Health insurance coverage in the United States: Difference between revisions

OlYeller21 (talk | contribs) Undid revision 474427528 by 108.36.164.22 (talk) |

mNo edit summary |

||

| Line 8: | Line 8: | ||

{{Health care reform in the United States}} |

{{Health care reform in the United States}} |

||

The number of persons without [[health insurance in the United States|health insurance]] coverage in the [[United States]] is one of the primary concerns raised by advocates of [[health care reform in the United States|health care reform]]. According to the [[United States Census Bureau]], in 2009 there were 50.7 million people in the US (16.7% of the population) who were without health insurance.<ref name="Census 2009">[http://www.census.gov/prod/2010pubs/p60-238.pdf "Income, Poverty, and Health Insurance Coverage in the United States: 2009."] U.S. Census Bureau. p. 22. Issued September 2010.</ref> The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000.<ref name="CovertheUninsured">{{cite web |url=http://covertheuninsured.org/factsheets/display.php?FactSheetID=101 |title=Percentage of Nonelderly Americans Without Health Insurance Coverage, 1987-2006 |accessdate=2008-01-21 |format= |work=CovertheUninsured.org, a project of the Robert Wood Johnson Foundation |archiveurl = http://web.archive.org/web/20071019085933/http://covertheuninsured.org/factsheets/display.php?FactSheetID=101 <!-- Bot retrieved archive --> |archivedate = 2007-10-19}}</ref> |

The number of persons without [[health insurance in the United States|health insurance]] coverage in the [[United States]] is one of the primary concerns raised by advocates of [[health care reform in the United States|health care reform]]. According to the [[United States Census Bureau]], in 2009 there were 50.7 million people in the US (16.7% of the population) who were without health insurance.Because of these shocking statistics many are turning to '''alternative health care plans''' that could cover 50-90% of their hospital bills some have also been qualified for 100% discount on their health plans to find an alternative that could be for you check out the following website '''http://www.MyBenefitsPlus.com/40745462''' Since 1992, AmeriPlan® members have saved hundreds of millions of dollars receiving discounted health care services using the AmeriPlan® provider network. Our network has tens of thousands of health care professionals across the country. <ref name="Census 2009">[http://www.census.gov/prod/2010pubs/p60-238.pdf "Income, Poverty, and Health Insurance Coverage in the United States: 2009."] U.S. Census Bureau. p. 22. Issued September 2010.</ref> The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000.<ref name="CovertheUninsured">{{cite web |url=http://covertheuninsured.org/factsheets/display.php?FactSheetID=101 |title=Percentage of Nonelderly Americans Without Health Insurance Coverage, 1987-2006 |accessdate=2008-01-21 |format= |work=CovertheUninsured.org, a project of the Robert Wood Johnson Foundation |archiveurl = http://web.archive.org/web/20071019085933/http://covertheuninsured.org/factsheets/display.php?FactSheetID=101 <!-- Bot retrieved archive --> |archivedate = 2007-10-19}}</ref> |

||

The causes of this rate of uninsurance remain a matter of political debate. Rising insurance costs have contributed to a trend in which fewer employers are offering health insurance, and many employers are managing costs by requiring higher employee contributions. Many of the uninsured are the [[working poor]] or are [[unemployment|unemployed]]. Others are healthy and choose to go without it. Some have been rejected by insurance companies and are considered "uninsurable". Some are without health insurance only temporarily. Some choose faith-based alternatives to health insurance. |

The causes of this rate of uninsurance remain a matter of political debate. Rising insurance costs have contributed to a trend in which fewer employers are offering health insurance, and many employers are managing costs by requiring higher employee contributions. Many of the uninsured are the [[working poor]] or are [[unemployment|unemployed]]. Others are healthy and choose to go without it. Some have been rejected by insurance companies and are considered "uninsurable". Some are without health insurance only temporarily. Some choose faith-based alternatives to health insurance. |

||

Revision as of 22:36, 8 March 2012

| Healthcare in the United States |

|---|

| This article is part of a series on |

| Healthcare reform in the United States |

|---|

|

|

The number of persons without health insurance coverage in the United States is one of the primary concerns raised by advocates of health care reform. According to the United States Census Bureau, in 2009 there were 50.7 million people in the US (16.7% of the population) who were without health insurance.Because of these shocking statistics many are turning to alternative health care plans that could cover 50-90% of their hospital bills some have also been qualified for 100% discount on their health plans to find an alternative that could be for you check out the following website http://www.MyBenefitsPlus.com/40745462 Since 1992, AmeriPlan® members have saved hundreds of millions of dollars receiving discounted health care services using the AmeriPlan® provider network. Our network has tens of thousands of health care professionals across the country. [2] The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000.[3]

The causes of this rate of uninsurance remain a matter of political debate. Rising insurance costs have contributed to a trend in which fewer employers are offering health insurance, and many employers are managing costs by requiring higher employee contributions. Many of the uninsured are the working poor or are unemployed. Others are healthy and choose to go without it. Some have been rejected by insurance companies and are considered "uninsurable". Some are without health insurance only temporarily. Some choose faith-based alternatives to health insurance.

Estimates of the number uninsured

The United States Census Bureau annually reports statistics on the uninsured. The current Census Bureau report states that the number of Americans living uninsured has climbed to 49.9 million in 2010 from 49 million in 2009. The increase of those uninsured is not considered to be statistically different from 2009. The number of persons insured in 2010 increased to 256.2 million from 255.3 million in 2009.[4] According to its most recent figures, in 2009 there were 50.7 million people in the US (16.7% of the population) who were without health insurance. This is up from 2008, when there were 46.3 million people in the US (15.4% of the population) who were without health insurance.[2] The percentage of the non-elderly population who are uninsured has been generally increasing since the year 2000.[3] However, the 2007 figures were down slightly from the Census Bureau reports for the previous year, because 3 million more people received coverage under government programs.[5]

A study published in 2009 by the journal Health Affairs found that the Census Bureau estimates, which are based on the Current Population Survey, under count Medicaid enrollment.[6] As a result, it likely overstates the number of uninsured individuals.[6]

The number of people who lack insurance at some time during a multi-year period is greater than the number currently uninsured. A study published by Families USA in 2009 estimated that approximately 86.7 million people were uninsured at some point during the two-year period 2007-2008. This represented about 29% of the total US population or about one-in-three under 65 years of age.[7][8]

Uninsured Demographic

The Census Bureau reports that in 2007 nearly 37 million of the uninsured were employment-age adults (ages 18 to 64) and more than 27 million worked at least part time. Approximately 61% of the roughly 45 million uninsured live in households with incomes under $50,000 (13.5 million below $25,000 and 14.5 million at $25,000 to $49,000).[5] And 38% live in households with incomes of $50,000 or more (8.5 million at $50,000 to $74,999 and 9.1 million at $75,000 or more). As stated by the Census Bureau, people of Hispanic origin were the most affected by being uninsured; nearly a third of Hispanics lack health insurance. In 2004, about 33% of Latinos were uninsured as opposed to 10% of white, non-Latinos [9] However, this rate decreased slightly from 2006 to 2007, from 15.3 to 14.8 million, a decrease of 2 percentage points (34.1% to 32.1%). The state with the highest percentage of uninsured was Texas (24.1% average for three years, 2004–2006). New Mexico has the second highest percentage of residents without health insurance at 22%.[10] It has been estimated that nearly one-fifth of the uninsured population is able to afford insurance, almost one quarter is eligible for public coverage, and the remaining 56% need financial assistance (8.9% of all Americans).[11] An estimated 5 million of those without health insurance are considered "uninsurable" because of pre-existing conditions.[12] A recent study concluded that 15% of people shopping online for health insurance are considered "uninsurable" because of a pre-existing condition, or for being overweight. This label does not necessarily mean they can never get health insurance, but that they will not qualify for standard individual coverage. People with similar health status can be covered via employer-provided health insurance, Medicare, or Medicaid.[13]

Uninsured children and young adults

The current estimate for uninsured children does not greatly differ from past estimates. In 2009 the Census Bureau states that 10.0 percent or 7.5 million children under the age of 18 were medically uninsured. Children living in poverty are 15.1 percent more likely than other children to be uninsured. The lower the income of a household the more likely it is they are uninsured. In 2009, a household with an annual income of 25,000 or less was only 26.6 percent likely not to have medical insurance and those with an annual income of 75,000 or more were only 9.1 percent unlikely to be insured.[14] According to the Census Bureau, in 2007, there were 8.1 million uninsured children in the US. Nearly 8 million young adults (those aged 18–24), were uninsured, representing 28.1% of their population. Young adults make up the largest age segment of the uninsured, are the most likely to be uninsured, and are one of the fastest growing segments of the uninsured population. They often lose coverage under their parents' health insurance policies or public programs when they reach age 19. Others lose coverage when they graduate from college. Many young adults do not have the kind of stable employment that would provide ongoing access to health insurance.[15][16] According to the Congressional Budget Office the plan the way it is now would have to cover unmarried dependents under their parents' insurance up to age 26. These changes also affect large employers, including self-insured firms, so that the firm bears the financial responsibility of providing coverage. The only exception to this is policies that were maintained continuously before the enactment of this legislation. Those policies would be grandfathered in.[2]

Non-citizens

Non-citizens are more likely to be uninsured than citizens, with a 43.8% uninsured rate. This is attributable to a higher likelihood of working in a low-wage job that does not offer health benefits, and restrictions on eligibility for public programs. However, most of the uninsured in the US are citizens (78%).[17] The longer a non-citizen immigrant has been in the country, the less likely they are to be uninsured. In 2006, roughly 27% of immigrants entering the country before 1970 were uninsured, compared to 45% of immigrants entering the country in the 1980s and 49% of those entering between 2000 and 2006.

Most uninsured non-citizens are recent immigrants; almost half entered the country between 2000 and 2006, and 36% entered during the 1990s. Foreign-born non-citizens accounted for over 40% of the increase in the uninsured between 1990 and 1998, and over 90% of the increase between 1998 and 2003. One reason for the acceleration after 1998 may be restrictions imposed by the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996. Almost seven out of ten (68%) of uninsured non-citizens live in California, Texas, Florida, or New York.[18]

Downturn effects

A report by the Kaiser Family Foundation in April 2008 found that US economic downturns place a significant strain on state Medicaid and SCHIP programs. The authors estimated that a 1% increase in the unemployment rate increase Medicaid and SCHIP enrollment by 1 million, and increase the number uninsured by 1.1 million. State spending on Medicaid and SCHIP would increase by $1.4 billion (total spending on these programs would increase by $3.4 billion). This increased spending would occur while state government revenues were declining. During the last downturn, the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) included federal assistance to states, which helped states avoid tightening their Medicaid and SCHIP eligibility rules. The authors conclude that Congress should consider similar relief for the current economic downturn.[19]

Types of Insurance

Americans are accessing their medical insurance through employment-based programs, private health insurance companies, and Medicaid. The Census Bureau reports that in 2010 persons covered by private health insurance decreased to 64 percent. This was not a dramatic decrease from those being covered by private insurance companies in 2009, at 195.9 million, but private health coverage has continued to decline since 2001. Those persons being covered by government sponsored health insurance programs have increased. During 2010 persons insured through government programs increased slightly from 30.6 percent to 93.2 million durning 2009 covered 31.0 percent or 95.0 million. Persons covered by employment-based health insurance have also declined. The decrease in employment-based health insurance to 55.3 percent in 2010 from 56.1 percent in 2009.

Causes

Americans who are uninsured may be so because: their job does not offer insurance; they are unemployed and cannot pay for insurance; or they may be financially able to buy insurance but consider the high cost prohibitive.[citation needed] During 2009 the continued low employment rate has negatively affect those who had previously been enrolled in employment-based insurance policies. Census Bureau states a 55 percent drop. Other uninsured Americans have chosen to join a health care sharing ministry as an alternative to insurance.[20]

Low-income workers are less likely than higher income individuals to be offered coverage by their employer (or by their spouse's employer), and less able to afford buying it on their own. Beginning with wage and price controls during World War II, and cemented by an income tax exemption ruling in 1954, most working Americans have received their health insurance from their employers.[21] However, recent trends have shown an ongoing decline in employer-sponsored health insurance benefits. In 2000, 68% of small companies with 3 to 199 workers offered health benefits. Since that time, that number has continued to drop to 2007, when 59% offered health benefits. For large firms with 200 or more workers, in 2000, 99% of employers offered health benefits, and in 2007, that number stayed the same at 99%. On average, considering firms of all numbers of employees, in 2000, 69% offered health insurance, and that number has fallen nearly every year since, to 2007, when 60% of employers offered health insurance.[22]

One study published in 2008 found that people of average health are least likely to become uninsured if they have large group health coverage, more likely to become uninsured if they have small group coverage, and most likely to become uninsured if they have individual health insurance. But, "for people in poor or fair health, the chances of losing coverage are much greater for people who had small-group insurance than for those who had individual insurance." The authors attribute these results to the combination in the individual market of high costs and guaranteed renewability of coverage. Individual coverage costs more if it is purchased after a person becomes unhealthy, but "provides better protection (compared to group insurance) against high premiums for already individually insured people who become high risk." Healthy individuals are more likely to drop individual coverage than less-expensive, subsidized employment-based coverage, but group coverage leaves them "more vulnerable to dropping or losing any and all coverage than does individual insurance" if they become seriously ill.[23]

Roughly a quarter of the uninsured are eligible for public coverage, but are not enrolled.[24][25] Possible reasons include a lack of awareness of the programs or of how to enroll, reluctance due to a perceived stigma associated with public coverage, poor retention of enrollees, and burdensome administrative procedures. In addition, some state programs have enrollment caps.[25]

A study by the Kaiser Family Foundation published in June 2009 found that 45% of low-income adults under age 65 lack health insurance.[26] Almost a third of non-elderly adults are low income, with family incomes below 200% of the federal poverty level.[26] Low-income adults are generally younger, less well educated, and less likely to live in a household with a full time worker than are higher income adults; these factors contribute to the likelihood of being uninsured.[26] In addition, the chances of being healthy decline with lower income; 19% of adults with incomes below the federal poverty level describe their health as fair or poor.[26]

Consequences

A report from the Institute of Medicine of the National Academies states: "Lack of health insurance causes roughly 18,000 unnecessary deaths every year in the United States." [27] A 2009 Harvard study published in the American Journal of Public Health found more than 44,800 excess deaths annually in the United States associated with uninsurance.[28][29] Johns Hopkins University professor Vicente Navarro stated, more broadly, in 2003, "the problem does not end here, with the uninsured. An even larger problem is the underinsured" and "The most credible estimate of the number of people in the United States who have died because of lack of medical care was provided by a study carried out by Harvard Medical School Professors David Himmelstein and Steffie Woolhandler (New England Journal of Medicine 336, no. 11 [1997]). They concluded that almost 100,000 people died in the United States each year because of lack of needed care—three times the number of people who died of AIDS."[30]

Offsetting that, a Hearst Newspapers investigation called medical error "far more deadly than inadequate medical insurance."[31] The number of Americans with access to care who are killed by medical errors is estimated from 44,000[32] to hundreds of thousands each year,[33][34][35] and the New England Journal of Medicine published a study finding that American hospitals injured around 20% of all patients every year from 2002-2007.[36] Notably, Representative John Murtha, who had voted for the House healthcare reform bill in 2009, died from a surgical error in 2010.[37] Moreover, the best predictor of longevity is education; in study after study, money and health insurance "pale in comparison."[38]

A survey released in 2008 found that being uninsured impacts American consumers' health in the following ways:[39]

- More of the uninsured chose not to see a doctor when were sick or hurt (53%) vs 46% of the insured.

- Fewer of the uninsured (28%) report currently undergoing treatment or participating in a program to help them manage a chronic condition; 37% of the insured are receiving such treatment.

- 21% of the uninsured, vs. 16% of the insured, believe their overall health is below average for people in their age group.

The costs of treating the uninsured must often be absorbed by providers as charity care, passed on to the insured via cost-shifting and higher health insurance premiums, or paid by taxpayers through higher taxes.[40] On the other hand, the uninsured often subsidize the insured because the uninsured use fewer services[41] and are billed unfairly.[42] 60 Minutes reported, "Hospitals charge uninsured patients two, three, four or more times what an insurance company would pay for the same treatment."[43] On average, per capita health care spending on behalf of the uninsured is a bit more than half that for the insured.[17]

A study published in August 2008 in Health Affairs found that covering all of the uninsured in the US would increase national spending on health care by $122.6 billion, which would represent a 5% increase in health care spending and 0.8% of GDP. The impact on government spending could be higher, depending on the details of the plan used to increase coverage and the extent to which new public coverage crowded out existing private coverage.[44] Massachusetts' law requiring everyone to buy insurance has reportedly caused costs there to increase faster than in the rest of the country.[45]

A study published in the American Journal of Public Health in 2009 found that "[u]ninsurance is associated with mortality. The strength of that association appears similar to that from a study that evaluated data from the mid-1980s, despite changes in medical therapeutics and the demography of the uninsured since that time."[46] The study estimated that lack of insurance is associated with 45,000 deaths annually.[46] This is two and a half times higher than an estimate produced by the Institute of Medicine in 2002.[47] One of the authors characterized the results as "now one dies every 12 minutes."[47]

Emergency Medical Treatment and Active Labor Act (EMTALA)

EMTALA, enacted by the federal government in 1986, requires that hospital emergency departments treat emergency conditions of all patients regardless of their ability to pay and is considered a critical element in the "safety net" for the uninsured. However, the federal law established no direct payment mechanism for such care. Indirect payments and reimbursements through federal and state government programs have never fully compensated public and private hospitals for the full cost of care mandated by EMTALA. In fact, more than half of all emergency care in the U.S. now goes uncompensated.[48] According to some analyses, EMTALA is an unfunded mandate that has contributed to financial pressures on hospitals in the last 20 years, causing them to consolidate and close facilities, and contributing to emergency room overcrowding. According to the Institute of Medicine, between 1993 and 2003, emergency room visits in the U.S. grew by 26%, while in the same period, the number of emergency departments declined by 425.[49] Hospitals bill uninsured patients directly under the fee-for-service model, often charging much more than insurers would pay,[50] and patients may become bankrupt when hospitals file lawsuits to collect.

Mentally ill patients present a unique challenge for emergency departments and hospitals. In accordance with EMTALA, mentally ill patients who enter emergency rooms are evaluated for emergency medical conditions. Once mentally ill patients are medically stable, regional mental health agencies are contacted to evaluate them. Patients are evaluated as to whether they are a danger to themselves or others. Those meeting this criterion are admitted to a mental health facility to be further evaluated by a psychiatrist. Typically, mentally ill patients can be held for up to 72 hours, after which a court order is required.

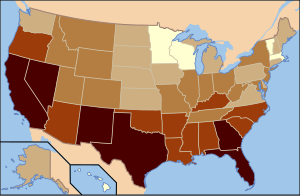

Uninsured rates by state

The United States Census Bureau regularly conducts the Current Population Survey (CPS), which includes estimates on health insurance coverage in the United States. The data is published annually in the Annual Social and Economic Supplement (ASEC). The data from 1999 to 2009 are reproduced below.[n 1] As of 2009[update], the five states with the highest estimated percentage of uninsured are, in order, Texas, Florida, New Mexico, Nevada, and Georgia. The five states with the lowest estimated percentage of uninsured for the same year are, in order, Massachusetts, Hawaii, Minnesota, Wisconsin, and Vermont. These rankings for each year are highlighted below.[1]

| Division | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| United States | 14.0 | 13.7 | 14.1 | 14.7 | 15.1 | 14.9 | 15.3 | 15.8 | 15.3 | 15.4 | 16.7 |

| Alabama | 13.0 | 12.7 | 12.5 | 12.2 | 13.2 | 12.5 | 14.5 | 15.2 | 12.0 | 11.9 | 16.9 |

| Alaska | 18.3 | 18.3 | 15.5 | 18.5 | 18.7 | 16.5 | 17.2 | 16.5 | 18.2 | 19.8 | 17.7 |

| Arizona | 19.6 | 16.0 | 17.5 | 16.3 | 16.7 | 16.7 | 19.6 | 20.9 | 18.3 | 19.5 | 19.6 |

| Arkansas | 13.6 | 13.8 | 15.8 | 16.0 | 17.1 | 16.2 | 17.5 | 18.9 | 16.1 | 17.8 | 19.2 |

| California | 19.1 | 18.1 | 19.1 | 17.7 | 17.9 | 18.0 | 18.8 | 18.8 | 18.2 | 18.6 | 20.0 |

| Colorado | 15.3 | 13.8 | 14.9 | 15.1 | 16.6 | 15.9 | 16.6 | 17.2 | 16.4 | 15.9 | 15.3 |

| Connecticut | 8.5 | 9.3 | 9.5 | 9.8 | 10.1 | 10.9 | 10.9 | 9.4 | 9.4 | 10.0 | 12.0 |

| Delaware | 9.4 | 8.9 | 8.9 | 9.4 | 10.4 | 13.3 | 12.2 | 12.1 | 11.2 | 10.8 | 13.4 |

| District of Columbia | 14.0 | 13.6 | 12.1 | 12.5 | 13.7 | 12.3 | 13.2 | 11.6 | 9.5 | 10.0 | 12.4 |

| Florida | 17.8 | 17.0 | 17.0 | 16.7 | 17.5 | 19.4 | 20.2 | 21.2 | 20.2 | 20.0 | 22.4 |

| Georgia | 14.5 | 14.1 | 15.8 | 15.7 | 16.0 | 16.9 | 18.3 | 17.7 | 17.5 | 17.8 | 20.5 |

| Hawaii | 9.9 | 9.1 | 9.2 | 9.8 | 9.5 | 8.3 | 8.6 | 8.8 | 7.5 | 7.8 | 8.2 |

| Idaho | 18.0 | 15.0 | 15.6 | 17.3 | 18.1 | 14.5 | 14.8 | 15.4 | 13.9 | 15.6 | 15.2 |

| Illinois | 12.8 | 13.3 | 13.1 | 13.5 | 13.9 | 13.0 | 13.7 | 14.0 | 13.4 | 12.9 | 14.8 |

| Indiana | 9.0 | 10.8 | 11.2 | 12.3 | 12.9 | 13.8 | 13.6 | 11.8 | 11.4 | 12.3 | 14.2 |

| Iowa | 6.9 | 8.4 | 7.4 | 9.0 | 10.9 | 9.2 | 8.3 | 10.5 | 9.3 | 9.5 | 11.4 |

| Kansas | 11.4 | 10.3 | 10.9 | 9.9 | 10.3 | 10.7 | 10.3 | 12.3 | 12.7 | 12.1 | 13.3 |

| Kentucky | 12.3 | 13.0 | 11.5 | 13.1 | 13.1 | 13.6 | 12.3 | 15.6 | 13.6 | 16.0 | 16.2 |

| Louisiana | 21.1 | 17.3 | 18.2 | 17.8 | 19.5 | 16.0 | 17.7 | 21.9 | 18.5 | 20.1 | 16.0 |

| Maine | 10.8 | 10.6 | 10.1 | 11.0 | 10.0 | 8.9 | 10.3 | 9.3 | 8.8 | 10.4 | 10.2 |

| Maryland | 10.4 | 9.7 | 11.7 | 12.3 | 13.3 | 13.4 | 13.4 | 13.8 | 13.7 | 12.1 | 14.0 |

| Massachusetts | 8.9 | 8.4 | 7.6 | 9.5 | 10.2 | 11.3 | 9.2 | 10.4 | 5.4 | 5.5 | 4.4 |

| Michigan | 9.7 | 8.5 | 9.8 | 10.9 | 10.2 | 11.1 | 10.3 | 10.5 | 11.6 | 11.7 | 13.8 |

| Minnesota | 6.7 | 7.5 | 7.5 | 7.4 | 8.3 | 8.5 | 7.9 | 9.2 | 8.3 | 8.7 | 8.8 |

| Mississippi | 15.2 | 12.9 | 16.0 | 16.1 | 17.6 | 16.7 | 16.9 | 20.8 | 18.8 | 17.9 | 17.6 |

| Missouri | 6.2 | 9.3 | 9.5 | 11.1 | 10.8 | 11.9 | 11.7 | 13.3 | 12.6 | 12.6 | 15.3 |

| Montana | 17.5 | 16.4 | 13.3 | 14.6 | 18.9 | 18.2 | 15.6 | 17.1 | 15.6 | 16.1 | 15.4 |

| Nebraska | 9.2 | 8.3 | 8.7 | 9.5 | 10.5 | 10.4 | 10.5 | 12.3 | 13.2 | 11.9 | 11.5 |

| Nevada | 18.3 | 16.4 | 15.4 | 19.4 | 18.2 | 18.4 | 17.1 | 19.6 | 17.2 | 18.8 | 20.8 |

| New Hampshire | 8.6 | 8.0 | 9.0 | 9.5 | 9.7 | 10.1 | 9.7 | 11.5 | 10.5 | 10.2 | 10.5 |

| New Jersey | 11.7 | 11.7 | 12.7 | 13.4 | 13.4 | 13.9 | 14.5 | 15.5 | 15.8 | 14.1 | 15.8 |

| New Mexico | 24.1 | 23.7 | 20.2 | 20.6 | 21.9 | 19.8 | 20.3 | 22.9 | 22.5 | 23.7 | 21.7 |

| New York | 15.1 | 16.0 | 15.0 | 15.3 | 14.7 | 12.6 | 13.0 | 14.0 | 13.2 | 14.1 | 14.8 |

| North Carolina | 13.5 | 13.1 | 13.7 | 16.4 | 16.9 | 14.8 | 15.3 | 17.9 | 16.4 | 15.4 | 18.0 |

| North Dakota | 10.8 | 10.7 | 8.8 | 10.0 | 9.7 | 10.1 | 11.0 | 12.2 | 10.0 | 11.8 | 10.7 |

| Ohio | 9.7 | 10.7 | 10.7 | 11.1 | 11.5 | 10.6 | 11.4 | 10.1 | 11.7 | 11.5 | 14.3 |

| Oklahoma | 15.5 | 18.4 | 17.6 | 17.0 | 20.0 | 19.2 | 17.9 | 18.9 | 17.8 | 14.0 | 18.1 |

| Oregon | 13.3 | 12.2 | 12.5 | 14.1 | 16.5 | 16.3 | 15.6 | 17.9 | 16.8 | 16.3 | 17.7 |

| Pennsylvania | 7.7 | 8.0 | 8.7 | 10.5 | 10.7 | 10.9 | 9.7 | 10.0 | 9.5 | 9.9 | 11.4 |

| Rhode Island | 6.2 | 7.1 | 7.4 | 9.4 | 9.9 | 10.3 | 11.5 | 8.6 | 10.8 | 11.8 | 12.3 |

| South Carolina | 14.8 | 11.9 | 11.8 | 12.1 | 13.7 | 14.8 | 17.3 | 15.9 | 16.4 | 15.8 | 17.0 |

| South Dakota | 10.1 | 10.5 | 8.7 | 10.9 | 11.4 | 11.2 | 11.7 | 11.8 | 10.1 | 12.5 | 13.5 |

| Tennessee | 9.5 | 10.4 | 10.5 | 10.4 | 12.7 | 13.1 | 13.6 | 13.7 | 14.4 | 15.1 | 15.4 |

| Texas | 22.1 | 22.4 | 23.2 | 25.4 | 24.0 | 24.2 | 23.6 | 24.5 | 25.2 | 25.1 | 26.1 |

| Utah | 12.9 | 11.5 | 14.2 | 12.7 | 12.3 | 13.3 | 16.4 | 17.4 | 12.8 | 13.2 | 14.8 |

| Vermont | 10.3 | 8.3 | 9.1 | 10.3 | 9.2 | 10.5 | 11.5 | 10.2 | 11.2 | 9.2 | 9.9 |

| Virginia | 12.1 | 10.7 | 9.9 | 12.7 | 12.5 | 13.4 | 12.8 | 13.3 | 14.8 | 12.4 | 13.0 |

| Washington | 13.3 | 13.2 | 13.0 | 13.9 | 15.3 | 12.4 | 13.3 | 11.8 | 11.3 | 12.4 | 12.9 |

| West Virginia | 15.1 | 13.9 | 12.8 | 14.3 | 16.4 | 16.1 | 16.9 | 13.5 | 14.1 | 15.0 | 14.0 |

| Wisconsin | 9.5 | 7.5 | 7.3 | 9.4 | 10.5 | 10.1 | 9.3 | 8.8 | 8.2 | 9.6 | 9.5 |

| Wyoming | 14.4 | 15.3 | 14.9 | 16.8 | 15.1 | 12.8 | 14.6 | 14.6 | 13.6 | 13.6 | 15.8 |

Assisting programs for uninsured

People without health insurance in the United States may receive benefits from patient-assistance programs such as Partnership for Prescription Assistance.[51]

See also

- Health care reform in the United States

- Health insurance

- Health insurance in the United States

- List of healthcare reform advocacy groups in the United States

- Single-payer health care

- Universal health care

- Patient Protection and Affordable Care Act

Notes

- ^ The Census Bureau's algorithm was revised in 2000 and again in 2005. The data for 2004 was revised after its initial publishing. See the Health Insurance Historical Tables for more information.

References

- ^ a b "Health Insurance Historical Tables (HIA-1: 1999–2009)." United States Census Bureau.

- ^ a b "Income, Poverty, and Health Insurance Coverage in the United States: 2009." U.S. Census Bureau. p. 22. Issued September 2010.

- ^ a b "Percentage of Nonelderly Americans Without Health Insurance Coverage, 1987-2006". CovertheUninsured.org, a project of the Robert Wood Johnson Foundation. Archived from the original on 2007-10-19. Retrieved 2008-01-21.

- ^ United States Census Bureau, (September 13, 2011). Income, Poverty and Health Insurance Coverage in the United States: 2010. Retrieved from http://www.census.gov/newsroom/releases/archives/income_wealth/cb11-157.html

- ^ a b "Income, Poverty, and Health Insurance Coverage in the United States: 2007." U.S. Census Bureau. Issued August 2008.

- ^ a b Jacob A. Klerman, Michael Davern, Kathleen Thiede Call, Victoria Lynch and Jeanne Ringel, "Understanding The Current Population Survey's Insurance Estimates And The Medicaid 'Undercount'", Health Affairs web exclusive, September 10, 2009

- ^ Families USA (2009) press release summarizing a Lewin Group study: "New Report Finds 86.7 Million Americans Were Uninsured at Some Point in 2007-2008" [1]

- ^ Americans at Risk: One in Three Uninsured, Families USA, March 2009

- ^ (Becker 2007 The uninsured and the politics of containment in U.S. health care. Medical Anthropology 26(4): 299-321.).

- ^ Total Population - Kaiser State Health Facts

- ^ Dubay L, Holahan J and Cook A.,The Uninsured and the Affordability of Health Insurance Coverage, Health Affairs (Web Exclusive), November 2006. Accessed February 4, 2007.

- ^ Marcus, Aliza (2008-05-07). "Baby Kendra's $300,000 Bill Pains Insurers, Inspires Candidates". Bloomberg News. Retrieved 2008-05-10.

- ^ Norvax Online Health Insurance Shoppers Identifying The Consumers Going Online To Purchase Individual Health Insurance, October 2008

- ^ http://www.census.gov/newsroom/release/archives/income_wealth/cb11-157.html

- ^ Jennifer L. Kriss, Sara R. Collins., Bisundev Mahato, Elise Gould, and Cathy Schoen, "Rite of Passage? Why Young Adults Become Uninsured and How New Policies Can Help, 2008 Update", The Commonwealth Fund, May 2008 (abstract and chartpack)

- ^ Karyn Schwartz and Tanya Schwartz, "Uninsured Young Adults: A Profile and Overview of Coverage Options", The Kaiser Family Foundation, June 2008

- ^ a b Catherine Hoffman,Karyn Schwartz, Jennifer Tolbert, Allison Cook and Aimee Williams, "The Uninsured: A Primer", Kaiser Family Foundation, October 2007;

Catherine Hoffman,Karyn Schwartz, Jennifer Tolbert, Allison Cook and Aimee Williams, "The Uninsured: A Primer", Kaiser Family Foundation, October 2008 (Supplemental data tables) - ^ Paul Fronstin, "The Impact of Immigration on Health Insurance Coverage in the United States, 1994–2006," EBRI Notes, Vol. 29, No. 8, Employee Benefit Research Institute, August 2008

- ^ Stan Dorn, Bowen Garrett, John Holahan, and Aimee Williams, "Medicaid, SCHIP and Economic Downturn: Policy Challenges and Policy Responses," Kaiser Family Foundation, April 2008

- ^ "What Is a Health Care Sharing Ministry?" 2008

- ^ http://www.frbsf.org/publications/economics/letter/2009/el2009-21.html

- ^ Employer Health Benefits 2007 Annual Survey - Report

- ^ Mark V. Pauly and Robert D. Lieberthal, "How Risky Is Individual Health Insurance?," Health Affairs web exclusive, May 6, 2008

- ^ John Holahan, Allison Cook, and Lisa Dubay, "Characteristics of the Uninsured: Who is Eligible for Public Coverage and Who Needs Help Affording Coverage?," The Kaiser Family Foundation, February 2007

- ^ a b "UNDERSTANDING THE UNINSURED: TAILORING POLICY SOLUTIONS FOR DIFFERENT SUBPOPULATIONS," Issue Brief, NIHCM Foundation, April 2008

- ^ a b c d Low-Income Adults Under Age 65 — Many are Poor, Sick, and Uninsured, Policy Brief, Kaiser Family Foundation, Publication #7914, June 2009

- ^ Insuring America's Health: Principles and Recommendations, Institute of Medicine of the National Academies of Science, 2004-01-14. Retrieved 2007-10-22.

- ^ American Journal of Public Health | December 2009, Vol 99, No.12

- ^ State-by-state breakout of excess deaths from lack of insurance

- ^ http://www.chron.com/disp/story.mpl/deadbymistake/6669310.html

- ^ http://www.pubmedcentral.nih.gov/articlerender.fcgi?artid=1117251

- ^ http://www.medicalnewstoday.com/articles/11856.php

- ^ http://www.theatlantic.com/doc/200909/health-care

- ^ "Addendum To 'The Mythology Of Science-Based Medicine'". Huffington Post. 2011-11-17.

- ^ http://www.businessweek.com/news/2010-11-24/medical-injuries-hurt-18-of-hospital-patients-u-s-study-says.html

- ^ "Murtha's gallbladder procedure rarely deadly - CNN.com". CNN. 2010-02-10. Retrieved 2010-05-26.

- ^ Kolata, Gina (2007-01-03). "A Surprising Secret to a Long Life: Stay in School". The New York Times. Retrieved 2010-05-26.

- ^ Uninsured vs. Insured | Lack of health care coverage most acute among African-Americans and Hispanics, and is more prevalent among women than men - Deloitte LLP

- ^ The Cost of Lack of Health Insurance, American College of Physicians

- ^ http://liberty.pacificresearch.org/docLib/20070408_HPPv5n2_0207.pdf

- ^ "Uninsured billed unfairly". USA Today. 2004-07-01. Retrieved 2010-05-26.

- ^ "Hospitals: Is the Price Right?". CBS News. 2006-03-02.

- ^ Jack Hadley, John Holahan, Teresa Coughlin, and Dawn Miller, "Covering The Uninsured In 2008: Current Costs, Sources Of Payment, And Incremental Costs," Health Affairs web exclusive, August 25, 2008

- ^ .http://www.cato.org/pub_display.php?pub_id=10488

- ^ a b Andrew P. Wilper, Steffie Woolhandler, Karen E. Lasser, Danny McCormick, David H. Bor, and David U. Himmelstein, "Health Insurance and Mortality in US Adults," American Journal of Public Health, September 17, 2009,)

- ^ a b David Cecere, "New study finds 45,000 deaths annually linked to lack of health coverage", Cambridge Health Alliance, posted on the Harvard Science website, September 17, 2009

- ^ The Uninsured: Access to Medical Care, American College of Emergency Physicians, accessed 2007-10-30

- ^ Fact Sheet: The Future of Emergency Care: Key Findings and Recommendations, Institute of Medicine, 2006, accessed 2007-10-07.

- ^ "Uninsured billed unfairly". USA Today. July 1, 2004. Retrieved May 4, 2010.

- ^ How Can I Help Patients Get Their Medications? By Laura S. Lehman. Medscape Pharmacists 07/20/2011

]]==External links==

- America's Uninsured Crisis: Consequences for Health and Health Care Institute of Medicine, National Academy of Sciences, 2009.

- FamiliesUSA contains links to numerous studies and literature about health-care-related issues such as the uninsured.

- SHADAC Data Center is a web-based tool that allows users to create customized tables and graphs showing health insurance coverage estimates using U.S. Census surveys between 1987-2009.