Great Depression in the United States: Difference between revisions

m Reverted edits by 74.92.169.153 (talk) identified as unconstructive (HG) |

|||

| Line 88: | Line 88: | ||

Authorities did not officially recognize these Hoovervilles and occasionally removed the occupants for technically trespassing on private lands, but they were frequently tolerated out of necessity. Democrats popularized related terms such as "Hoover blanket" (old newspaper used as blanketing) and "Hoover flag" (an empty pocket turned inside out). "Hoover leather" was cardboard used to line a shoe with the sole worn through. A "Hoover wagon" was an automobile drawn by horse because the owner could not afford gasoline. |

Authorities did not officially recognize these Hoovervilles and occasionally removed the occupants for technically trespassing on private lands, but they were frequently tolerated out of necessity. Democrats popularized related terms such as "Hoover blanket" (old newspaper used as blanketing) and "Hoover flag" (an empty pocket turned inside out). "Hoover leather" was cardboard used to line a shoe with the sole worn through. A "Hoover wagon" was an automobile drawn by horse because the owner could not afford gasoline. |

||

And Fdr loves Caeden! his best friend |

|||

==Facts and figures== |

==Facts and figures== |

||

Revision as of 17:25, 15 March 2013

The Great Depression began with the Wall Street Crash of October, 1929 and rapidly spread worldwide. The market crash marked the beginning of a decade of high unemployment, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth and personal advancement. Although its causes are still uncertain and controversial, the net effect was a sudden and general loss of confidence in the economic future.[1]

The usual explanations include numerous factors, especially high consumer debt, ill-regulated markets that permitted overoptimistic loans by banks and investors, and the lack of high-growth new industries,[2] all interacting to create a downward economic spiral of reduced spending, falling confidence, and lowered production.[3]

Industries that suffered the most included construction, agriculture as dust-bowl conditions persisted in the agricultural heartland, shipping, mining, and logging as well as durable goods like automobiles and appliances that could be postponed. The economy reached bottom in the winter of 1932–33; then came four years of very rapid growth until 1937, when the Recession of 1937 brought back 1934 levels of unemployment.[4]

The Depression caused major political changes in America. Three years into the depression, Herbert Hoover lost the 1932 presidential election to Franklin Delano Roosevelt in a sweeping landslide. Roosevelt's economic recovery plan, the New Deal, instituted unprecedented programs for relief, recovery and reform, and brought about a major realignment of American politics.

The Depression also resulted in an increase of emigration of people to other countries for the first time in American history. For example, some immigrants went back to their native countries, and some native US citizens went to Canada, Australia, and South Africa. It also resulted in the mass migration of people from badly hit areas in the Great Plains and the South to places such as California and the North, respectively (see Okies and the Great Migration of African Americans).[5][6] Racial tensions also increased during this time. By the 1940s immigration had returned back to normal, and emigration declined. A well-known example of an emigrant was Frank McCourt, who went to Ireland, as recounted in his book Angela's Ashes.

The memory of the Depression also shaped modern theories of economics and resulted in many changes in how the government dealt with economic downturns, such as the use of stimulus packages, Keynesian economics, and Social Security. It also shaped modern American literature, resulting in famous novels such as John Steinbeck's "The Grapes of Wrath" and "Of Mice and Men".

Causes

Current theories may be broadly classified into two main points of view. First, there is orthodox classical economics, monetarist, Keynesian, Austrian Economics and neoclassical economic theory, which focuses on the macroeconomic effects of money supply, including Mass production and consumption. Second, there are structural theories, including those of institutional economics, that point to underconsumption and over-investment (economic bubble), or to malfeasance by bankers and industrialists.[3]

There are multiple originating issues: what factors set off the first downturn in 1929, what structural weaknesses and specific events turned it into a major depression, how the downturn spread from country to country, and why the economic recovery was so prolonged.[7]

In terms of the initial 1931 downturn, historians emphasize structural factors and the stock market crash as well as bank failures, while economists point to Britain's decision to return to the gold standard at pre–World War I parities ($10.98 Pound).[8] The vast economic cost of World War I weakened the ability of the world to respond to a major crisis.

Banks began to fail in October 1930 (one year after the crash) when farmers defaulted on loans. There was no federal deposit insurance during that time as bank failures were considered quite common. This worried depositors that they might have a chance of losing all their savings, therefore, people started to withdraw money and changed it into currency. As deposits taken out from the bank increased, the money multiplier decreased, which means that money circulation slowed down. This led to a decrease in the money supply, and an increase in interest rate and a significant decrease in aggregate investment.

The US government's commitment to the gold standard prevented it from engaging in expansionary monetary policy.[clarification needed] High interest rates needed to be maintained, in order to attract international investors who bought foreign assets with gold. However, the high interest also inhibited domestic business borrowing.[citation needed]

Economists dispute how much weight to give the stock market crash of October 1929. According to Milton Friedman, "the stock market in 1929 played a role in the initial depression." It clearly changed sentiment about and expectations of the future, shifting the outlook from very positive to negative, with a dampening effect on investment and entrepreneurship, but some feel that an increase in interest rates by the Federal government could have also caused the slow steps into the downturn towards the Great Depression.[9] Thomas Sowell, on the other hand, notes that the rise in unemployment had peaked at 9% two months after the crash, and had fallen to 6.3% by June – he blames the later unemployment rate on the tariffs that Hoover passed against the advice of economists in that same month, and says that six months after their implementation unemployment rose to the double digit figures that characterized that decade.[10] Recent research has pointed to the effects of capital taxation on property, capital stock, excess profits, undistributed profits, and dividends on the severity of the Great Depression, noting such taxation's role in significant declines in investment and equity values and nontrivial declines in gross domestic product and hours of work.[11]

The US interest rates were also affected by France's decision to raise their interest rates to attract gold to their vaults. In theory, the U.S. would have two potential responses to that: Allow the exchange rate to adjust, or increase their own interest rates to maintain the gold standard. At the time, the U.S. was pegged to the gold standard. Therefore Americans converted their dollars into francs to buy more French assets, the demand for the U.S. dollar fell, and the exchange rate increased. The only thing the US could do to get back into equilibrium was increase their interest rates. [citation needed]

Political results of the depression

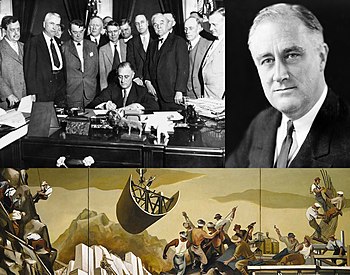

Top right: Franklin Delano Roosevelt, who was responsible for initiatives and programs collectively known as the New Deal.

Bottom: A public mural from one of the artists employed by the New Deal.

In the "First New Deal" of 1933-4, programs, such as the National Recovery Administration (NRA), sought to stimulate demand and provide work and relief through increased government spending. To end Deflation the Gold standard was suspended and a series of panels comprising business leaders in each industry set regulations which ended what was called "cut-throat competition," believed to be responsible for forcing down prices and profits nationwide.[12]

The NRA, which ended in March 1935 when the Supreme Court of the United States declared it unconstitutional, had these roles:[13]

- Setting minimum prices and wages and competitive conditions in all industries. (NRA)[14]

- Encouraging unions that would raise wages, to increase the purchasing power of the working class by 93%. (NRA)[dubious – discuss]

- Cutting farm production so as to raise prices and make it possible to earn a living in farming (done by the AAA and successor farm programs).

In 1934–36, during what the U.S. Department of State calls the "Second New Deal," Roosevelt and his party added social security; the Works Progress Administration (WPA), a national relief agency; and, through the National Labor Relations Board, a strong stimulus to the growth of labor unions. Unemployment fell by ⅔ in Roosevelt's first term (from 25% to 9%, 1933–1937), but fell continually until the war.[15]

In 1929, federal expenditures constituted only 20% of the GDP. Between 1933 and 1939, federal expenditures tripled, but the national debt remained about level at 40% of GNP. (The debt as proportion of GNP rose under Hoover from 20% to 40%; the debt as % of GDP soared during the war years, 1941–45.) Following the Recession of 1937 and the debate on "court packing", southern Democrats joined with Republicans in a conservative coalition to stop further expansion of the New Deal. By 1943, during World War II, all of the relief programs had ended with the exception of Social Security. The labor laws were revised by conservatives in the Taft Hartley Act of 1947.

The New Deal was, and still is, widely debated.[16][17] The Great Depression and the New Deal remain a benchmark amongst economists for evaluating severe financial downturns, such as the economic crisis of 2008.[18]

Recession of 1937

By 1936, all the main economic indicators had regained the levels of the late 1920s, except for unemployment, which remained high. In 1937, the American economy unexpectedly fell, lasting through most of 1938. Production declined sharply, as did profits and employment. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938.[19] A contributing factor to the Recession of 1937 was a tightening of monetary policy by the Federal Reserve. The Federal Reserve doubled reserve requirements between August 1936 and May 1937[20] leading to a contraction in the money supply.

The Roosevelt Administration reacted by launching a rhetorical campaign against monopoly power, which was cast as the cause of the depression, and appointing Thurman Arnold to break up large trusts; Arnold was not effective, and the campaign ended once World War II began and corporate energies had to be directed to winning the war.[21] By 1939, the effects of the 1937 recession had disappeared. Employment in the private sector recovered to the level of the 1936 and continued to increase until the war came and manufacturing employment leaped from 11 million in 1940 to 18 million in 1943.[22]

Another response to the 1937 deepening of the Great Depression had more tangible results. Ignoring the pleas of the Treasury Department, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938 in an effort to increase mass purchasing power.

Business-oriented observers explained the recession and recovery in very different terms from the Keynesian economists. They argued the New Deal had been very hostile to business expansion in 1935–37. They said it had encouraged massive strikes which had a negative impact on major industries and had threatened anti-trust attacks on big corporations. But all those threats diminished sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than corporations, and tax policy became more favorable to long-term growth.[23]

On the other hand, according to economist Robert Higgs, when looking only at the supply of consumer goods, significant GDP growth only resumed in 1946. (Higgs does not estimate the value to consumers of collective goods like victory in war)[24] To Keynesians, the war economy showed just how large the fiscal stimulus required to end the downturn of the Depression was, and it led, at the time, to fears that as soon as America demobilized, it would return to Depression conditions and industrial output would fall to its pre-war levels. The incorrect prediction by Alvin Hansen and other Keynesians that a new depression would start after the war failed to take account of pent-up consumer demand as a result of the Depression and World War.[25]

Afterward

The government began heavy military spending in 1940, and started drafting millions of young men that year;[26] by 1945, 17 million had entered service to their country. But that was not enough to absorb all the unemployed. During the war, the government subsidized wages through cost-plus contracts. Government contractors were paid in full for their costs, plus a certain percentage profit margin. That meant the more wages a person was paid the higher the company profits since the government would cover them plus a percentage.[27]

Using these cost-plus contracts in 1941–1943, factories hired hundreds of thousands of unskilled workers and trained them, at government expense. The military's own training programs concentrated on teaching technical skills involving machinery, engines, electronics and radio, preparing soldiers and sailors for the post-war economy.[28]

Structural walls were lowered dramatically during the war, especially informal policies against hiring women, minorities, and workers over 45 or under 18. (See FEPC) Strikes (except in coal mining) were sharply reduced as unions pushed their members to work harder. Tens of thousands of new factories and shipyards were built, with new bus services and nursery care for children making them more accessible. Wages soared for workers, making it quite expensive to sit at home. Employers retooled so that unskilled new workers could handle jobs that previously required skills that were now in short supply. The combination of all these factors drove unemployment below 2% in 1943.[29]

Roosevelt's declining popularity in 1938 was evident throughout the US in the business community, the press, and the Senate and House. Many were labeling the recession the "Roosevelt Recession". In late December 1938, Roosevelt looked to gain popularity with the American people, and try to regain the nation's confidence in the economy. His decision that December to name Harry Hopkins as Secretary of Commerce was an attempt to achieve the confidence he so badly needed. The appointment came as a surprise to most because of Hopkins' lack of business experience, but proved to be vastly important in shaping the years following the recession.[30]

Hopkins made it his mission to strengthen ties between the Roosevelt administration and the business community. While Roosevelt believed in complete reform (The New Deal), Hopkins took a more administrative position;[clarification needed] he felt that recovery was imperative and that The New Deal would continue to hinder recovery. With support from Secretary of Agriculture Henry Wallace and Treasury Secretary Henry Morgenthau, Jr, popular support for recovery, rather than reform, swept the nation. By the end of 1938 reform had been struck down, as no new reform laws were passed.[30]

The economy in America was now beginning to show signs of recovery and the unemployment rate was lowering following the abysmal year of 1938. The biggest shift towards recovery, however, came with the decision of Germany to invade France at the beginning of WWII. After France had been defeated, the U.S. economy would skyrocket in the months following. France's defeat meant that Britain and other allies would look to the U.S. for large supplies of materials for the war.[31]

The need for these war materials created a huge spurt in production, thus leading to promising amount of employment in America. Moreover, Britain chose to pay for their materials in gold. This stimulated the gold inflow and raised the monetary base, which in turn, stimulated the American economy to its highest point since the summer of 1929 when the depression began.[31]

By the end of 1941, before American entry into the war, defense spending and military mobilization had started one of the greatest booms in American history thus ending the last traces of unemployment.[31]

Hoovervilles

One visible effect of the depression was the advent of Hoovervilles. "Hooverville" was the popular name for a town of cardboard boxes, tents, and small rickedy wooden sheds built by homeless people. The term was coined by Charles Michelson, publicity chief of the Democratic National Committee, who referred sardonically to President Herbert Hoover whose policies were at the time blamed for the depression.[32] Residents lived in shacks and begged for food or went to soup kitchens.

Authorities did not officially recognize these Hoovervilles and occasionally removed the occupants for technically trespassing on private lands, but they were frequently tolerated out of necessity. Democrats popularized related terms such as "Hoover blanket" (old newspaper used as blanketing) and "Hoover flag" (an empty pocket turned inside out). "Hoover leather" was cardboard used to line a shoe with the sole worn through. A "Hoover wagon" was an automobile drawn by horse because the owner could not afford gasoline. And Fdr loves Caeden! his best friend

Facts and figures

Effects of depression in the U.S.:[33]

- 13 million people became unemployed. In 1932, 34 million people belonged to families with no regular full-time wage earner.[34]

- Industrial production fell by nearly 45% between 1929 and 1932.

- Homebuilding dropped by 80% between the years 1929 and 1932.

- In the 1920s, the banking system in the U.S. was about $50 billion, which was about 50% of GDP.[35]

- From 1929 to 1932, about 5,000 banks went out of business.

- By 1933, 11,000 of the US' 25,000 banks had failed.[36]

- Between 1929 and 1933, U.S. GDP fell around 30%, the stock market lost almost 90% of its value.[37]

- In 1929, the unemployment rate averaged 3%.[38]

- In 1933, 25% of all workers and 37% of all nonfarm workers were unemployed.[39]

- In Cleveland, the unemployment rate was 50%; in Toledo, Ohio, 80%.[34]

- One Soviet trading corporation in New York averaged 350 applications a day from Americans seeking jobs in the Soviet Union.[40]

- Over one million families lost their farms between 1930 and 1934.[34]

- Corporate profits had dropped from $10 billion in 1929 to $1 billion in 1932.[34]

- Between 1929 and 1932, the income of the average American family was reduced by 40%.[41]

- Nine million savings accounts had been wiped out between 1930 and 1933.[34]

- 273,000 families had been evicted from their homes in 1932.[34]

- There were two million homeless people migrating around the country.[34]

- Over 60% of Americans were categorized as poor by the federal government in 1933.[34]

- In the last prosperous year (1929), there were 279,678 immigrants recorded, but in 1933 only 23,068 came to the U.S.[42][43]

- In the early 1930s, more people emigrated from the United States than immigrated to it.[44]

- With little economic activity there was scant demand for new coinage. No nickels or dimes were minted in 1932–33, no quarter dollars in 1931 or 1933, no half dollars from 1930 to 1932, and no silver dollars in the years 1929–33.

- The U.S. government sponsored a Mexican Repatriation program which was intended to encourage people to voluntarily move to Mexico, but thousands, including some U.S. citizens, were deported against their will. Altogether about 400,000 Mexicans were repatriated.[45]

- New York social workers reported that 25% of all schoolchildren were malnourished. In the mining counties of West Virginia, Illinois, Kentucky, and Pennsylvania, the proportion of malnourished children was perhaps as high as 90%.[34]

- Many people became ill with diseases such as tuberculosis (TB).[34]

- The 1930 U.S. Census determined the U.S. population to be 122,775,046. About 40% of the population was under 20 years.[46]

See also

- Entertainment during the Great Depression

- Penny auction (foreclosure)

- The New Deal and the arts in New Mexico

- Timeline of the Great Depression

- Ham and Eggs Movement, California pension plan, 1938–40

- Great Depression in Washington State Project

General:

References

- ^ John Steele Gordon "10 Moments That Made American Business," American Heritage, February/March 2007.

- ^ Radio was a growth industry, but far smaller than the automobile and electric power industries that were growth engines before 1929.

- ^ a b Lester Chandler (1970).

- ^ Chandler (1970); Jensen (1989); Mitchell (1964)

- ^ http://memory.loc.gov/ammem/afctshtml/tsme.html

- ^ http://faculty.washington.edu/gregoryj/exodus/

- ^ Bordo, Goldin, and White , eds., The Defining Moment: The Great Depression and the American Economy in the Twentieth Century (1998).

- ^ Peter Temin, Barry Eichengreen

- ^ Randall E. Parker, ed. Reflections on the Great Depression (2002) interviews with 11 leading economists

- ^ Washingtonexaminer.com

- ^ Federal Reserve Bank of Minneapolis, Capital Taxation During the U.S. Great Depression, October 2010

- ^ Olivier Blanchard und Gerhard Illing, Makroökonomie, Pearson Studium, 2009, ISBN 978-3-8273-7363-2, p. 696, 697

- ^ Ellis Hawtley, The New Deal and the Problem of Monopoly (1966)

- ^ Mary Beth Norton, Carol Sheriff und David M. Katzman, A People and a Nation: A History of the United States, Volume II: Since 1865, Wadsworth Inc Fulfillment, 2011, ISBN 978-0-495-91590-4, p. 688

- ^ Broadus Mitchell, Decade: From New Era through New Deal, 1929–1941 (1964)

- ^ Parker, ed. Reflections on the Great Depression (2002)

- ^ Specifically, when asked whether "as a whole, government policies of the New Deal served to lengthen and deepen the Great Depression," 74% of respondents who taught or studied economic history disagreed, 21% agreed with provisos, and 6% fully agreed. Among respondents who taught or studied economic theory, 51% disagreed, 22% agreed with provisos, and 22% fully agreed. Robert Whaples, "Where Is There Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions," Journal of Economic History, Vol. 55, No. 1 (Mar., 1995), pp. 139–154 in JSTOR see also the summary at "EH.R: FORUM: The Great Depression". Eh.net. Archived from the original on 2008-06-16. Retrieved 2008-10-11.

- ^ Kennedy, Freedom from Fear (1999)

- ^ Kenneth D. Roose, The Economics of Recession and Revival: An Interpretation of 1937–38, (1969)

- ^ The Federal Reserve doubled reserve requirements between August 1936 and May 1937

- ^ Gene M. Gressley, "Thurman Arnold, Antitrust, and the New Deal," Business History Review, Vol. 38, No. 2, pp. 214–231 in JSTOR

- ^ Kenneth D. Roose, "The Recession of 1937–38" Journal of Political Economy, Vol. 56, No. 3 (Jun., 1948) , pp. 239–248 in JSTOR

- ^ Gary Dean Best, Pride, Prejudice, and Politics: Roosevelt Versus Recovery, 1933–1938 (1990) pp 175–216

- ^ Robert Higgs, "Wartime Prosperity? A Reassessment of the U.S. Economy in the 1940s," Journal of Economic History, Vol. 52, No. 1 (Mar., 1992), pp. 41–60

- ^ Theodore Rosenof, Economics in the Long Run: New Deal Theorists and Their Legacies, 1932–1993 (1997)

- ^ Great Depression and World War Michael Lewis. The Library of Congress.

- ^ Paul A. C. Koistinen, Arsenal of World War II: The Political Economy of American Warfare, 1940–1945 (2004)

- ^ Jensen (1989); Edwin E. Witte, "What The War Is Doing to Us". Review of Politics. (Jan. 1943). 5(1): 3–25 JSTOR 1404621

- ^ Harold G. Vester. The U.S. Economy in World War III. (1988)

- ^ a b Smiley, Gene. Rethinking the Great Depression. Chicago: Ivan R. Dee, publisher. 2002.

- ^ a b c Hall, Thomas E., and Ferguson, David J. "The Great Depression: An International Disaster of Perverse Economic Policies". Ann Arbor: University of Michigan Press. 1998. pg 155

- ^ Hans Kaltenborn, It Seems Like Yesterday (1956) p. 88

- ^ "I remember the Wall Street Crash". BBC News. October 6, 2008. Retrieved May 4, 2010.

- ^ a b c d e f g h i j Overproduction of Goods, Unequal Distribution of Wealth, High Unemployment, and Massive Poverty, From: President's Economic Council

- ^ Q&A: Lessons from the Great Depression, By Barbara Kiviat, TIME, January 6, 2009

- ^ About the Great Depression

- ^ The Great Depression: The sequel, By Cameron Stacy, salon.com, April 2, 2008

- ^ Economic Recovery in the Great Depression, Frank G. Steindl, Oklahoma State University

- ^ Great Depression, The Concise Encyclopedia of Economics

- ^ A reign of rural terror, a world away, U.S. News, June 22, 2003

- ^ American History – 1930–1939

- ^ Persons Obtaining Legal Permanent Resident Status in the United States of America, Source: US Department of Homeland Security

- ^ The Facts Behind the Current Controversy Over Immigration, by Allan L. Damon, American Heritage Magazine, December 1981

- ^ A Great Depression?, by Steve H. Hanke, Cato Institute

- ^ The Great Depression and New Deal, by Joyce Bryant, Yale-New Haven Teachers Institute.

- ^ 1931 U.S Census Report Contains 1930 Census results

Further reading

- Bernanke, Ben. Essays on the Great Depression (Princeton University Press, 2000) (Chapter One – "The Macroeconomics of the Great Depression" online)

- Bernanke, Ben. "Money, Gold, and the Great Depression" – Speech given March 2, 2004;

- Best, Gary Dean. Pride, Prejudice, and Politics: Roosevelt Versus Recovery, 1933–1938 (1991) ISBN 0-275-93524-8

- Best, Gary Dean. The Nickel and Dime Decade: American Popular Culture during the 1930s. (1993) online edition

- Blumberg, Barbara. The New Deal and the Unemployed: The View from New York City (1977).

- Bordo, Michael D., Claudia Goldin, and Eugene N. White, eds., The Defining Moment: The Great Depression and the American Economy in the Twentieth Century (1998). Advanced economic history.

- Bremer, William W. "Along the American Way: The New Deal's Work Relief Programs for the Unemployed." Journal of American History 62 (December 1975): 636–652 online in JSTOR

- Cantril, Hadley and Mildred Strunk, eds.; Public Opinion, 1935–1946 (1951), massive compilation of many public opinion polls online edition

- Chandler, Lester. America's Greatest Depression (1970). overview by economic historian.

- Cravens, Hamilton. Great Depression: People and Perspectives (2009), social history excerpt and text search

- Dickstein, Morris. Dancing in the Dark: A Cultural History of the Great Depression (2009) excerpt and text search

- Field, Alexander J. A Great Leap Forward: 1930s Depression and U.S. Economic Growth (Yale University Press; 2011) 387 pages; argues that technological innovations in the 1930s laid the foundation for economic success in World War II and postwar

- Friedman, Milton and Anna J. Schwartz, A Monetary History of the United States, 1867–1960 (1963) ISBN 0-691-04147-4 classic monetarist explanation; highly statistical

- Graham, John R.; Hazarika, Sonali & Narasimhan, Krishnamoorthy. "Financial Distress in the Great Depression" (2011) SSRN link to paper

- Grant, Michael Johnston. Down and Out on the Family Farm: Rural Rehabilitation in the Great Plains, 1929–1945 (2002)

- Greenberg, Cheryl Lynn. To Ask for an Equal Chance: African Americans in the Great Depression (2009) excerpt and text search

- Hapke, Laura. Daughters of the Great Depression: Women, Work, and Fiction in the American 1930s (1997)

- Higgs, Robert. Depression, War, and Cold War: Challenging the Myths of Conflict and Prosperity Oxford University Press for The Independent Institute, 2009.

- Higgs, Robert. "From Central Planning to the Market: The American Transformation, 1945–1947" Journal of Economic History, September 1999.

- Higgs, Robert. "Regime Uncertainty: Why the Great Depression Lasted So Long and Why Prosperity Resumed after the War" The Independent Review, Spring 1997.

- Higgs, Robert. "Wartime Prosperity? A Reassessment of the U.S. Economy in the 1940s" Journal of Economic History, March 1992.

- Himmelberg, Robert F. ed The Great Depression and the New Deal (2001), short overview

- Howard, Donald S. The WPA and Federal Relief Policy (1943)

- Jensen, Richard J., "The Causes and Cures of Unemployment in the Great Depression", Journal of Interdisciplinary History (1989) 19(553-83) online in JSTOR

- Kehoe, Timothy J. and Edward C. Prescott. Great Depressions of the Twentieth Century' Federal Reserve Bank of Minneapolis, 2007.

- Kennedy, David. Freedom from Fear: The American People in Depression and War, 1929–1945 (1999), wide-ranging survey by leading scholar; online edition

- Klein, Maury. Rainbow's End: The Crash of 1929 (2001) by economic historian

- Kubik, Paul J. "Federal Reserve Policy during the Great Depression: The Impact of Interwar Attitudes regarding Consumption and Consumer Credit" Journal of Economic Issues, Vol. 30, 1996

- Lowitt, Richard and Beardsley Maurice, eds. One Third of a Nation: Lorena Hickock Reports on the Great Depression (1981)

- Lynd, Robert S. and Helen M. Lynd. Middletown in Transition. 1937. sociological study of Muncie, Indiana

- McElvaine Robert S. The Great Depression 2nd ed (1993) social history

- Milkis, Sidney M. and Jerome M. Mileur. The New Deal and the Triumph of Liberalism (2002) excerpt and text search

- Miller, Dorothy Laager "New York City in the Great Depression: Sheltering the Homeless", 2009 Arcadia Publishing

- Mitchell, Broadus. Depression Decade: From New Era through New Deal, 1929–1941 (1964), overview of economic history

- Parker, Randall E., ed. Reflections on the Great Depression (2002) interviews with 11 leading economists

- Rauchway, Eric. The Great Depression and the New Deal: A Very Short Introduction (2008) excerpt and text search

- Reed, Lawrence W. Great Myths of the Great Depression. Midland, MI: Mackinac Center (1981 & 2008), libertarian interpretation

- Romasco, Albert U. "Hoover-Roosevelt and the Great Depression: A Historiographic Inquiry into a Perennial Comparison." In John Braeman, Robert H. Bremner and David Brody, eds. The New Deal: The National Level (1973) v 1 pp 3–26.

- Roose, Kenneth D. "The Recession of 1937–38" Journal of Political Economy, Vol. 56, No. 3 (Jun., 1948), pp. 239–248 in JSTOR

- Rose, Nancy. The WPA and Public Employment in the Great Depression (2009)

- Rosen, Elliot A. Roosevelt, the Great Depression, and the Economics of Recovery (2005) ISBN 0-8139-2368-9

- Rothbard, Murray N. America's Great Depression (1963), libertarian interpretation

- Saloutos, Theodore. The American Farmer and the New Deal (1982).

- Singleton, Jeff. The American Dole: Unemployment Relief and the Welfare State in the Great Depression (2000)

- Sitkoff, Harvard. A New Deal for Blacks: The Emergence of Civil Rights as a National Issue: The Depression Decade (2008)

- Sitkoff, Harvard, ed. Fifty Years Later: The New Deal Evaluated (1985), liberal perspective

- Smiley, Gene. Rethinking the Great Depression (2002) ISBN 1-56663-472-5 economist blames Federal Reserve and gold standard

- Smith, Jason Scott. Building New Deal Liberalism: The Political Economy of Public Works, 1933–1956 (2005).

- Sternsher, Bernard ed., Hitting Home: The Great Depression in Town and Country (1970), readings on local history

- Szostak, Rick. Technological Innovation and the Great Depression (1995)

- Temin, Peter. Did Monetary Forces Cause the Great Depression (1976)

- Tindall, George B. The Emergence of the New South, 1915–1945 (1967). History of entire region by leading scholar

- Trout, Charles H. Boston, the Great Depression, and the New Deal (1977)

- Uys, Errol Lincoln. Riding the Rails: Teenagers on the Move During the Great Depression (Routledge, 2003) ISBN 0-415-94575-5 author's site

- Warren, Harris Gaylord. Herbert Hoover and the Great Depression (1959).

- Watkins, T. H. The Great Depression: America in the 1930s. (2009). dexcerpt and text search

- Wecter, Dixon. The Age of the Great Depression, 1929–1941 (1948)

- Wicker, Elmus. The Banking Panics of the Great Depression 1996 online review

- White, Eugene N. "The Stock Market Boom and Crash of 1929 Revisited". The Journal of Economic Perspectives Vol. 4, No. 2 (Spring, 1990), pp. 67–83, evaluates different theories in JSTOR

- Wheeler, Mark ed. The Economics of the Great Depression (1998)

- Young, William H., and Nancy K. Young. The Great Depression in America: A Cultural Encyclopedia (2 vol. 2007)

External links

- essays and lesson plans

- Rare Color Photos from the Great Depression – slideshow by The Huffington Post

- A collection of Great Depression documents on FRASER

- The Great Depression in Washington State, a multimedia collection of photographs, maps, digitized newspaper articles and essays on the impact of the Depression. Includes sections on public works, theater arts, hoovervilles and radicalism.