are in a new phase of financial capitalism.[42]

State intervention in global capital markets following the financial crisis of 2007–2010 was perceived by some as signaling a crisis for free-market capitalism.[citation needed] Others claim the financial crisis was not a result of capitalism but was instead caused by government interventions.[citation needed] Serious turmoil in the banking system and financial markets due in part to the subprime mortgage crisis reached a critical stage during September 2008, characterized by severely contracted liquidity in the global credit markets posed an existential threat to investment banks and other institutions.[43][44]

Future

According to some,[45] the transition to the information society involves abandoning some parts of capitalism, as the "capital" required to produce and process information becomes available to the masses and difficult to control, and is closely related to the controversial issues of intellectual property. Some[45] even speculate that the development of mature nanotechnology, particularly of universal assemblers, may make capitalism obsolete, with capital ceasing to be an important factor in the economic life of humanity.

See also

- Capitalist mode of production

- Enclosure and British Agricultural Revolution

- Fernand Braudel

- Financial crisis of 2007–2010

- History of capitalist theory

- History of globalization

- History of private equity and venture capital

- Primitive accumulation of capital

- Simple commodity production

References

- ^ a b c Jairus Banaji (2007), "Islam, the Mediterranean and the rise of capitalism", Journal Historical Materialism 15#1 pp 47-74, Brill Publishers.

- ^

Sayle, Murray (2001-04-05). "Japan goes Dutch". London Review of Books. 23 (7): 3–7. ISSN 0260-9592. Retrieved 2010-06-20.

[...] the maladies of capitalism: the boom-bust cycle, the world's first asset-inflation bubble, the tulip mania of 1636–37, and even, in 1607, history's first bear raider, a canny shareholder named Isaac le Maire who dumped his VOC stock, forcing the price down, and then bought it back at a discount.

- ^ a b Scott (2005)

- ^ See Jennifer Schuessler "In History Departments, It’s Up With Capitalism" New York Times April 6, 2013

- ^ Brenner, Robert, 1977, "The Origins of Capitalist Development: a Critique of Neo-Smithian Marxism," in New Left Review 104: 36-37, 46

- ^ Dobb, Maurice 1947 Studies in the Development of Capitalism. New York: International Publishers Co., Inc. 42-46, 48 ff.

- ^ Marx, Karl [1867] 1976 Capital: A Critique of Political Economy Volume One trans. Ben Fowkes. Harmondsworth and London: Penguin Books and New Left Review. 874

- ^ Marx, Karl [1867] 1976 Capital: A Critique of Political Economy Volume One trans. Ben Fowkes. Harmondsworth and London: Penguin Books and New Left Review. 875

- ^ James Fulcher, Capitalism (New York: Oxford University Press, 2004) 19

- ^ Degen, Robert. The Triumph of Capitalism. 1st ed. New Brunswick, NJ: Transaction Publishers, 2008. p. 12

- ^ Warburton, David, Macroeconomics from the beginning: The General Theory, Ancient Markets, and the Rate of Interest. Paris: Recherches et Publications, 2003.p49

- ^ Stark, Rodney. Victory of Reason, (Random House New York, 2005)

- ^ Ferguson, Niall. The Ascent of Money, (Pengiun,2008)

- ^ Skinner, Quentin, The Foundations of Modern Political Thought, vol I: The Renaissance; vol II: The Age of Reformation. Cambridge University Press, 1978)

- ^ a b c d Burnham (2003)

- ^ a b Encyclopædia Britannica (2006)

- ^ Polanyi, Karl. The Great Transformation. Beacon Press, Boston.1944.p87

- ^ Quoted in Sir George Clark, The Seventeenth Century (New York: Oxford University Press, 1961), p. 24.

- ^ Economic system :: Market systems. Encyclopædia Britannica. 2006.

- ^ "chartered company".

- ^ # Skinner, Quentin, The Foundations of Modern Political Thought, vol I: The Renaissance vol II: The Age of Reformation Cambridge University Press, 1978)

- ^ Selkirk (1805) pp.31-54

- ^ Smout (1969) pp.353-4

- ^ Richards (1973) p.216

- ^ Buchanan (1814) p.144

- ^ Steuart [1767]

- ^ James Anderson (1777)

- ^ Benjamin Franklin, 1773

- ^ a b Marx (1867), ch. 27, pp.890-2

- ^ a b Newman (1851) pp. 131-2

- ^ Perelman, p.142

- ^ "A People's History of the World" Chris Harman pg. 251-397

- ^ "The New Industrial State" J.K. Galbraith pg. 16-35

- ^ "Zombie Capitalism" Chris Harman pg. 142-160

- ^ Marois, Thomas (2012) 'Finance, Finance Capital, and Financialisation.' In: Fine, Ben and Saad Filho, Alfredo, (eds.), The Elgar Companion to Marxist Economics. Cheltenham: Edward Elgar.

- ^ Engerman (2001)

- ^ Doug Henwood is an economists who has argued that the heyday of globalization was during the mid-19th century. For example, he writes in What Is Globalization Anyway?:

Not only is the novelty of "globalization" exaggerated, so is its extent. Capital flows were freer, and foreign holdings by British investors far larger, 100 years ago than anything we see today. Images of multinational corporations shuttling raw materials and parts around the world, as if the whole globe were an assembly line, are grossly overblown, accounting for only about a tenth of U.S. trade.[1]

(See also Henwood, Doug (October 1, 2003). After the New Economy. New Press. ISBN 1-56584-770-9.)

- ^ For an assessment of this question, see Peter Evans, "The Eclipse of the State? Reflections on Stateness in an Era of Globalization," World Politics, 50, 1 (October 1997): 62-87.

- ^ Milanovic, Branko (2006-08-01). "Global Income Inequality: What It Is And Why It Matters?". DESA Working Paper. 26: 9.

- ^ Brooks, David (2004-11-27). "Good News about Poverty". Retrieved 2008-02-26.

- ^ Fengbo Zhang: Speech at "Future China Global Forum 2010": China Rising with the Reform and Open Policy.

- ^ Marois, Thomas (2012) States, Banks and Crisis: Emerging Finance Capitalism in Mexico and Turkey. Cheltenham, Gloucestershire, UK: Edward Elgar Publishing.

- ^ "President Bush Meets with Bicameral and Bipartisan Members of Congress to Discuss Economy", Whitehouse.gov, September 25, 2008.

- ^ House Votes Down Bail-Out Package

- ^ a b Kaku, Michio (1999). Visions: How Science Will Revolutionize the 21st Century and Beyond. New York: Oxford University Press. ISBN 0-19-288018-7

Further reading

- James Anderson of Hermiston (1777) Observations on the Means of Exciting a Spirit of National Industry

- David Buchanan (1814) Observations on the Subjects Treated of in Dr. Smith's Inquiry into the Nature and Causes of the Wealth of Nations Vol 4, p. 144

- George C. Comninel English feudalism and the origins of capitalism Journal of Peasant Studies, Volume 27, Issue 4 July 2000, pages 1 – 53 doi:10.1080/03066150008438748

- Maurice Dobb and Paul Sweezy's famous debate on transition from feudalism to capitalism. Hilton, Rodney H. 1976. ed. The Transition from Feudalism to Capitalism. London:

- Ben Dodds Peasants and Production in the Medieval North-East: The Evidence from Tithes, 1270–1536. Boydell Press, 2007, Pp. xii + 205. 50.00 (hardback) ISBN 1-84383-287-9

- MC Howard, JE King CRISES IN MARX’S ANALYSIS OF THE MARKET countdownnet.info

- Rosa Luxemburg What is economics?

- Karl Marx (1867) Das Kapital

- Adam David Morton The Age of Absolutism: capitalism, the modern states-system and international relations Review of International Studies (2005), 31 : 495-517 Cambridge University Press doi:10.1017/S0260210505006601

- Francis William Newman Lectures on Political Economy London, pp. 131–2

- Peter Nolan (2009) Crossroads: The end of wild capitalism. Marshall Cavendish, ISBN 978-0-462-09968-2

- Larry Patriquin The Agrarian Origins of the Industrial Revolution in England Review of Radical Political Economics, Vol. 36, No. 2, 196-216 (2004) doi:10.1177/0486613404264190

- Larry Patriquin Why was there no 'Old Poor Law' in Scotland and Ireland? Journal of Peasant Studies, Volume 33, Issue 2 April 2006, pages 219 - 247*Eric Richards (1973) The Leviathan of Wealth: The Sutherland Fortune in the Industrial Revolution. ISBN 0-7100-7455-7, ISBN 978-0-7100-7455-3 p. 216

- Michael Perelman (2000) The Invention of Capitalism: Classical Political Economy and the Secret History of Primitive Accumulation. Published by Duke University Press. ISBN 0-8223-2491-1, ISBN 978-0-8223-2491-1

- Stephen H. Rigby Historical Materialism: Social Structure and Social Change in the Middle Ages Journal of Medieval and Early Modern Studies 2004 34(3):473-522; doi:10.1215/10829636-34-3-473

- S. H. Rigby's book review in Volume 35, Issue 1 of Journal of Peasant Studies

- Jennifer Schuessler In History Departments, It’s Up With Capitalism April 6, 2013 New York Times

- John Scott and Gordon Marshall "Capitalism". In A Dictionary of Sociology, Third Edition, Oxford University Press (2005). Oxford Reference Online. Oxford University Press. ISBN 0-19-860987-6

- James Denham-Steuart [1767] An Inquiry into the Principles of Political Economy vol1, vol2, vol3

- Mike Zmolek (2000) The case for Agrarian capitalism: A response to albritton Journal of Peasant Studies, Volume 27, Issue 4 July 2000, pages 138 - 159

- Zmolek M. (2001) DEBATE - Further Thoughts on Agrarian Capitalism: A Reply to Albritton The Journal of Peasant Studies, Volume 29, Number 1, October 2001, pp. 129–154(26)

- Debating Agrarian Capitalism: A Rejoinder to Albritton

- Research in Political Economy, Volume 22

- The Roots of Merchant Capitalism

- World Socialist Movement. "What Is Capitalism?." World Socialism. 13, Aug. 2007.

- Thomas K. McCraw, "The Current Crisis and the Essence of Capitalism", The Montreal Review (August, 2011)